eCommerce: Japan

eCommerce in Japan 2023: Top Online Stores and Revenue Development

The Japanese eCommerce market is the fifth largest globally, recording sales of US$124.3 billion in 2023. Stores by U.S. players – Amazon and Apple – lead, with homegrown brands like Yodobashi and Shiseido following behind.

March 18, 2024Download

Coming soon

Share

Top 10 Online Stores in Japan 2023: Key Insights

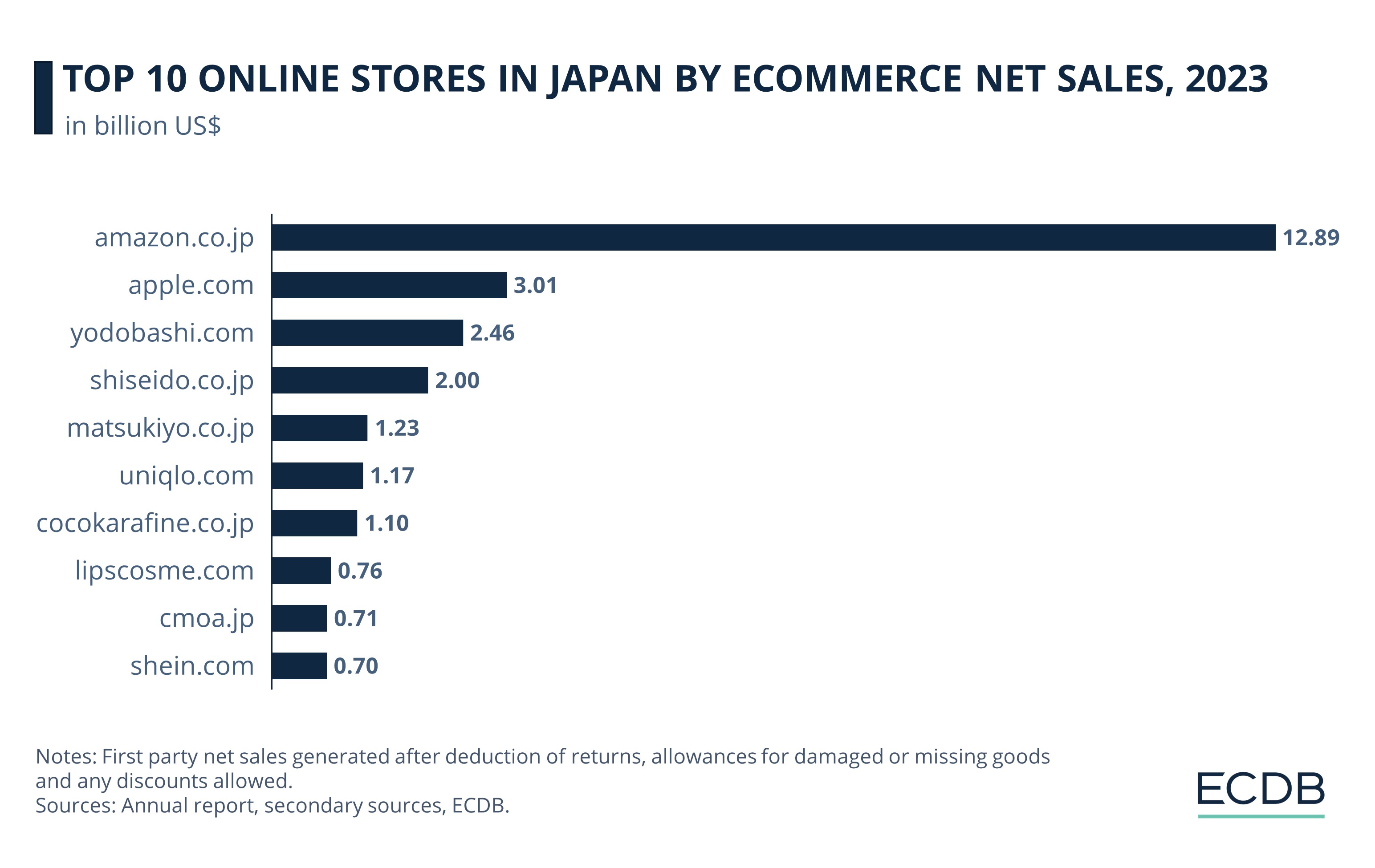

Top eCommerce Stores: In terms of online sales, Amazon.co.jp leads in Japan. It is followed by Apple.com and Yodobashi.com. Whereas Shiseido.co.jp and Matsukiyo.co.jp stand fourth and fifth respectively.

Market concentration: The top 3 stores together claim more than 38% of the total eCommerce revenue of the top 100 eCommerce stores in Japan, hinting at a pattern of market concentration.

Revenue development of top 3 stores: The top 3 stores all recorded negative growth in the past years – Amazon.co.jp in 2022, Apple.com in 2023, while Yodobashi.com in both 2022 and 2023. Going forward, a modest recovery is expected, with positive sales development predicted for all three online stores in 2024.

Japan has one of the most powerful eCommerce markets worldwide. According to ECDB data, it ranks fifth globally, with total revenues of US$124.3 billion generated in 2023.

Which online stores rank in the top ten by revenue in Japan? How have the top three online stores on the list developed over time? ECDB data provides answers.

Top Ten Online Stores in Japan by

Net Sales in 2023

In 2023, the biggest online stores in the Japanese eCommerce market are amazon.co.jp, apple.com, and yodobashi.com.

Some names on the list are international players, whereas the rest have a national focus. For this evaluation, only revenue generated by the online stores in Japan is considered.

Amazon.co.jp dominates the Japanese eCommerce landscape, earning US$12.89 billion in 2023. Its revenue is higher than the combined revenues of stores ranked second to ninth, underlining its extensive market reach.

Apple.com takes the second spot, with sales of US$3.01 billion. At the third position is yodobashi.com, which generated sales of US$2.46 billion.

Shiseido.co.jp, owned by the Japanese company Shiseido Japan Co., Ltd., trails close, taking the fourth position with US$2 billion in sales.

The middle market segment includes matsukiyo.co.jp, uniqlo.com, and cocokarafine.co.jp, with each generating over US$1 billion net sales. In the lower tier, lipscosme.com, cmoa.jp, and shein.com register net sales between US$700 and US$760 million .

The eCommerce landscape in Japan is populated by various players. Most of the stores on the top ten list generate nationally focused sales, including Amazon.co.jp, whereas some keep an international focus, including Apple.com, Uniqlo.com, and Shein.com.

The data further reveals a pattern of market domination by the top players. This means that the Japanese eCommerce market is relatively concentrated: when it comes to net sales, the top three online stores account for a market share of 38.5% of the top 100 stores.

Top 3 Online Stores in Japan: Revenue Development Analysis, 2018-2024

Japan’s top three online stores are Amazon.co.jp. Apple.com, and Yodobashi.com.

Although these stores together claim the largest shares of the Japanese eCommerce market, their individual revenue development has fluctuated in the past years.

Below, we provide an analysis of their revenue growth between 2018 and 2024, based on ECDB data.

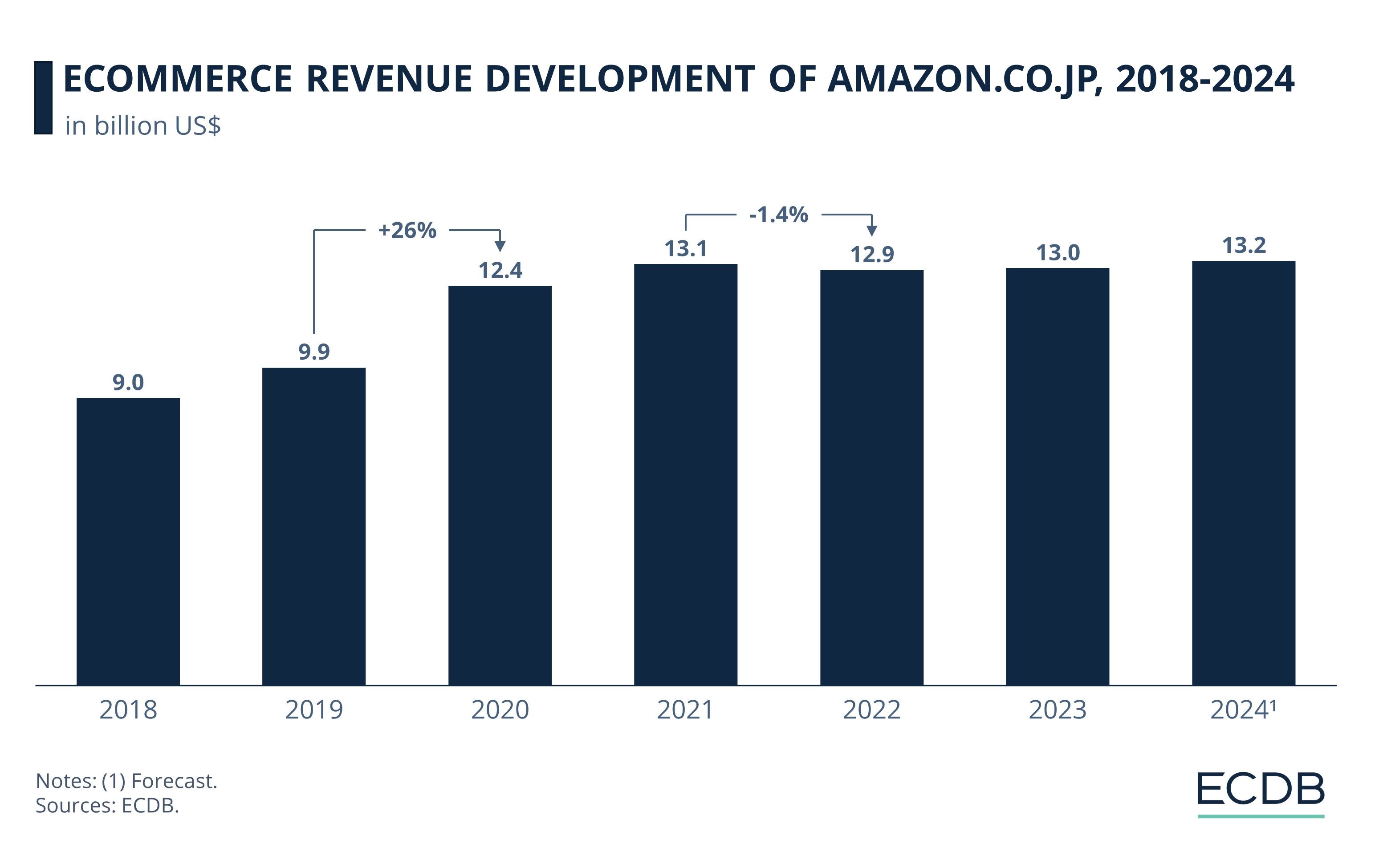

Amazon.co.jp: Recovery in 2023 after 2022 Decline

Amazon.co.jp, operated by Amazon.com Services, LLC, is an online store with nationally focused sales. Its eCommerce net sales are generated almost entirely in Japan, with the main category being Hobby & Leisure.

In 2023, amazon.co.jp’s eCommerce sales in Japan stood at US$12.9 billion.

In terms of revenue development, amazon.co.jp recorded a solid growth of 26% in 2020. At this time, its sales rose to US$12.4 billion from just US$9.9 billion in the previous year. This performance occurred during the pandemic when online sales had accelerated worldwide.

In the following years, absolute sales for this online store continued to increase. However, the growth rate dipped in 2022, with negative growth of 1.6% registered.

However, amazon.co.jp recovered in 2023 and recorded positive growth once more. The outlook is optimistic going forward. ECDB predicts that sales for the online store will reach US$13.2 billion by 2024.

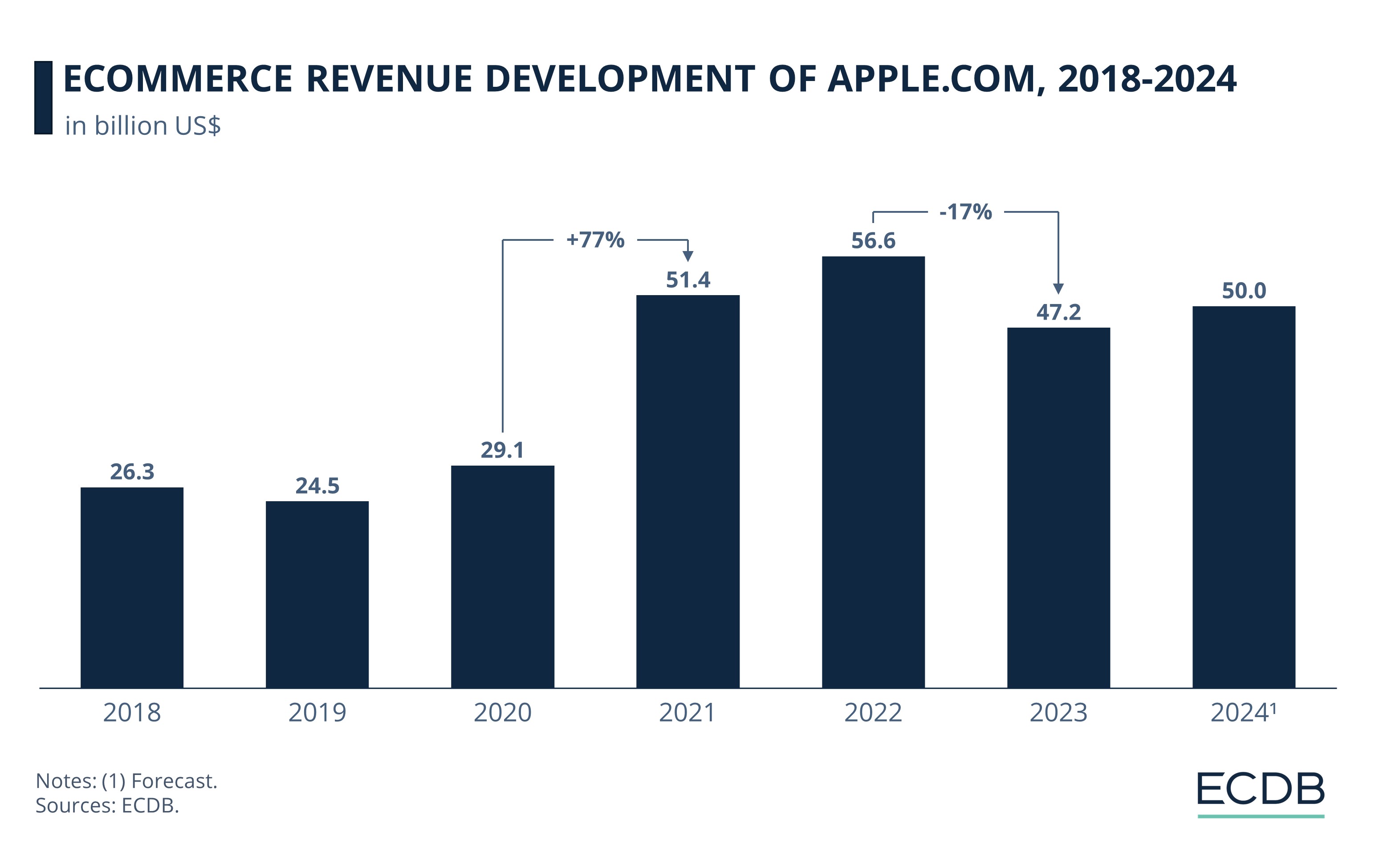

Apple.com: Growth Drops by Over 16% in 2023

Apple.com, operated by Apple, Inc., generates over half of its eCommerce net sales in the United States. Japan is its second-largest market, but it accounts for only 6.4% of the store’s sales. Its main category is Electronics.

In 2023, apple.com’s online sales in Japan stand at US$3 billion, as opposed to its net sales of US$47.2 billion.

A look at apple.com’s performance over the past years shows that the store’s total online revenue increased for three successive years, from 2020 to 2022, with a tremendous growth of 77% registered in 2021.

However, apple.com’s growth plummeted by 17% in 2023. Absolute sales fell to US$47.2 billion in 2023 from US$56.6 billion in 2022. Reports blame Apple’s lackluster performance on a challenging economic climate for phones and computers, as well as the fact that the company did not release a new iPad model for the first time since 2010.

Nonetheless, recovery is expected. Revenue is anticipated to reach US$50 billion, at a growth rate of 6%, in 2024.

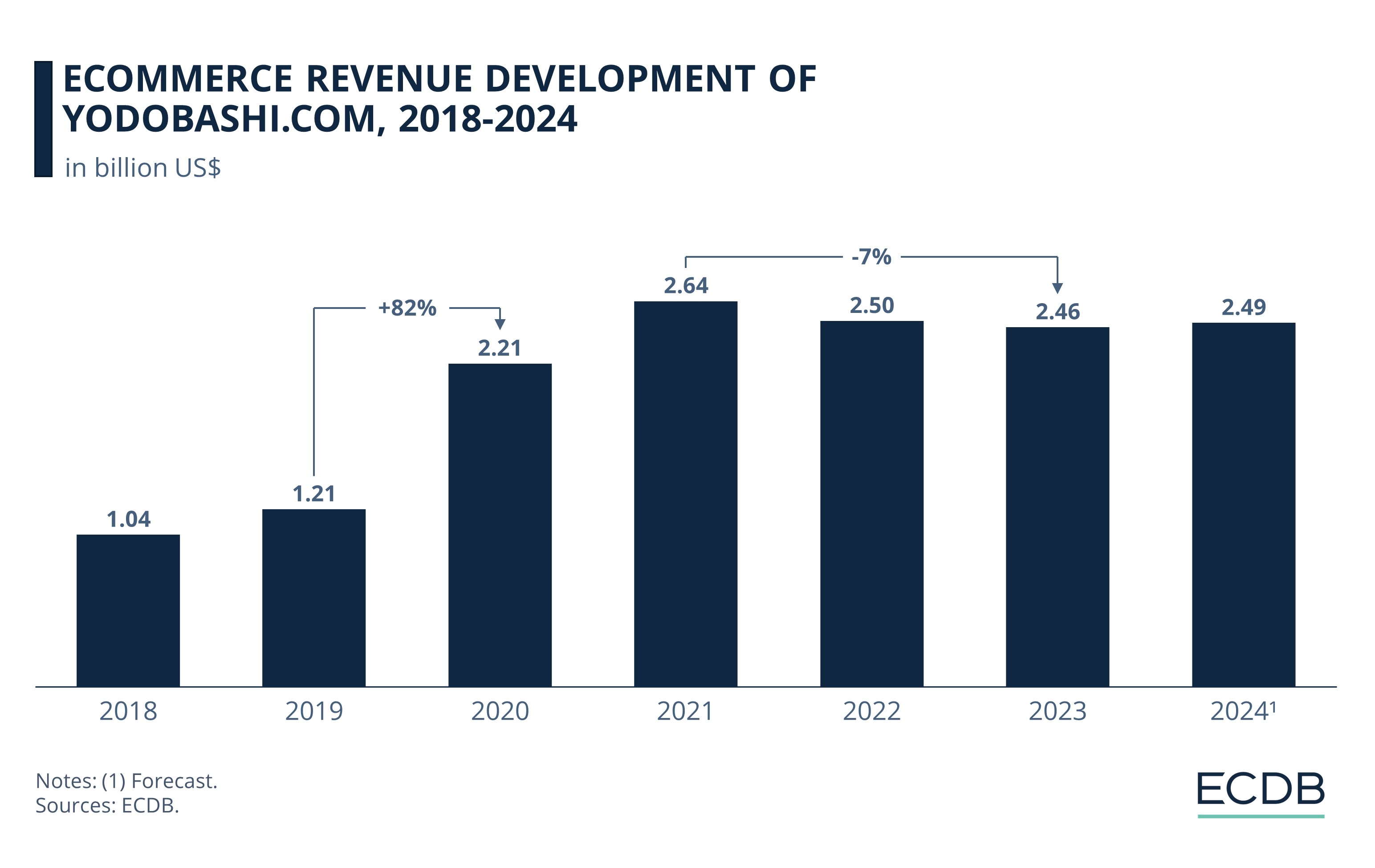

Yodobashi.com: Negative Growth Registered for Two Consecutive Years

Yodobashi.com, operated by Yodobashi Camera Co., Ltd., is an online store with nationally focused sales. It generates all its eCommerce net sales in Japan, with its main category being Hobby & Leisure.

In 2023, yodobashi.com recorded US$2.5 billion in online sales.

With regards to its revenue development, yodobashi.com grew steadily between 2018 and 2021. Its largest growth jump occurred in 2020, when sales grew by a remarkable 82%, hitting US$2.2 billion.

However, sales for the store decreased by 7% between 2021 and 2023, with dips registered for consecutive years in 2022 and 2023. The reopening of brick-and-mortar stores and an enthusiastic return to in-store shopping after the pandemic lockdowns may have contributed to this slump.

Going forward, sales for yodobashi.com are expected to grow by a modest 1.2%, reaching US$2.5 billion in 2024.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics