eCommerce: Operational Success

Operational Excellence: How to Be Successful in German eCommerce

Competition in German eCommerce is growing more intense. But the most successful retailers have found different winning strategies to come out on top.

Article by Nikolai Surminski | September 18, 2024Download

Coming soon

Share

Operational Excellence: Key Insights

Germany's Strong eCommerce Position: Germany's broad consumer base and its strong purchasing power make it a lucrative but competitive target for eCommerce companies.

Relationship Between AOV and Conversion Rate: Stores with high AOV (e.g., Apple) have lower Conversion Rates, while stores with cheaper price points, such as grocery retailers, are showcasing high conversion numbers.

Conversion Rates Drive Growth: Online platforms with higher conversion rates are also growing faster, an indicator for optimized user experience and efficient operations.

The German eCommerce market is the sixth-largest eCommerce market in the world. Germany is also one of the most economically developed countries in the world across almost all criteria. This means that German eCommerce is among the most established and optimized in the entire industry.

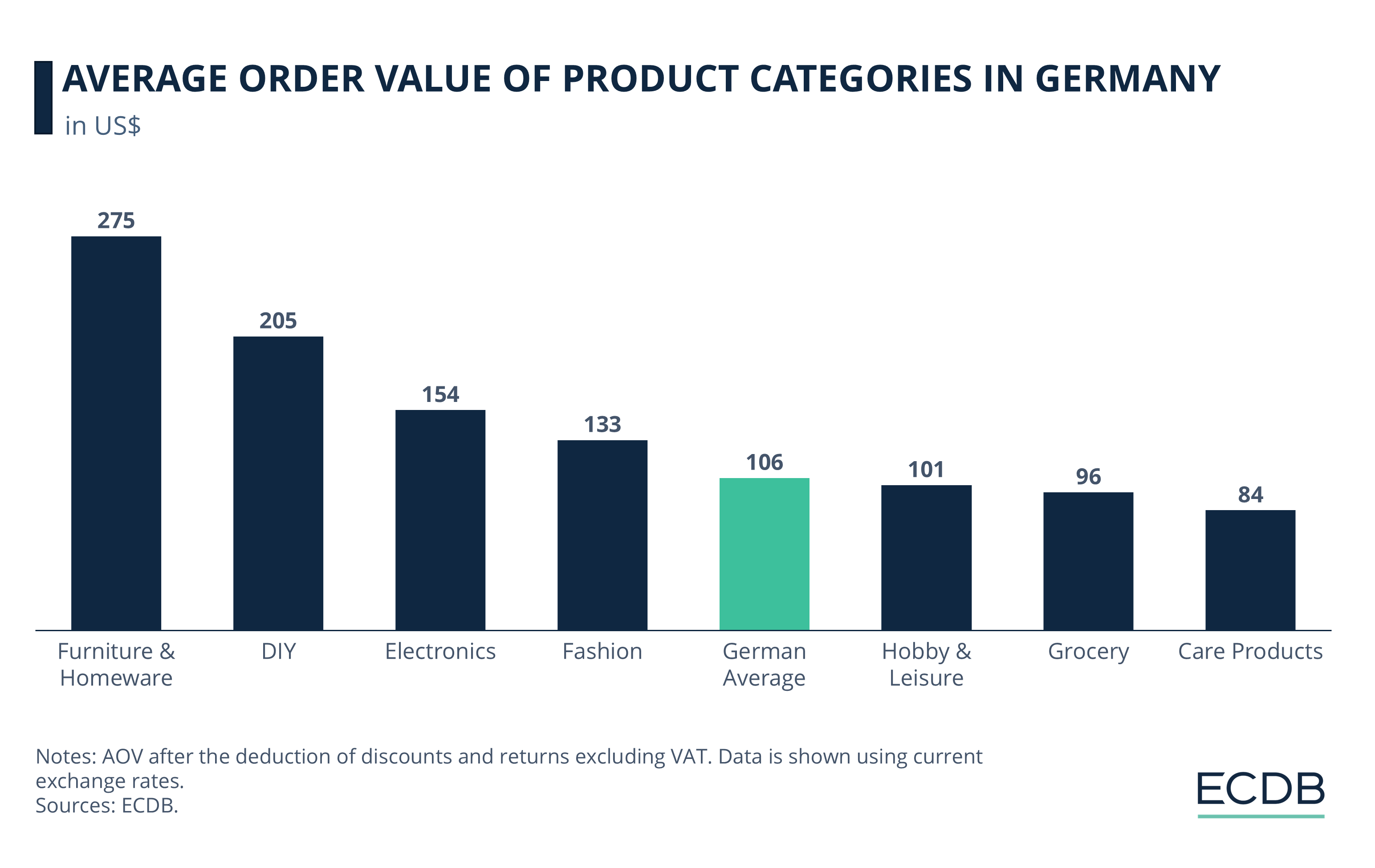

Average Order Value (AOV) is the tenth highest in the world (US$106) far ahead of the other big European markets such as France (US$103), the United Kingdom (US$101) or Italy (US$92). And besides the United States and Canada, all other countries with a higher AOV are small but rich states such as Singapore, Switzerland or Norway which tend to have a much higher income per capita.

So, German eCommerce represents the perfect mix of a broad consumer base and high purchasing power.

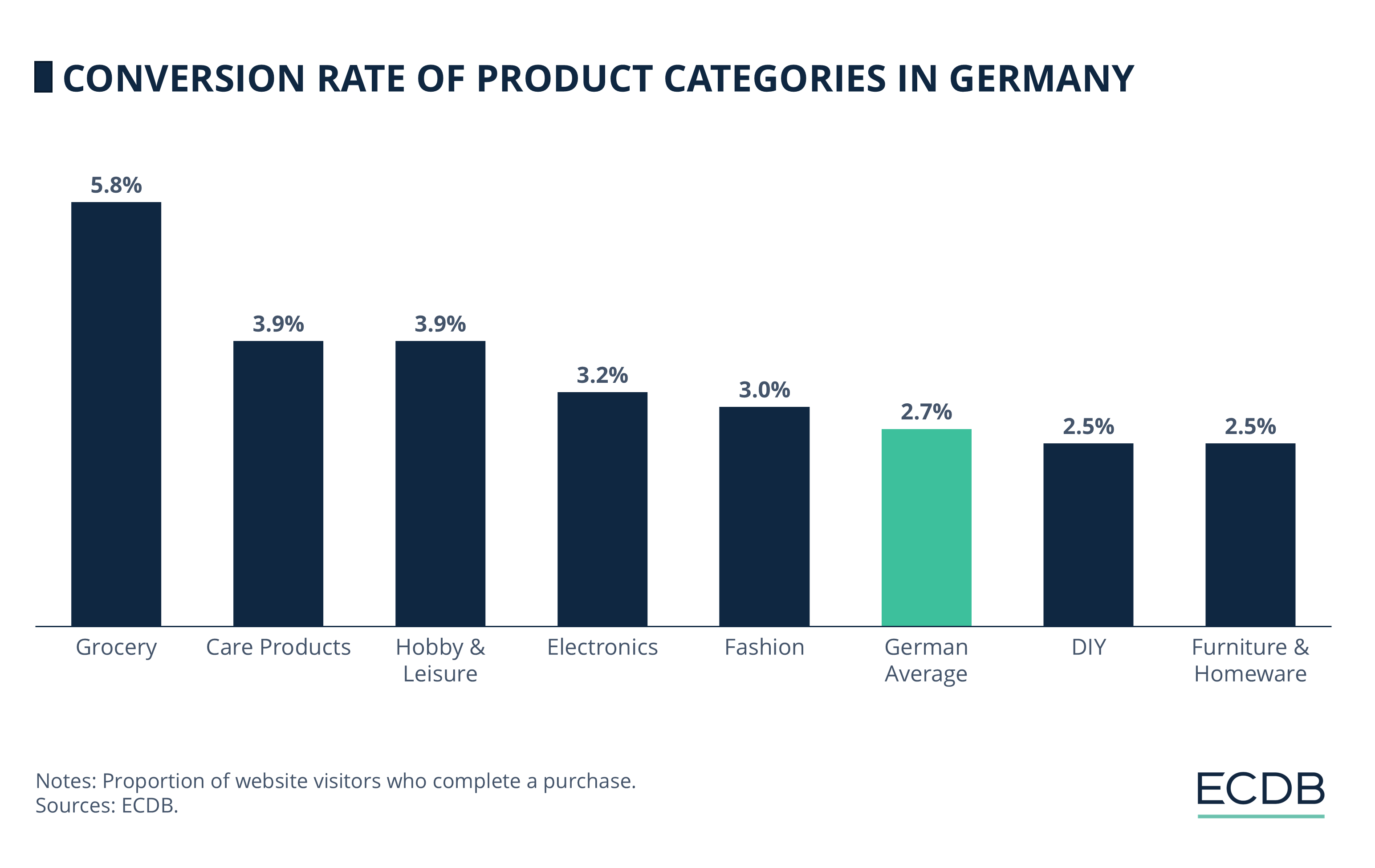

Since it is such a lucrative market, competition is fierce, and retailers need to bring their best to ensure their platform’s survival. Because along with a high AOV, Germany also has the tenth-highest conversion rate in the world with 2.7%.

This coincides with one of the lowest add-to-cart rates and one of the highest return rates among all eCommerce markets. To achieve such a high conversion rate despite these obstacles, stores and marketplaces need to function on a high level of operational quality.

In cooperation with the Marketplace Convention 2024, we show you the most important operational benchmarks for German retailers and how the most successful platforms have optimized these to their advantage.

Like this insight? This article is part of a series in cooperation with Marketplace Convention 2024. Over the course of multiple in-depth analyses, we highlight the key topics for the convention such as Chinese marketplaces in Germany, cross-border eCommerce in Germany and the growing reCommerce market. The largest online marketplace event in the DACH region will open its doors on the 23. and 24. of October in Cologne. During our talk, we will cover the European eCommerce market with our exclusive data and give you valuable insights into the growing importance of marketplaces in Germany.

Low AOV and High Conversion Rate Go Hand in Hand

A close-up at the German eCommerce market presents a more granular, albeit logical picture. The category Furniture & Homeware has by far the highest AOV as couches and beds tend to come with a larger price tag. This is followed by DIY and Electronics, product categories in which the individual items also tend to come with a relatively high price.

Quite surprisingly, Fashion has the fourth-largest AOV in Germany surpassing the overall AOV by almost US$30. As fashion sales in Germany are heavily influenced by fast fashion retailers, individual items are trending towards lower price points. The high Fashion AOV therefore implies that consumers constantly buy a higher number of products at the same time while the comparatively high return rate shows that they do not have any troubles with sending them back.

But our data shows that higher price points come with some obstacles. The product categories with the highest AOV also come with the lowest conversion rate. Especially Furniture & Homeware and DIY tend to be single, non-recurring purchases that customers do without acting on impulse.

Customers are also more prone to compare prices or reconsider a purchase if it is connected to a higher price tag. In contrast, categories like Grocery and Care Products have a higher conversion rate as consumers are not as sensitive to these prices.

Grocery represents a particular outlier with a conversion rate that is almost two percentage points higher than any other product category. Digital grocery purchases are highly recurring in nature and customers rarely visit a grocery store’s site and add items to their cart without also completing the transaction.

To a lesser degree, this is also true for Care Products and Hobby & Leisure which include items that consumers anticipate to purchase in regular intervals for a relatively low price.

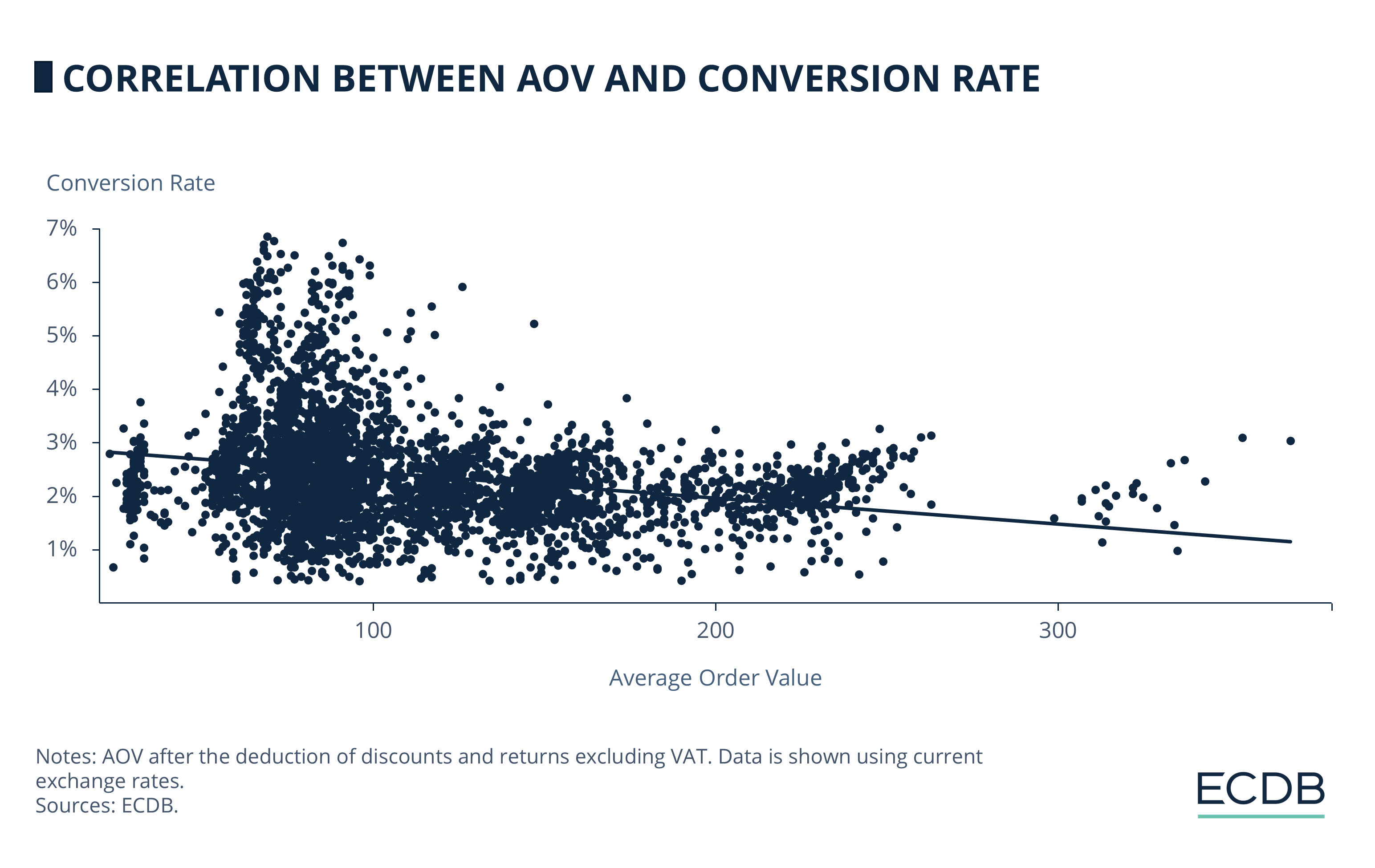

This relationship is also confirmed by a deeper analysis of the biggest stores in Germany which shows the negative connection between AOV and conversion rate. Increasing your store’s prices and therefore the AOV steadily reduces the conversion rate as impulse purchases become less frequent and customers think longer about their decisions.

In real numbers, increasing the AOV of your platform by US$100 (e.g., by offering products at a higher price point) reduces the conversion rate by around half a percentage point. This may not sound like much but with conversion rates traditionally on the lower side, this represents almost 20% of the average conversion rate in the German eCommerce market.

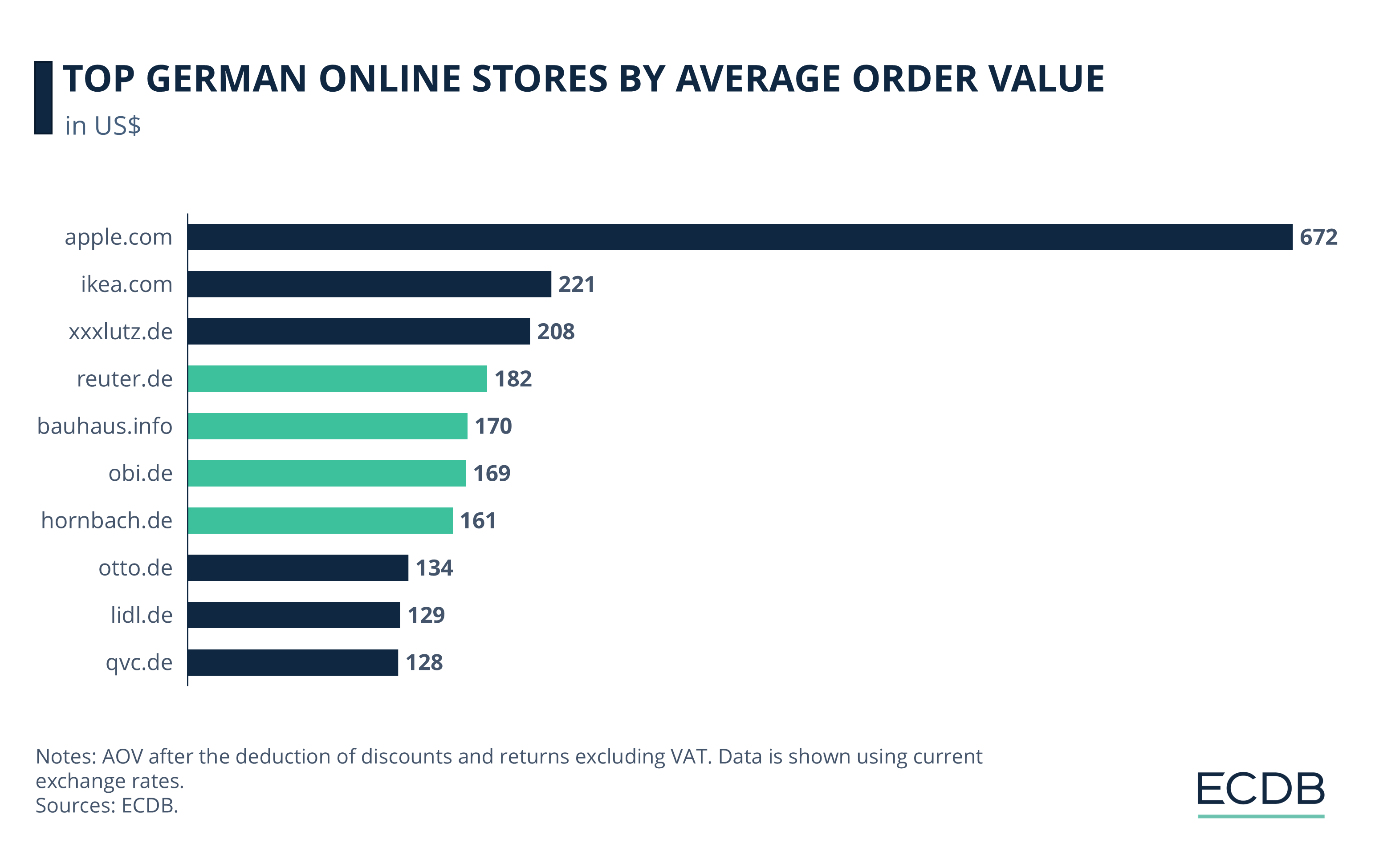

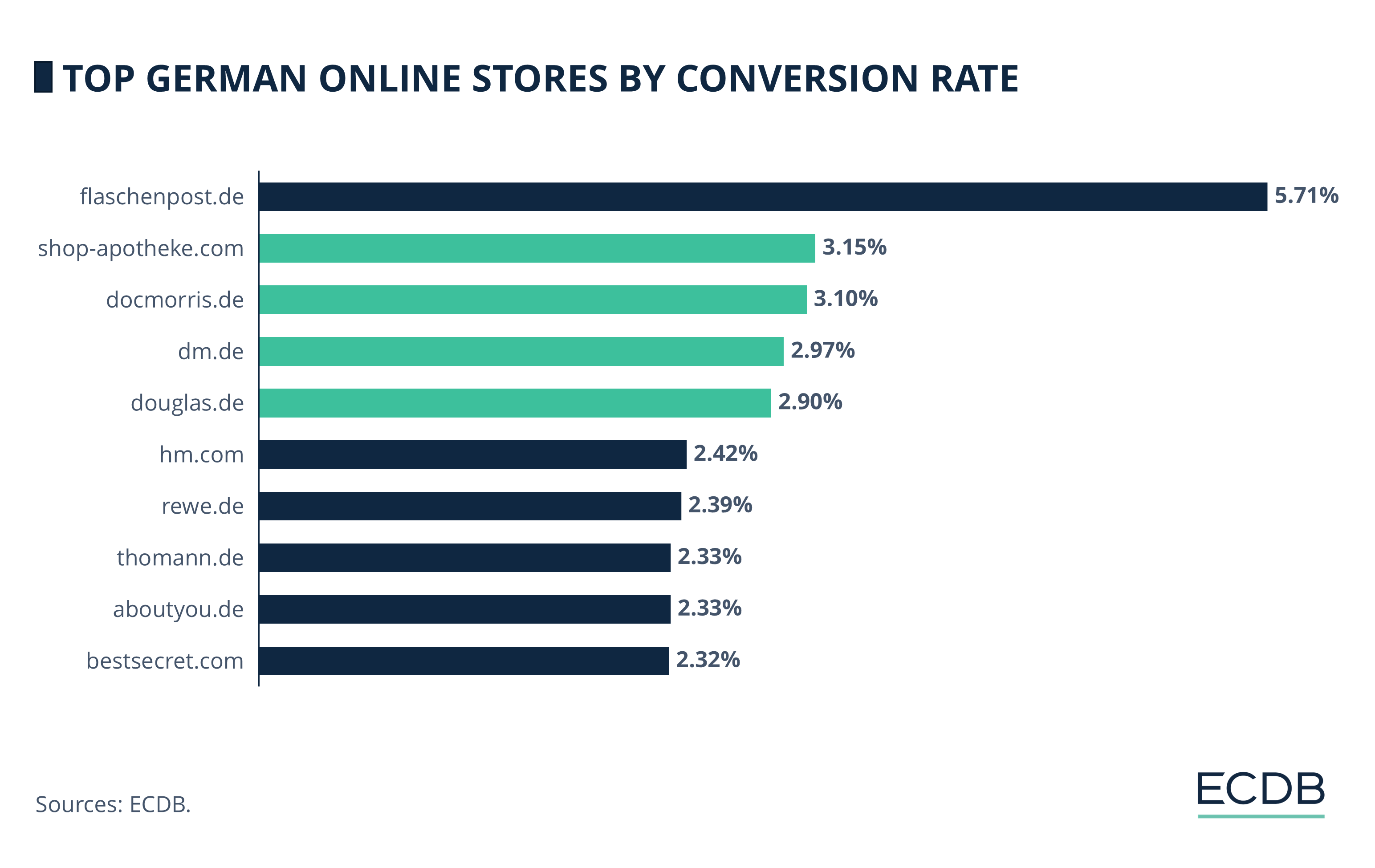

Apple Dominates Average Order Value, Flaschenpost Is the Pinnacle of Conversion

The nature of AOV and conversion rates is integral to the operation of a successful business in the German eCommerce market. And some of the biggest retailers show that they understand how to use this to their advantage.

Apple.com is the third-largest electronics store in Germany, generating US$1.2 billion in German net sales. It achieves this to a large part through having by far the highest AOV in the German eCommerce market. Apple’s AOV of US$672 is an incredible US$450 above its closest competitor. The AOV also reflects Apple’s larger corporate strategy of establishing its products at the highest end of prices as even the cheapest smartphone on the website costs more than US$400. With Apple’s consumers accustomed to higher prices, the retailer is in a position to stomach a low conversion rate of just 1.3%. An AOV that is more than six times the German average in combination with a conversion rate that is about half the national average results in a vastly positive trade-off for the tech retailer.

The rest of the high AOV retailers is a tribute to the higher-priced product categories. Four of the retailers are DIY that have traditionally high order values. The other platforms are either pure furniture players (Ikea, XXXLutz) or have a strong presence in German fashion eCommerce (Otto, Lidl, QVC). The fact that all of these stores are also part of the 50 largest online shops in Germany shows that the maximization of order value can be a winning strategy in the German eCommerce market.

Flaschenpost.de, the German grocery retailer and delivery service, is Apple’s counterpart for conversion rates. Its conversion rate of 5.71% is more than 2.5 percentage points higher than the second-highest conversion rate. To a large degree, this is due to the high-conversion nature of digital grocery retail. Customers come back periodically to repurchase daily goods, fewer people visit the store to just browse without a real intention to buy and prices are too low for a significant level of cart abandonment. But its conversion is vastly higher than even its competitors in the grocery space such as rewe.de or bofrost.de. Flaschenpost also offers quicker deliveries and a high level of reliability, which it combines with the structural advantages of grocery quick commerce.

The list of retailers with the highest conversion rate also confirms the conversional dominance of care products in Germany. Four of the five retailers with the highest conversion rate generate the majority of their sales through health and personal care products.

These stores are also the most successful care product retailers in Germany, showing the level of optimization necessary to excel in the competitive German market. In fact, almost all of the stores present in the list of highest conversion rates are also among the stores with the highest sales in their respective product category.

High Conversion Stores Are Growing Faster

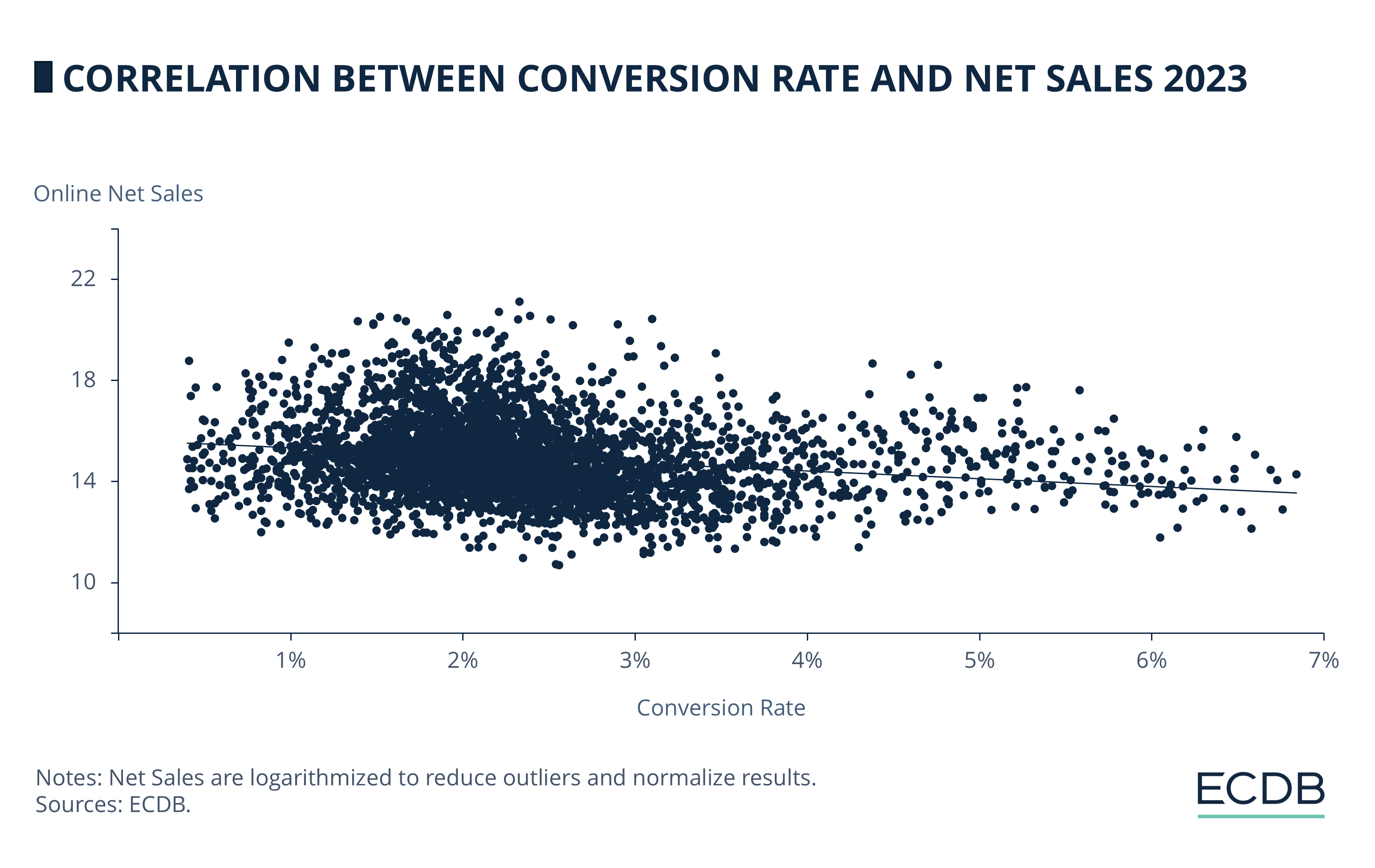

But the relationship between conversion rate and Net Sales is not as straightforward when looking at the entirety of German online stores. Operational data for more than 4,000 German stores shows that higher conversion rates coincide with lower overall sales.

This represents one of the key challenges that stores are facing on their way to higher revenues. To achieve continuous growth, platforms need to address a bigger and more diverse audience through both a more complex product range and more marketing. And while it is comparably straightforward to keep up a high conversion rate for a focused product in a singular niche, it becomes continuously harder to keep up the same conversion rate for a bigger audience.

Larger stores attract more traffic of casual browsers who are not necessarily ready to buy or do not have a tangible interest in the product catalogue decreasing the rate of people finalizing a purchase. Larger stores are therefore dependent on increased traffic to keep up higher sales levels.

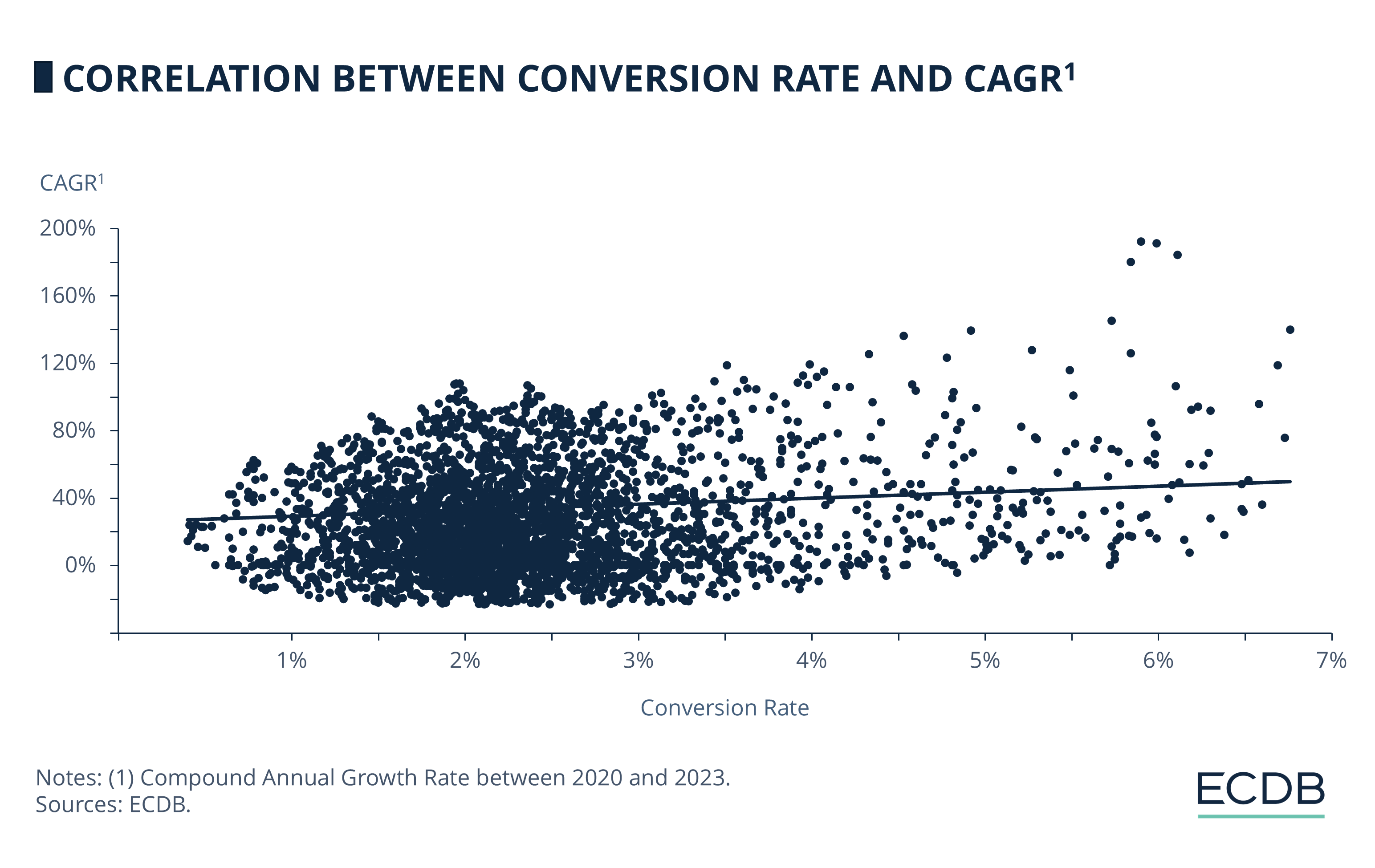

But stores that can maintain their conversion levels also tend to be more successful. Online stores with a higher conversion rate have also grown faster over the last four years showing a comparatively higher CAGR than their competitors.

Higher conversion rates indicate more efficient customer acquisition and better user experience, both of which tend to increase sales. It is also an encouraging sign that it is not only marketing spending that is driving growth in the competitive eCommerce space.

Operational Excellence in German eCommerce: Closing Thoughts

The German eCommerce market is a blend of high commercial potential and competitive pressures. With high Average Order Value and conversion rates, Germany represents a lucrative opportunity for retailers.

However, success in this market demands efficient operations as well as a deep understanding of consumer behavior and product categories. Retailers that balance high AOV with solid conversion strategies, like Apple and Flaschenpost, highlight the importance of aligning price, product offerings, and customer expectations.

Our data also shows the delicate relationship between AOV, conversion rates and online net sales. While retailers focusing on high AOV products may struggle with conversion rates, those optimizing for conversion efficiency in recurring purchase categories tend to outperform in long-term growth.

As the eCommerce landscape continues to evolve, retailers who can master this balance will not only survive but thrive in this highly competitive space.

Sources: ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

German Cross-Border eCommerce: Marketplaces, Online Stores, Top Markets & Product Categories

German Cross-Border eCommerce: Marketplaces, Online Stores, Top Markets & Product Categories

Deep Dive

EHI: eCommerce Market Germany - Top 1,000 Online Stores Made €77.5 Billion in 2023

EHI: eCommerce Market Germany - Top 1,000 Online Stores Made €77.5 Billion in 2023

Deep Dive

Top eCommerce Countries in Africa

Top eCommerce Countries in Africa

Back to main topics