Amazon Prime Day 2023: New Deals, Established Trends, and Shopper Preferences

Download

Coming soon

Share

It is that time of the year again when shoppers around the world flock to the internet to shop for products they expect to find a bargain on – Amazon Prime Day. On July 11 and 12 this year, Amazon in Australia, Austria, Belgium, Brazil, Canada, China, Egypt, France, Germany, Italy, Japan, Luxembourg, Mexico, the Netherlands, Poland, Portugal, Saudi Arabia, Singapore, Spain, Sweden, Turkey, the United Kingdom, and the United States will offer discounts on select products from chosen brands in an effort to boost sales and Prime memberships.

That is why we are taking the time to examine what is new and what consumers can expect from this year’s shopping frenzy. We are also looking at data from last year’s Amazon Prime Day, which took place on July 12-13.

For Prime Day 2023, Amazon Will Introduce Invite-Only Deals

As customers look forward to placing their orders for products they have been eyeing all year, Amazon is ready to up the ante. The tech giant will use its vast data analytics capabilities to improve the customer experience with a more personalized and intuitive shopping platform.

First, Amazon will introduce invite-only deals for customers to get an early hold on items that are expected to sell out quickly. Moreover, Prime members in the U.S. were able to get some of the benefits as early as June 26, including a $200 Amazon gift card upon authorization of a Prime VISA card.

Second, Amazon will offer an integration of smart home devices such as the company’s own Alexa, enabling voice searches and reservations for products to provide customers with a seamless shopping experience. As a result, these devices will also be able to notify users of the start of the shopping day and exclusive deals.

In addition, last year’s live shopping events featuring popular influencers, TV personalities, comedians, and models will continue, although third-party estimates of the effectiveness of these QVC-inspired events have been underwhelming at best. While Amazon representatives have disputed these reports, blaming technical glitches that limited the number of views displayed to a level well below the actual number of onlookers, these claims cannot be verified at this time.

Speaking of last year’s Prime Day, the stats from the previous shopping event will help us get a better idea of what to expect in 2023. Luckily, Numerator conducted surveys with verified Amazon shoppers to examine shopper behavior and characteristics, since Amazon itself rarely shares its own data.

Prime Day 2022 Shoppers Preferred to Place a Higher Volume of Low-Priced Orders

In our article on Prime Day 2022, we reported on third-party estimates that US$12.1 billion in sales were generated. The Numerator figures go into more detail, providing information on the average order size, household spend, prices of items sold, and more details on shoppers’ purchase purpose, as well as most bought product categories.

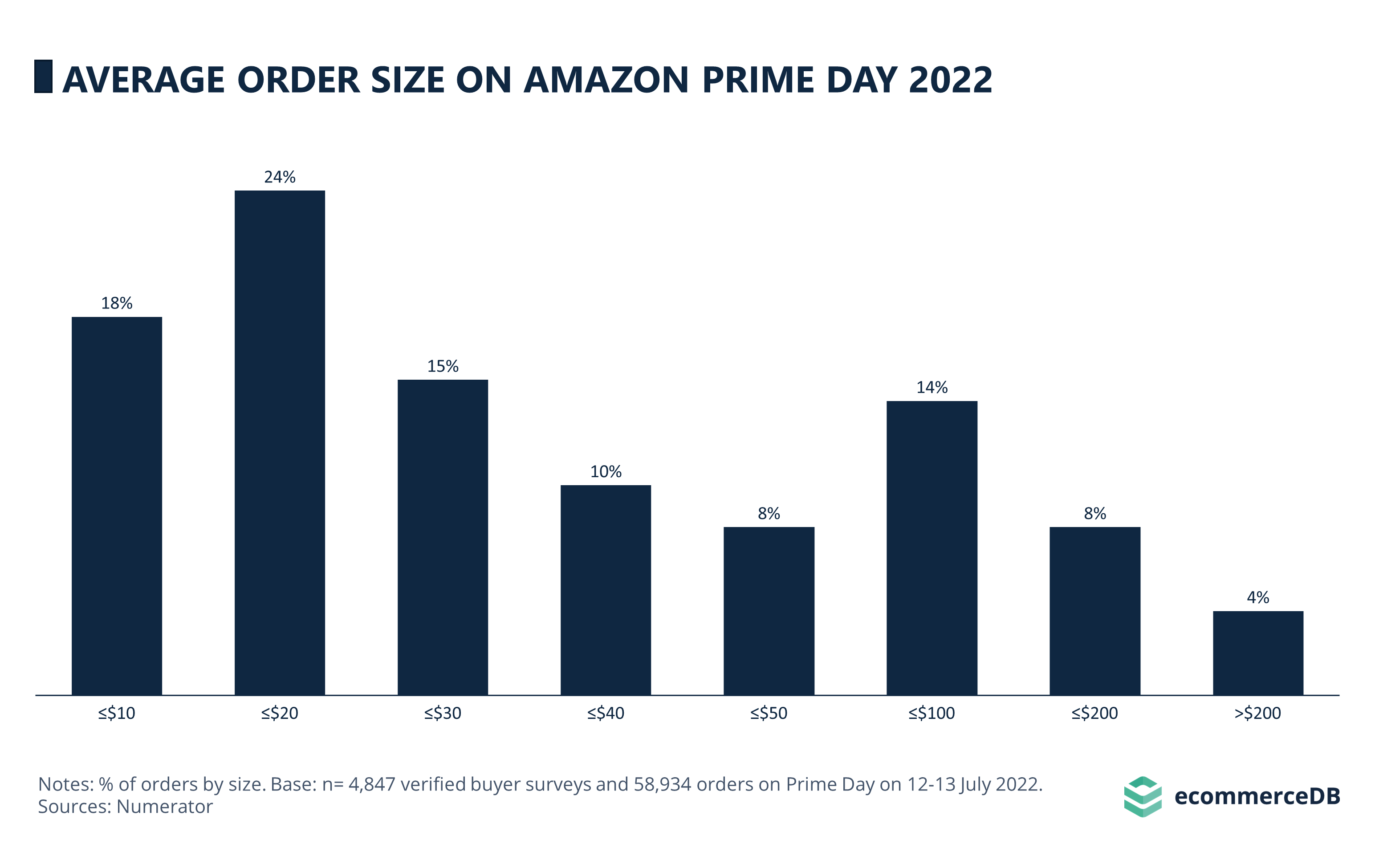

Order Sizes on Prime Day 2022 Averaged US$52.26

The average order size for Prime Day 2022 was US$52.26. A breakdown shows that well over half of orders (57%) were no more than US$30, while an additional 18% of orders were below US$50. Only 26% of orders were in the US$50+ price range, suggesting that shoppers prioritized smaller order values that represented a larger household spend in bulk, as seen in the next category, average household spend.

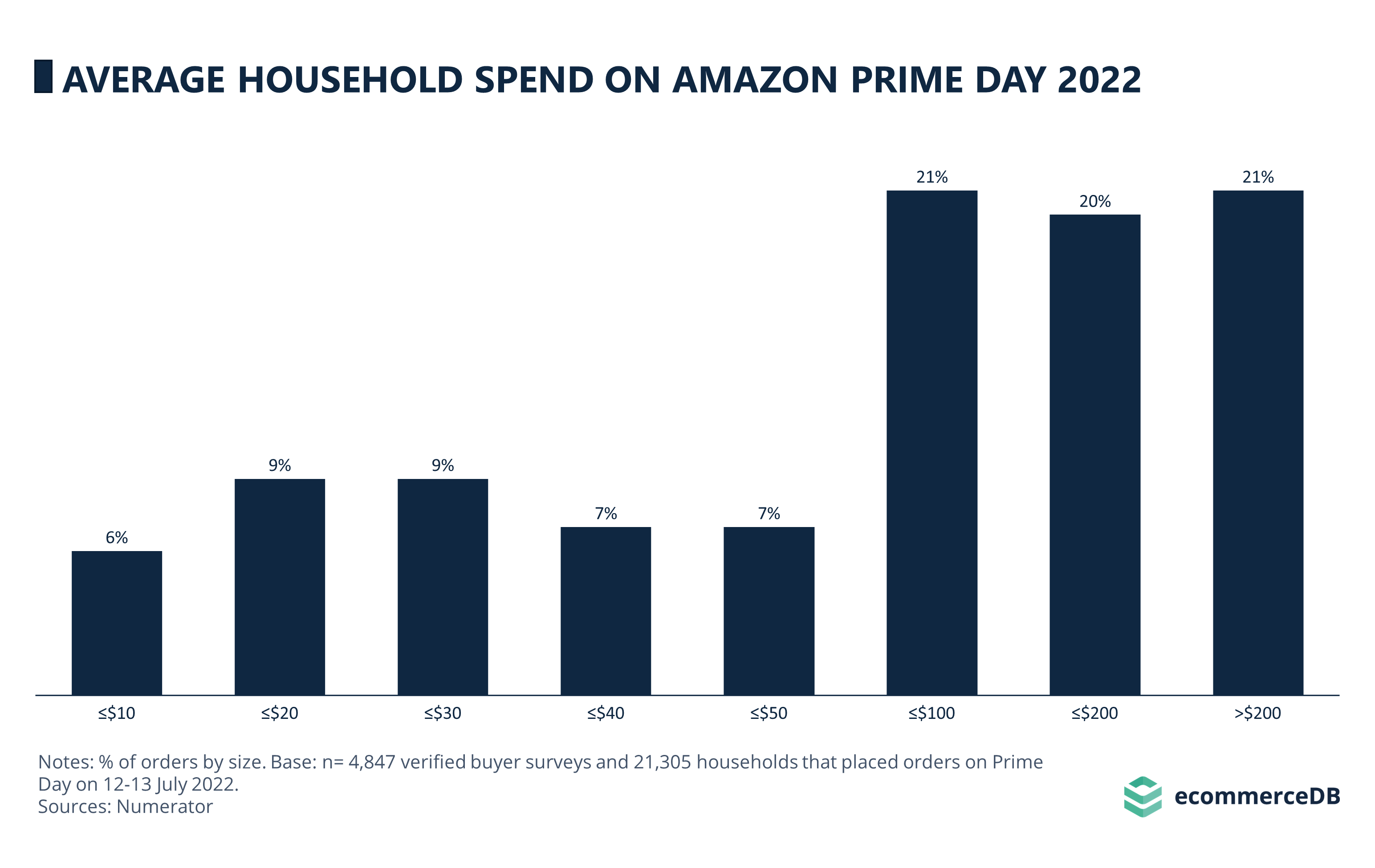

Prime Day 2022: Households Spent US$144.56 on Average

Average household spending shows an inverse pattern to order size. While the average value amounted to US$144.56, 62% of respondents to the Numerator survey reported spending US$100 or more, and a smaller proportion of households spent less.

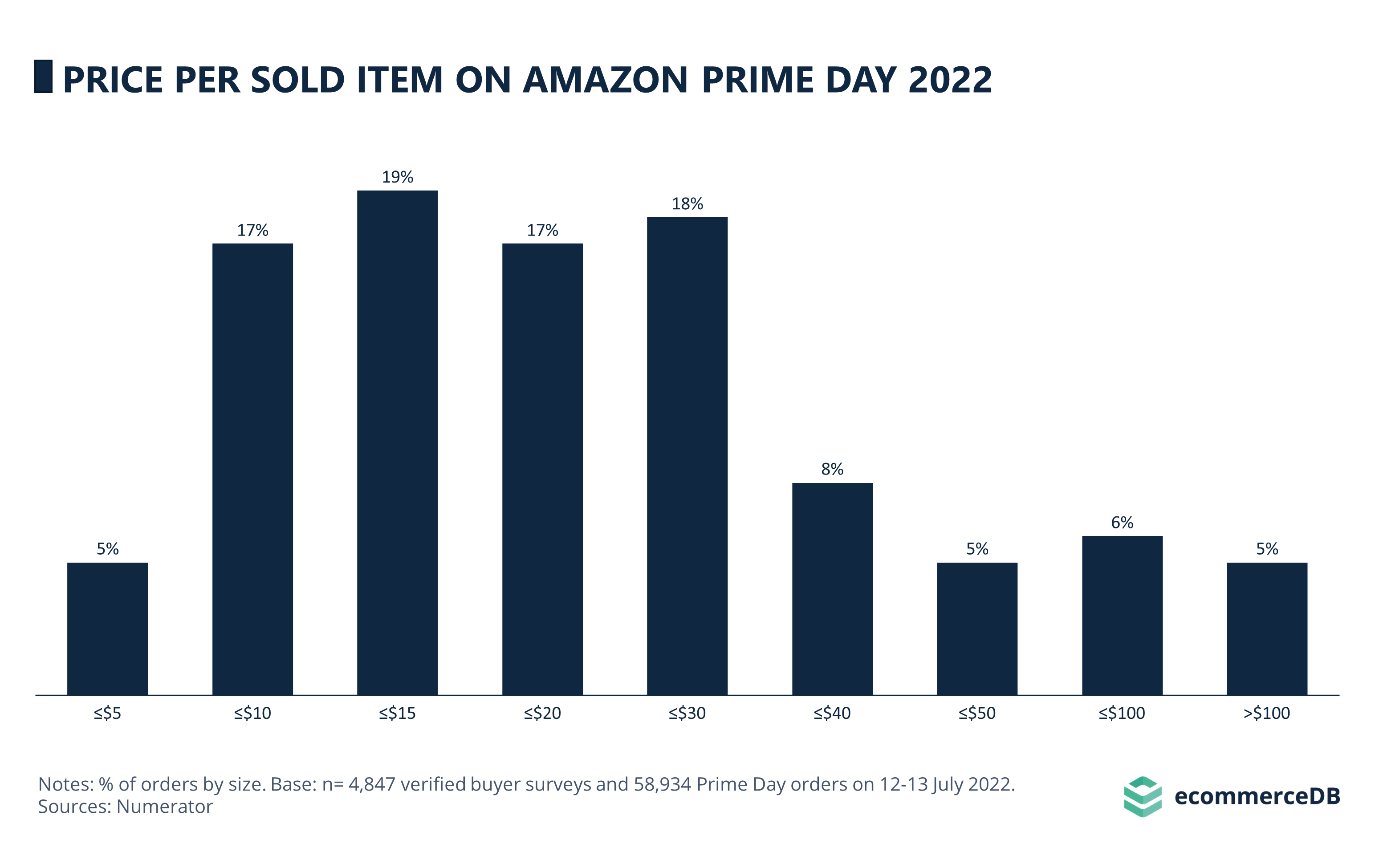

Average Consumer Spent US$33.58 per Item Last Prime Day

The price per item sold supports the assumption that households purchased several smaller-priced items that amounted to a larger household spend. As we can see, a whopping 76% of items were bought for US$30 or less. Only 13% of items purchased cost between US$31 and US$50, and 11% of items cost more than that. Consequently, the average price per item sold was US$33.58.

To gauge the drivers of Prime Day purchases, let us look at the purposes for the purchases most frequently cited by survey respondents.

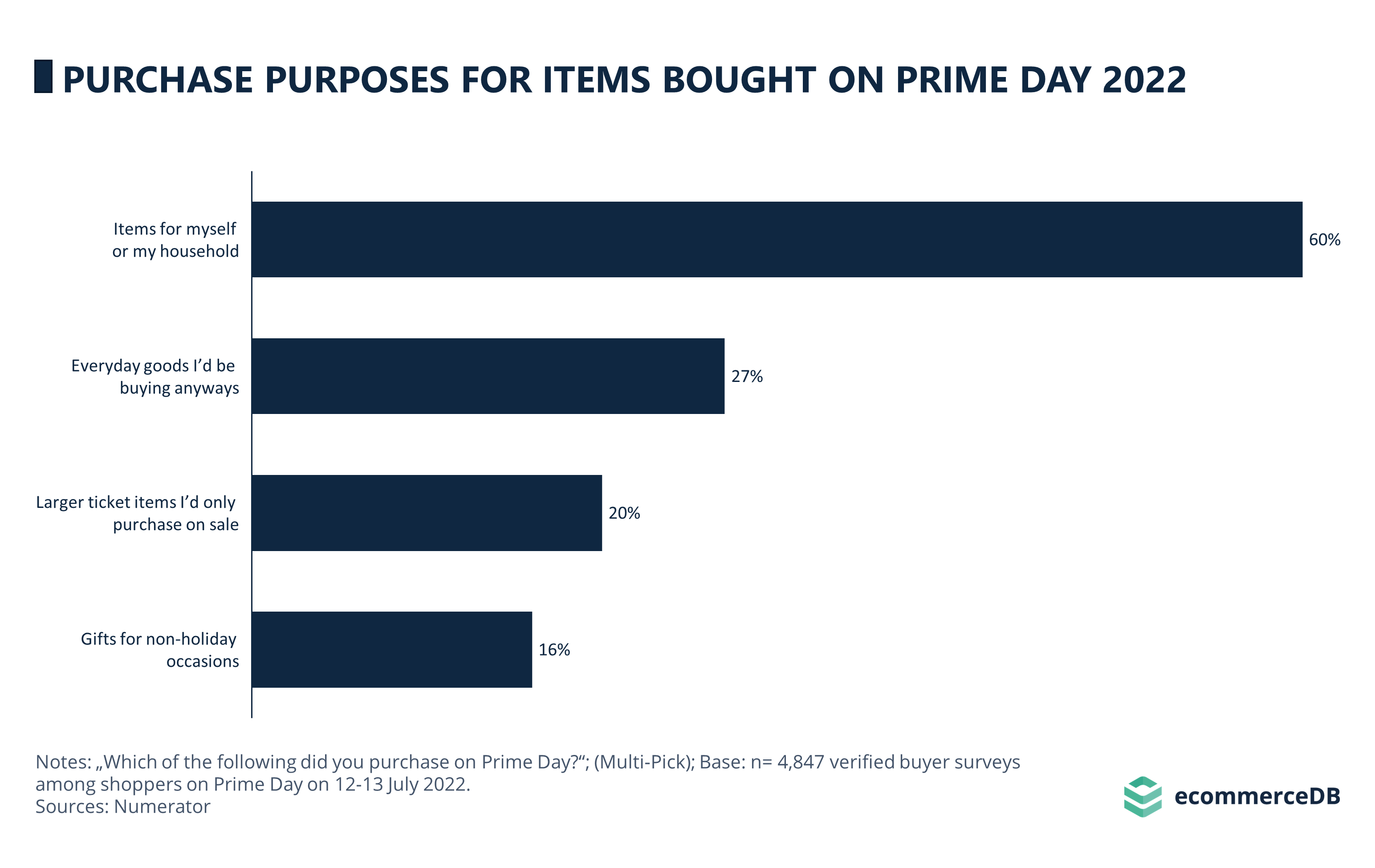

Most Consumers Bought Items for Themselves or Their Household on Prime Day 2022

Most of the respondents (60%) said they purchased items for either themselves or their household. Similarly, 27% said the items they bought were everyday goods they would buy anyway, and only one-fifth of shoppers said they made larger purchases that they would only buy on sale. These results confirm the earlier trend of buying larger quantities of lower-priced items rather than smaller quantities of higher-priced items. Only 16% of respondents said they used Prime Day to buy gifts for non-holiday occasions.

Household Essentials Was the Most Purchased Product Category on Prime Day 2022

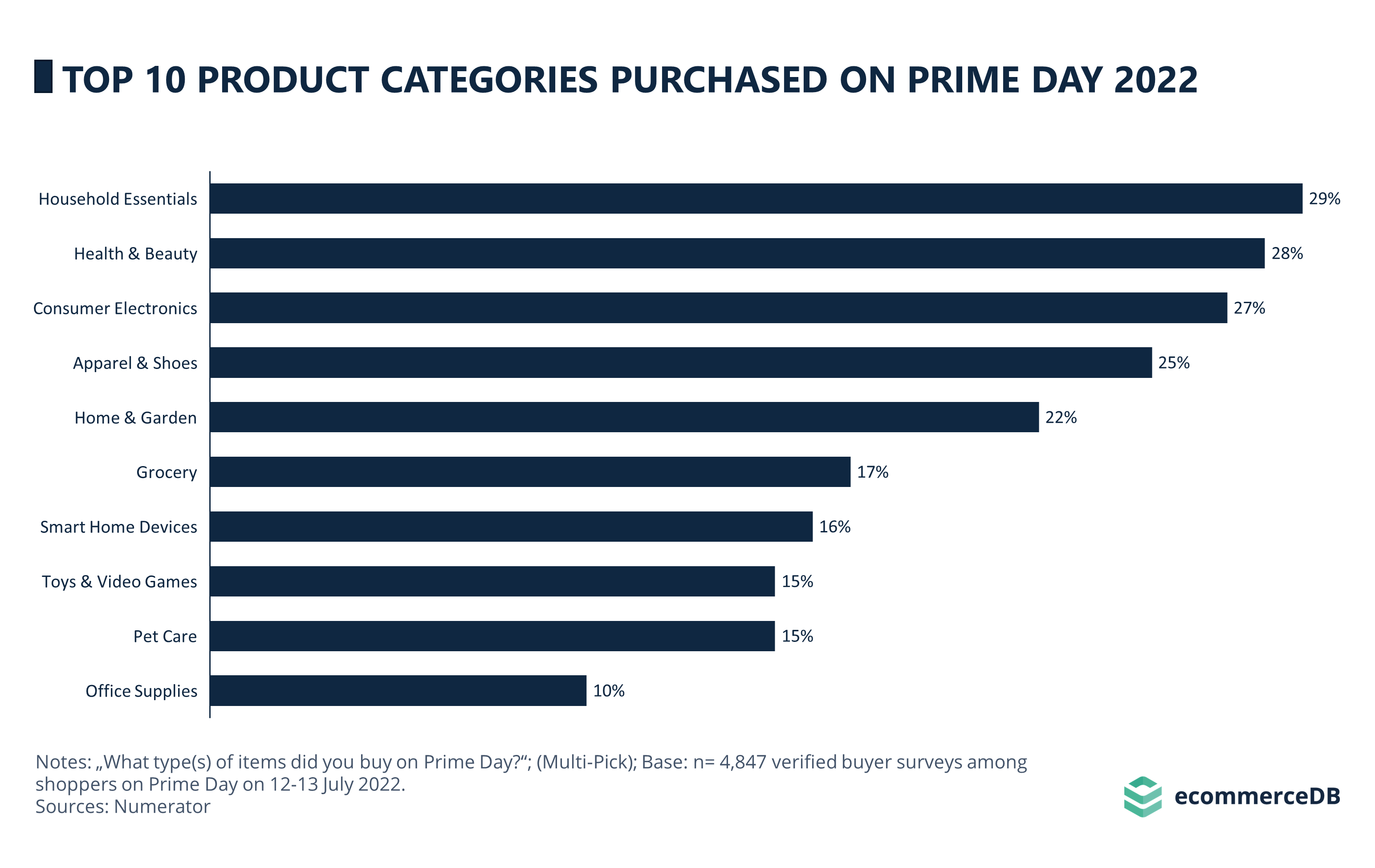

A look at the top 10 product categories purchased on Prime Day 2022 shows that Household Essentials were most commonly bought, with 29% of survey respondents indicating a purchase, closely followed by Health & Beauty products (28%) and Consumer Electronics (27%).

The fashion category ranks fourth with Apparel & Shoes at 25%, and Home & Garden products still tops 20% by two percentage points. Grocery (17%) and Smart Home Devices (16%) are next, followed by Toys & Video Games and Pet Care, each with 15% of responses. Finally, Office Supplies ranks tenth with 10%.

Prime Day 2023: Old Favorites Blend With New Experiments

This year’s Amazon Prime Day will use a combination of new and established offers to increase purchases and Prime memberships. A new feature will be invite-only deals, which will allow customers to pre-order products they expect to sell out quickly. In addition, integration with smart home devices will be used to provide a seamless and convenient shopping experience, and last year’s live shopping events with celebrities will continue despite rumors of low profitability in 2022.

Data from the Numerator survey on Prime Day 2022 shows that shoppers preferred buying a larger quantity of lower-priced items, which most often represent an average household spend of more than US$100. Accordingly, most shoppers reported purchasing items for personal or household use, as well as products they typically buy anyway. The top 3 product categories purchased on Prime Day include Household Essentials, Beauty & Health products, and Consumer Electronics.

As such, it will be interesting to see how this year's shopping event turns out and whether the recent innovations will have the desired effect of boosting sales and Prime memberships.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics