eCommerce: Market Insights

Global Smoking Supplies eCommerce Market: Tobacco Industry Continues Growth Trend

The Smoking Supplies market has grown over the years in the variety of products it offers. What once consisted of items such as cigars and ashtrays has expanded today into electronic devices and liquids. Find out how the subcategory has proliferated in eCommerce.

Article by Antonia Tönnies | July 03, 2024Download

Coming soon

Share

Global Smoking Supplies eCommerce Market: Key Insights

The Global Tobacco Products Market: The global tobacco products market is projected to surpass US$1 trillion by 2026, with cigarettes generating the majority of revenue.

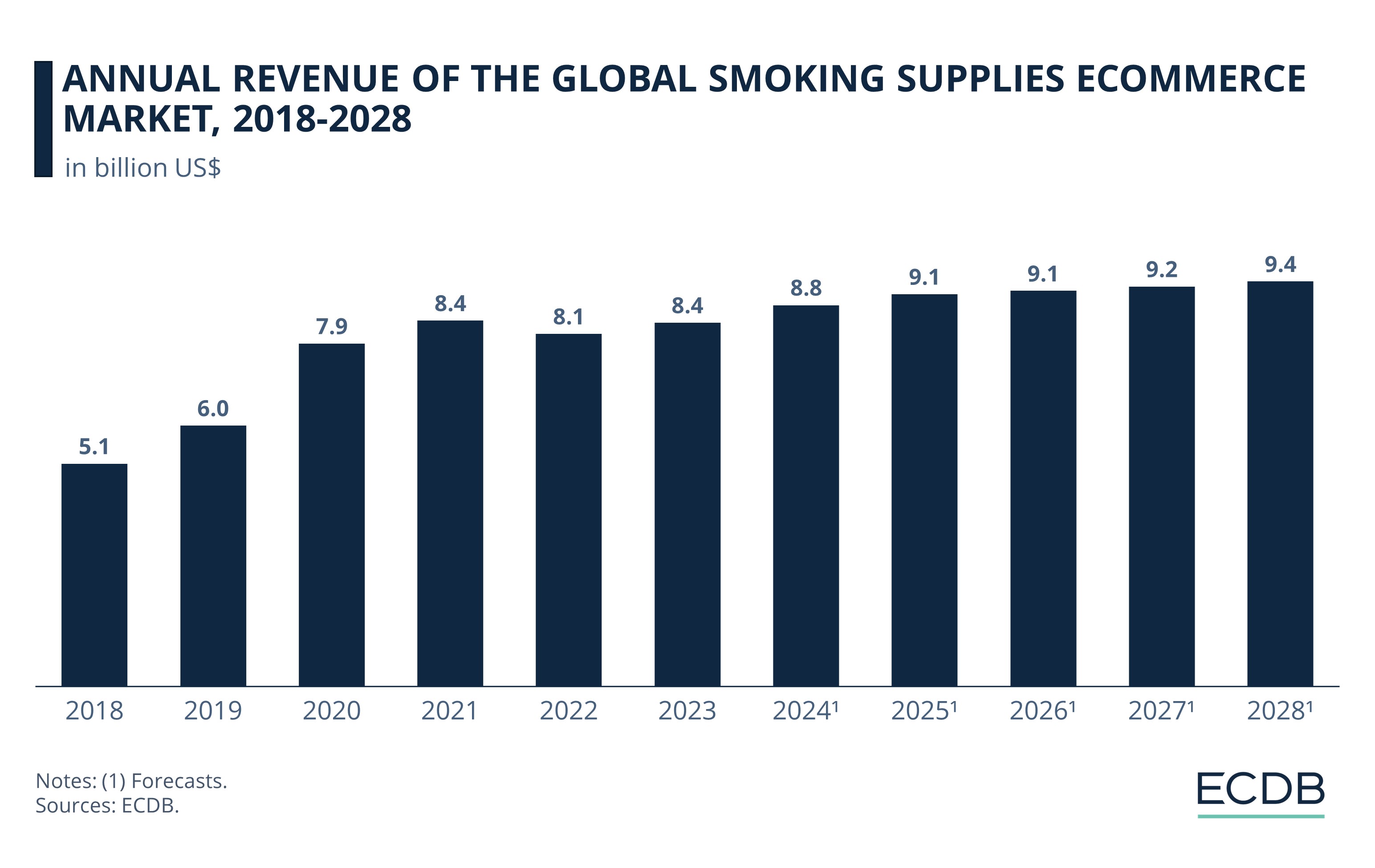

Global Online Smoking Supplies: The Smoking Supplies eCommerce market saw substantial growth, peaking at US$8.4 billion in 2021. The sector is projected to increase steadily to US$9.4 billion by 2028.

Leading Digital Retailers: Amazon and iqos.com are at the forefront of the online Smoking Supplies market with significant sales figures.

Regulation Influence: Regulatory measures, such as the upcoming ban on disposable e-cigarettes in Belgium, could affect future market growth. This development highlights the role of government policy in this market.

Smoking is deadly – nothing new for most people, but many still do it. Worldwide, more than one billion people over the age of 15 are smokers, according to Statista. That means at least as many people who are potential online shoppers in the smoking paraphernalia category.

But what does the online smoking supplies category include? Cigarettes? Liquids? Tobacco? Vapes? What has been the market's evolution in recent years? Discover the global Smoking Supplies sector and how the sale of tobacco products has developed in eCommerce.

What Is the Online Smoking Supplies Market?

An important part in the tobacco industry is eCommerce: called online Smoking Supplies at ECDB. We define the Smoking Supplies market as a submarket of the Hobby & Leisure market, which accounts for 1.3% within this market.

Market definition: Hobby & Leisure > Smoking Supplies

The category encompasses the commercial (B2C) sale of:

Tobacco (e.g. smoking blends, E-Liquids),

Smoking devices (e.g. pipes, vaporizers, vaping pens, water pipes),

Smoking supplies (e.g. rolling papers, filters, ashtrays, grinders, cigar and cigarette cases).

Excluded from the Smoking Supplies category are:

Smoking cessation products (e.g. nicotine gum, nicotine patches, nicotine lozenges).

Ordering Smoking Supplies online can be especially beneficial for consumers who want to stock up on supplies or who are looking for a wider range of products than what a regular corner store can offer. Whatever the motivation for buying smoking supplies via eCommerce, one would suspect that the pandemic has had an impact, right?

Smoking Supplies eCommerce Follows New Growth Trend

In 2023, the market generated revenues of US$8.4 billion. This is equal to an eCommerce online share of 10.6% in the total Smoking Supplies market in the same year. Similar to the general Tobacco Products sector, the Smoking Supplies sub-category is expected to grow after some ups and downs in the past years:

Pre-COVID-19: Before 2020, the Smoking Supplies online market followed a considerable growth trend, progressing its revenue from US$5.1 billion in 2018 to US$6 billion in 2019 – an increase of 17%.

eCommerce Boom: 2019-2020 the smoking supplies sector had a remarkable jump of 31% and came to a head in 2021 at US$8.4 billion.

Post-Corona Development: Following the reopening and easing of restrictions due to the pandemic situation, sales in the Smoking Supplies market briefly dropped to US$8.1 billion in 2022. However, last year the market almost regained its 2022 peak at US$8.4 billion.

The Years Ahead: A look into the crystal ball reveals a linear growth trend over the next four years. By 2028, the Smoking Supplies market is predicted to generate US$9.4 billion in revenue.

Despite a slight decline in 2022, the global Smoking Supplies eCommerce Market continues its positive growth trajectory. What stores generate highest revenues in this market?

Iqos Prominent in the Smoking Supplies Market, Just Behind Amazon

There are two main online stores that dominate the Smoking Supplies eCommerce market. The first is an old acquaintance, amazon.com, with net sales of US$416.8 million in 2023. The U.S. tech giant focuses 37.7% on the Hobby & Leisure category and less than 1% on the Smoking Supplies sub-category.

With 7% less than Amazon, iqos.com follows in second place with US$387.6 million in net sales in 2023. The online store specializes in electronic cigarette alternatives that heat tobacco instead of burning it. The spacing to the next online stores in line is more significant:

The electronic cigarette online store, elementvape.com, ranks third with net sales of US$136.4 million in 2023, representing 35% of Iqos' income in the same year.

snusbolaget.se, an online retailer of snus, follows with a net sales value of US$120.5 million in 2023. Snus is a product similar to chewing tobacco, except that it must be placed between the upper lip and the gum to be absorbed over a longer period of time. This type of tobacco product is illegal in, among other places, the EU (except in Sweden).

Last in the world's top 5 Smoking Supplies online stores is coles.com.au, the online store operated by Coles Supermarkets Australia Pty. Last year they achieved a turnover of US$76.6 million in the smoking sub-category, representing 4% of their total net sales.

Global Smoking Supplies eCommerce Market: Closing Remarks

The Hobby & Leisure sub-category Smoking Supplies continues a new growth trend. Despite this growth, it is important to remember that this market is profiting from the sale to consumers of harmful drugs or devices for such use. The World Health Organization (WHO) describes it as “one of the biggest public health threats the world has ever faced, killing over 8 million people a year around the world”.

As one of the countries in the EU, Belgium is working to ban disposable e-cigarettes from January 1, 2025. Other countries – especially of the EU – may follow, which could lead to a lower growth development as predicted in the smoking accessories market. Time will tell if health and environmental concerns are stronger than the tobacco lobby.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Deep Dive

Walmart Expands Pet Care Services

Walmart Expands Pet Care Services

Deep Dive

Monthly eCommerce Market Revenue Growth: Online Retail Sales (September 2024)

Monthly eCommerce Market Revenue Growth: Online Retail Sales (September 2024)

Deep Dive

Online Toys Market: Top Stores & Market Development

Online Toys Market: Top Stores & Market Development

Deep Dive

Bad Dragon Business Analysis: Net Sales, Revenue & Market Development

Bad Dragon Business Analysis: Net Sales, Revenue & Market Development

Back to main topics