Marketplaces: VIP.com

Online Marketplace VIP.com: GMV Development, YoY Growth Rate & Chinese eCommerce Market

With marketplaces like Pinduoduo, Taobao, Tmall and JD.com, China has a remarkable strength in the Asian eCommerce market, making it difficult for domestic companies like VIP.com to keep up with the big players. Let's take a look at how VIP.com stacks up against these eCommerce giants.

April 24, 2024Download

Coming soon

Share

Online Marketplace VIP.com: Key Insights

Asia's eCommerce Leadership: Asia, spearheaded by China, dominates global eCommerce with almost US$2.2 trillion in revenue in 2023, set to reach US$3.3 trillion by 2028.

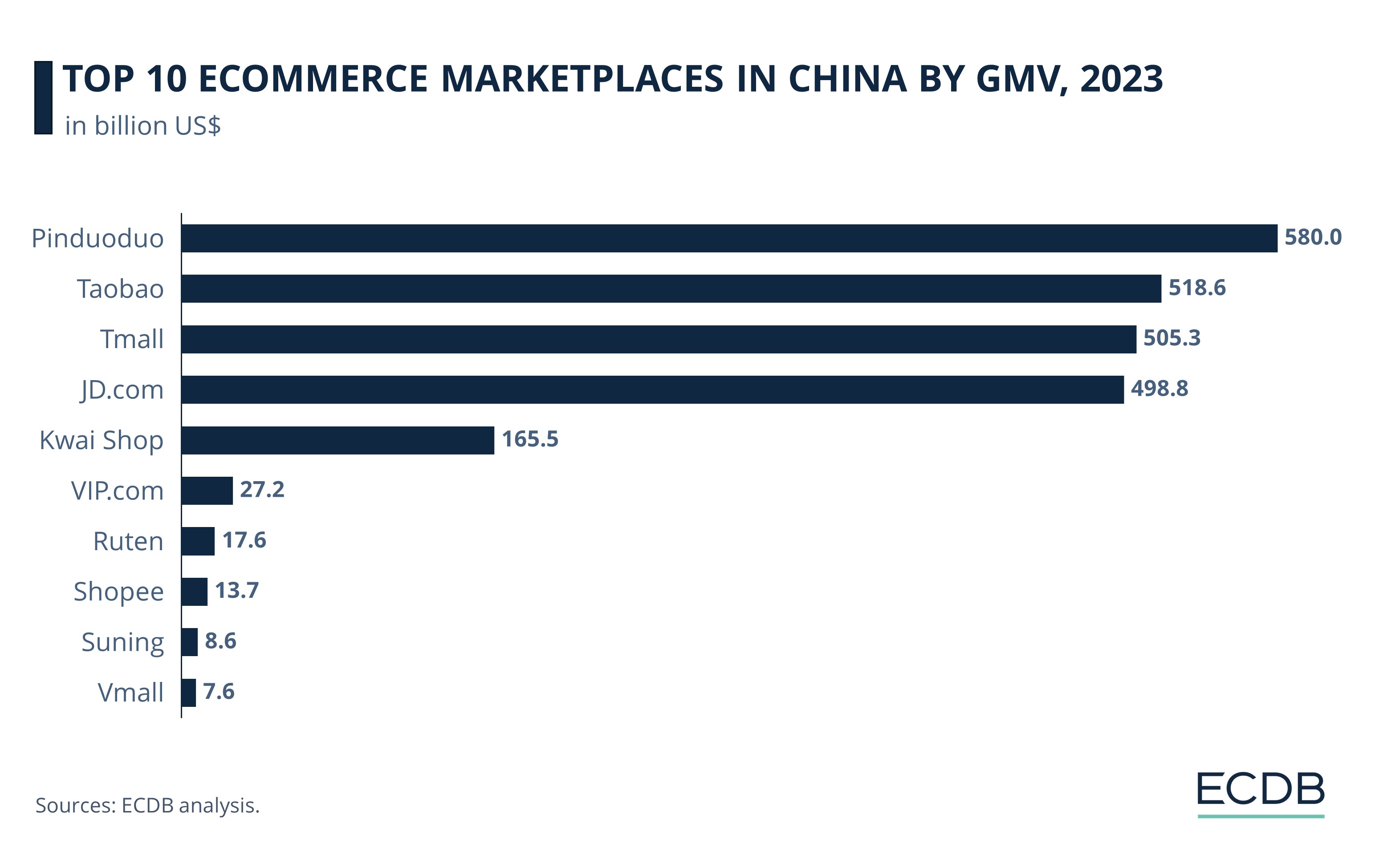

eCommerce Marketplaces in China: Key players like Pinduoduo, Taobao, Tmall, and JD.com shape the global and Chinese eCommerce landscape, alongside VIP.com, the sixth biggest eCommerce marketplace in China by GMV.

VIP.com's Growth Challenges: VIP.com has faced declining growth rates, leading to operational optimizations and staff reductions.

COVID-19 Impact: The pandemic temporarily boosted Vipshop's performance, but post-pandemic figures show stabilization around US$24 billion.

Asia is a front-runner in terms of eCommerce market size and growth. The biggest player in Asia and worldwide is China, which generated nearly US$2.2 trillion in revenue in 2023, according to our eCommerce country ranking.

In fact, China generates far more eCommerce revenue than the United States, United Kingdom, South Korea, Japan, and Germany combined. Between 2024 and 2028, eCommerce revenues are expected to grow at a compound annual growth rate (CAGR) of 8.1%, resulting in a projected market volume of US$3.3 trillion by 2028. With an expected increase of 10.7% in 2024, the Chinese eCommerce market will contribute to the global growth rate of 10.4% in 2024.

China’s Top 5 Are Also Among the Global

Top 6

Asian eCommerce markets are traditionally shaped by online marketplaces. In fact, four Chinese marketplaces – Pinduoduo, Taobao, Tmall, JD.com, and Kwai Shop – are in the world's top 6 marketplaces. In addition, there are other successful Chinese companies following the big players, such as VIP.com or Ruten.

As in the global eCommerce marketplace ranking, Pinduoduo leads the ranking in China with a GMV of US$580 billion. Next in line comes Taobao holding US$518.6 billion, followed by Tmall and JD.com with US$505.3 billion and US$498.8 billion in GMV, respectively.

In fifth place, with about a third of JD.com, is Kwai Shop with US$165.5 billion. The following marketplaces are further behind. VIP.com (US$27.2 billion) lands in the sixth position with nearly one-seventh of Kwai Shop’s GMV, followed by Ruten (US$17.6 billion), Shopee (US$13.7 billion), Suning (US$8.6 billion), and, last but not least, Vmall (US$7.6 billion).

Despite Peak During Corona, VIP.com Figures Shrink

The Chinese online marketplace VIP.com is owned by Vipshop Holdings, Ltd. and operated by Guangzhou VIP Information Technology Co., Ltd.. The online marketplace generated a GMV of almost US$24 billion in 2023, ranking sixth in the Chinese eCommerce market with fashion as its main product category (70%) – especially apparel (30%) – followed by electronics (15%) and care products (15%).

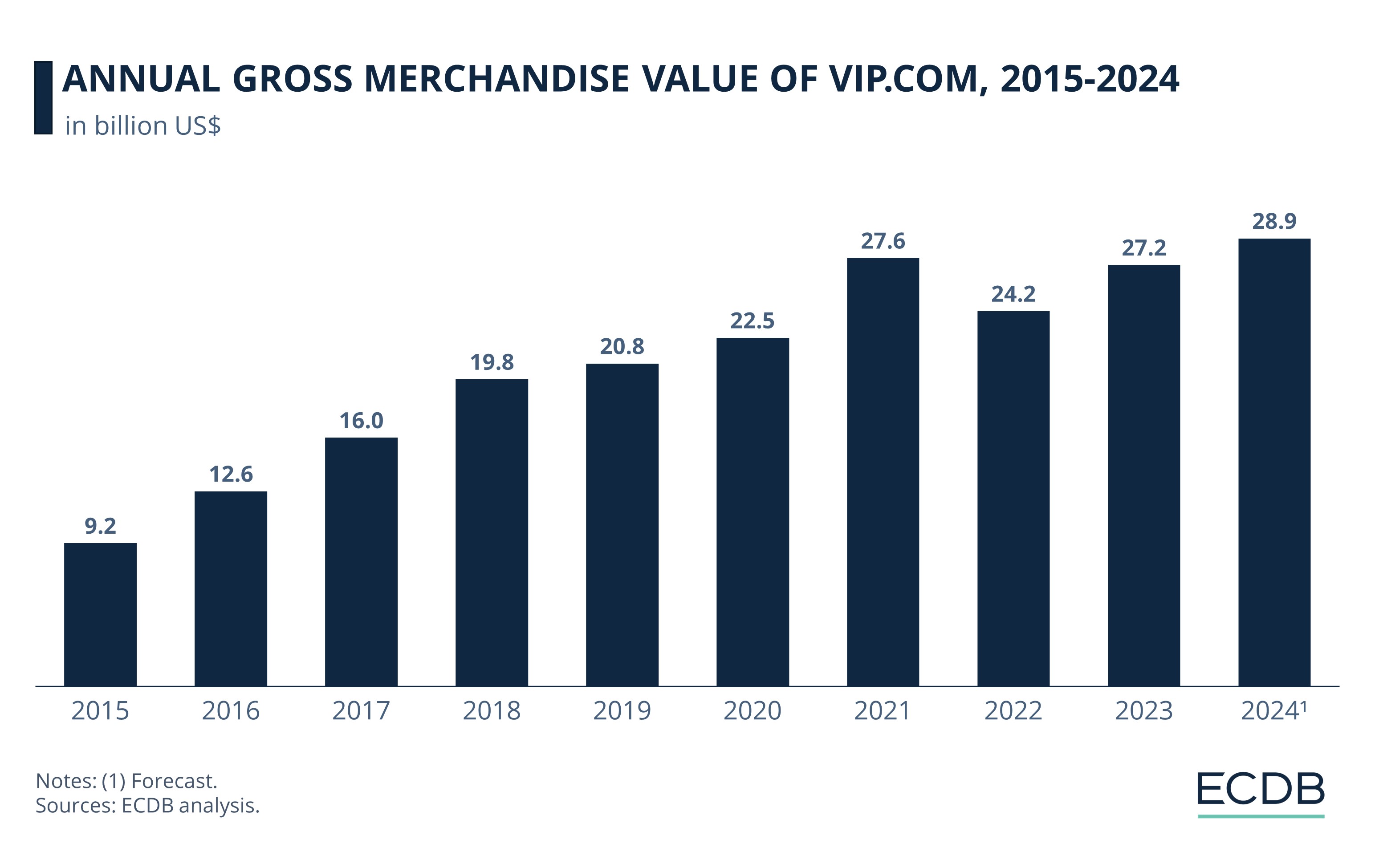

However, unlike many other Chinese eCommerce players, VIP.com’s recent growth has been far from exponential. Vip.com's GMV growth has been steadily declining over the past few years, with a brief peak in between. While 2016 still saw a year-on-year GMV growth of 36.2%, the growth rates since then have been lower year after year, reaching a total GMV growth of only 5.1% between 2018 and 2019.

In early 2021, Vipshop was hit with a 3 million yuan fine – the equivalent of US$464 million at the time, according to Reuters – from the Chinese government, specifically the State Administration for Market Regulation (SAMR). This penalty was imposed for monopolistic behavior according to the Chinese Monopoly Law. This may have caused, among other things, the sharp decline that followed in 2022.

Shortly before that, the SAMR announced an antitrust investigation into Alibaba and other major players in China's tech sector, which later led to a regulatory crackdown.

The operating margin in 2019 was already higher than in 2016 and increased again in 2020 to 5.8%. In particular, the COVID-19 pandemic gave the company a boost, with GMV peaking at $27.6 billion in 2021 and a YoY growth rate of 22.9% between 2020 and 2021. After the pandemic, the figure fell significantly to US$24.2 billion in 2022, but then increases again to reach almost the same level as in 2021 at US$24 billion in 2023.

Online Marketplace VIP.com: Closing Thoughts

ECDB expects the year-on-year growth rate to increase again in 2024, with an anticipated value of US$28.9 billion in 2024. It remains to be seen what will happen to gross merchandise value after that and whether VIP.com will grow again.

Meanwhile, as previous events, such as the tech crackdown in 2022, have already shown, the Chinese government has strong macroeconomic power that shouldn't be underestimated by my VIP.com as well as other tech players.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics