eCommerce: Shoes

Top Online Shoe Stores Worldwide: Online Footwear Market & Impact of Sneaker Culture

How has the pandemic reshaped the online footwear market and which stores are leading the way? We provide answers using data.

Article by Cihan Uzunoglu | July 16, 2024Download

Coming soon

Share

Top Online Shoe Stores Worldwide: Key Insights

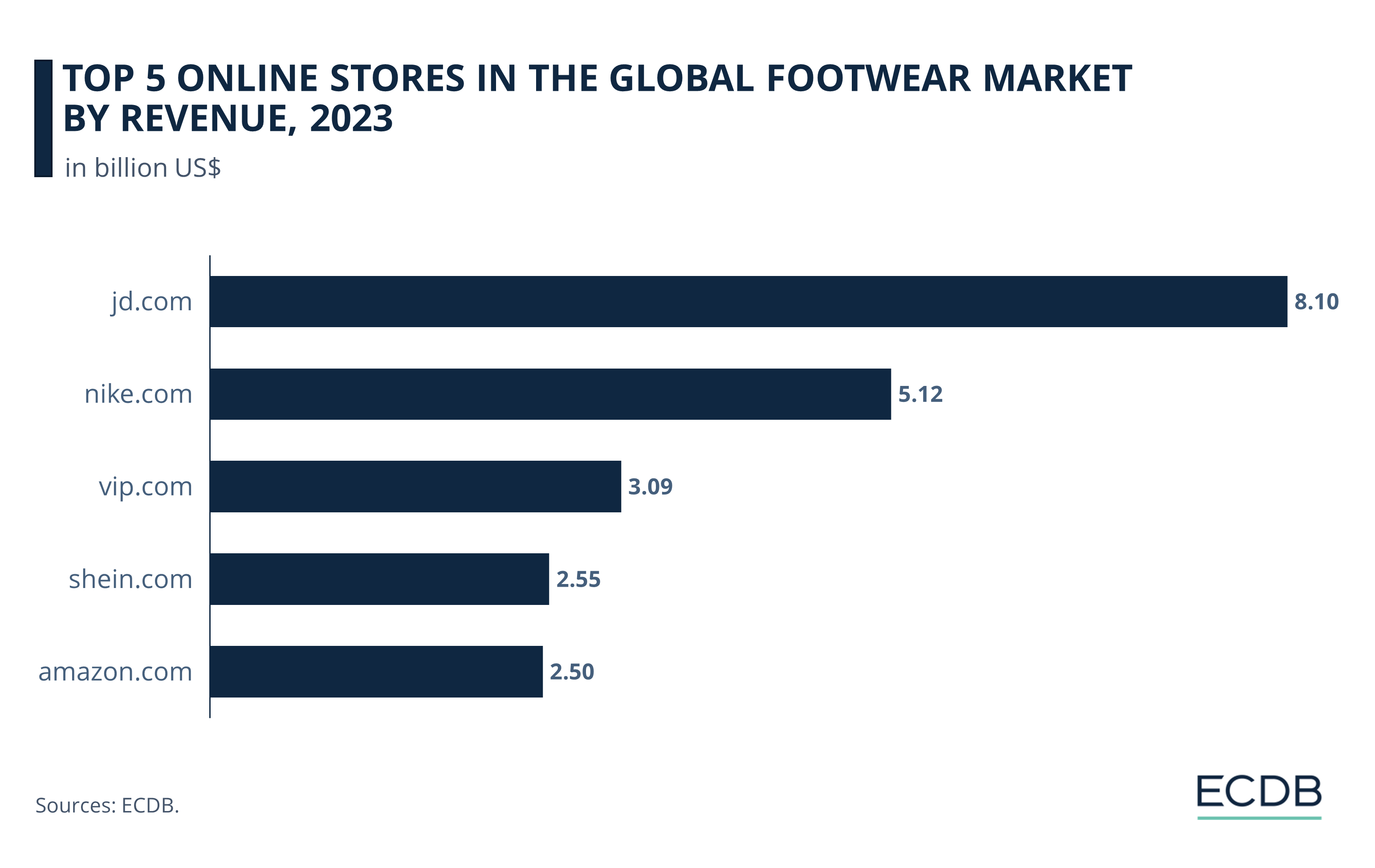

Top Online Stores: The top 5 online shoe stores in 2023 — JD.com, Nike.com, Vip.com, Shein.com, and Amazon.com — collectively accounted for about 40% of the global online footwear market's net sales.

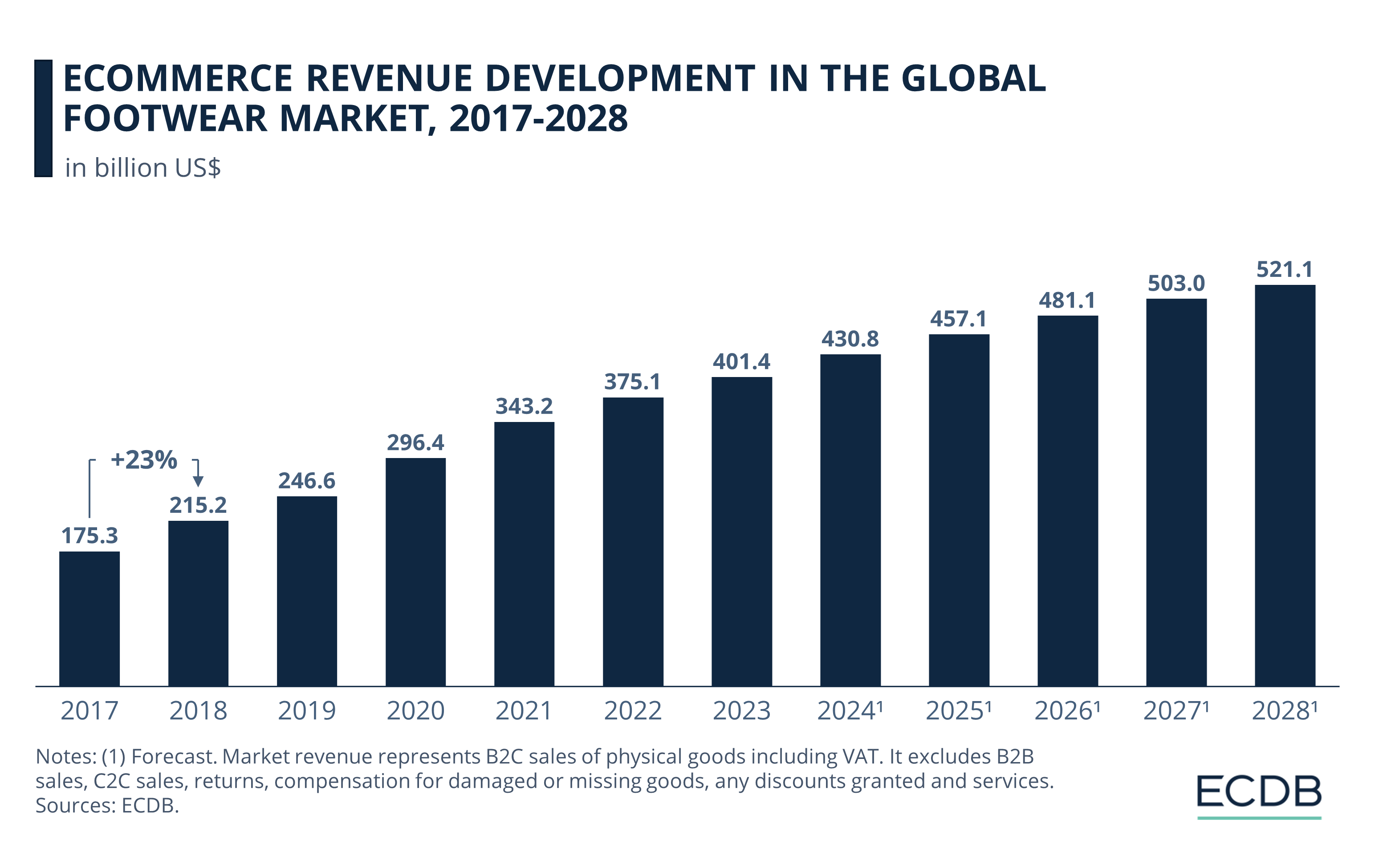

Market Growth: The online footwear market has grown from US$175.3 billion in 2017 to a projected US$521 billion by 2028, nearing the GDP of Norway, despite consistently lower growth rates compared to the overall eCommerce market since the pandemic.

Sneaker Culture: Driven by the convergence of basketball, hip-hop, and fashion, sneaker culture has transformed the market. This is evidenced by the growth of the sneaker resale market from US$6 billion in 2019 to a projected US$30 billion by 2030.

Many say that shoes are one of the first things we look at when we meet someone new. For some, a shoe is a piece of footwear designed to protect and comfort our feet. For others, it is also a fashion statement.

We talk all the time about how the pandemic has changed online shopping. The same is true for the footwear market. But how exactly has the market changed and which online stores are leading the way in terms of sales? We answer these questions and also take a look at how sneaker culture has impacted the market.

What is the Online Footwear Market?

The online footwear market, a subset of the fashion market, encompasses digital sales of various types of shoes, including sneakers, sports shoes, sandals, boots, high heels, and slippers.

It excludes sport-specific footwear, such as soccer shoes, climbing shoes, and bike shoes, as well as orthopedic footwear.

Top 5 Online Shoe Stores in 2024

The global footwear market saw impressive net sales from its top online stores. Here’s a breakdown of these top stores:

Leading the market, JD.com emerged as the frontrunner with net sales totaling US$8.1 billion.

Following closely behind, Nike.com secured net sales of US$5.12 billion.

Claiming the third spot, Vip.com reported net sales amounting to US$3.09 billion.

In the fourth position, Shein.com demonstrated impressive performance with net sales reaching US$2.55 billion.

Rounding out the top five, Amazon.com recorded net sales of US$2.5 billion.

Together, these top 5 stores accounted for about 40% of the net sales among the top 100 stores in the global online footwear market in 2023.

Let’s take a closer look at each of these top players and see what makes them successful in this competitive market.

1. JD.com

The Chinese retailer was one of the first major names to integrate augmented reality (AR) into its online footwear shopping experience: In 2020, JD.com launched an AR try-on feature that allows customers to measure their foot size using a mobile phone equipped with a ToF (Time of Flight) camera. This technology, developed in partnership with Sony Semiconductor Solutions Corporation, leverages Sony's innovative ToF distance measuring technology.

JD.com has also attracted prestigious fashion brands known for their footwear collections. Over the years, the likes of Gucci, Acne Studios, Steve Madden, and Golden Goose have launched their flagship stores on JD.com. This highlights the online store’s appeal as a premier destination for high-end footwear shopping.

2. Nike.com

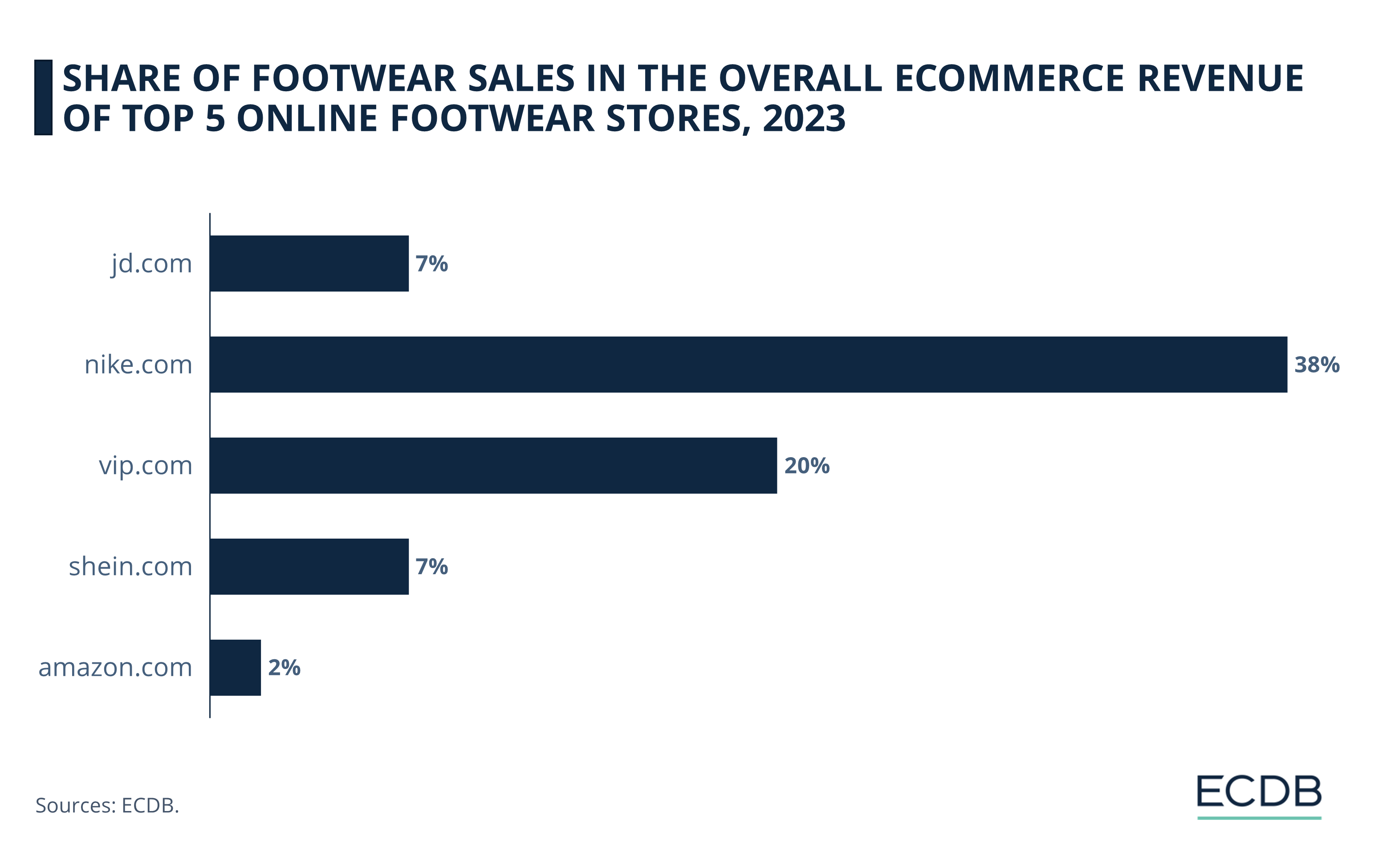

Nike.com stands out in the online footwear market not only for its impressive sales, but also for its iconic status as a top footwear manufacturer. In 2023, footwear accounted for 38% of Nike's online sales, a testament to the brand's enduring popularity.

The online store's innovative features, such as virtual try-ons and personalized recommendations, make online shopping easier and more enjoyable. This commitment to enhancing the customer experience sets Nike apart from other top players.

Nike's impact on sneaker culture is unparalleled. The brand's collaborations with athletes and celebrities, as well as its limited-edition releases, keep sneaker enthusiasts eagerly anticipating the next drop. Nike doesn't just sell shoes, it fuels a global community of sneakerheads. More on sneaker culture later.

3. Vip.com

Generating one fifth of its eCommerce net sales from the Footwear category, vip.com is the top third online store in the global online footwear market. The online store is also the second largest in the Chinese online footwear market, only behind JD.com.

Despite its recent growth challenges, vip.com remains a key player with revenues of US$15.45 billion made last year. Its strategic focus on fashion, particularly footwear, and its strong presence in China’s booming eCommerce market have cemented its position. Collaborations with popular brands and a dedicated customer base help maintain its influence in the competitive market.

4. Shein.com

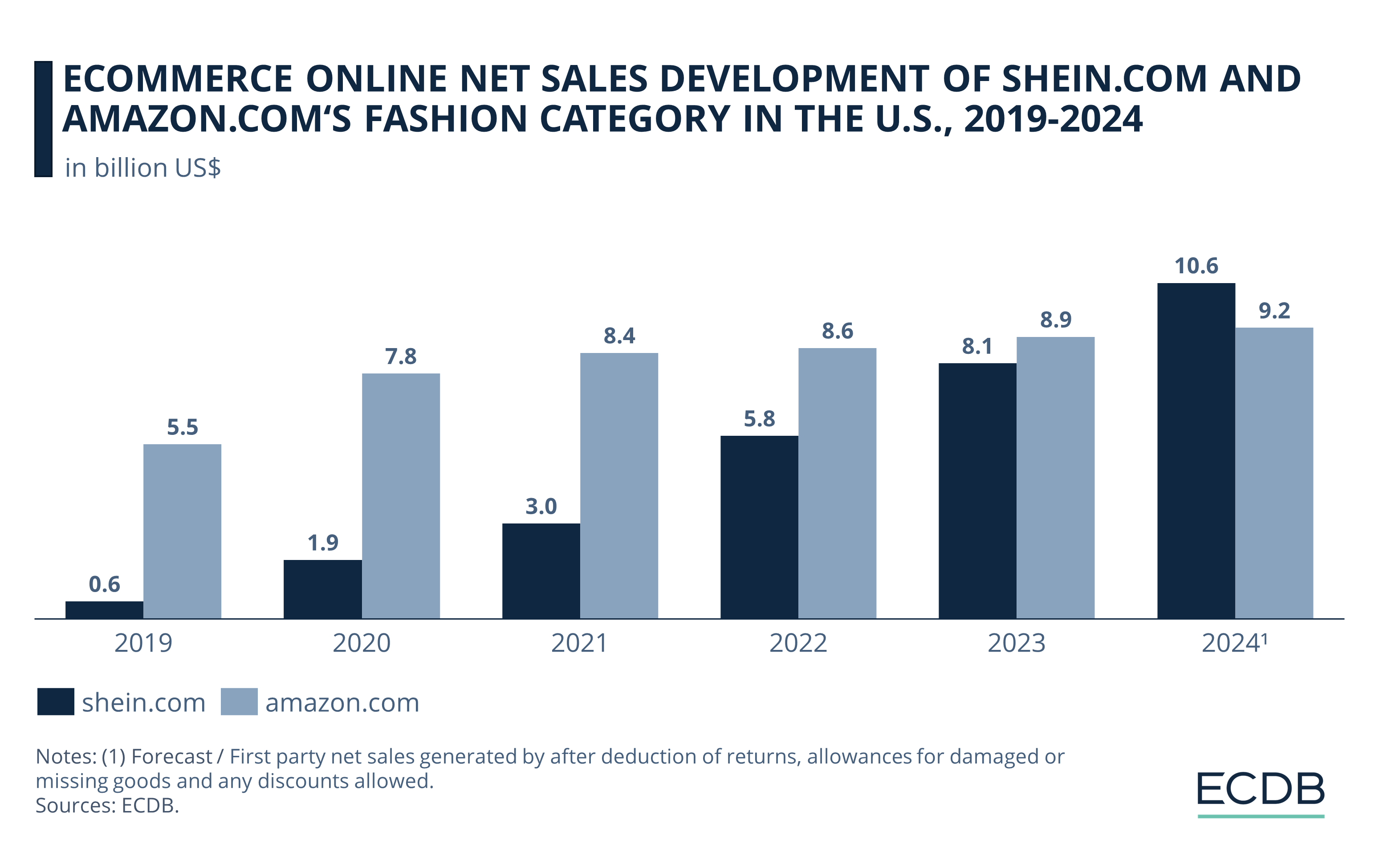

Shein.com is the fourth largest online store in the global footwear market. Known for its fast fashion appeal, Shein has quickly risen to prominence by offering trendy, affordable products that resonate with young, fashion-conscious consumers. The brand’s rapid rise is fueled by effective social media strategies and a keen understanding of its target market, making it a formidable player in the global eCommerce market.

However, Shein has also faced significant challenges. South Korean government tests revealed alarming levels of toxic chemicals in children's shoes and accessories sold on the platform, including phthalates at 428 times the permitted limit.

This revelation has raised serious health concerns and highlighted the need for stricter safety standards in fast fashion. The issue underscores the potential risks associated with Shein’s rapid growth and cost-cutting measures, prompting calls for greater accountability and consumer protection in the eCommerce industry.

5. Amazon.com

Looking at the online footwear market allows us to understand just how big amazon.com is. Despite accounting for just under 2% of its net eCommerce sales, the online store's US$2.5 billion in footwear sales places it among the top 5 online stores in the global market.

Amazon's success on the global stage is also reflected in the U.S. market: At US$2.43 billion, amazon.com is the top online footwear retailer in the country, leaving behind the likes of nike.com, walmart.com and shein.com.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

Online Footwear Market: Half a Trillion Dollars in a Few Years

The online footwear market has experienced remarkable growth over the past decade, driven by the increasing popularity of eCommerce and the shift in consumer shopping habits:

In 2017, the market generated US$175.3 billion. Before the pandemic, revenue increased to US$246.6 billion by 2019, continuing the positive momentum.

In the first year of the pandemic, sales jumped to US$296.4 billion by the end of 2020 as online shopping becomes more prevalent.

Fast-forward to last year, the market generated US$401.4 billion in revenue, reflecting steady growth despite economic fluctuations.

Our forecast for 2024’s market revenue is US$430 billion, with further projections predicting the market will reach US$521 billion by 2028. To put this into perspective, this figure is close to the GDP of Norway.

While the market growth was similar to the global eCommerce market until the pandemic, we see a different trend since then. In 2020, the online footwear market growth was 20.2%, which was about 11 percentage points lower than the global ecommerce market growth.

Although the gap has narrowed since then, the online footwear market growth tends to remain below the overall eCommerce market growth.

Impact of Sneaker Culture on the

Online Footwear Market

Beyond numbers, sneaker culture has also profoundly impacted the online footwear market, driven by the intertwining of basketball, hip-hop and fashion. The subculture, which started gaining momentum in the 1980s, has grown into a global phenomenon with significant economic implications.

Air Jordans

The origins of sneaker culture can be traced back to the rise of hip-hop and basketball in New York City during the 1970s and 1980s. Sneakers transitioned from mere athletic gear to symbols of cultural identity and style.

Michael Jordan's collaboration with Nike in 1984, resulting in the iconic Air Jordan 1, forever changed the market. The shoe's bold design and the controversy surrounding its NBA ban sparked immense hype, making it a must-have item and propelling Nike into a new era of marketing and cultural influence.

Hip-hop's Influence

Hip-hop also played a critical role. In 1986, Run-D.M.C. released "My Adidas," a track that solidified sneakers' place in hip-hop fashion. This partnership with Adidas led to a million-dollar endorsement deal, marking one of the first major collaborations between a music group and a sneaker brand.

Such collaborations have continued to drive the market, with artists like Kanye West and Travis Scott contributing to the hype with their limited-edition releases.

Impact on the Market

The online market has particularly benefited from this cultural shift. Sneaker drops, characterized by limited releases and high demand, create a sense of urgency and exclusivity that translates well to eCommerce platforms.

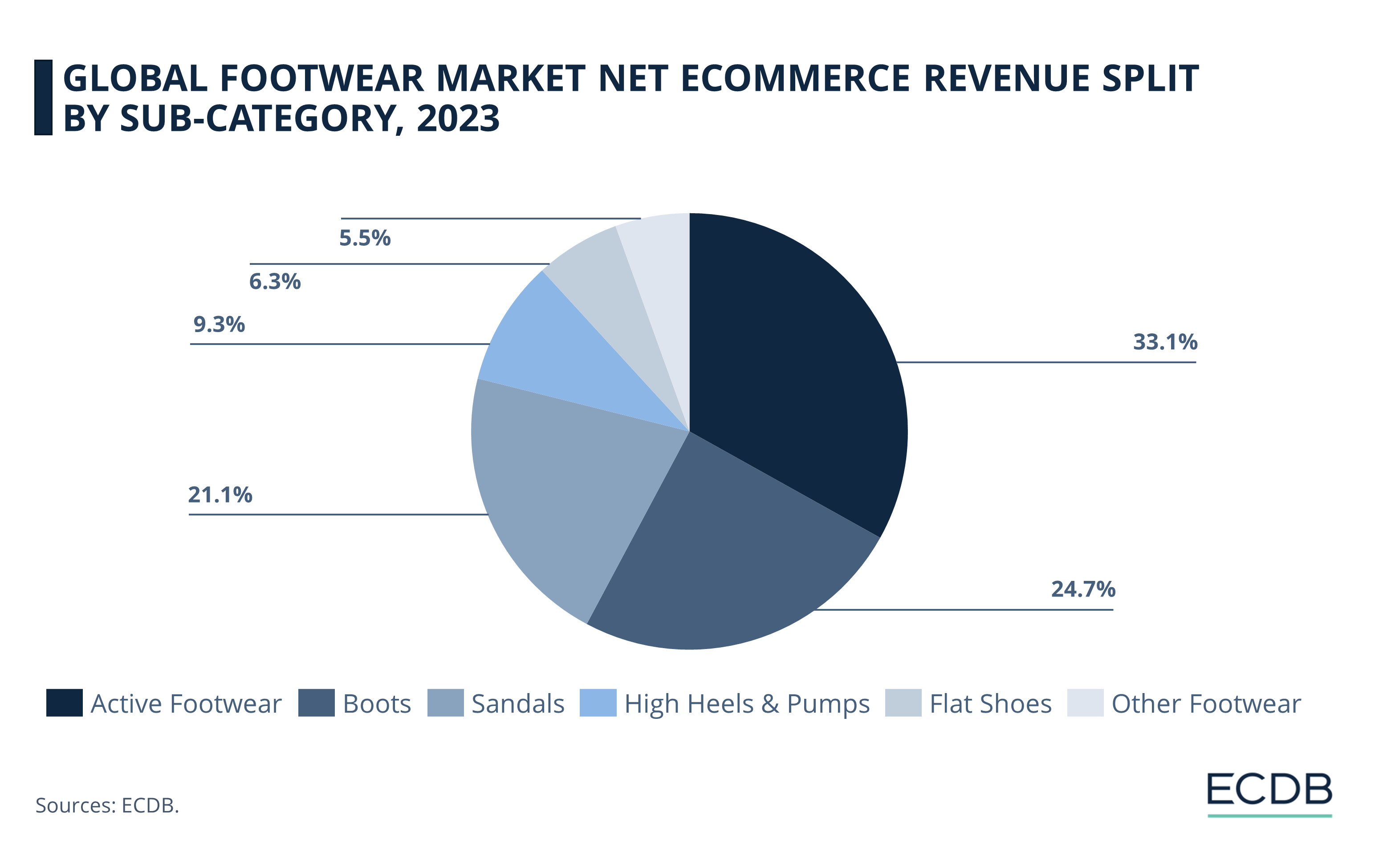

The active footwear category, which includes sneakers, is the largest segment of the global online footwear market (33%).

Online marketplaces like StockX have capitalized on this, offering a space for buying and selling rare sneakers, authenticated for genuine quality. This has transformed sneakers into collectible items, with some pairs fetching thousands of dollars.

Data supports this impact. The sneaker resale market was valued at US$6 billion in 2019 and is projected to reach US$30 billion by 2030, driven largely by online sales. The global sneaker market itself has grown at a compound annual growth rate (CAGR) of 5.1% over the last five years, showcasing the significant economic impact of sneaker culture.

Top 5 Online Shoe Stores in 2024:

Closing Thoughts

The online footwear market has been significantly shaped by the pandemic, accelerating the shift to online shopping and driving substantial growth. This momentum is likely to continue over the next decade, with innovations like AR try-ons and personalized shopping experiences becoming standard.

The integration of sneaker culture into mainstream fashion has also fueled demand, particularly for limited-edition releases and collaborations. As technology advances and consumer habits evolve, we can expect further growth and diversification in the market, potentially reaching half a trillion dollars in revenue by 2028.

The challenge will be balancing growth with quality and safety standards, ensuring sustained consumer trust and engagement.

Sources: PushBlack, Communicate, National Geographic, Lace Lab, Underground Sound, Scrappy Apparel, Supercut Magazine, The Sole Supplier, Fast Company, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics