eCommerce: Sexual Wellness

Bad Dragon Business Analysis: Net Sales, Revenue & Market Development

Learn about Bad Dragon's business analysis, net sales and market development. How has the brand navigated challenges in online shopping and grown its market presence?

Article by Cihan Uzunoglu | August 19, 2024Download

Coming soon

Share

Bad Dragon Business Analysis: Key Insights

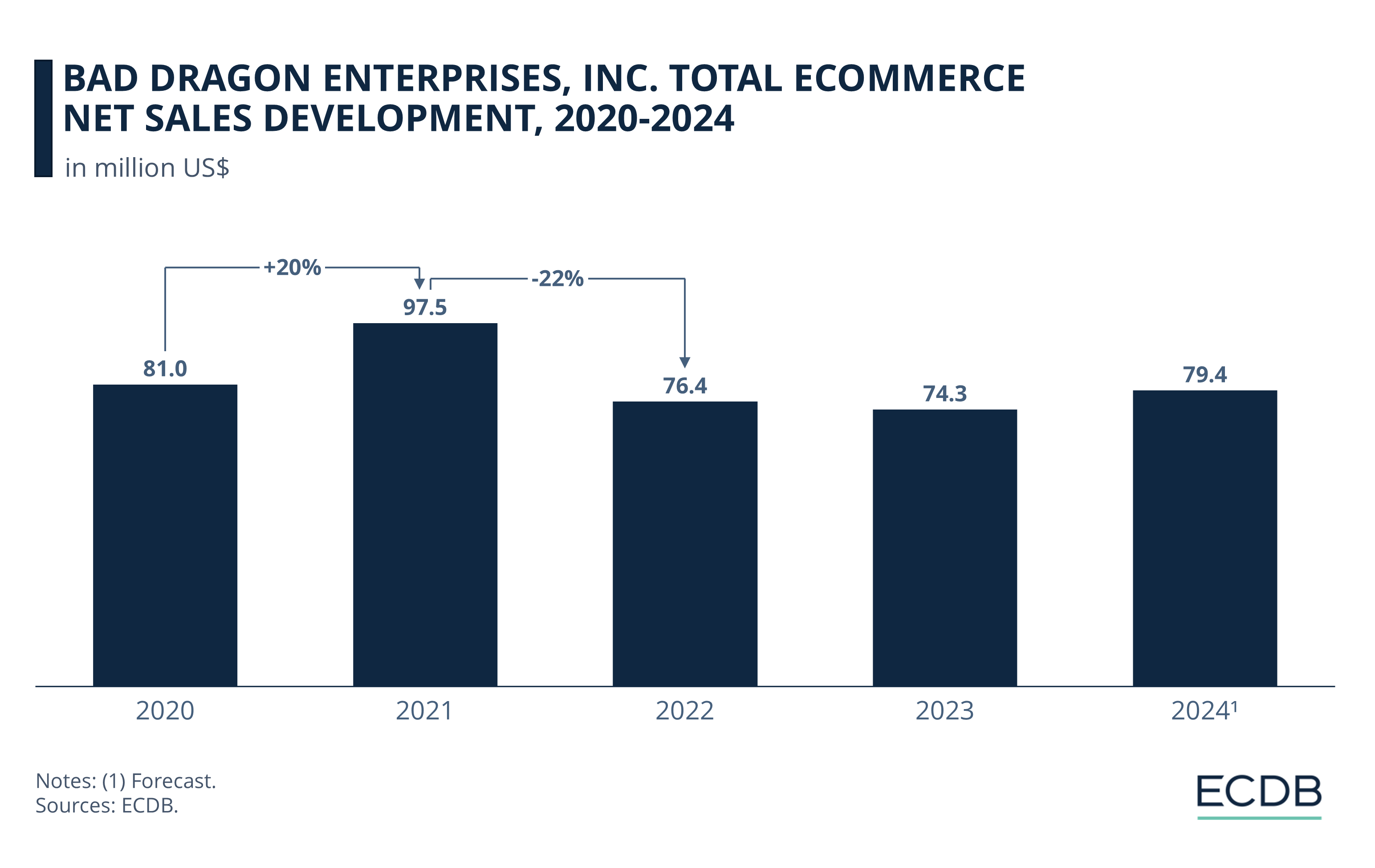

Sales Trends: Bad Dragon's online sales hit a high of US$97.5 million in 2021 but declined to US$74.3 million by 2023. A modest recovery to US$79.4 million is expected in 2024, despite the company’s strong rankings—#8 in the U.S. and #12 globally among erotic and adult product retailers.

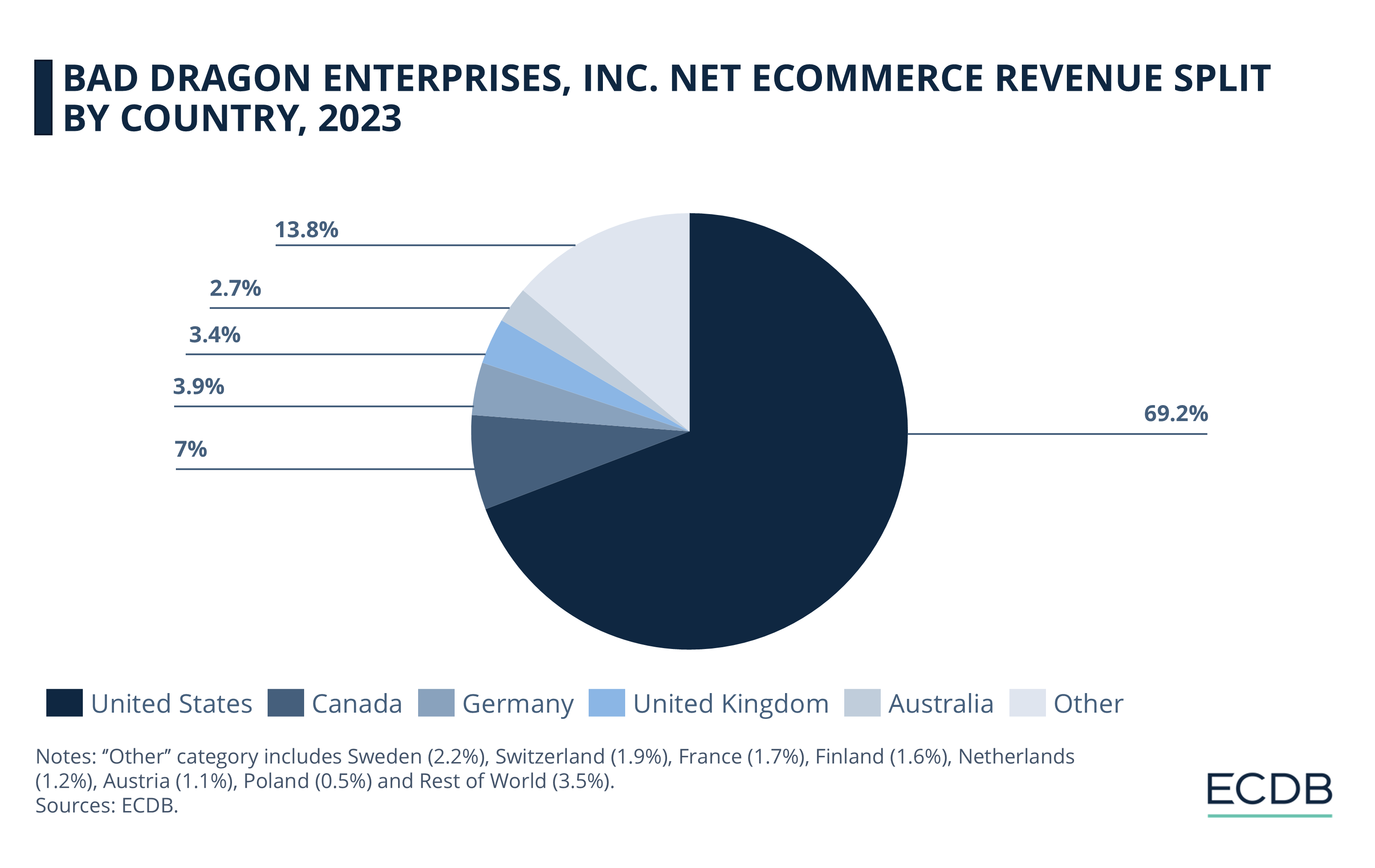

Market Focus: In 2023, 69.2% of Bad Dragon's online revenue came from the U.S., with Canada contributing 7%, and other countries making up the remaining 23.8%.

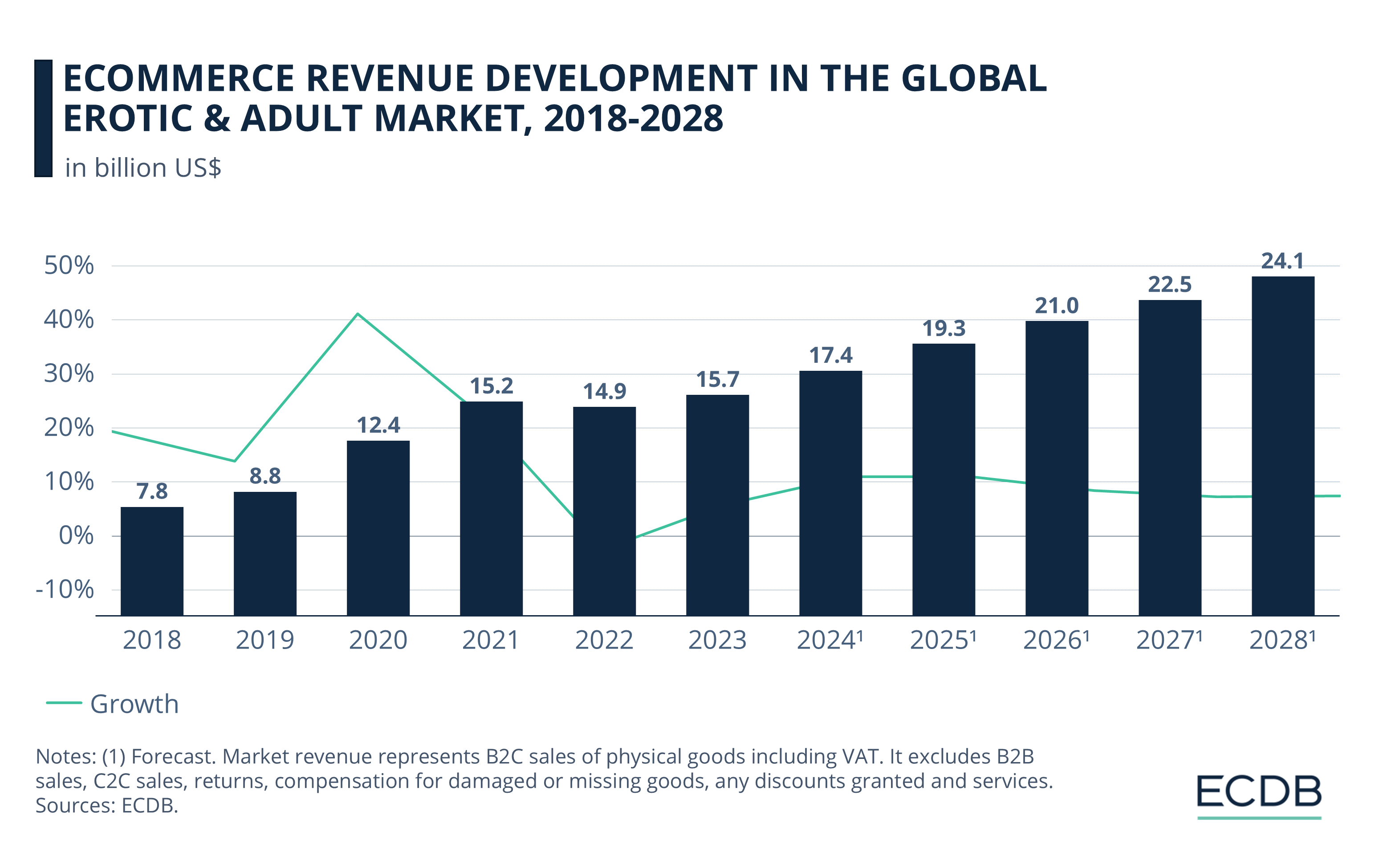

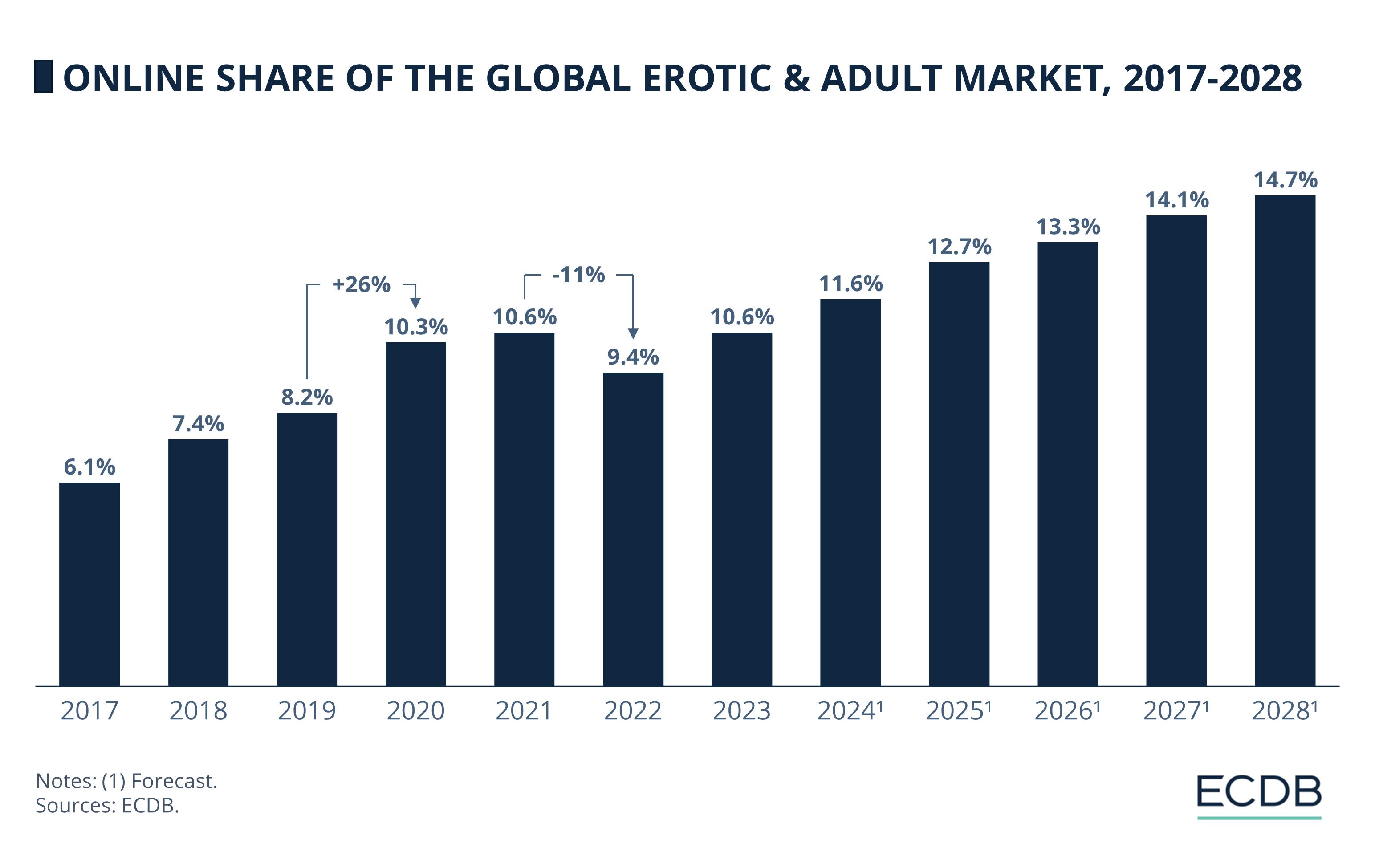

Industry Growth: The erotic and adult eCommerce market expanded from US$7.75 billion in 2018 to a projected US$24.12 billion by 2028. Online sales are forecasted to grow from 10.6% in 2023 to 14.7% by 2028.

Bad Dragon has carved out a niche in the crowded world of adult products by transforming mythical creatures into uniquely imaginative sex toys. Since its launch in 2008, the company has attracted a loyal following, particularly within the furry community, thanks to its bold designs and creative approach.

From dragon-inspired dildos to customizable creations that push the boundaries of fantasy, Bad Dragon offers something different. But how has this niche player fared in the competitive eCommerce space? And where are its strongest markets? Let's dive into the recent sales trends and market distribution to find out.

Bad Dragon Online Store

Net Sales Development

Bad Dragon's online sales saw significant fluctuations from 2020 to 2024. The data suggests the company experienced a sharp rise during the early pandemic years, followed by a downturn and only a modest rebound expected in the near future:

After peaking at US$97.5 million in 2021, revenue dropped to US$76.4 million in 2022.

The decline continued to US$74.3 million in 2023.

A slight recovery is forecast for 2024, with expected sales reaching US$79.4 million.

Ranked #8 among the top online stores specialized in erotic & adult products in the U.S., baddragon.com is ranked #12 in the global arena.

So, in which markets is the online store strongest?

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Top Markets of Bad Dragon

The online store’s revenue distribution by country highlights the company’s strong reliance on the U.S. market, with limited but notable presence in several other regions:

In 2023, the United States dominated Bad Dragon's online sales, accounting for 69.2% of total eCommerce revenue.

Canada followed, contributing 7%, while Germany, the United Kingdom, and Australia made up smaller portions at 3.9%, 3.4%, and 2.7% respectively.

The remaining 13.8% of sales were spread across other countries.

Online Sexual Wellness Sales

The global erotic and adult market has experienced significant shifts in eCommerce revenue over the past decade.

In 2018, the market generated US$7.75 billion in revenue, which grew to US$8.82 billion by 2019.

The pandemic fueled a sharp increase in 2020, pushing revenue to US$12.44 billion. Growth continued into 2021, reaching US$15.24 billion, but dipped slightly in 2022 to US$14.86 billion before rebounding to US$15.72 billion in 2023.

Looking forward, 2024 is expected to see revenue climb to US$17.43 billion, with projections suggesting a steady rise to US$24.12 billion by 2028.

Online Share of the Market is Set to Increase

The shift to online purchasing has allowed consumers to access a wide range of sexual wellness products from the privacy and convenience of their homes. This digital transition provides customers with ample time and information to make informed decisions.

Online sales saw a significant jump between 2019 and 2020, rising from 8.2% to 10.3%, a 26% increase.

However, from 2021 to 2022, there was a decline from 10.6% to 9.4%, an 11% decrease, likely due to market saturation or shifts in post-pandemic consumer behavior.

Projections indicate that online market share will increase steadily from 10.6% in 2023 to 14.7% by 2028, reflecting growing consumer comfort and the expanding reach of online sales in this sector.

Bad Dragon Business Analysis: Final Thoughts

The pandemic has undeniably accelerated growth in the online sexual wellness market, but whether this surge will sustain over the next decade remains to be seen. As consumer habits evolve, driven by privacy and convenience, the market is likely to keep expanding, but perhaps at a steadier pace.

Bad Dragon's ability to maintain its niche appeal while adapting to broader market trends will be crucial. If the company can innovate while solidifying its presence in other markets, it may continue to thrive as the online adult market matures and competition intensifies.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics