Business eCommerce Model of Adidas 2024

Adidas AG Business Strategy: Why It Lags Behind Its Main Competitor Nike

Adidas has a long-standing history as a sneaker and athleisure wear brand. What factors account for its global recognition? Which role does eCommerce have in overall revenues? Learn more with the help of ECDB data.

Article by Nadine Koutsou-Wehling | July 26, 2024Download

Coming soon

Share

Adidas Business Model: Key Insights

Footwear Generates Highest Revenues: The majority of Adidas' sales come from footwear. The other major brand in the portfolio is Reebok, which was rebranded by the Adidas AG to match the conglomerate's timeless designs and high-profile collaborations.

About One-Fifth of Revenues Are Online: Since the pandemic, Adidas has seen a steady share of eCommerce revenues, which account for about 20%. Its many international domains demonstrate the brand's global ubiquity.

Strategies and Challenges: Celebrity collaborations and frequent high-profile sneaker collections, sponsorship of major sporting events, as well as catchy marketing phrases account for Adidas' continued relevance. While these aspects are quite similar to Nike's business practices, it is this that poses the biggest problem for Adidas.

Adidas’ business strategy is a tale of success, given that the company celebrates its 100-year anniversary this year. Adidas is a household name in the footwear and athleisure game, but competition from other players and external circumstances led to earnings losses that Adidas must tackle to stay competitive.

These circumstances include the controversy surrounding Kanye West (Ye), whose Yeezy product collection was discontinued by Adidas. But the online footwear and athleisure market itself is experiencing stagnant sales, making it especially difficult for established retailers to maintain positive growth rates for long.

Here is a look at how Adidas’ business model fares within the market, including the company’s performance, strategy and challenges.

What Brands Does the Adidas AG Encompass?

In addition to the flagship Adidas, the other major brand in the portfolio is Reebok. Both brands have a similar focus on athleisure products, particularly fashion.

Other sub-brands include acquisitions of smaller companies in the footwear and athletic wear industry over time. These acquisitions help Adidas stay at the forefront of new designs and production technologies. For example, the acquisition of the German sports shoe manufacturer Five Ten led to a new athletic footwear line that was made entirely from recycled and recyclable materials.

Apart from that, Adidas is known for creating collections with well-known personalities in the arts or sports. This is also how the rebranding of Reebok happened around 2018, collaborating with Victoria Beckham as a designer to give the brand a different feel. In the case of Adidas, the Kanye West collaboration was one of the most notable in recent years, but it crashed and burned due to Ye’s antisemitic comments and erratic behavior toward staff.

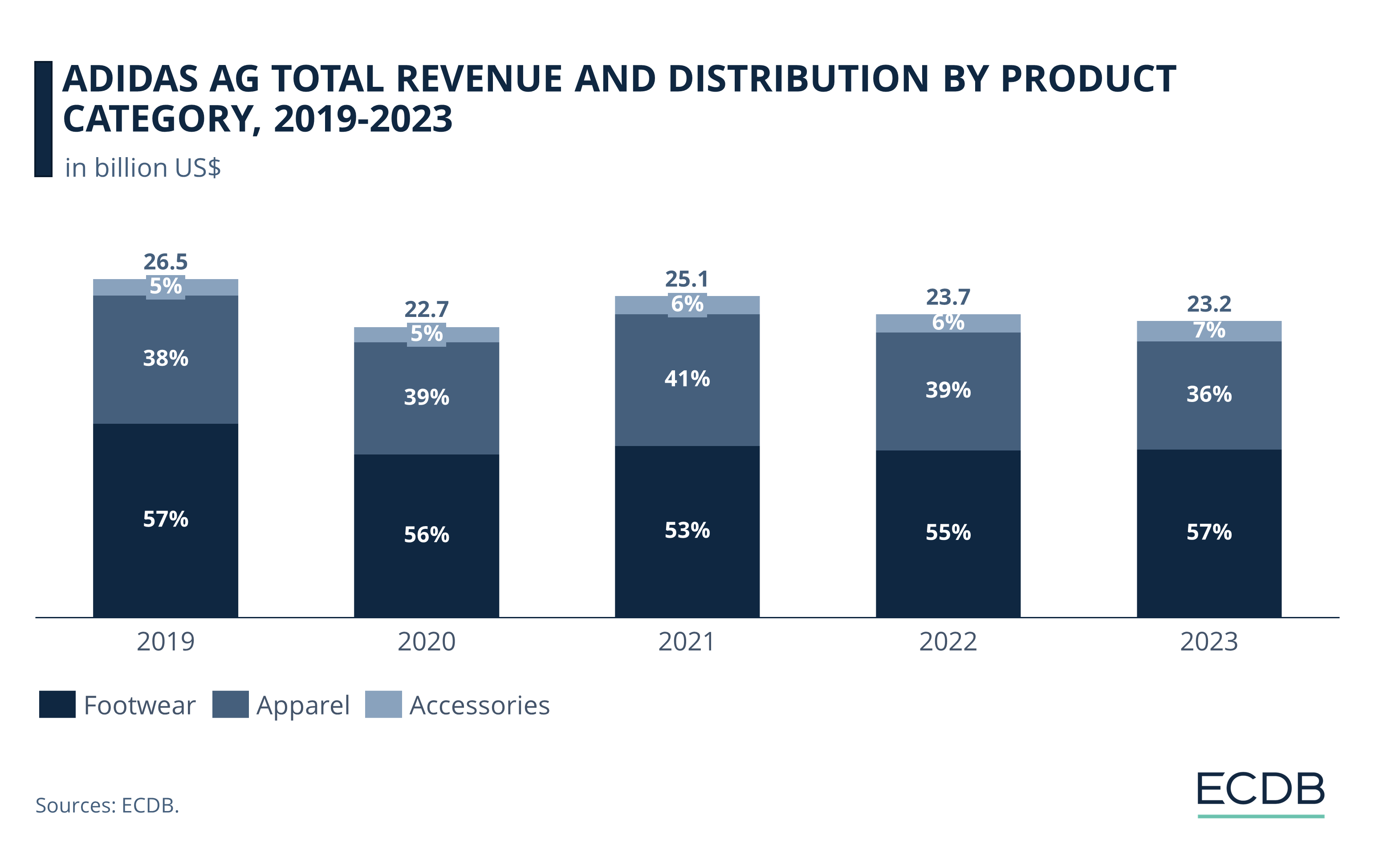

Shoes Make Up Most of Adidas AG’s Revenues

Adidas AG has seen its revenues fluctuate in recent years. The pandemic cut into profits as stores closed and consumers prioritized other products. Since then, recovery has been slow:

The 2019 revenue of US$26.5 billion has been unmatched up to 2023: It wasn't until 2021 that sales approached the previous level, at US$25.1 billion.

Throughout the years, footwear remained the most profitable category. The revenue share generated by shoes sales was at least 53% (2021) and at most 57% (2019 and 2023).

Apparel is the second largest revenue driver for Adidas AG, with revenue share peaking at 41% in 2021 and declining to 36% in 2023.

Accessories account for only a small share of revenue. They accounted for 5% in 2019 and 2020 and increased to 7% in 2023.

Consider that the figures shown include both online and offline sales. Changing the layout highlights the primary sales focus of Adidas AG.

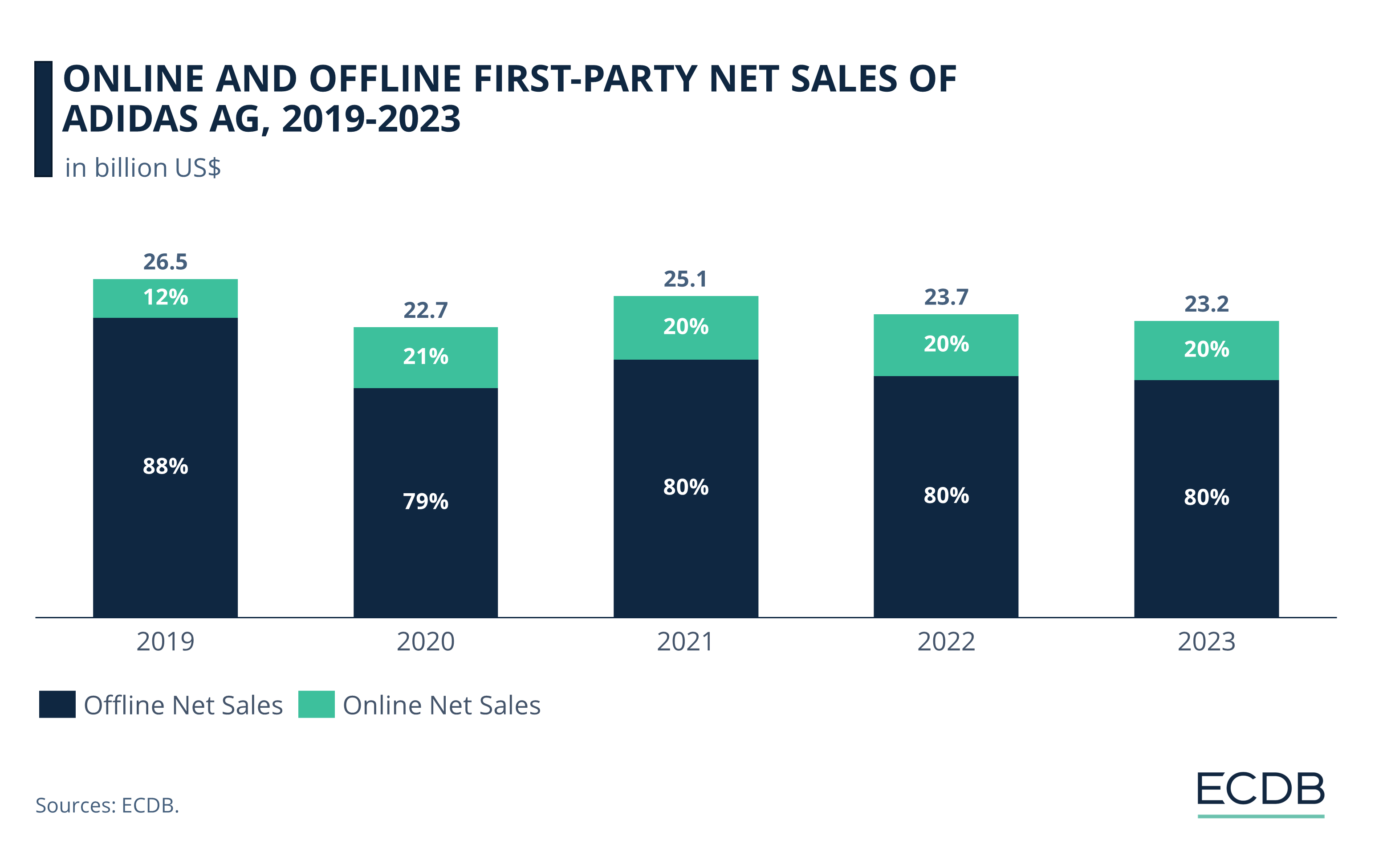

Adidas AG’s eCommerce Sales Share Is 20%

Despite revenue declines in recent years, eCommerce has been a complementary sales channel to offset some of the declining revenues.

With an online sales share of 12% in 2019, the pandemic had a lasting impact on eCommerce revenues: Since 2020, online sales share has been at least 20%.

What markets does Adidas focus on?

