Digital Retail Media in Europe: Challenging Amazon’s Status Quo

Article by Nadine Koutsou-Wehling | June 22, 2023

The European digital retail media advertising market has seen remarkable growth in recent years as consumers spend more time shopping online and therefore pay more attention to product advertising. One notable player that is a dominant force in this space is Amazon. With its broad appeal, extensive reach, and unmatched scale, Amazon is playing a pivotal role in shaping the landscape of digital retail advertising.

This article examines Amazon’s role in the European digital retail media market, with a particular focus on its expected development and the external factors at play. As with most things, there are both advantages and disadvantages for sellers placing their advertising on Amazon, which we will highlight below.

Amazon's Influence in European Digital Retail Advertising Unmatched, but on Decline

European eCommerce is a diverse market, encompassing countries with unique consumer behaviors, cultural nuances, and varying levels of eCommerce maturity. Amazon is uniquely positioned within these diverse markets, as its generalist approach caters to a wide range of interests, and its large scale provides an incentive for brands seeking their share of the burgeoning online retail market to place their advertising on this platform.

By leveraging Amazon’s extensive consumer database, robust logistics infrastructure, and widespread name recognition, brands can gain access to a vast and diverse audience, regardless of their specific niche or industry.

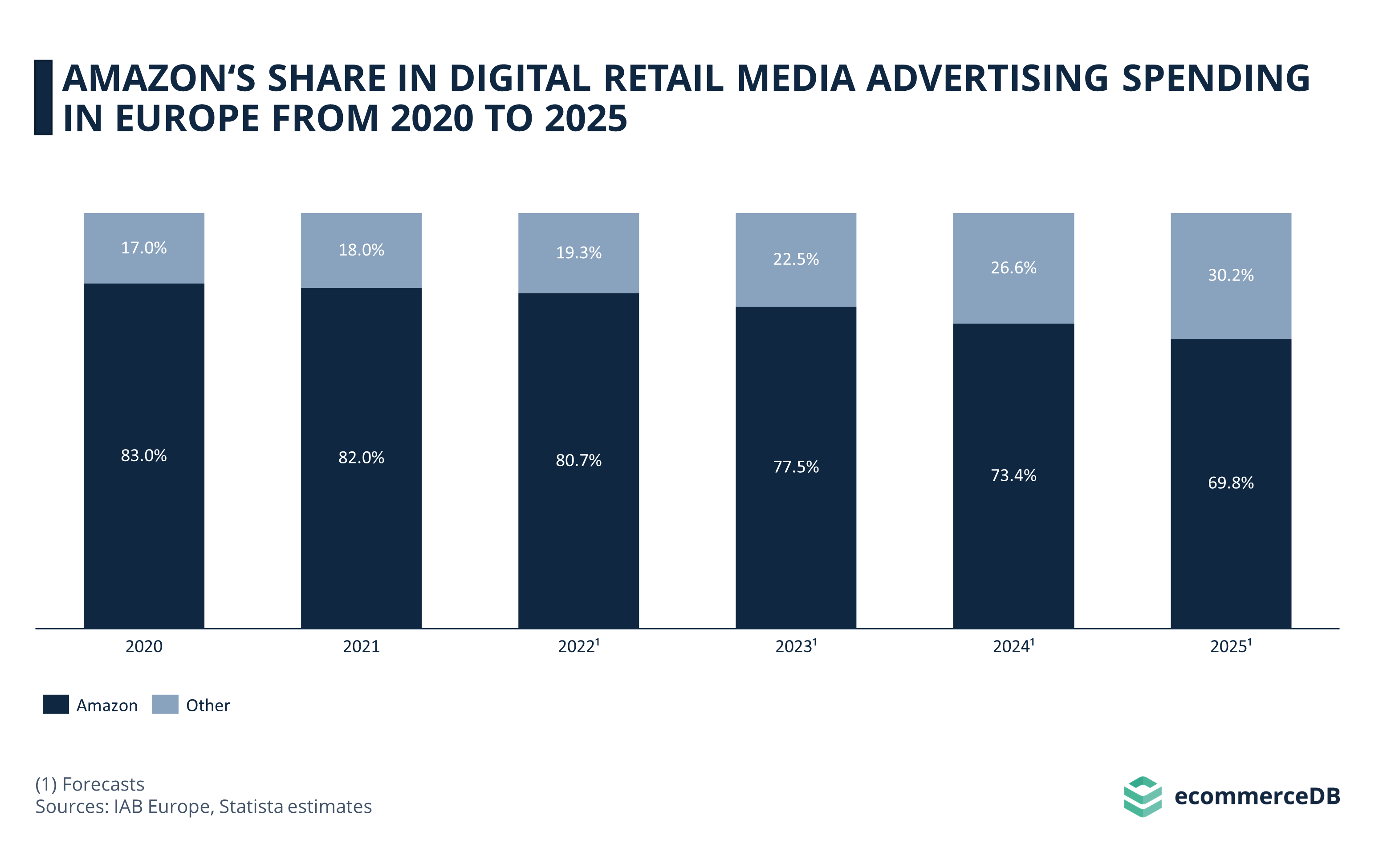

However, as Statista’s recent report on digital retail media advertising in Europe shows, Amazon’s relevance is expected to decline in the coming years. According to an IAB Europe forecast and Statista estimates, Amazon’s share of European retail media ad spend will decline by around 13 percentage points between 2020 and 2025, while other retail media networks (RMNs) are expected to collectively reach 30.2% of the market share by 2025, starting from just 17% in 2020.

As European online platforms such as Zalando, Carrefour, or Criterio saw the value of advertising revenue in an increasingly volatile and unstable eCommerce market, they moved to set up their own RMNs to provide more competition to Amazon’s dominance. This gives sellers more options to spread their ad spend across multiple platforms to diversify their reach and target different audiences.

The move comes at a critical time as sellers on Amazon face rising advertising costs due to the growing number of vendors on the site competing for ad space and the most favorable placement at the top of the page. Amazon’s pay-to-play nature means that sellers must spend a significant portion of their sales on Amazon advertising in order to be noticed by customers. As a result, sellers reported that they had to raise the prices of their merchandise to offset the costs.

In addition, privacy concerns have come to the forefront of public debate. Far-reaching digital regulatory frameworks, such as the European Commission’s General Data Protection Regulation or Apple’s changes to its privacy settings in 2021 significantly limit the scope of information that retailers can collect across multiple platforms.

However, for a significant number of SMEs, having an advertising presence on Amazon is essential to breaking into the market, rather than missing out on opportunities to capture the attention of potential customers. As the value of first-party data has increased in recent years and Amazon remains the largest online retailer in the Western world, advertising on the platform is essential for many businesses.

Digitalcommerce360¹ conducted an interview with the co-founder of a men’s skincare brand, Alex Lewkowict, who describes the struggles startup companies face when advertising products without a corresponding store page on Amazon:

“Instead of finding our product on Amazon, [customers would] see competitor options that were also advertising using the same keywords,” Lewkowict says. “So, whether they’re seeing our TV ads or a Facebook ad, they’ll always go to Amazon to comparison shop, […]. Our strategy here is to encourage those Amazon shoppers to go and buy on Amazon. Traffic that comes off of Amazon helps our ranking [on the marketplace search results]. The more shoppers search for our products, the better our ranking.”

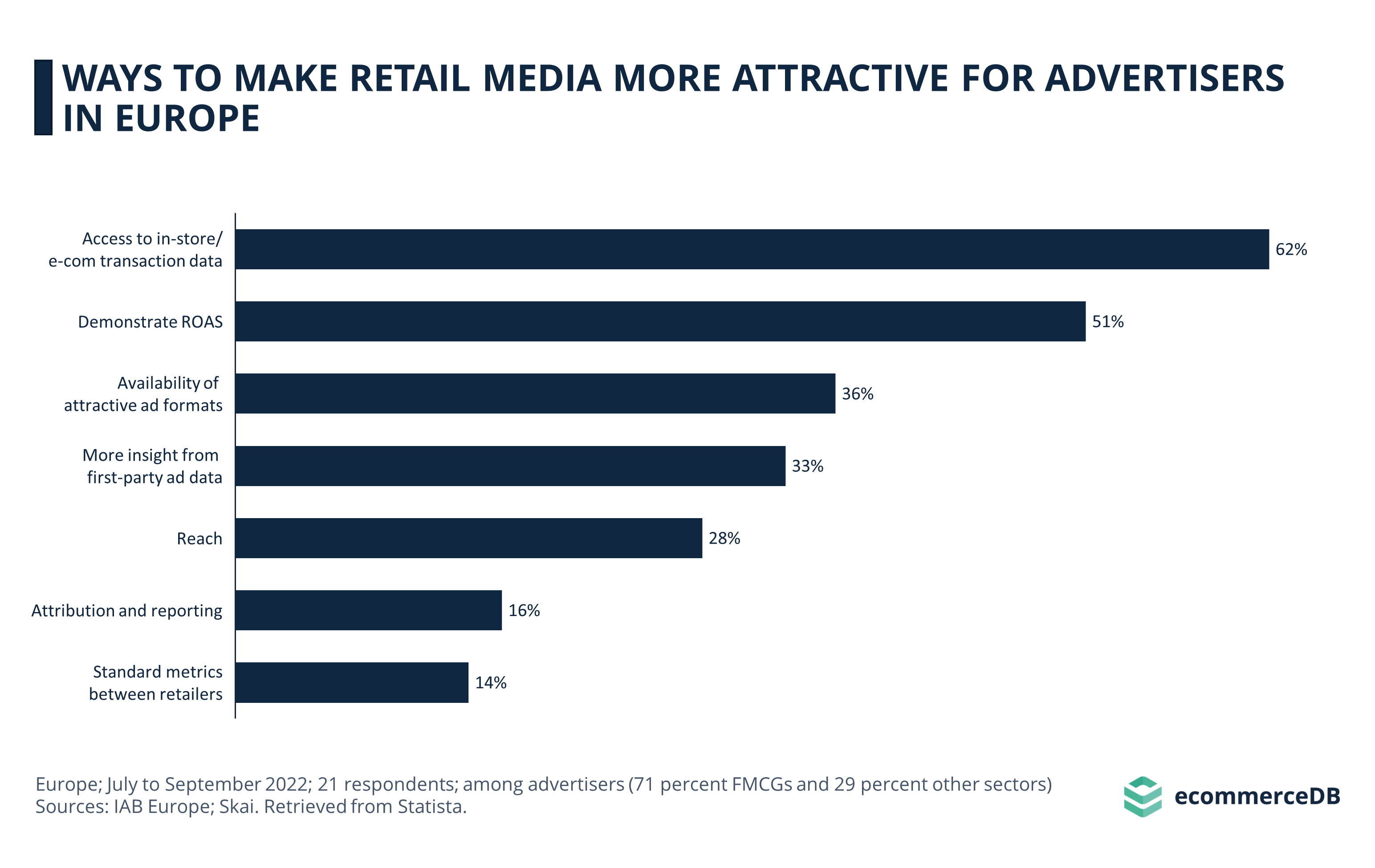

According to a survey conducted by IAB Europe among European advertisers, 65% of respondents named access to transaction data as a factor that would make retail media more attractive to them. Leveraging consistent KPIs such as RoAS, a choice of attractive ad formats, first-party data insights, having a larger reach, as well as reporting and standardization were named.

To date, the proliferation of RMNs has only fragmented the digital retail media advertising market, resulting in different measurements and KPIs being used to assess the effectiveness of advertising on a site. Having entered this market in 2012, Amazon has been able to develop its experience and network, giving the company a significant advantage over its competitors despite the challenges and drawbacks that exist.

While Rising Costs and Increased Competition Challenge Amazon's Dominance of European Ad Spend, Privacy Regulations and Quality of Data Solidify its Position

An assessment of Amazon’s role in the European retail media advertising market confirms its outstanding importance in that field. This should come as no great surprise, as Amazon established its ad spend sector back in 2012. Therefore, the company has had ample time to leverage its vast first-party data and build out its seller networks and infrastructure. With these competitive advantages, Amazon can offer an array of businesses, both established and new, an incentive to place their advertising on its platform.

However, IAB Europe and Statista estimate that Amazon’s share of ad spend in Europe will decline in the coming years. As other online retailers have realized the potential of revenue in the online advertising market, they are setting up their own RMNs, offering sellers the opportunity to diversify their portfolio, reach a wider audience, and circumvent the rising costs of ad placement on Amazon.

There is a shift toward the value of first-party data collected within a closed ecosystem, and the European Commission’s legal regulation and Apple’s privacy settings prohibit cross-platform data collection. This, in turn, benefits large networks such as Amazon due to the improved quality of their data, which is not in the least supported by the congruence of their KPIs to assess the success of an ad on their site. Due to the increasing fragmentation of the digital retail media advertising market, these metrics are difficult to compare across sites, which leads to low-quality assessments.

This means that while Amazon’s prominence is expected to decline in the coming years, its preeminent position in the ad market is likely to continue, with other RMNs struggling to match its size and effectiveness.

Footnote: 1

Sources: Digiday - IAB Europe - Forbes - Vox - Wunderman Thompson

Related insights

Article

Amazon's Top Competitors in the UK: GMV, Product Categories & Annual Growth

Amazon's Top Competitors in the UK: GMV, Product Categories & Annual Growth

Article

Temu Continues to Grow in 2024: Outselling Shein, Wish & Alibaba

Temu Continues to Grow in 2024: Outselling Shein, Wish & Alibaba

Article

Amazon: Which Domains Grew the Fastest?

Amazon: Which Domains Grew the Fastest?

Article

Most Valuable Global eCommerce Companies 2024

Most Valuable Global eCommerce Companies 2024

Article

Online Consumer Electronics Market in the United States: Top Players & Market Development

Online Consumer Electronics Market in the United States: Top Players & Market Development

Back to main topics