eCommerce: Sexual Wellness

Online Sexual Wellness Market: Top Stores & Market Development

The online sexual wellness market is booming as more people turn to eCommerce. Explore top stores, market size, and countries leading in online sales growth.

Article by Cihan Uzunoglu | August 16, 2024

Online Sexual Wellness Market: Key Insights

Top Market Leaders:

Adameve.com leads the global online erotic market, with eis.de and lovense.com close behind, while Lelo.com and lovehoney.co.uk also had strong performances in 2023.

Steady Market Growth:

The global erotic and adult market is growing steadily, with online sales projected to reach a 14.7% market share by 2028, driven by increasing consumer comfort and the rise of online shopping.

U.S. Consumer Dominance:

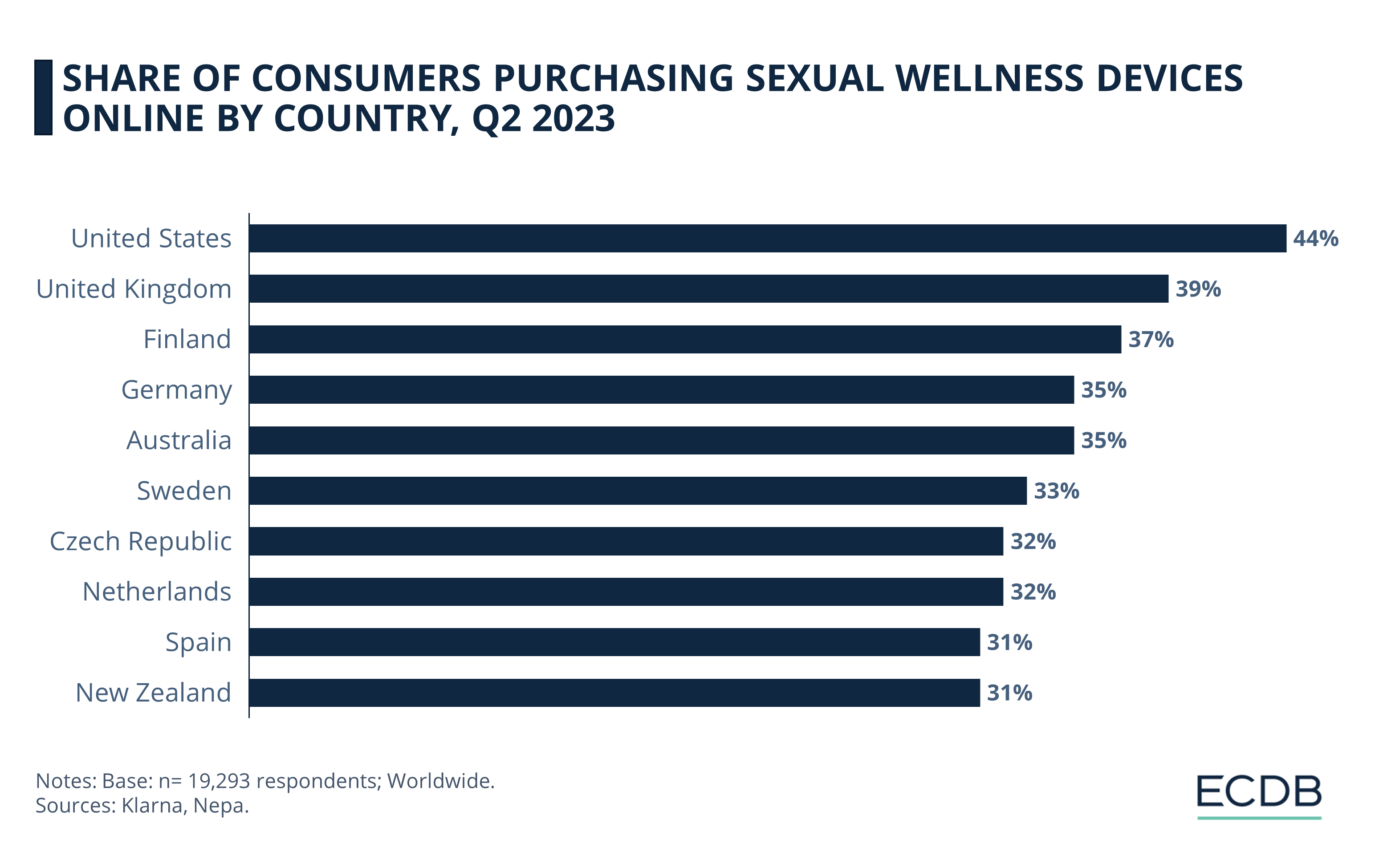

The U.S. leads in online sex toy purchases, with 44% of consumers participating, followed by the UK at 39%, and most purchases are made through specialist stores, both online and offline.

Generational & Gender Trends:

Millennials dominate online sex toy purchases at 47%, with Gen Z at 39%, while the U.S. shows the smallest gender gap in online shopping for sexual wellness products.

The online sexual wellness market is a fast-growing multi-billion-dollar industry. It includes not just sex toys but also products for sexual health, intimate care, and reproductive health.

Which online stores are dominating, and how has the market shifted, especially after the pandemic? We have the data-driven insights.

What is the Erotic & Adult Market?

The Erotic & Adult market, a segment within the Hobby & Leisure category, includes digital sales of products like erotic lingerie, sex toys, lubricants, sexual wellness products, and fetish gear.

This category focuses solely on these items and does not encompass erotic books, contraceptives, or online dating and matchmaking services.

Online Erotic Market: Top Stores

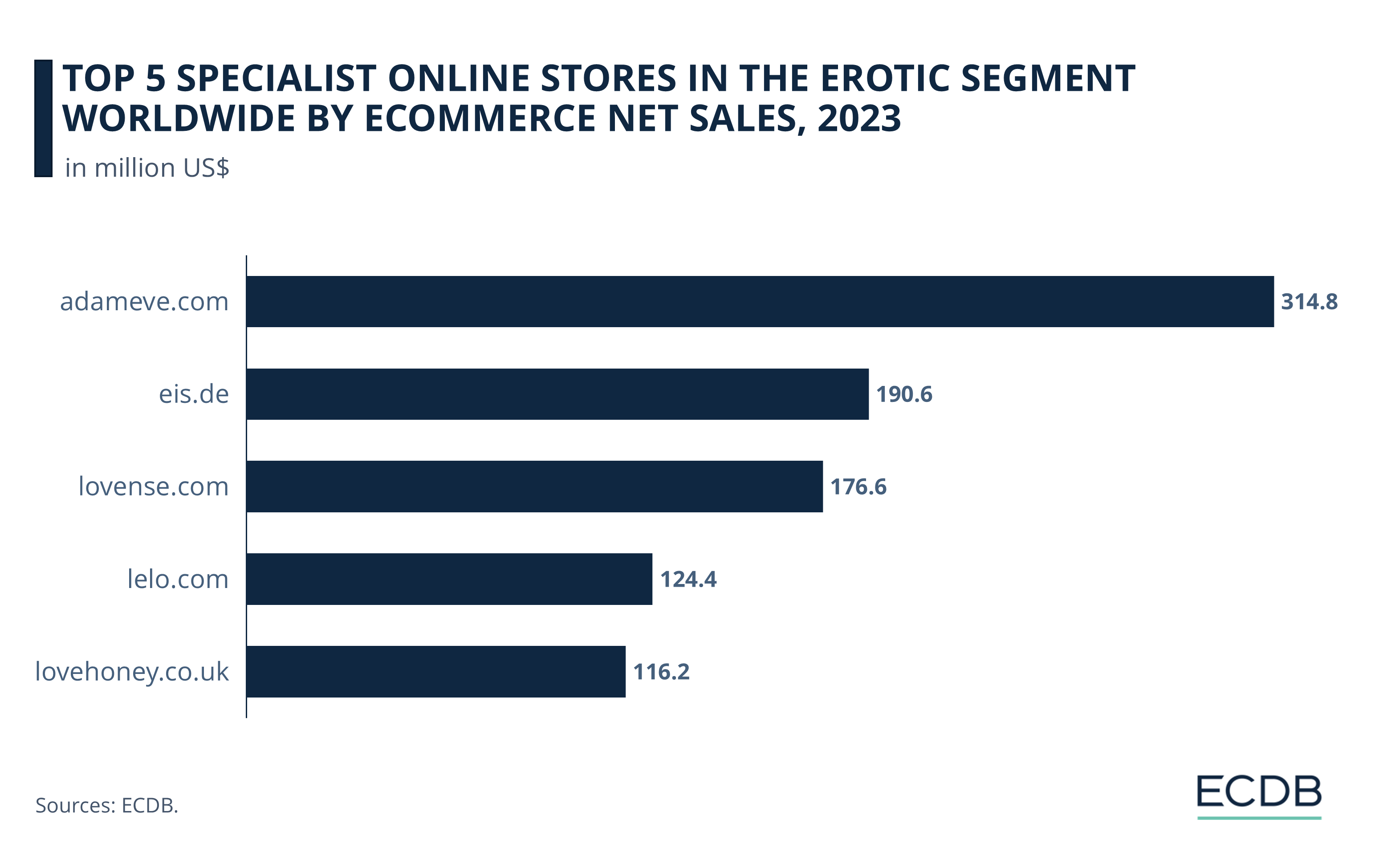

According to our data, the top 5 specialist online stores in the erotic segment can be seen in 3 tiers:

Adameve.com continues to lead the global market in online sales for the erotic category, generating US$314.8 million in 2023.

It's followed by eis.de, with sales amounting to US$190.6 million. Close behind, t

he third position is held by lovense.com, reaching net sales of US$176.6 million with 21% growth last year.

Lelo.com and lovehoney.co.uk also performed well last year, generating US$124.4 million and US$116.2 million respectively.

While the likes of Amazon may indeed sell a significant volume of erotic products, our focus here is on those eCommerce platforms that have built their business exclusively around the selling of erotic products. These top specialist stores, with their sales records and business strategies, serve as potent indicators of the industry's current state and potential future directions.

1. Adameve.com

Adameve.com reported revenues of US$314.8 million in 2023. Growing revenues by 3.8% last year, Adam & Eve is the biggest erotic online store globally.

With a legacy spanning over 50 years in the U.S. adult toy sector, Adam & Eve offers a diverse array of products that go beyond toys to include wellness essentials and intimate apparel. These offerings are tailored for both singles and couples.

The brand's emphasis on confidentiality, along with its varied product lineup, underscores its industry leadership and attuned understanding of consumer preferences in the U.S. market.

2. Eis.de

In 2023, Eis.de reported sales of US$190.6 million, marking a 2.7% decline compared to 2022.

With over 8.5 million customers, eis.de is Germany's leading online store for intimate lifestyle products. Founded in 2006 in Bielefeld, the online store offers a diverse range of products catering to women, men, and couples who seek to explore and enjoy their sexuality and passion. The platform features over 25,000 regularly updated products, providing an ideal space for browsing, inspiration, and pleasure.

Eis.de emphasizes top-quality products, offering a 365-day money-back guarantee and a 10-year product warranty, ensuring customer satisfaction and trust.

3. Lovense.com

Last year, lovense.com posted strong financial results, with revenues amounting to US$176.6 million. Moreover, Lovense experienced a 21.6% YoY (year-over-year) growth rate, indicating its thriving business and enlarging footprint in the market.

What sets Lovense apart in the digital adult toy industry is its emphasis on high-tech capabilities. The company specializes in products that facilitate long-distance interactions, enhancing intimate experiences irrespective of physical location. Their proprietary "Lovense Remote App" amplifies this aspect by allowing remote toy control and featuring an extensive selection of customizable vibration settings.

Beyond mere product offerings, Lovense enriches the customer journey with additional features like interactive gaming and erotic audio narratives, fortifying their all-encompassing market strategy.

4. Lelo.com

Recording strong earnings amounting to US$124.4 million last year, lelo.com also showcased a growth rate of 20%, illustrating a diversified and growing footprint in both domestic and international markets.

Lelo.com distinguishes itself not just as a maker of luxury sexual wellness products, but also as a leader in the broader self-care arena. Emphasizing inclusivity across various demographics like gender, orientation, race, and age, the platform holds a unique spot in the industry. With a comprehensive approach that combines an array of products and a focus on consumer education, the brand has set itself apart.

A two-decade-long legacy adds to the brand's strong market credibility. As it continues to evolve, lelo.com stands as a symbol of quality, inclusivity, and educational outreach in the realm of intimate care products.

5. Lovehoney.co.uk

In 2023, lovehoney.co.uk, a key player in the sexual wellness arena, recorded net sales amounting to US$116.2 million. Though the online store scored an impressive growth of 33.6% in 2020, 2021 brought a decline of 12.9%. 2022 saw lovehoney.co.uk make a comeback with 15.1% growth, and the online store finished 2023 with a healthy 6.4% growth.

The setback in 2021 is largely credited to issues with dominant technology platforms like Google and Instagram. An alteration in Google's SafeSearch feature notably dimmed Lovehoney's online presence, resulting in a loss of an estimated one million customers. To directly confront Google's impact on their business, Lovehoney launched its "Ogle" billboard campaign in June 2022. The campaign featured a billboard with the recognizable primary colors of Google's search engine and carried the provocative message: "Turn off SafeSearch to lay eyes on our full range."

Despite this bold initiative and subsequent discussions with Google's advertising division, the brand found no relief in policy changes. Additional hurdles arose from third-party sales platforms like Amazon and various social media outlets, due to their conservative guidelines on product listings and advertisements. Nevertheless, Lovehoney posted a relatively low but still hopeful growth rate last year, and is expected to continue its growth, albeit at lower rates.

Online Sexual Wellness Sales: United States Leads the Booming Market

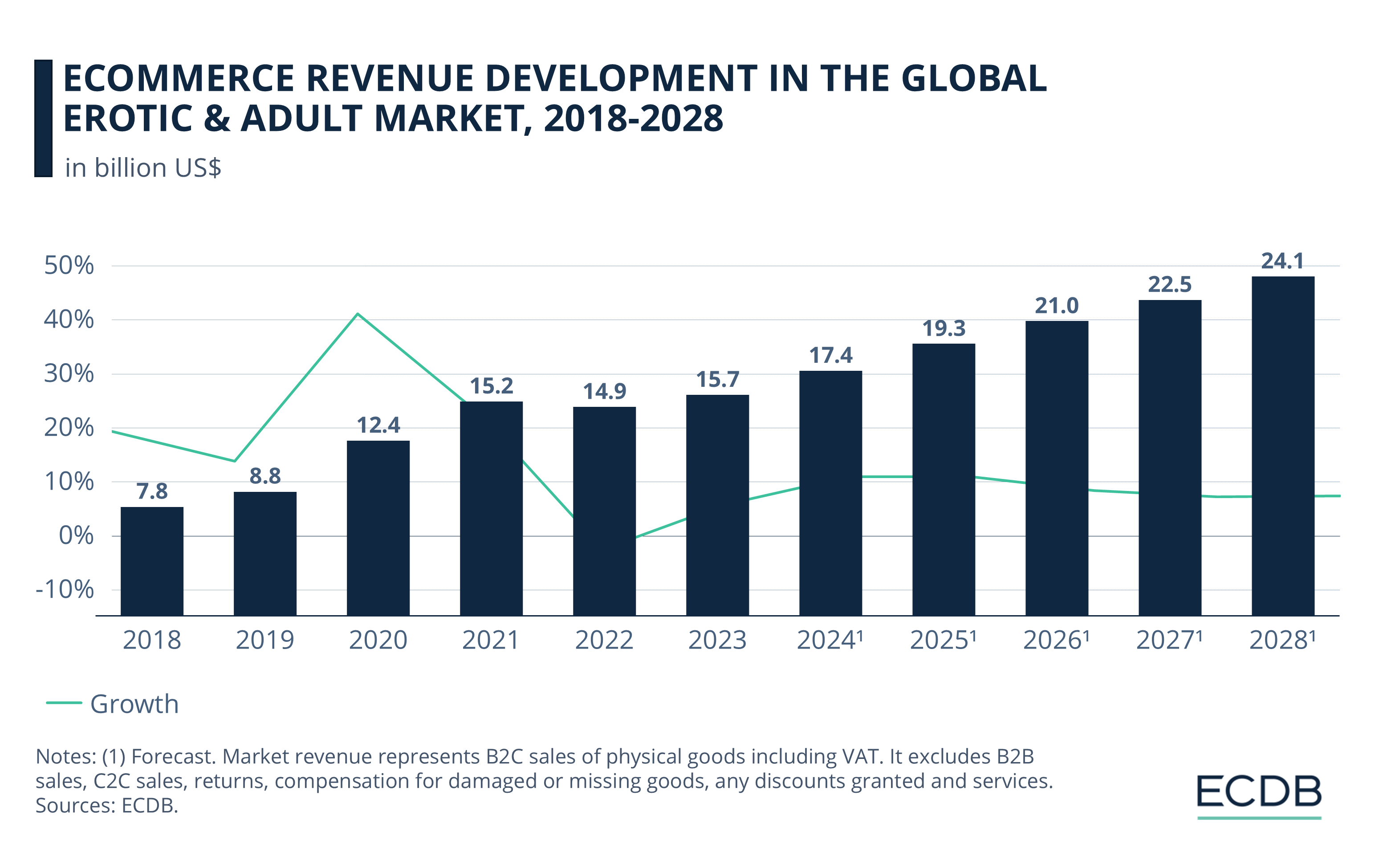

The eCommerce revenue in the global erotic and adult market has shown notable changes in the last decade or so.

In 2018, revenue was US$7.75 billion. By 2019, it had increased to US$8.82 billion.

In 2020, there was a sharp rise to US$12.44 billion, largely driven by the surge in online activity during the pandemic.

The growth continued in 2021, with revenue reaching US$15.24 billion. However, 2022 saw a slight dip to US$14.86 billion, followed by a rebound to US$15.72 billion in 2023.

Looking forward, forecasts for 2024 estimate revenue at US$17.43 billion, with projections for steady growth reaching US$24.12 billion by 2028.

Online Share of the Market is Set to Increase

From the comfort of their homes, customers can access an unprecedented array of sexual wellness devices with a level of privacy and anonymity that brick-and-mortar stores may not offer. In addition, the online sphere affords consumers the luxury of time and an informational richness to make well-informed choices.

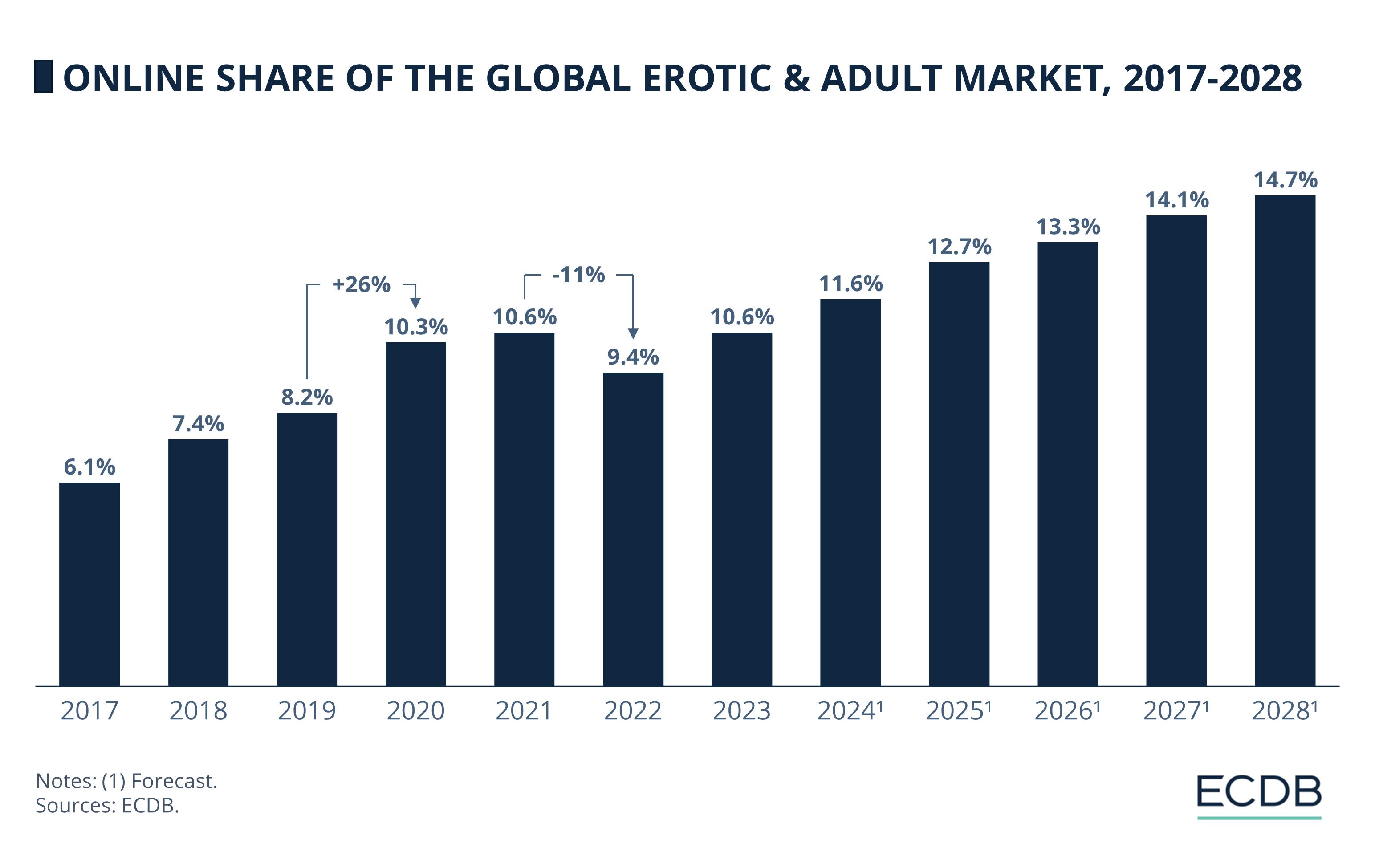

As per our data on the online share of the global erotic and adult market from 2017 through 2028:

There was a significant increase in online sales from 2019 to 2020, jumping from 8.2% to 10.3%, showing a 26% increase.

However, there was a decline from 2021 to 2022, dropping from 10.6% to 9.4%, representing an 11% decrease, due to a temporary market saturation or a shift in consumer behavior post-pandemic.

Looking ahead, forecasts indicate a steady increase in the online market share, climbing annually from 10.6% in 2023 to 14.7% by 2028, suggesting growing consumer comfort and increasing penetration of online sales in the erotic and adult market.

But how do different countries fare when it comes to buying sexual wellness devices online?

United States: Largest Share of Consumers Buying

Sex Toys Online

According to the latest data from Klarna Insights on the percentages of consumers purchasing sexual wellness devices online in different countries, the U.S. leads with 44% of consumers making such purchases, marking it as the top country for sales of sex toys. The United Kingdom follows closely with 39%.

Finland and Germany both show significant engagement, with 37% and 35% respectively. Australia also has 35% of its online shoppers buying these products. Sweden and the Czech Republic have 33% and 32% respectively, matching the Netherlands at 32%, which is the global average. Spain and New Zealand round out the list, each with 31% of their consumers purchasing sexual wellness devices online.

Majority of Sexual Wellness Devices Are Bought From

Online Specialists

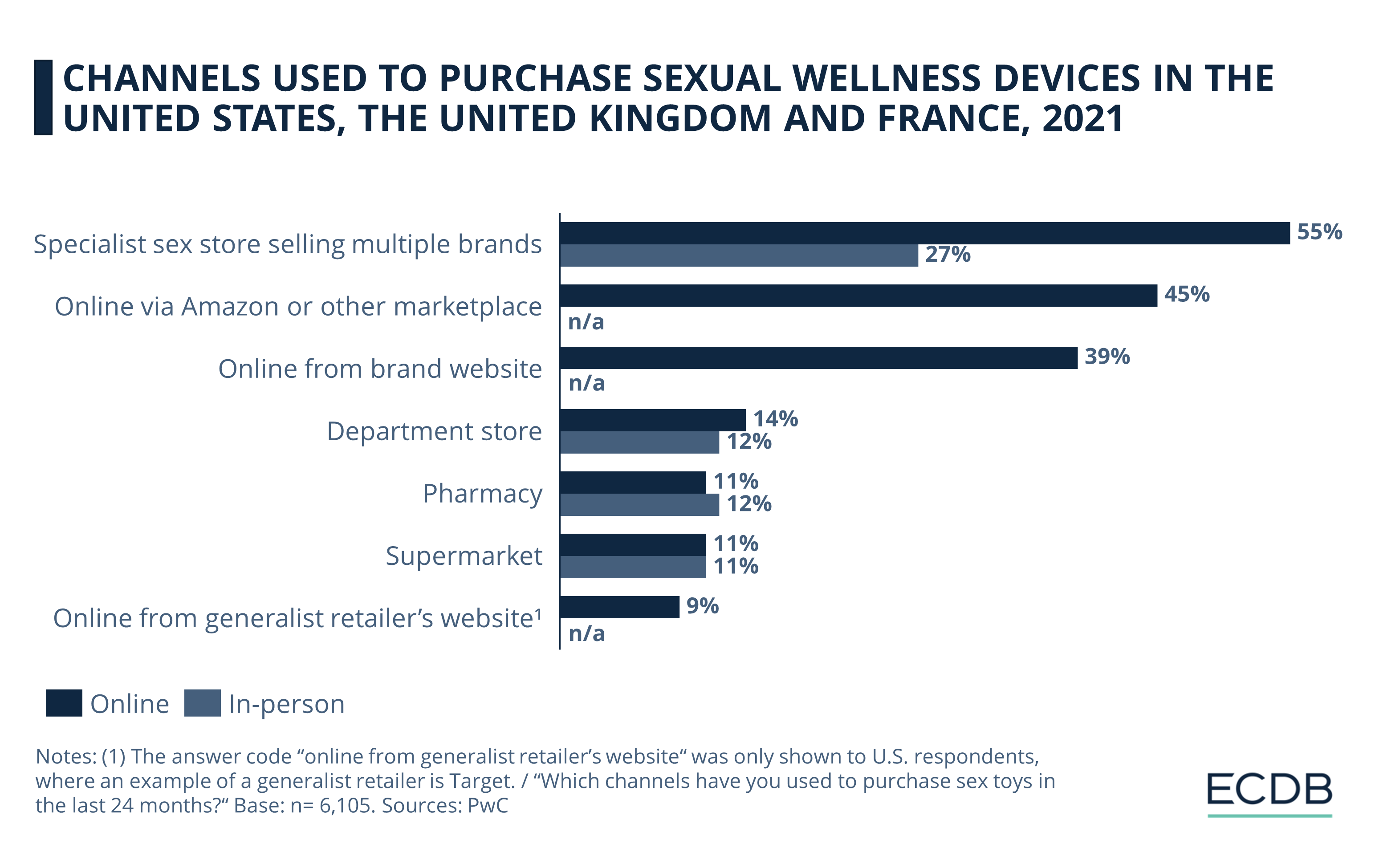

For better context, it's beneficial to zoom out a bit and look at the offline channels as well. A report by PwC provides a glimpse into the channels used by consumers to purchase sexual wellness devices in the United States, the United Kingdom, and France.

In a survey where respondents could pick multiple channels, the most commonly preferred method of purchase is through specialist sex stores selling multiple brands, both online (55%) and in-person (27%). Online marketplaces such as Amazon are the second most popular channel, with 45% of consumers making their purchases through these platforms. In addition to this, a significant number of consumers (39%) prefer to buy directly from brand websites.

More traditional retail outlets such as department stores and pharmacies are also utilized, albeit less frequently, for both online (14% and 11%, respectively) and in-person (12% each) purchases. Supermarkets too feature on this list, catering to 11% of consumers for their in-person shopping needs.

Lastly, 9% of consumers prefer to shop online from generalist retailers' websites. While this option was only presented to U.S. respondents in the survey, it reveals that retailers like Target are carving out their own niche in this market, despite being a less conventional choice for such purchases.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Who Buys Sex Toys Online?

Having covered the top players and the market evolution of the industry, we will now focus on the demographics of consumers who purchase sexual wellness devices online.

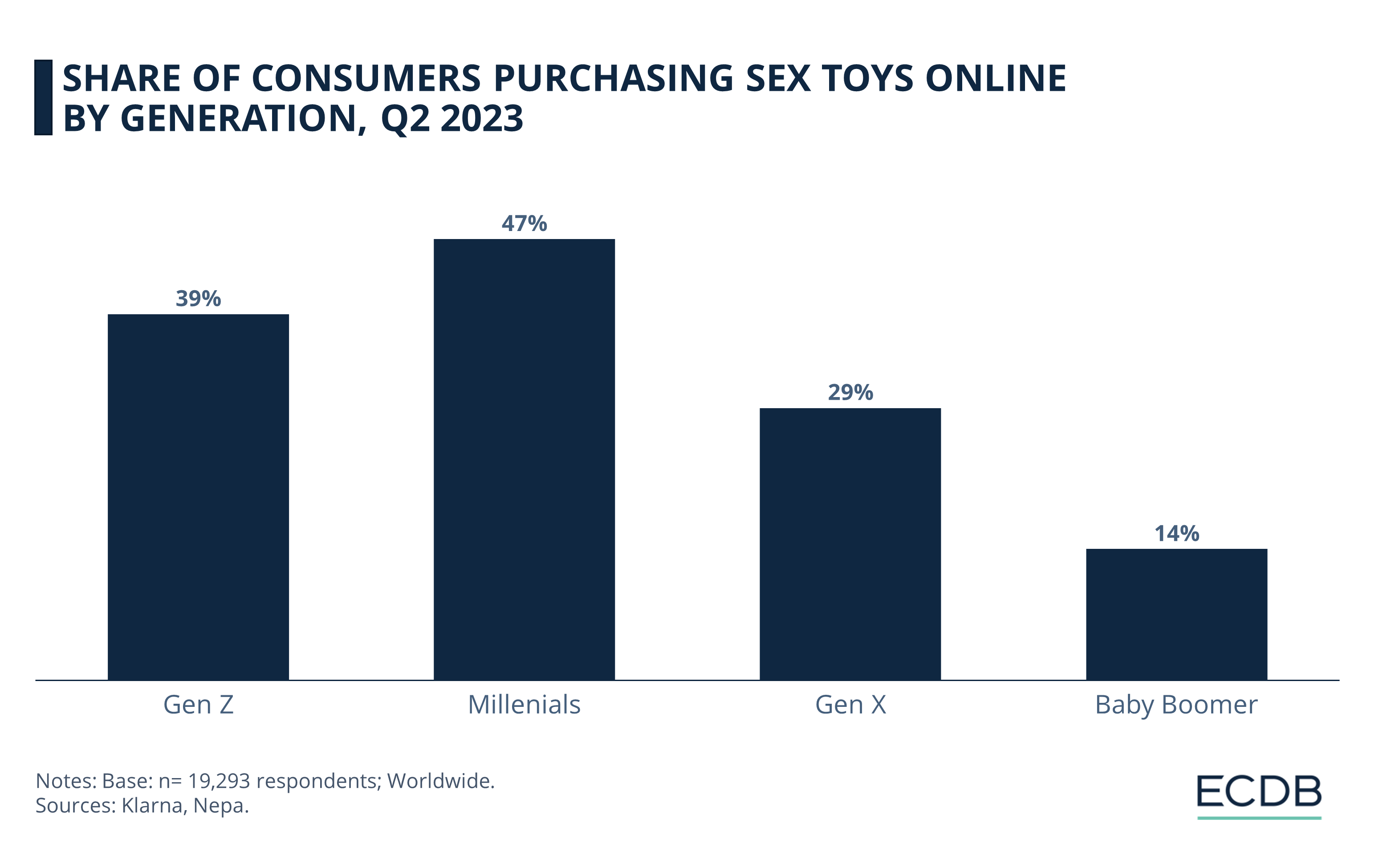

Data from Klarna and Nepa shows that millennials, at 47%, are the generation with the highest share of online purchases of erotic materials and toys.

While Gen Z follows with a significant 39%, only nearly a third (29%) of Gen Xers purchase these products online. As might be expected, the Baby Boomer share is rather low at 14%.

Sexual Wellness in Germany: (Almost) Gender Equality in Online Shopping

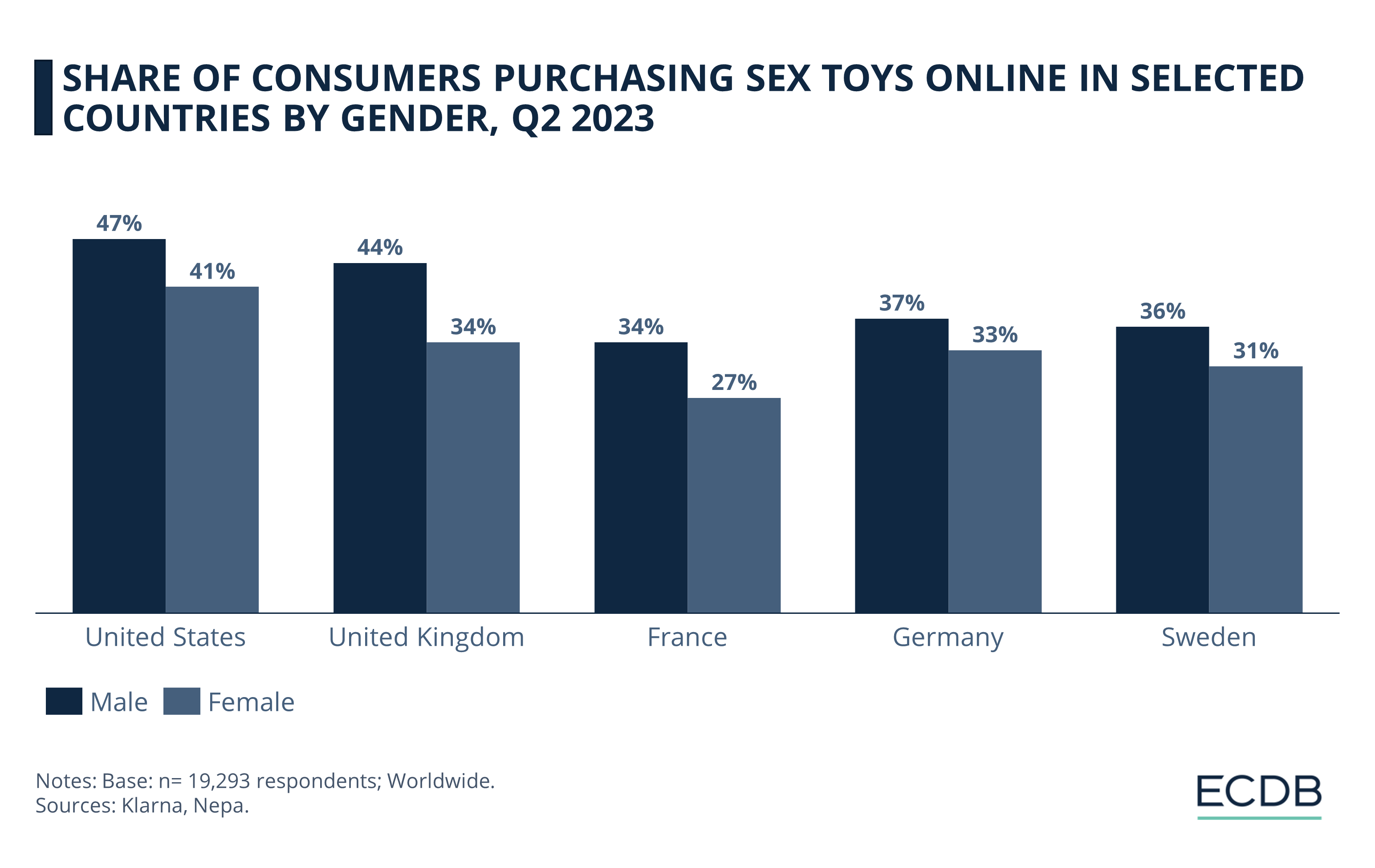

The types of sex toys differ when it comes to different genders, but so does the share of consumers who purchase these devices online.

As the largest online market for sexual wellness products, the U.S. has the highest share of both male (47%) and female (41%) users, while the difference in share (based on percentage points) between the genders is not as great as in the other countries in the chart below. In the UK, for example, the percentage point difference between the shares of male (44%) and female (34%) users is 10, suggesting a bigger gap between genders, as well as reluctance among female users to purchase sexual wellness products online.

Female consumers in France are even more reluctant, with just over a quarter (27%) making such purchases online. The participation of their male counterparts isn't much higher at 34%. Germany and Sweden, on the other hand, stand out as countries where the gap between genders is somewhat smaller in this regard. In Germany, the difference is only 4 percentage points, while in Sweden it's 5.

Online Sexual Wellness Market:

Final Thoughts

The online sexual wellness market is set for dynamic growth and innovation. As societal attitudes continue to shift and technology advances, we can expect even more diverse and sophisticated product offerings. The increasing acceptance of sexual health products, coupled with the convenience and privacy offered by online shopping, will drive further market expansion.

Innovations such as app-controlled devices and virtual reality experiences will redefine consumer expectations and engagement. Additionally, the rise of gender-neutral products and targeted marketing strategies will broaden the market's appeal. Looking ahead, the global market is poised to grow, with significant opportunities for new and established players alike.

Sources: Klarna Insights, PwC, ECDB, Statista

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Back to main topics