eCommerce: Alibaba Competition

Pinduoduo vs. Alibaba: Market Cap, Revenue & Insights

Pinduoduo overtook Alibaba in the market capitalization ranking. What makes the world's second largest eCommerce company so special, and what can we expect in the future?

Article by Lukas Görlitz | July 22, 2024Download

Coming soon

Share

Pinduoduo vs. Alibaba: Key Insights

Rapid Rise:

Pinduoduo's rapid rise has reshaped the Chinese eCommerce market, surpassing Alibaba in market capitalization and prompting significant strategic shifts from its rivals.

Aggressive Strategies:

Pinduoduo's aggressive discount strategies and global expansion, particularly through its U.S. subsidiary Temu, have fueled its extraordinary year-on-year growth, significantly surpassing market expectations and overtaking both JD.com and Alibaba.

Regulatory Setbacks:

Regulatory pressures and significant setbacks, including a US$2.8 billion fine, have caused Alibaba's market cap and profitability to decline sharply, allowing Pinduoduo to surpass it, despite modest growth in its core eCommerce divisions and international business.

"We have to change, otherwise there is really no way out for us," Richard Liu, founder of JD.com, said in an internal chat, referring to the rise of rival Pinduoduo. This wake-up call highlights the intense competition between China's leading eCommerce giants.

The rise of Pinduoduo has not only shaken JD.com but has also caught the attention of Alibaba, long considered the dominant force in Chinese eCommerce. This rivalry is reshaping the entire industry, prompting significant strategic shifts and sparking intense competition.

Pinduoduo vs. Alibaba: A New Rivalry

Pinduoduo has quickly become a formidable competitor, challenging both JD.com and Alibaba. This shift in power dynamics is reshaping the Chinese eCommerce market, making it essential to understand how these companies are navigating this fierce rivalry.

Pinduoduo's Meteoric Rise

As reflected in our ranking of the world's top eCommerce companies by market capitalization, PDD Holdings Inc. (Pinduoduo’s parent company) now stands as the second largest eCommerce business globally, trailing only Amazon but surpassing Alibaba. This makes Pinduoduo the largest eCommerce company in China, a position that underscores its rapid ascent.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Internal Reactions and Strategic Shifts

The rise of Pinduoduo has not gone unnoticed. JD.com founder Richard Liu commented on the company's struggles with execution and coordination in response to an employee's critique. Liu agreed with the assessment, recognizing the need for JD.com to adapt to the changing market dynamics.

Similarly, Alibaba co-founder Jack Ma acknowledged the need for "change and reform" after observing Pinduoduo’s impressive Q3 2023 results, where the Shanghai-based company nearly doubled in value to US$9.4 billion. Alibaba's plans to restructure into six smaller entities were recently shelved, underscoring the urgency to respond to Pinduoduo's success. Shortly after Ma’s comments, Pinduoduo overtook Alibaba in market capitalization.

Pinduoduo's Winning Strategy

Pinduoduo's success can be attributed to its aggressive discount and subsidy strategies, which have resonated well with consumers amid China's economic slowdown. Pinduoduo excels not only in its home market but is also expanding globally with its subsidiary, Temu. The company’s focus on extremely low prices and customer engagement through platforms like WeChat has set it apart from competitors.

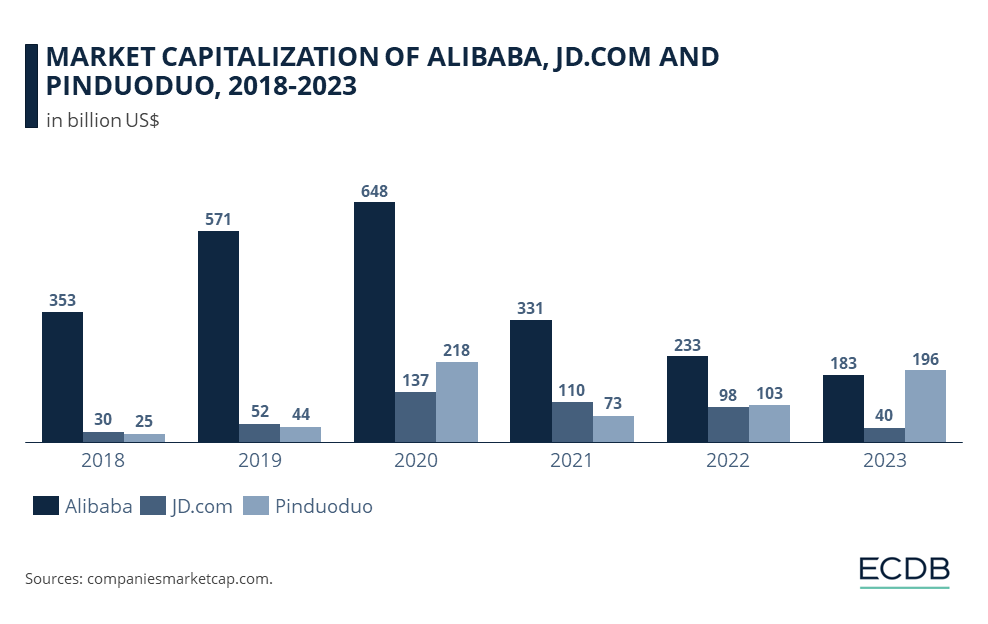

Pinduoduo’s year-on-year growth is unparalleled. From a staggering 239.6% growth in 2017 to an astounding 688.5% the following year, the company’s market cap soared to US$25 billion, eventually reaching US$196 billion by 2022, overtaking both JD.com and Alibaba.

Pinduoduo Quarterly Results: Above Expectations

PDD Holdings reported stellar first-quarter earnings in 2024, significantly surpassing market expectations. Revenue for the quarter reached US$11.93 billion, more than doubling from the previous year’s US$5.17 billion, which far exceeded analysts' predictions of US$10.5 billion. Additionally, Pinduoduo’s net income soared to US$3.84 billion, tripling from US$1.11 billion a year ago and more than doubling the estimated US$1.78 billion.

Temu, Pinduoduo's U.S. subsidiary, has been a significant driver of this growth, steadily increasing its market share and consumer base since its launch in September 2022.

Alibaba's Challenges

The rivalry between Pinduoduo, Alibaba, and JD.com has been influenced by Chinese regulatory changes. Alibaba, in particular, faced significant setbacks, including a US$2.8 billion fine for abusing market dominance. While Alibaba struggled, Pinduoduo not only recovered but thrived during these turbulent times.

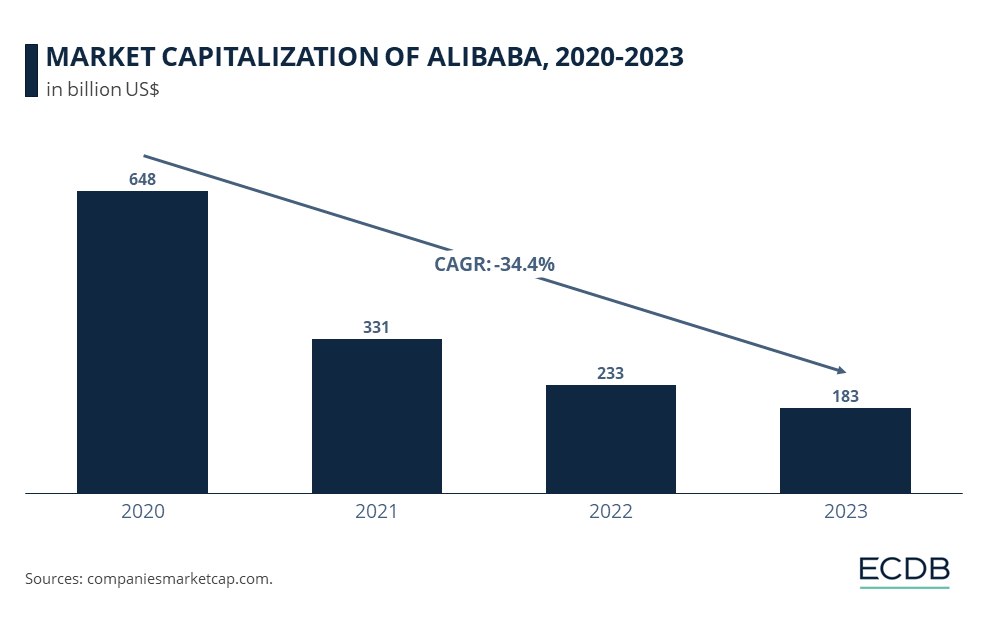

From 2014 to 2020, Alibaba saw a robust compound annual growth rate (CAGR) of 20.7% in market cap, peaking at US$648 billion in 2020. However, regulatory pressures caused a decline, with its market cap decreasing by a CAGR of -34.4% since 2020, allowing Pinduoduo to surpass it.

Alibaba Quarterly Results: Net Income Decreased

In stark contrast, Alibaba faced a challenging quarter. Despite posting a revenue of US$30.5 billion, slightly above the expected US$30.19 billion, its net income plummeted by 86% year-over-year to US$453.6 million. This decline in profitability led to a 6% drop in Alibaba’s stock, reflecting investor concerns. Alibaba attributed the profit drop primarily to a net loss from investments in publicly-traded companies, compared to gains in the same quarter of the previous year.

Alibaba’s core eCommerce divisions, Taobao and Tmall, saw modest revenue growth of 4% to US$12.81 billion, slightly up from the previous quarter's 2% growth. Customer management revenue increased by 5% year-over-year, signaling a slight recovery in consumer spending. However, these gains were overshadowed by the company's overall profit decline. Alibaba’s international commerce business did show promise with a 45% increase in revenue to US$3.76 billion, indicating potential growth areas outside its core domestic market.

Sources: Forbes, Financial Times, Investopedia, CNBC, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Tinaba Partners with Alipay+ to Launch European Super App

Tinaba Partners with Alipay+ to Launch European Super App

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics