eCommerce: Marketplace Insights in Germany

Marketplaces in Germany: Platforms Under Pressure

eCommerce in Germany is shifting towards marketplaces. All of the biggest German retailers have started to embrace third-party sellers. We give you an in-depth analysis of the biggest marketplace trends.

Article by Nikolai Surminski | September 13, 2024Download

Coming soon

Share

Shift Towards Marketplace: Consumer demand and new strategies of the biggest retailers transition the German market towards third-party sellers.

Amazon's Dominance: Amazon is still by far the largest marketplace in Germany. It generates over 50% of all GMV in the market.

German Leadership in Fashion: German retailers have found their successful niche in fashion. Local players such as Zalando and Otto can even compete with Amazon in the fashion market.

Whether in the United States or in Europe, marketplaces have been on everyone’s mind long before the global launch of the retail phenomenon Temu. Kickstarted by the Covid-19 pandemic, both consumers and retailers in Europe increasingly appreciated the many perks of large and successful platforms that allow third-party vendors to offer their products.

For consumers, it is a larger selection of products gathered in one place. For vendors, it is a broader customer base without large investment into infrastructure. And for the operators of these platforms, it is healthy margins without the many risks of consumer-facing retail.

It is no surprise that many retailers with their roots in first-party online retail such as Amazon, Walmart, or Otto have embraced marketplaces as the strategy of the future in recent years. After just 5 years, almost 30% of Otto’s Gross Merchandise Value (GMV) is generated by third-party activity. Zalando shows a similar trend, while external sellers make up more than 80% of Kaufland’s marketplace sales. Other players that have strong roots in brick-and-mortar retail such as Hornbach or Bauhaus, are only just entering the marketplace business.

And while the advantages of a marketplace expansion are undeniable, it is also a reaction to outside pressure. Many of the large American platforms operating in Germany, say Amazon, eBay or Etsy, already have a head start on many of its German competitors.

And with Temu and AliExpress, two Asian retailers are pushing aggressively into the German eCommerce market bankrolled by two of the largest eCommerce companies in the world.

So, how do these new developments impact marketplaces in Germany? And is Amazon still streets ahead of all its competitors? In preparation for the Marketplace Convention 2024, we will show you what the marketplace landscape in Germany looks like and what to expect for the future.

Like this insight? This article is part of a series in cooperation with Marketplace Convention 2024. Over the course of multiple in-depth analyses, we highlight the key topics for the convention such as Chinese marketplaces in Germany, cross-border eCommerce in Germany and the growing reCommerce market. The largest online marketplace event in the DACH region will open its doors on the 23. and 24. of October in Cologne. During our talk, we will cover the European eCommerce market with our exclusive data and give you valuable insights into the operational trends of the future.

First Party Online Stores Grow Faster Than Marketplaces, But Lag Behind in Germany

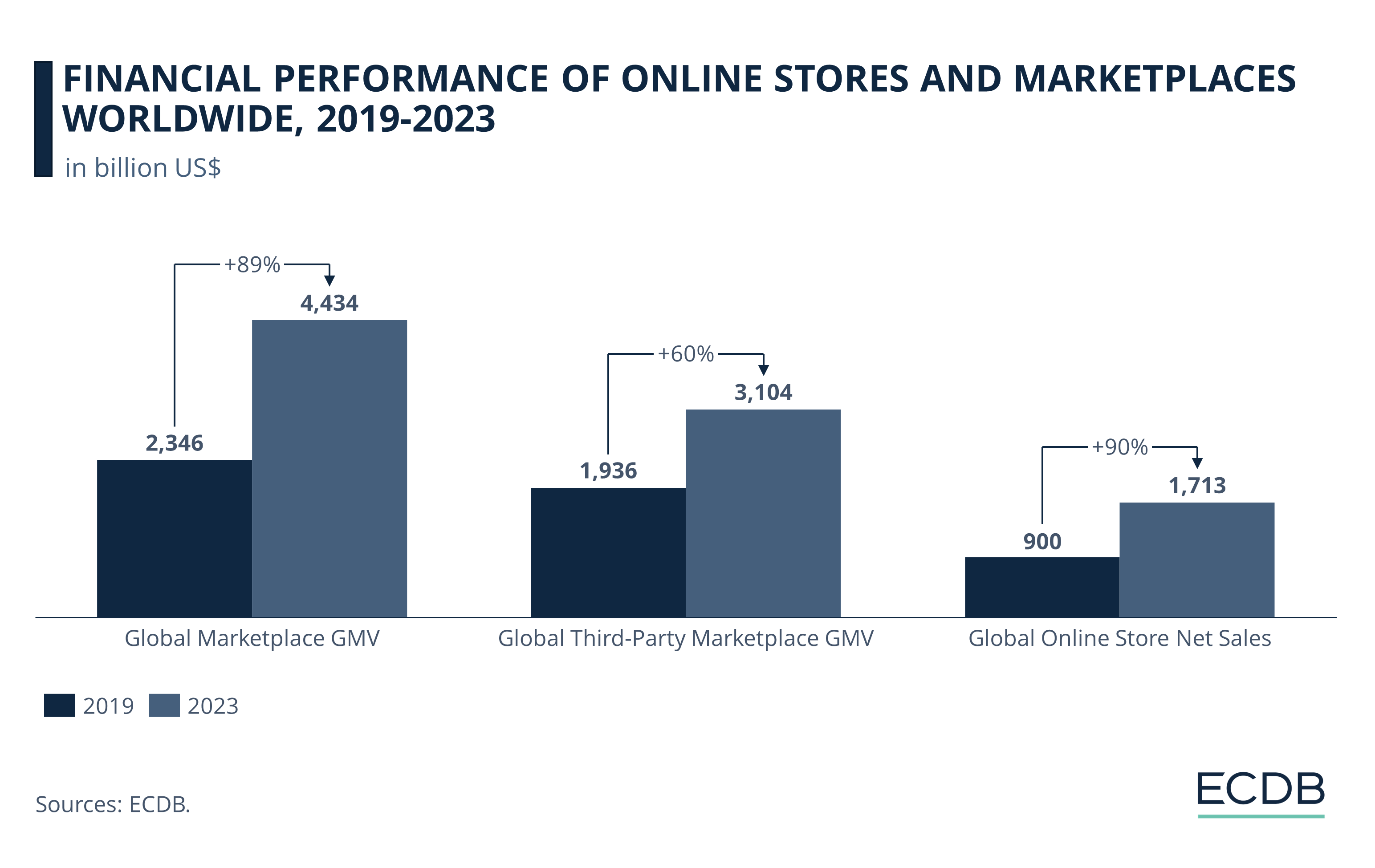

Both first-party and third-party online retail has been booming in recent years. Lasting shifts in consumer behavior during the pandemic have led to impressive growth rates across all parts of the industry.

Quite surprisingly, growth for marketplaces worldwide has been slightly slower than that of online stores. Net sales of first-party shops have increased by 90% from 2019, reaching US$1.7 trillion in 2023.

In contrast, third-party marketplace GMV has only grown by 60%. And while still more than two-thirds of all sales in eCommerce are generated by third-party vendors, it appears that the gap has narrowed over the last years.

The explanation for that lies in the performance of the large Chinese marketplace platforms such as Tmall, Taobao and JD.com. These eCommerce giants still make almost 60% of all GMV generated globally, as almost all digital retail in China is conducted through third-party marketplaces instead of online stores.

But growth in the Chinese market has slowed significantly in recent years, not sharing in the same pandemic-induced boom as other countries in the Americas or Europe. As a consequence, marketplace GMV in China and therefore worldwide has not kept up pace with online stores around the world.

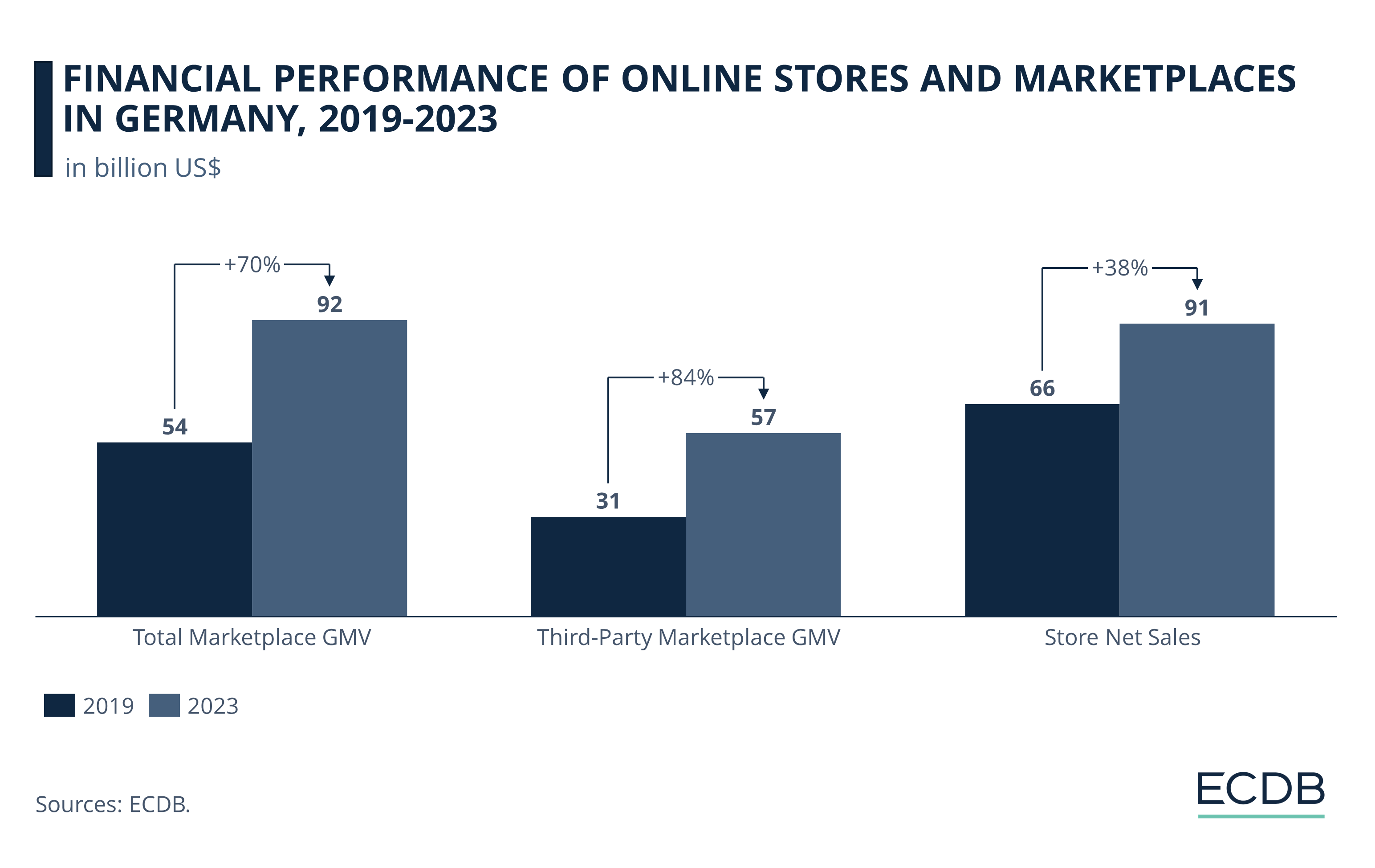

The comparison with the German eCommerce market paints a drastically different picture. Total Marketplace GMV and online store net sales are almost equal with marketplace activity, having only surpassed online store sales in 2023.

This underlines the traditional strong position of online stores in Germany caused by large local players that have focused on selling their own products first. But growth for these stores has not kept up with the marketplaces in recent years.

Total marketplace GMV in Germany has grown by 70% over the last five years, with online shop net sales increasing by just 38%. Third-party activity has increased even more, almost doubling to US$57 billion in 2023.

While Germany is a market with a historically strong first-party store culture, the last years have represented something of a change of guard. Marketplaces had more growth potential in the German market, as these platforms have been relatively weak in the past.

Developments in Germany are also following global trends, as many non-Chinese marketplaces are growing significantly faster than their store competitors.

In Germany, the strong marketplace growth is juxtaposed with revenue declines of the largest stores such as otto.de (-10.2% in 2023), zalando.de (-1.2%) or mediamarkt.de (-7.7%). It seems that marketplaces are meeting a consumer sentiment that first-party stores no longer capture in the same way.

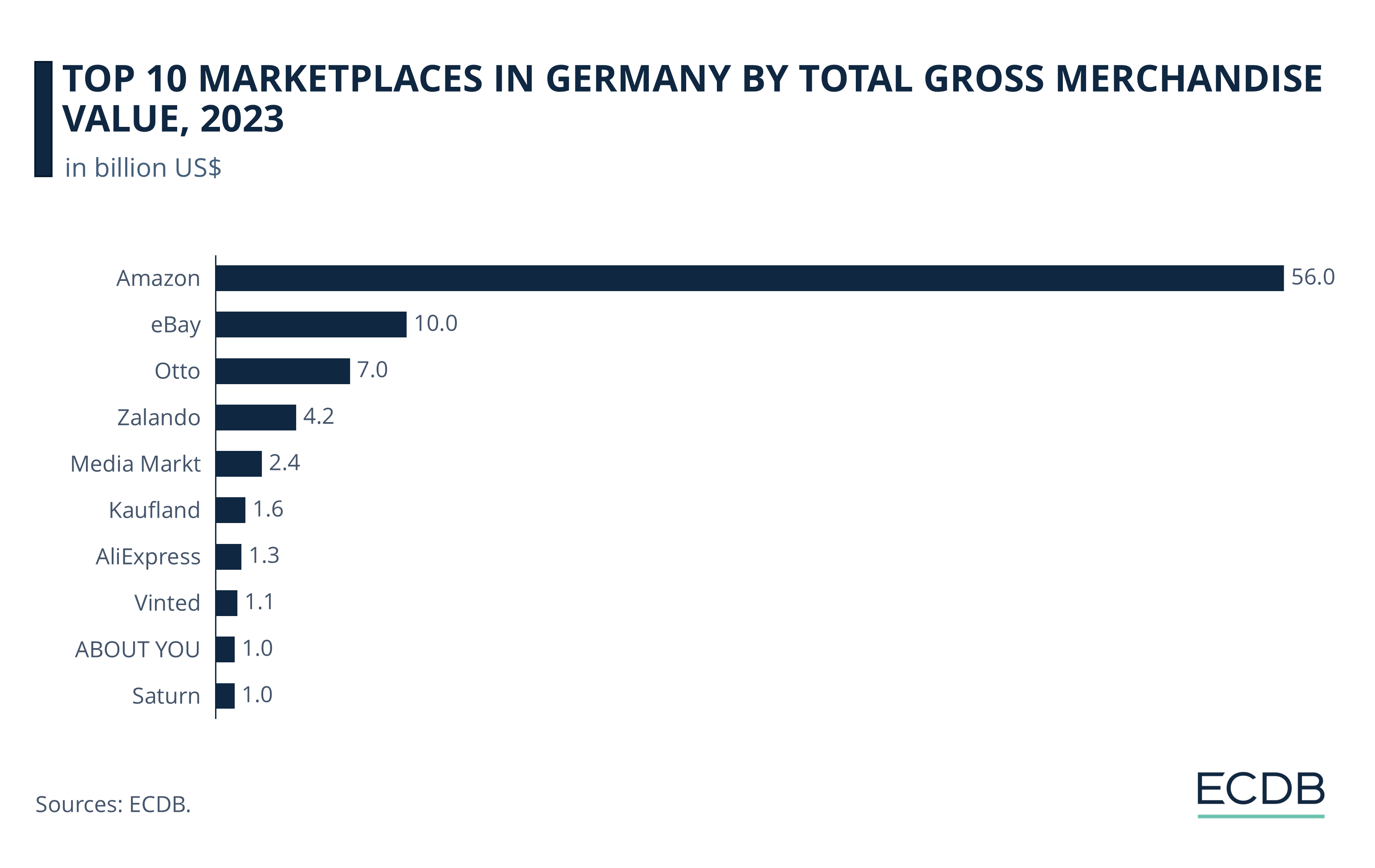

Marketplace Business Is Still Dominated by Amazon

Just as in many other Western markets, the marketplace landscape in Germany is quite uncongested and dominated by one big player: Amazon. Amazon generated US$56 billion in GMV in 2023, roughly two-thirds of which is third-party activity.

That is more than half of all marketplace GMV in the German eCommerce market and more than US$55 billion above the second-biggest marketplace. Amazon’s dominance in Germany mirrors almost all other European markets in which Amazon has a presence.

Besides just Amazon, the largest marketplaces in Germany show an even mix of German and foreign retailers operating in Germany. eBay, despite declining slightly in 2023, is still the second-biggest marketplace in the market, generating almost 15% of its global GMV in Germany alone.

AliExpress, the seventh-largest marketplace with US$1.3 billion in GMV, is a testament to the growing importance of Chinese platforms both across the world and in Germany specifically.

A longer list would also capture the stellar rise of Temu, which has generated just shy of US$750 million in 2023, its first full year of business. Vinted is the only marketplace from another European country and a reminder that reCommerce and third-party marketplaces are intrinsically linked.

In comparison to other European markets, marketplaces by German retailers are in a distinctly stronger position. Six of the ten largest marketplaces are operated by German companies, generating a total GMV of US$17.2 billion in 2023.

All of these companies have expanded upon their pure first-party strategy to also offer third-party products in recent years. As a consequence, third-party activity is still the smaller part of business for most of these marketplaces. But it seems that external sellers are a growth area for German marketplaces.

However, while third-party shares of merchandise volume for all of the largest platforms are growing, the decline in net sales of first-party stores operated by the same companies indicates a concerning level of cannibalization through the marketplaces.

German Marketplace Space Characterized by Success Stories

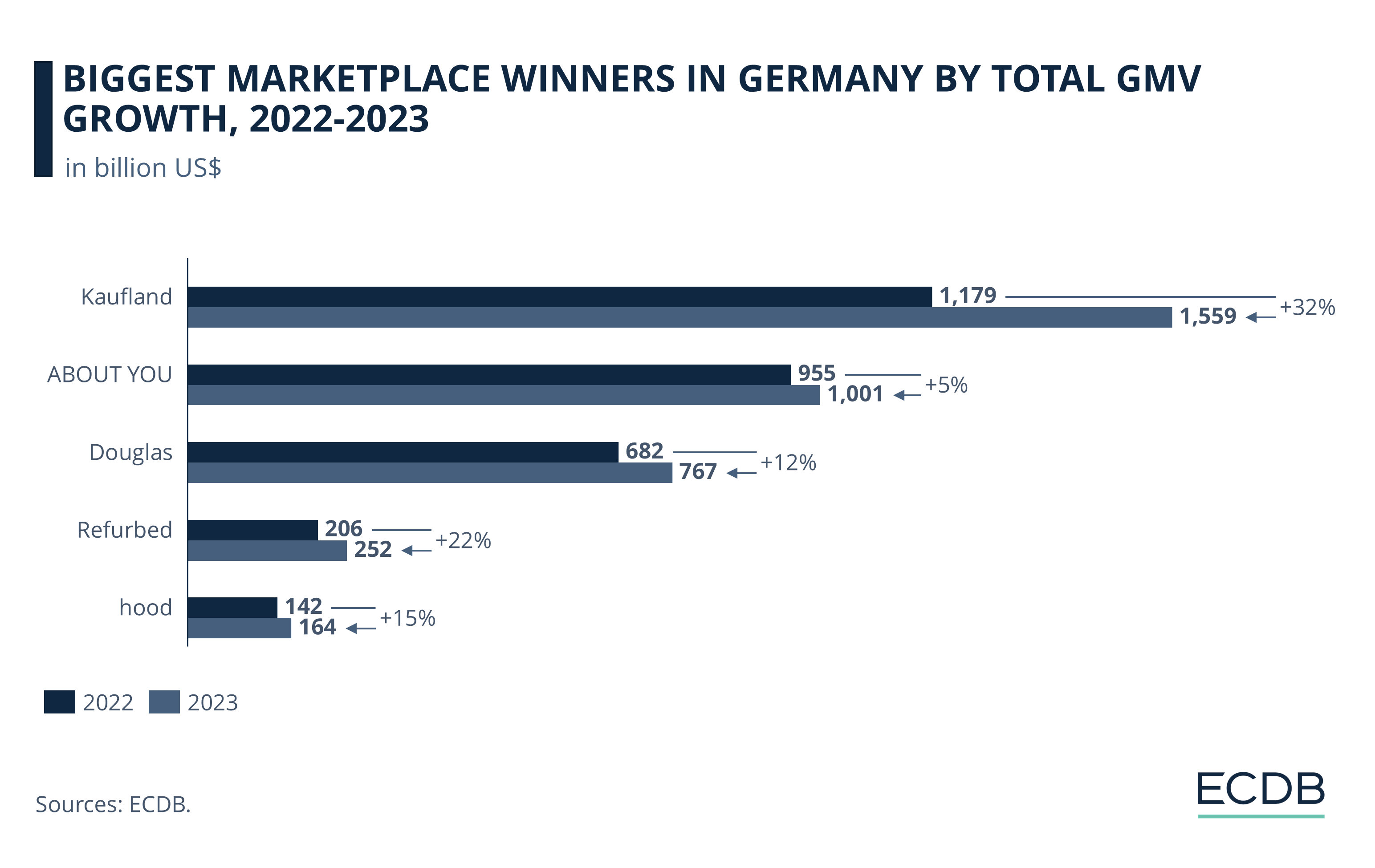

Regardless of possible downsides, German marketplace platforms have collectively performed better than German first-party stores in recent years. One of the biggest winners is Kaufland, which managed to grow its GMV by 32% compared to 2022 and is now the sixth-largest marketplace in Germany.

By focusing on third-party activity (83.5% of all merchandise volume is from external sellers), the marketplace has clearly bet on one of the biggest marketplace trends in Germany. Kaufland has recently launched its marketplace in Czechia and Slovakia and is planning to expand it into Austria, the first market in which it does not have physical stores.

ABOUT YOU is now the largest pure-fashion marketplace in Germany, crossing the US$1 billion mark in GMV for the first time in 2023. Over the last years, ABOUT YOU has shown higher growth than Zalando, arguably its biggest competitor, following a strategy that is more focused on fashion and business in Germany.

The Douglas marketplace grew by 12% in 2023, making it the third-largest marketplace for Care Products in Germany and showing signs of underlying success for a company that has mostly made the headlines with a disappointing IPO.

Refurbed and hood round out the Top 5 of fastest-growing online marketplaces in Germany increasing GMV by 22% and 15%, respectively.

The success of Refurbed confirms the growing importance of reCommerce or marketplace. Together with Vinted and Back Market, three of the 20 largest marketplaces in Germany primarily sell second-hand products.

Hood is one of the oldest German marketplaces, founded in 2000 as a marketplace with a focus on consumer satisfaction and low fees. With low-price marketplaces pushing into the German eCommerce market, this strategy has grown hood’s GMV by 15% in 2023.

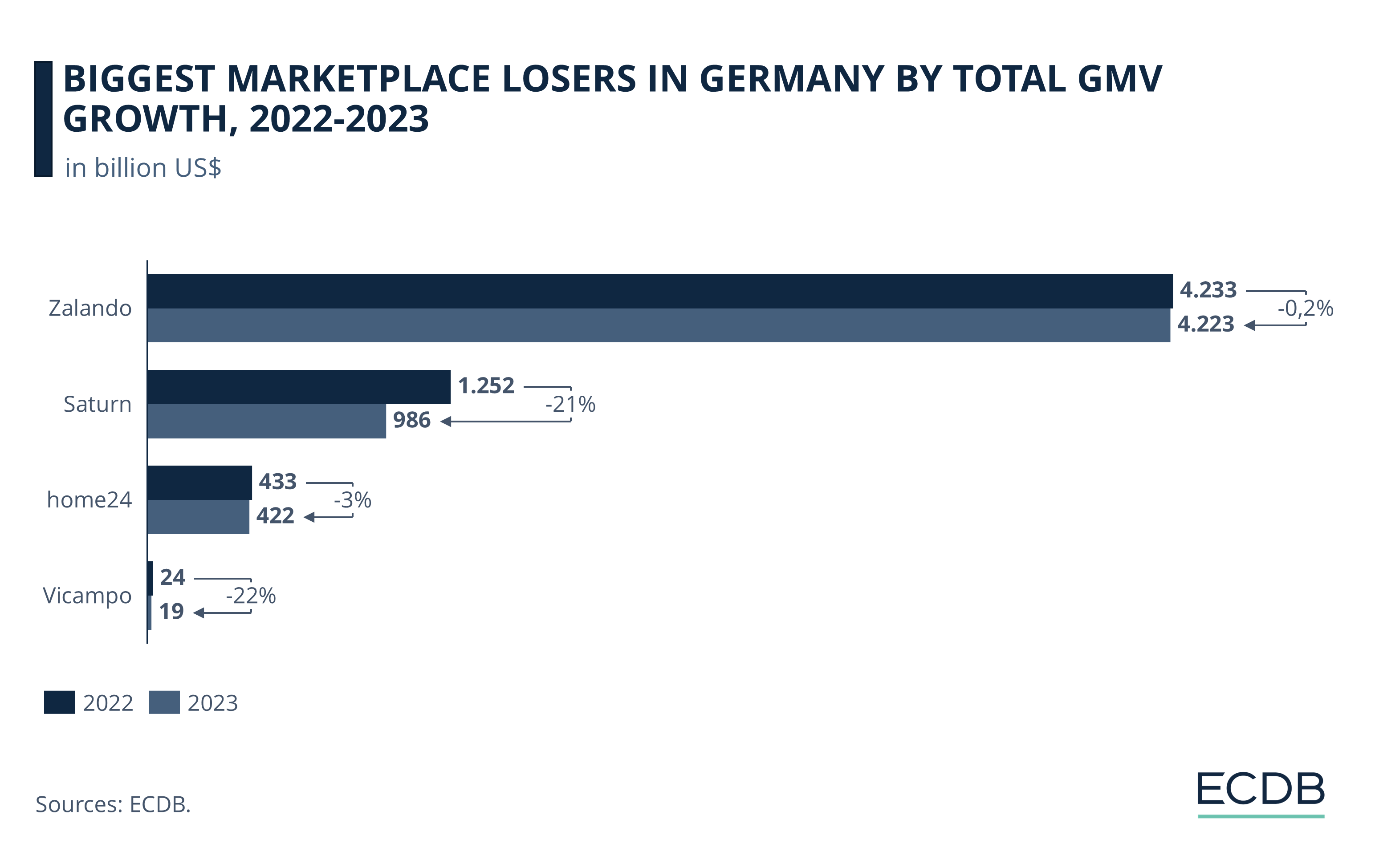

The success of marketplaces in Germany is also characterized by the fact that there are very few shrinking platforms in the market.

GMV for the marketplace Zalando declined by just 0.2% in 2023. But it seems that this is just a temporary setback, as the marketplace business has returned to strong growth in 2024.

All other declines in GMV can be explained by corporate decision making and changes in strategy by the parent company. Ceconomy, the parent company of Saturn, clearly favors Media Markt for its online business (US$2.4 billion in GMV for 2023).

Home24 and Vicampo were both subject to corporate takeovers in recent years, which had different levels of impact on their online business. This is particularly true for Vicampo, which is part of the larger Viva Wine Group.

German Marketplaces Are Strongest in Fashion

The dominance of Amazon in the German marketplace space becomes even more clear when looking at the individual product categories. Amazon generates the most GMV in six out of the seven product categories tracked by ECDB.

In the category Hobby & Leisure, Amazon (US$20.8 billion in category GMV) generates more than 80% of all online GMV by marketplaces in Germany. Behind Amazon, Otto seems the closest Germany has to a true generalist marketplace. The market’s third-largest marketplace sits in the Top 4 for all product categories except Grocery.

With the small additional exception of Kaufland, all other German marketplaces have a much more focused product scope. The remaining marketplaces in the Top 10 largest marketplaces by German companies all generate 75% or more of their GMV through a single product category.

This is most prevalent in the Fashion category, as this is the only product group in which Amazon is merely the second-largest marketplace. In first place sits the German marketplace Zalando, which generates 92% of its GMV, or US$3.9 billion, with fashion sales.

With Otto and ABOUT YOU, Germany has two local marketplaces rounding out the Top 5. This is no coincidence: Fashion has the largest share of the entire German eCommerce market with stronger native players than many other European countries.

Marketplace Landscape in Germany: Final Thoughts

In summary, the German eCommerce market is witnessing a significant shift towards third-party marketplaces, driven by increased consumer demand and changing retail strategies. Platforms like Kaufland, Otto, and others have embraced third-party sales, allowing them to grow rapidly and expand their market presence.

This mirrors global trends, where marketplaces have become key drivers of eCommerce growth, though first-party online stores still hold a strong position in Germany.

The dominance of Amazon in Germany, capturing over half of all marketplace GMV, underscores the competitive challenges local platforms face.

However, the strong performance of German players in specific categories like fashion highlights their ability to carve out niches in the broader marketplace landscape. As third-party activity continues to grow, the German eCommerce ecosystem is poised to evolve, with marketplaces playing a more central role in shaping its future trajectory.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Temu Is the Second Most Visited eCommerce Website in the World

Temu Is the Second Most Visited eCommerce Website in the World

Deep Dive

Indonesia Urges Apple and Google To Restrict Temu

Indonesia Urges Apple and Google To Restrict Temu

Back to main topics