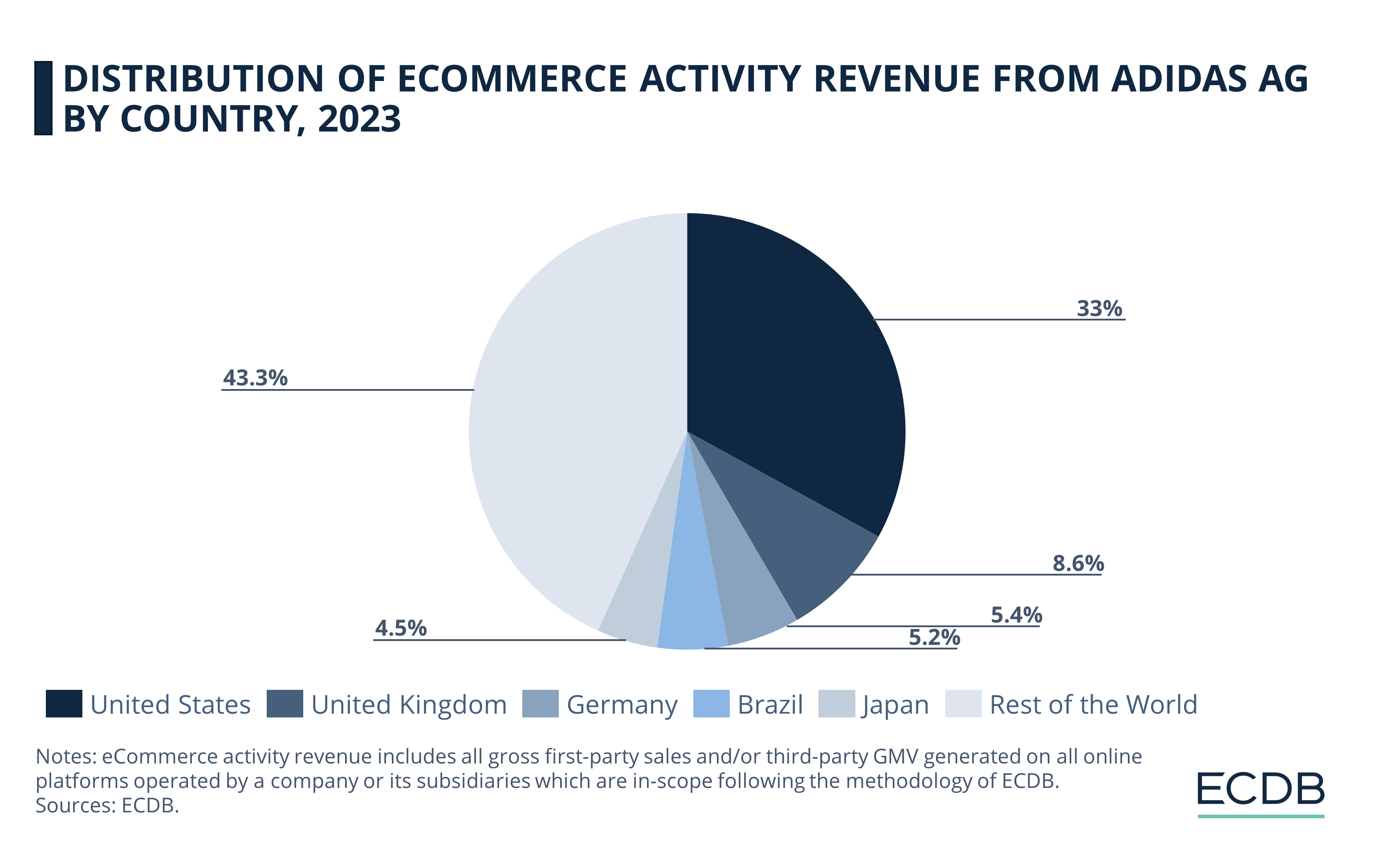

Adidas Serves Highly Diverse Markets

Adidas was founded one hundred years ago in Germany, but it has since evolved into a highly internationalized brand. This is illustrated by the fact that the majority of its eCommerce activity revenue is generated in many small markets.

The United States is Adidas AG’s largest market. In 2023, 33% of eCommerce activity revenue was generated in this country alone.

Ranks 2-5 include the United Kingdom (8.6%), Germany (5.4%), Brazil (5.2%), and Japan (4.5%).

Many smaller market shares make up most of eCommerce activity revenue: These encompass Argentina, Canada, France, Spain, India, Australia, and others. The distribution reflects the ubiquity of Adidas around the world.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

Adidas AG’s Growth Is Lagging

While Adidas is certainly a prominent player in the global athleisure wear market, it still lags behind its closest competitor, Nike.

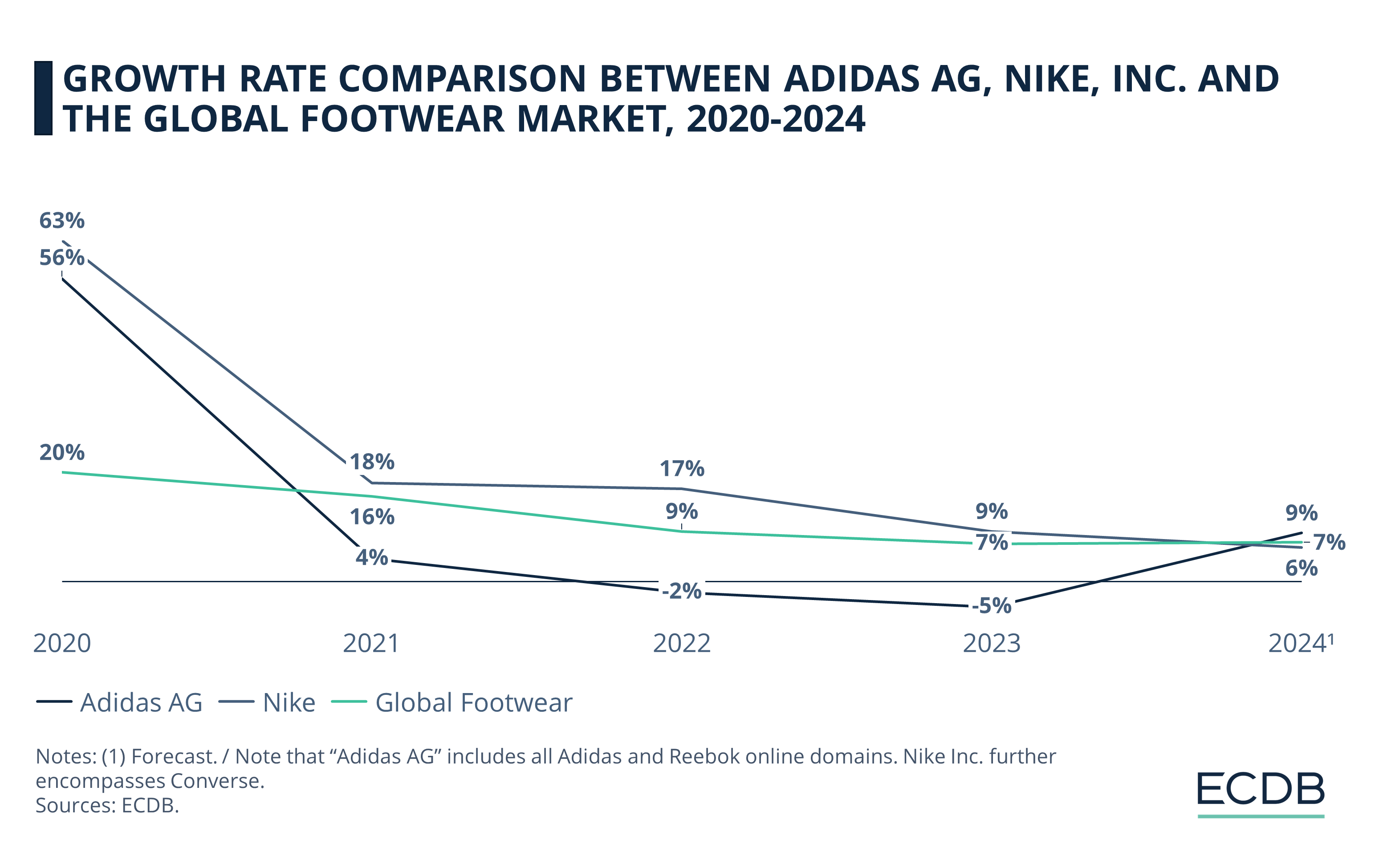

The 2020 pandemic phase was the most profitable for global footwear eCommerce, Adidas AG and Nike: Market revenues increased by 20%, while Adidas grew by 56% and Nike by 63%.

During the normalization period, the unusual peaks during the global health crisis returned to more regular levels. But Adidas AG saw deeper declines than Nike or the global footwear market. In 2021, revenues were up 4% year-over-year, but fell to –2% in 2022 and even –5% in 2023.

The dip in 2023 is partially due to losses from the Yeezy controversy and Adidas’ response of dropping the brand.

The forecast for 2024 anticipates a recovery for Adidas AG: revenues are expected to increase by 9% year-over-year. While fluctuations are normal for large conglomerates, this year's increase can be attributed to the occurrence of major sporting events such as the FIFA Euro Cup and the Olympic Games. These events are usually associated with higher profits for dominant sports retailers.

On that note, what strategies are characteristic of Adidas AG’s operations?

Adidas’ Business Model: Strategies for Success

Not for nothing is Adidas one of the best known and respected sports brands. Its three stripes are instantly recognizable, and Adidas AG was able to improve Reebok’s reputation and sales with similar management strategies.

1. Celebrity Endorsements and High-Profile Partnerships in Collections

Celebrity collaborations in and of themselves are nothing out of the ordinary. Adidas, however, succeeds in leveraging high-profile personalities in the arts and sports industries in two specific ways:

First, by choosing brand ambassadors who are relevant to the cause. The affiliation with Lionel Messi, for example, has become one of the most iconic brand partnerships to date.

Second, by producing celebrity collections to gain a unique branding. Naming each collaboration would take a separate article, but the most notable include Jeremy Scott, Kobe Bryant, Raf Simons, Pharrell Williams, and even luxury brands Gucci and Prada have collaborated with Adidas at one time or another. A partnership with environmental organization Parley for the Ocean resulted in a shoe collection made from ocean plastic waste.

2. Sponsorship of Major Sporting Events

For each region, Adidas makes sure to be in front of audiences at major sporting events. In the U.S., this means sponsoring top teams in baseball and basketball, while in Europe it is the soccer teams that wear the three stripes. In fact, if you look at the sponsorship distribution of teams in the FIFA Euro Cup or the World Cup, Nike and Adidas share the outfitting of the jerseys. In India, Adidas focuses on cricket, boxing and wrestling.

The impact of these sponsorships should not be underestimated: In 2024, when both the FIFA European Cup and the Olympic Games are held, Adidas’ online revenue growth is expected to return to positive levels after a two-year slump.

3. Catchy Marketing Phrases & Social Media Campaigns

In conjunction with the brand logo, a catchy brand slogan is important to effectively stay in the minds of consumers. In the case of Adidas, the slogan is “Impossible Is Nothing”, especially brought forward by the Lionel Messi campaign for the 2022 FIFA World Cup: When Football Is Everything, Impossible Is Nothing.

To further stand out on social media platforms, Adidas uses repostable content and hashtags to create a relatable image. The hashtags typically use messages around socially conscious topics like feminism (#SheBreaksBarriers), sustainability (#RunForTheOceans) and sportsmanship (#ImpossibleIsNothing).

Adidas vs. Nike: Upcoming Challenges for Adidas AG

Comparing the dominant strategies of Adidas and its main competitor Nike, the main issue becomes clear: The two business strategies are extremely similar, which makes it all the more remarkable when one eclipses the other in some way.

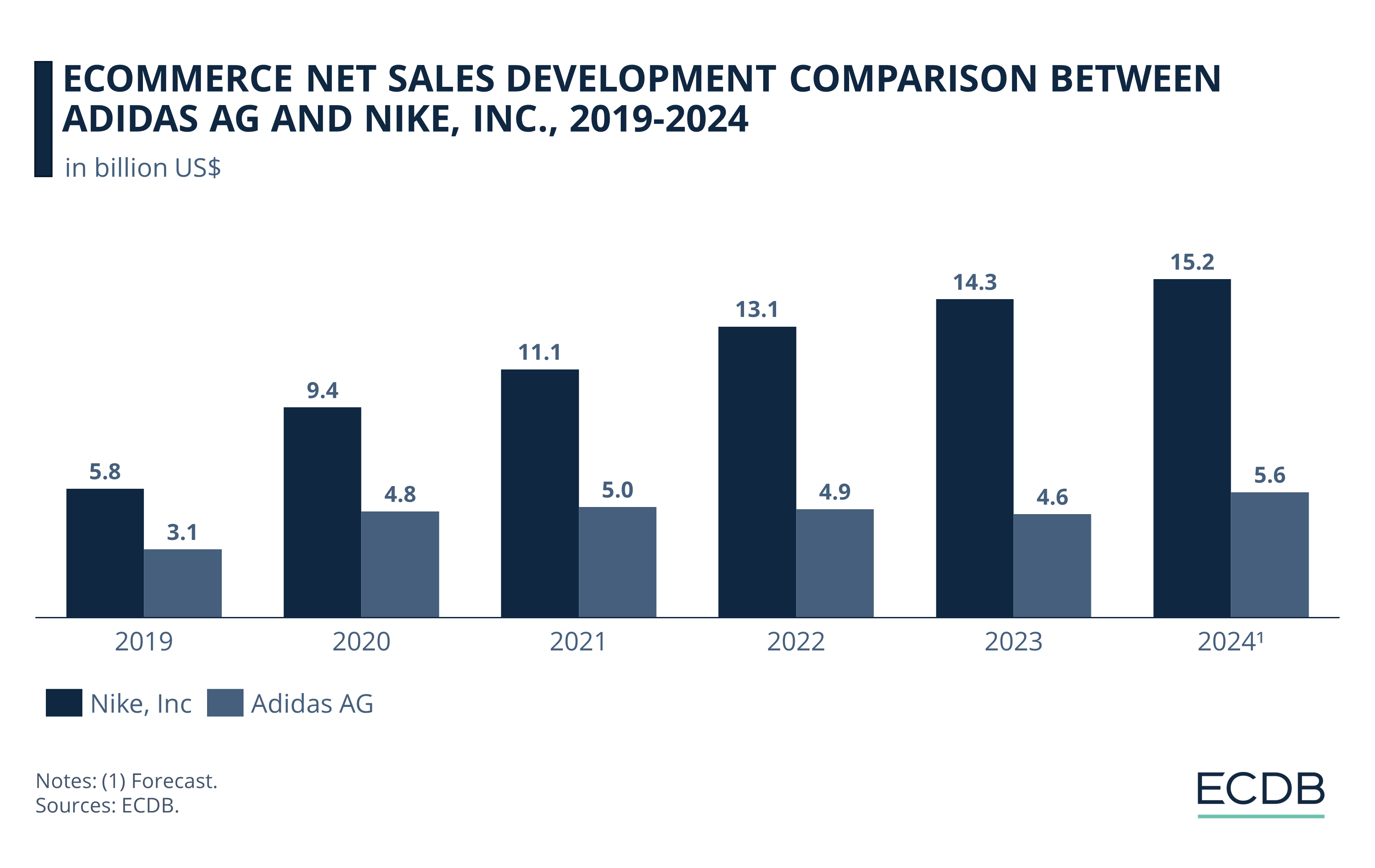

Unlike Adidas, Nike has not experienced fluctuations in online revenues in recent years and therefore seems to be better equipped to deal with market dynamics.

An eCommerce net sales comparison shows that Adidas lags significantly behind Nike, as it generates about one-third of Nike’s sales.

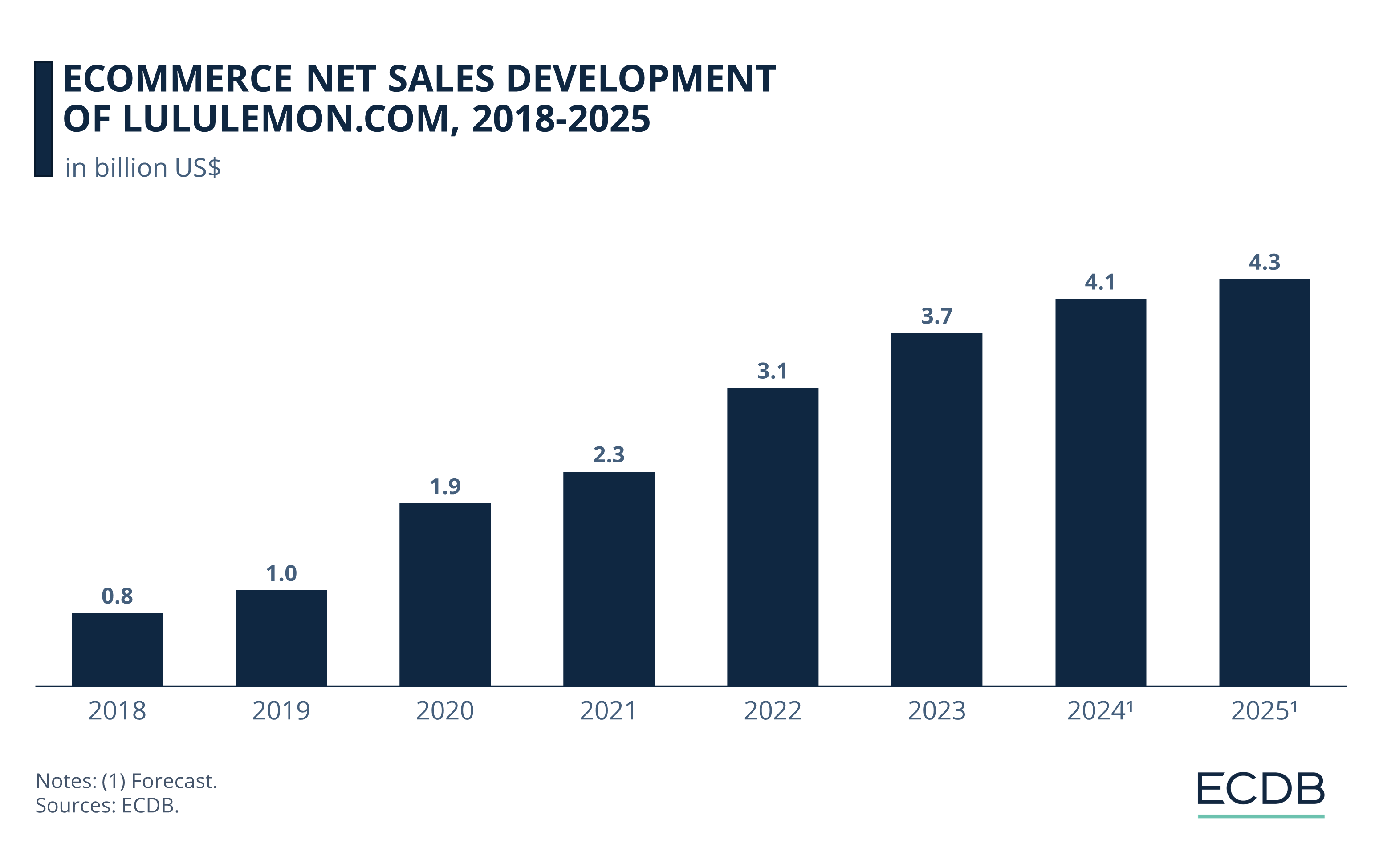

But other competitors are emerging in the online footwear market. They include On Running, Hoka and Lululemon. While none of these stores pose a threat to Nike, Adidas’ lead is not as big:

Adidas is only a few million U.S. dollars ahead of Lululemon, which generated US$3.7 billion in eCommerce net sales. Compared to the US$4.6 billion across all Adidas domains, there is just a small margin between the two.

The remaining challenges are common to all major players in the footwear market, and include economic slowdown, difficulty of growth for larger conglomerates, and ethical scandals in manufacturing countries.

Adidas Business Strategy: Wrap-Up

Adidas is an iconic brand for sneakers and athleisure wear. But the conglomerate is nonetheless struggling to maintain growth and compete effectively with the multitude of other brands vying for market share and consumer interest.

Despite its struggles, Adidas is expected to remain a leading player in the industry. The effective rebranding of its Reebok subsidiary has shown that successful collaborations and high-profile endorsements are highly effective in sustaining consumer interest. As can product quality and innovation.

Sources: Adidas AG – Digital Agency Network – Fastcompany – Kicker

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

DM vs. Rossmann 2024: Which Online Drugstore Comes Out on Top

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

Back to main topics