eCommerce Categories: Pet Supplies

Top Online Pet Supplies Stores in the United Kingdom

Where do UK pet owners shop online for their animal companions? How has the online Pet Supplies market developed in recent years? Which pet supplier is the most successful in the United Kingdom?

Article by Antonia Tönnies | August 22, 2024Download

Coming soon

Share

Top Online Pet Supplies Stores in the UK: Key Insights

Top Online Retailers: The leading online Pet Supplies store in the UK is petsathome.com, with revenues of US$281.2 million in 2023. This is followed by zooplus.co.uk (US$140.1 million), animeddirect.co.uk (US$59.4 million), petdrugsonline.co.uk (US$45.2 million), and viovet.co.uk (US$40.1 million).

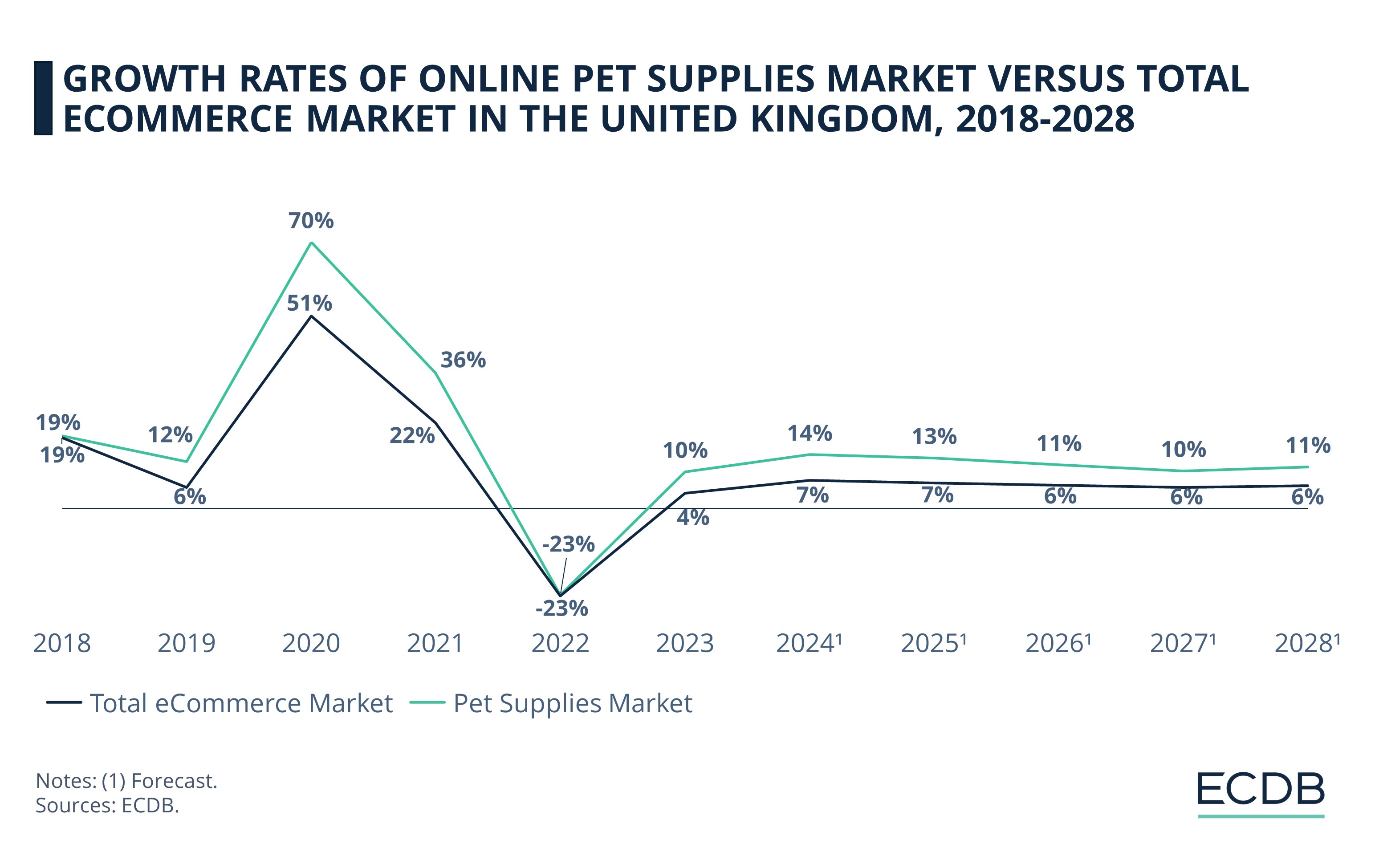

Economic Challenges: The UK Pet Supplies eCommerce market declined by 23% in 2022 due to Brexit-related supply chain issues, inflation, and cautious consumer behavior.

Future Market Projections: Analysts predict a relatively stable future for this eCommerce industry, with a new upward trend. It is expected to hit an estimated revenue of US$6.7 billion by 2028, an increase of 92% compared to 2022.

Changing Consumer Behavior: High inflation, economic uncertainty and rising living costs have led consumers to cut back on non-essential spending, including Pet Supplies. All of these factors contributed to a more pronounced decline in this market compared to the broader eCommerce sector.

Over the past few years, the online Pet Supplies market in the United Kingdom has witnessed a strong upward surge. However, after 2021, boosters such as the pandemic have come to an end and the growth trend has changed.

How has the online Pet Supplies market developed since then? What is the Online Pet Supplies market, and what can we expect in the coming years? Discover the answers to these questions and more by diving into the market for dogs, cats, horses and beyond.

What Is the Online Pet Supplies Market?

ECDB defines the Pet Supplies market as a submarket of the Hobby & Leisure market and accounts for 6.9 of this eCommerce sector in the United Kingdom. The category encompasses the commercial (B2C) sale of pet food and treats, pet toys, crates, carriers, aquariums, tanks and enclosures, collars and leashes, pet grooming supplies, pet clothing and accessories, and Pet pharmaceuticals and nutrition. Excluded from the Pet Supplies are pet care services (e.g. dog walking, grooming, pet training) and medical treatments (e.g. veterinary care).

Top Online Pet Supplies Stores in the United Kingdom: Petsathome.com Leads

Before diving into the market, let's take a look at the top specialized online Pet Supplies stores in the United Kingdom by revenue in 2023:

Among the top five are online stores that are also strong in other countries, such as zooplus.co.uk, whose German domain is the leading online store in the online Pet Supplies market in Germany. But the number one online Pet Supplies store in the UK is another store – let's check it out.

1. Petsathome.com

The number one specialized online store in the United Kingdom in the Pet Supplies category is petsathome.com. The Pet Supplies store generated revenues of US$281.2 million in 2023, representing 15.6% of the total Pet Supplies market in the UK.

The online store was founded in 1991 by Anthony Preston in the United Kingdom and has since focused entirely on its home market. Pets at Home offers a wide range of pet products, from food to accessories. In addition, the online retailer offers a variety of in-store services, including an in-store veterinary clinic. The goal is to make pet ownership convenient, affordable and rewarding.

2. Zooplus.co.uk

In second place follows the British domain of the company zooplus SE, zooplus.co.uk, with a revenue of US$140.1 million last year. Like petsathome.com, the online store's revenue has grown from 2022 (US$122 million) to 2023, but still the distance to the leading store remains large, with a difference of over 50% between these two Pet Supplies players.

The eCommerce company was founded back in 1999 in Germany. Over the years, they expanded their activities Europe-wide, shipping their products to over 25 countries in the world. In 2023, the United Kingdom was the most important online Pet Supplies market for Zooplus, generating an eCommerce activity of 7%.

3. Animeddirect.co.uk

Third place is again a long way behind: Animeddirect.co.uk comes next with US$59.4 million in revenue, which is 44% of zooplus.co.uk's revenue and 21% of petsathome.com's revenue. In the past two years, the online Pet Supplies retailer has declined in growth, which may give other stores the opportunity to overtake them.

The Pet Supplies Store specializes in the supply of prescription and non-prescription medicines, as well as pet food and care products. The online veterinary dispensary focuses since 2010 to almost 100% on the market in the United Kingdom.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

4. Petdrugsonline.co.uk

In fourth place is petdrugsonline.co.uk, operated by Independent Vetcare, Ltd., which generated US$45.2 million in revenue in 2023. If petdrugsonline.co.uk continues its projected growth rate, it has a good chance of overtaking animedirect.co.uk sooner or later.

The online retailer is similar to the third-place finisher, specializing in veterinary medicine and generating almost all of its eCommerce revenue in the United Kingdom. Pet Drugs Online was founded in 2005 in the office of a small veterinary practice in Bath. The shop's mission is "to help pet owners dramatically reduce the cost of their pet's healthcare".

5. Viovet.co.uk

Last but not least, viovet.co.uk completes the ranking of the top 5 specialist online Pet Supplies stores in the United Kingdom. The online store, which is owned by Viovet, Ltd. has recently seen its revenue decline from US$78.9 million in 2021 to US$40.1 million in 2023.

Founded in 2006, the online store offers a wide range of products from prescription and non-prescription medications to food, toys and equipment for pets. Viovet.co.uk operates to 99.5% in the UK market and 0.5% in the rest of the world.

Online Pet Supplies Market Stabilizes After Crash in 2022

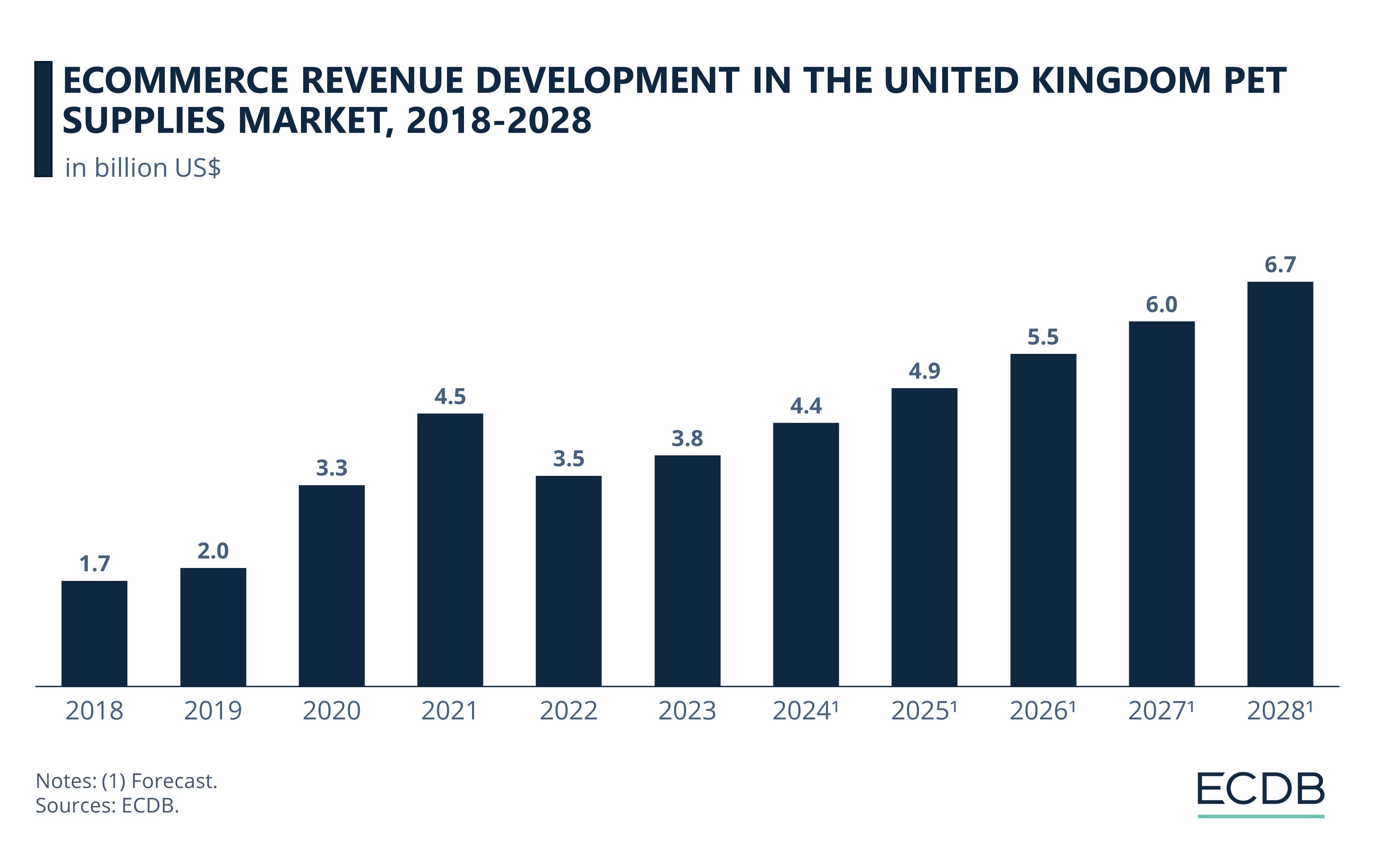

The development of eCommerce sales in the Pet Supplies market in the United Kingdom can be divided into a total of four time periods:

Before the Corona Virus: From 2018 to 2019 the Pet Supplies market stretched from US$1.7 billion to US$2 billion, an augmentation of 19%.

The Years of the Pandemic: Thanks to the global eCommerce boom, the Pet Supplies subcategory has expanded rapidly, jumping to revenues of US$3.3 billion in 2020 and peaking at US$4.5 billion in 2021.

Pre-COVID-19: The peak is followed by a decline. The eCommerce revenue shrank by 23% to attain US$3.5 billion in 2022. Last year, the online Pet Supplies market rose a little to US$3.8 billion – an increase of 10%.

Forecast of the Pet Supplies Market: The coming years are projected with a new growth trend. By 2028, the ECDB analysts expect the market to reach US$6.7 billion in revenue – an increase of 92% compared to 2022.

What Happened to the eCommerce Industry in the UK?

As recent eCommerce market trends have shown, the Pet Supplies eCommerce market is struggling. There are several reasons that explain this trend. Among the most pertinent factors explaining the turn of events are:

Brexit: After the U.K. left the European Union in January 2020, the government had to deal with challenges such as supply chains, trade barriers, and customs regulations.

Inflationary struggles: Inflation peaked at 9% in 2022 due to Brexit issues as well as the end of the pandemic-related boom, which led to a normalization of the market.

Consumer Behavior: The combination of high inflation, economic uncertainty, and rising cost of living led to more cautious consumer behavior and shrinking consumer demand.

Compared to the general eCommerce market in the UK, the Pet Supplies industry has been hit as hard as the general UK eCommerce market by the aforementioned factors. Both experienced a decline of 23% in 2022.

Keeping a pet is expensive and can be seen as a luxury that not everyone can afford. Especially in times of economic uncertainty, the cost of such luxuries is the first to be cut, which may explain the growth rates of the online Pet Supplies market and the overall UK eCommerce market.

What Subcategories Contains the Pet

Supplies Market?

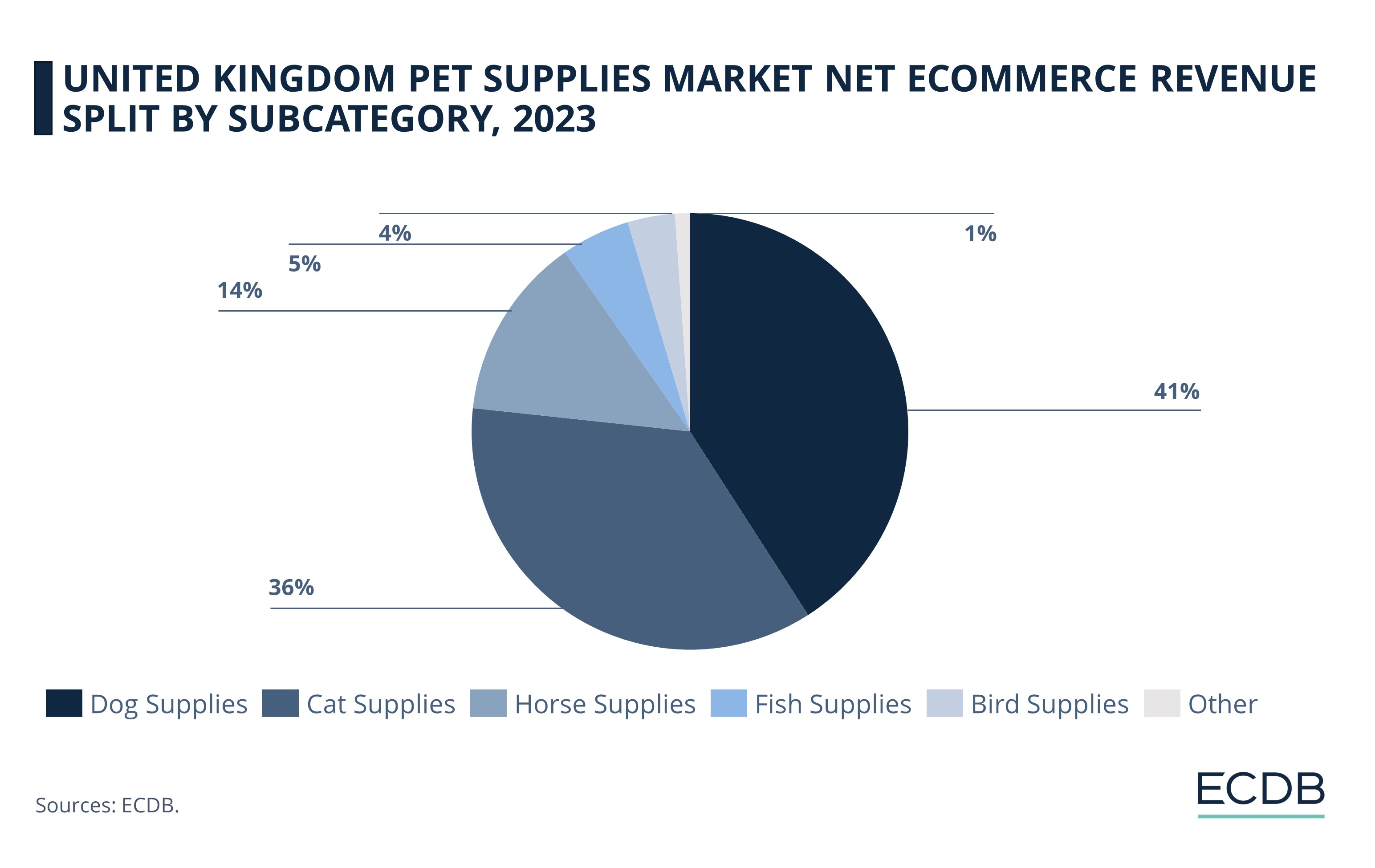

There are a total of six different subcategories in the Pet Supplies market: Bird Supplies, Cat Supplies, Dog Supplies, Fish Supplies, Horse Supplies and Other Pet Supplies. In 2023, the Pet Supplies subcategories performed as follows:

1st place: Dog Supplies (41%),

2nd place: Cat Supplies (36%),

3rd place: Horse Supplies (14%),

4th place: Fish Supplies (5%),

5th place: Bird Supplies (4%).

Top Online Pet Supplies Stores in the United Kingdom: Closing Thoughts

The online Pet Supplies market has experienced strong growth in recent years. After a return to normal in the UK in 2022, the industry has faced some challenges due to the end of the eCommerce boom, as well as the earlier political decision to leave the EU and its financial consequences.

Overall, the market is forecast to remain stable with the start of a new upward trend. If the market follows the expected growth trend, it could surpass the US$6 billion mark by 2027.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Social Commerce in China and the United States: Consumer Preferences, Leading Platforms and Product Categories

Social Commerce in China and the United States: Consumer Preferences, Leading Platforms and Product Categories

Deep Dive

Top Categories for Online Shopping in Spain: Food and Beverages Lead

Top Categories for Online Shopping in Spain: Food and Beverages Lead

Deep Dive

Top Online Pet Supply Stores in Germany

Top Online Pet Supply Stores in Germany

Deep Dive

Top Online Wine and Liquors Online Stores in France

Top Online Wine and Liquors Online Stores in France

Article

Revenue Distribution Among the Global Top 100 Apparel Online Stores 2023

Revenue Distribution Among the Global Top 100 Apparel Online Stores 2023

Back to main topics