eCommerce Categories: Toys

Online Toys Market: Top Stores & Market Development

What were your favorite toys as a child? Maybe stuffed animals, Lego sets, or maybe Barbies? 20 years ago, it was common to buy such products in toy stores, but today it is increasingly online.

Article by Antonia Tönnies | September 19, 2024Download

Coming soon

Share

Global Online Toys Market: Key Insights

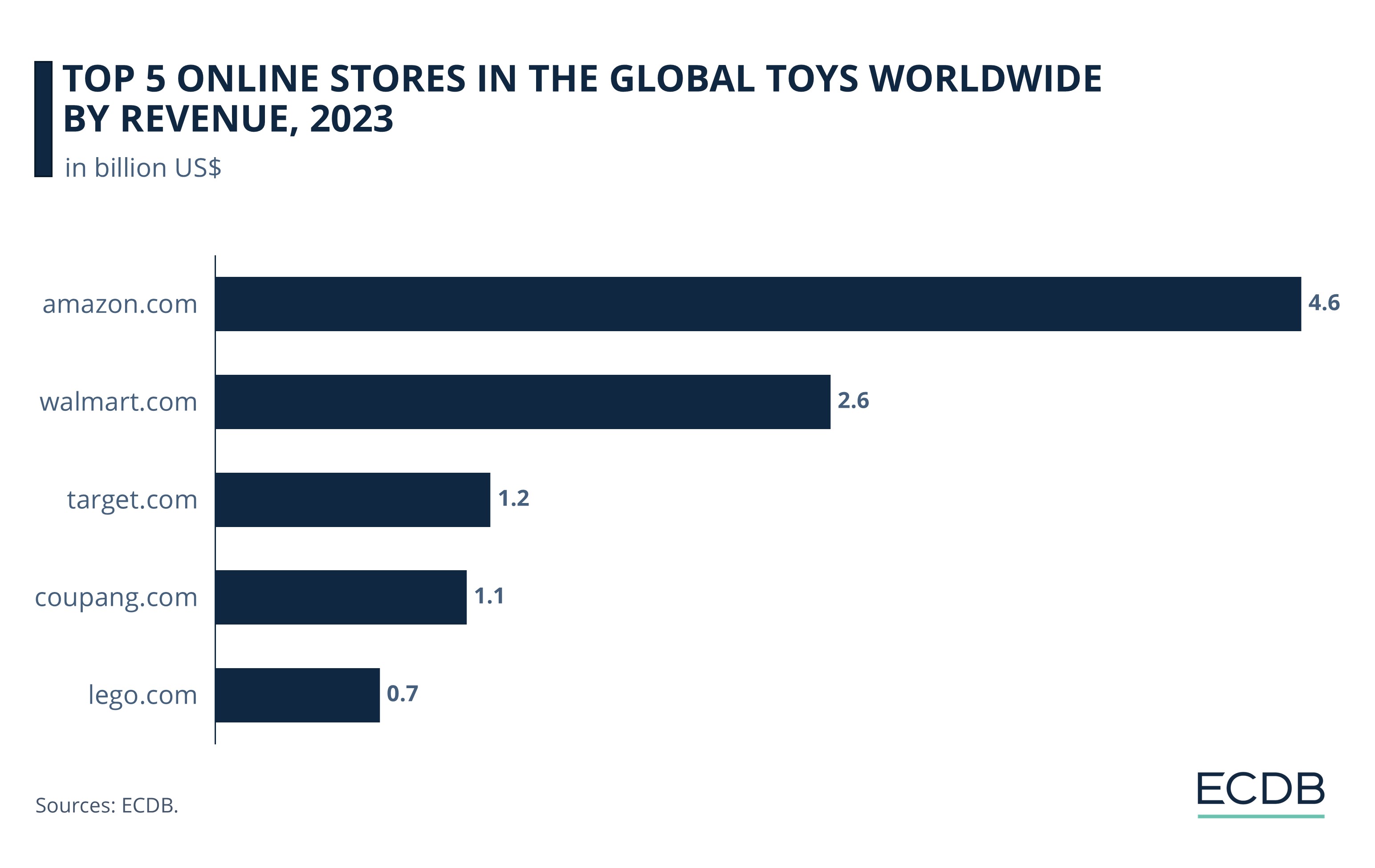

Top Online Retailers: Amazon remains the top player in the global online Toys market, generating significant revenue and maintaining a strong U.S. market focus.

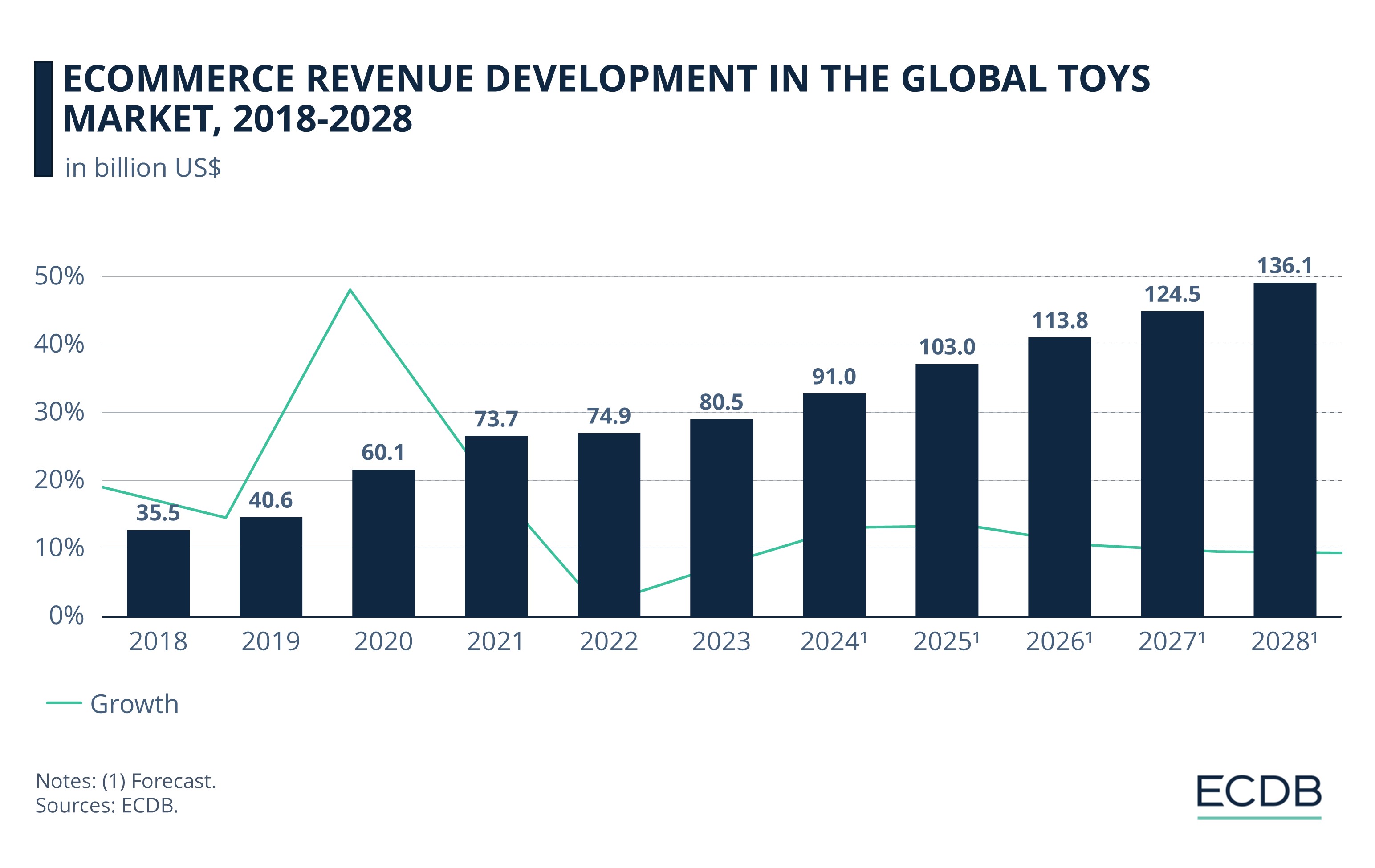

Market Growth: The online Toys market is projected to grow substantially, with a forecasted revenue of over US$136 billion by 2028, driven by post-pandemic eCommerce trends.

Event-Driven Turnovers: Sales spikes are often tied to major events such as holiday seasons and movie releases, underscoring the importance of timely product launches in the toy industry.

When was the last time you bought a toy online? Whether it's a cuddly teddy bear for a toddler or the latest board game for family game nights, online shopping is now a common way to get a treat for young and old.

As so often, U.S. giant Amazon dominates, but a popular toy company has also made it into the top 5 of the Toys eCommerce industry. Can you guess who it is? Here is a hint: it is small, square, and comes in a variety of colors.

What Is the Online Toys Market?

ECDB defines the Toys market as a submarket of the Hobby & Leisure market. The eCommerce category encompasses baby and toddler toys (e.g. cuddly toys, rattles), as well as games (e.g. board games, card games). Not included in the Toys market are video games and collectibles.

Top Online Stores in the Global Toys Market: Amazon Leads (Again)

The global online Toys market is shaped by large international eCommerce players. Not only American eCommerce specialists are represented here, but also from South Korea and Denmark:

Right at the top is the U.S. giant amazon.com, which is once again the market leader with US$4.6 billion in revenue.

In second place is another American player, walmart.com, with US$2.6 billion in 2023.

Next in line comes target.com with revenues of US$1.2 billion in 2023.

In fourth place follows the South Korean online store coupang.com, which generated eCommerce net sales of US$1.1 billion in 2023.

Last but not least in the top 5 is lego.com with net sales of US$694 million in 2023.

Let's look at the details.

1. Amazon.com

Amazon.com leads the global Toys market in terms of revenue. In 2023, the U.S. tech giant has generated a revenue of US$4.6 billion. The online store concentrates 97.4% on the U.S. market, with a total of 3.3% of its eCommerce net sales generated in the subcategory of Toys.

At the turn of the year, Amazon, along with Walmart and Target, decided to stop selling water beads because they pose a health risk to children. In doing so, the online stores are taking a stand against products that endanger children. But one should not forget that Amazon is often criticized for its working conditions and human rights violations.

2. Walmart.com

In second place is another U.S.-based online store: walmart.com. In 2023, the online store reached a turnover of US$2.6 billion, which is almost 56% of amazon.com's turnover. The eCommerce retailer operated by Walmart, Inc. is 100% centered on the U.S. market, with a 4% share in the Toys subcategory.

Walmart’s Toys section has recently made headlines by adding Pudgy Toys to its lineup through a partnership with Pudgy Penguins. These toys are connected to a type of digital ownership known as NFTs (non-fungible tokens), and the goal is to bring more attention to a project that started in the world of cryptocurrency.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

3. Target.com

Target.com follows in third place with net eCommerce sales of US$1.2 billion in 2023. Like Target, the online store is fully focused on the U.S. eCommerce industry, where it derives 6% of its sales from the Toys market.

After a successful launch at Walmart, Pudgy Penguins expanded its NFT collection into a collaboration with Target. The combination of physical goods with Web3 technology – in other words, data ownership – is still relatively new, but has the potential to become more widespread.

4. Coupang.com

In fourth position ranks the South Korean eCommerce player coupang.com. In 2023, the online store reached a net eCommerce turnover of US$1.1 billion. Its main market is the domestic South Korean market (99.5%), while 5% of its total revenue is generated in the Toys sector.

Last year, Coupang, Inc. entered the Fortune 500 at number 195. Meanwhile, the online store ranks among the top 10 eCommerce stores worldwide, among other major tech players such as apple.com, amazon.com, and jd.com. The competition from South Korea is not to be underestimated.

5. Lego.com

The remaining top five online Toys retailer is lego.com. The online retailer of the Danish Toys company Lego A/S achieved net eCommerce sales of US$694 million in 2023. A large portion of this generated in the United States (45.4%), while a large portion was earned in European countries. Lego sells only products in the Toys category.

The famous Lego bricks have become an integral part of many children's and adults' homes. Recently, Lego announced a long-term collaboration with Nike. There is still speculation as to what products this collaboration might produce – exciting for all Lego and sneaker collectors.

Online Toys Market Worldwide: Forecasted to Reach US$136 billion until 2028

The global eCommerce market for Toys has seen a lot of development, with the eCommerce boom in 2020 giving it a boost:

In 2018, the market generated revenues of US$35.5 billion, followed by US$40.6 billion in 2019.

As the pandemic began in late 2019, it led to a major eCommerce boom, resulting in 48% annual growth and US$60.1 billion in revenue by 2020.

In 2021, the growth rate slowed down with revenues of US$73.7 billion, until it bottomed out at 1.6% in 2022 with net sales of US$74.9 billion.

Last year, the YoY growth rate increased to 7.5%, resulting in annual sales of US$80.5 billion.

ECDB expects the online Toys market to continue to rise at a CAGR of 11% between 2024 and 2028. By 2028, the market is forecast to reach US$136 billion in revenue.

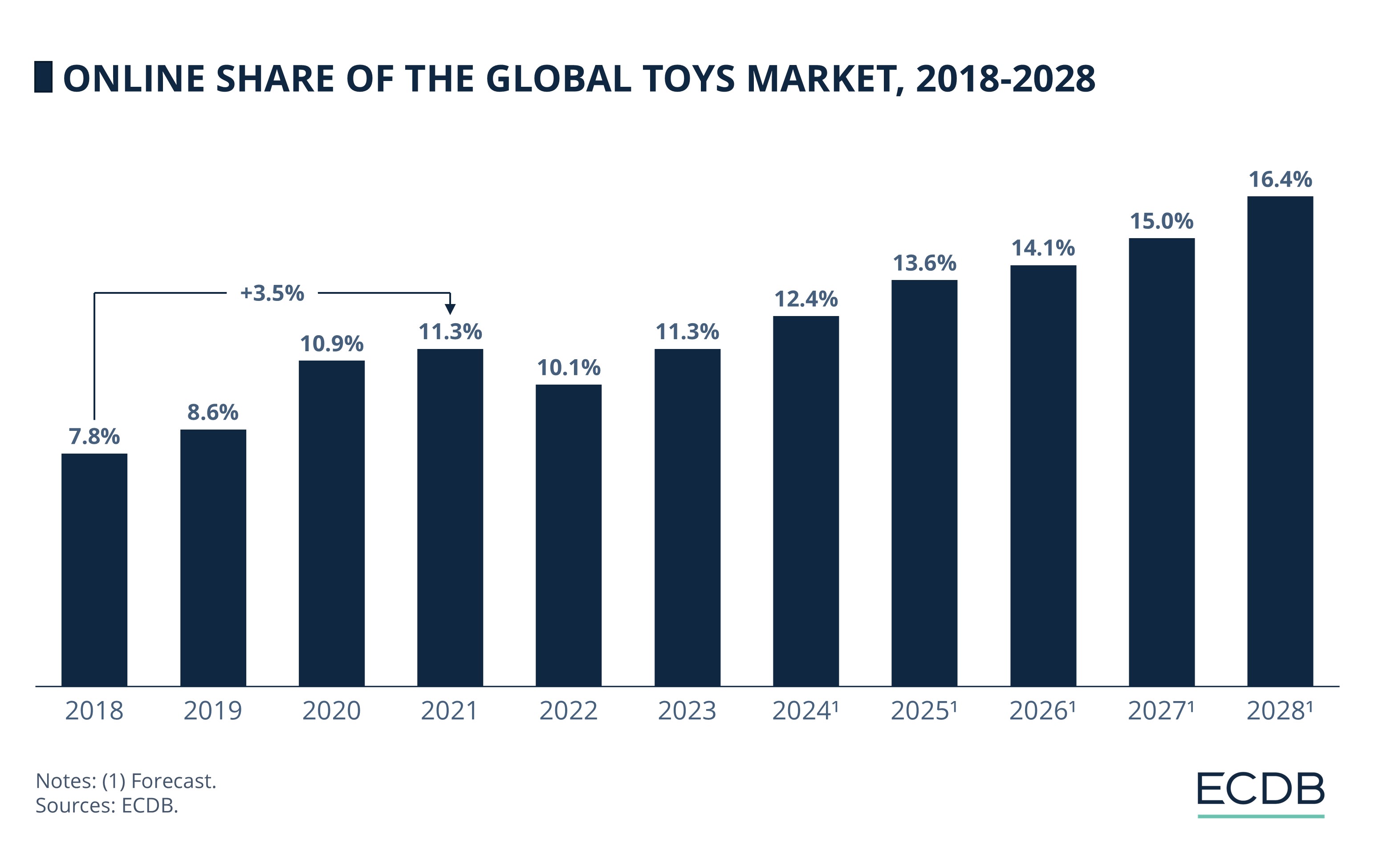

Online Share at Same Level as 2021 High

The eCommerce online share of the total Toys market experienced a similar development as the global turnover for this industry. Online share refers to the proportion of retail volume that is transacted via the Internet, such as purchases made via smartphone:

The online share for the Toys market increased by 2.5% from 2018 (7.8%) to 2020 (10.9%).

Compared to 2022, the online share grew from 10.1% to 11.3% in 2023. Thus, the share in 2023 reached the same level as it did in 2021.

Looking ahead, ECDB forecasts that the online share of the global Toys market could reach 16.4%.

Global Online Toys Market: Closing Thoughts

The online Toys market is an industry that revolves around the wishes of the little ones, although adults can also get their money's worth. Some toys, such as Lego, are never outgrown. Toys are the products with which young and old alike celebrate annual events such as Christmas and Lunar New Year.

Not only do these events drive sales, but so do events like the release of new movies. New toys are released to coincide with the latest blockbuster, such as Barbie or the latest Spider-Man movie. These movie launches are the perfect advertisement to sell related toys.

In addition, the industry shows a willingness to innovate. For example, Pudgy Penguins demonstrates how a toy can be connected to the digital world, especially with a blockchain token like NFT. It will be exciting to watch the development of Web3 in combination with physical goods.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

Walmart Expands Pet Care Services

Walmart Expands Pet Care Services

Deep Dive

eCommerce in the United States: Best Product Categories

eCommerce in the United States: Best Product Categories

Back to main topics