Top eCommerce Retailers

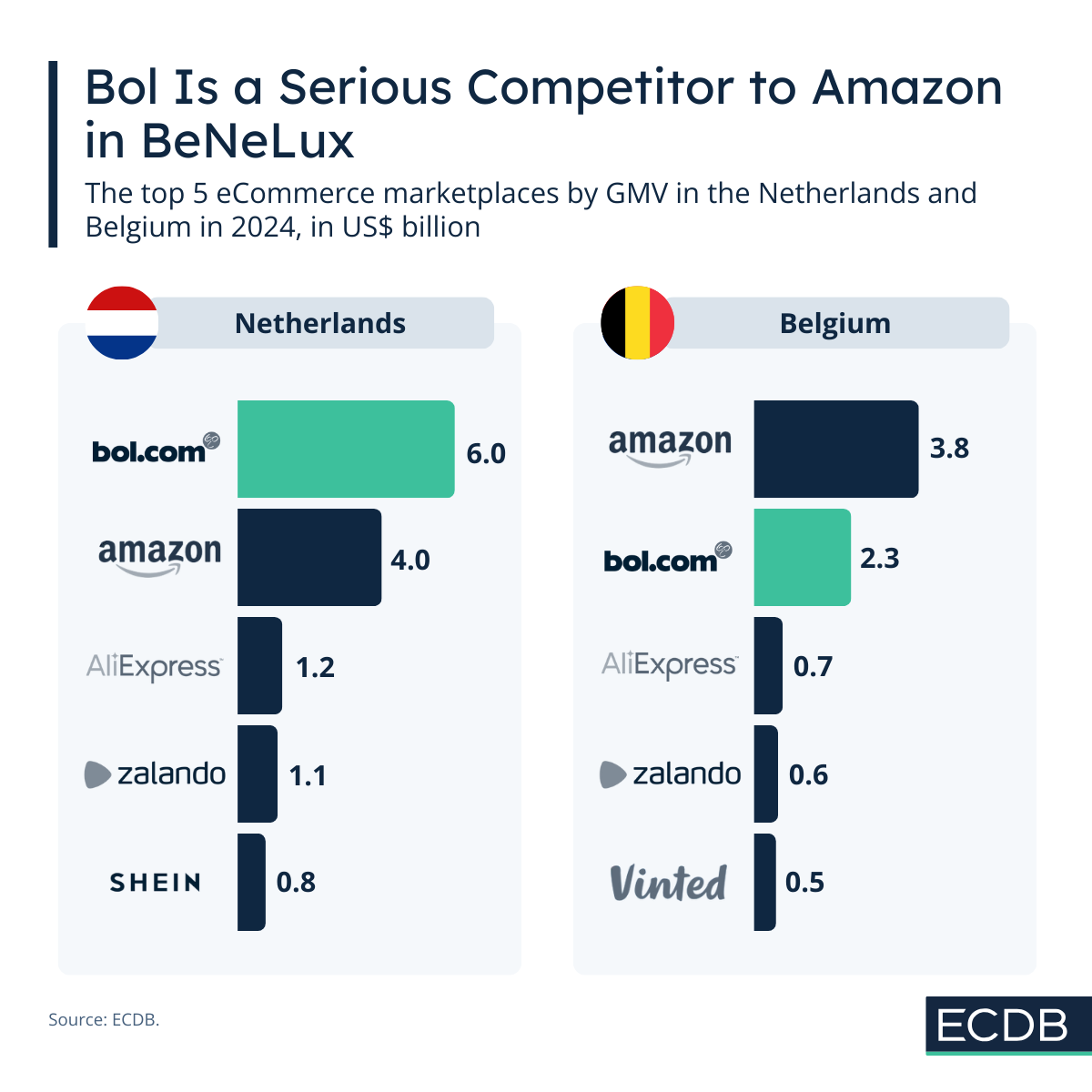

Bol.com Struggles With Amazon for Market Dominance in BeNeLux

The Netherlands is one of the few markets where a retailer other than Amazon leads the eCommerce ranking. What makes bol.com stand out?

Article by Nadine Koutsou-Wehling | March 17, 2025

A common phrase in a report on European countries is Amazon’s leadership in the respective market. It is rare that Amazon is not the number one eCommerce retailer, especially in the cases where Amazon is active in the country.

The Netherlands is such a case. Bol.com is the leading eCommerce company in the market, operated by Koninklijke Ahold Delhaize N.V. The following analysis also includes Belgian eCommerce, where the dynamics are very similar to the Dutch ranking.

What are the factors that give bol.com an advantage in the Netherlands and Belgium, its only two markets?

Bol.com Served the Netherlands and Belgium Earlier

Bol.com was originally launched in 1999 by the German media conglomerate Bertelsmann as an alternative to Amazon. It was intended to become a pan-European eCommerce player, but was eventually bought by multinational retail company Koninklijke Ahold Delhaize N.V. in 2012. This narrowed bol.com's regional focus to the Netherlands and Belgium.

The development represents competitive advantage bol.com has had over Amazon: It launched earlier in these markets and therefore has a more stable foothold than Amazon, which released the amazon.nl domain for all categories in 2020. Previously, amazon.nl was a pure book shop, but no other categories were sold on the domain. For these, the two markets were served by Amazon domains from neighbouring countries, which extended delivery times and hindered a tighter focus on consumer needs and preferences in the region.

Bol had this regional specification in place, which allowed it to cater more specifically to the preferences of consumers in the Netherlands and Belgium. Consumers in the market know bol.com and perceive it as an easy one-stop shop for a wide range of categories. Amazon is of course well known and the leading eCommerce marketplace in Belgium, but Bol is holding its own in the Netherlands.

Bol Implements Strategic Adjustments to Keep Pace

It's not just timing, however, that is contributing to Bol's success in the two markets in which it operates. It offers many of the same consumer conveniences that have become standard in eCommerce: Free delivery (minimum order value €25 as of 2024), next-day service, return options and customer service.

Bol.com has also followed the global trend in terms of business structure, increasing its share of third parties (3P) on the marketplace early on. In 2018, its 3P share stood at 40.0% and is expected to grow steadily, reaching 62.9% by 2023 and a projected 66.4% by 2025. With Amazon's inclusion of a wider range of categories in 2020, bol.com was under pressure to double down on customer convenience with vast offerings on its marketplace business, or else Amazon would take the online shoppers who previously did most of their shopping on bol.com.

Online posts about consumer perceptions of both retailers reflect a widespread perception that prices at bol.com are slightly higher than at amazon.nl or AliExpress. While some believe that the higher prices are in line with a higher overall quality, others do not see much difference between the two platforms. This is reflected in the strong position of AliExpress in both countries, with a lower GMV than the two market leaders, but it is not out of the question that the market dynamics could change soon.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Shein’s Third-Party Share Is Expected to Approach 18% This Year

Shein’s Third-Party Share Is Expected to Approach 18% This Year

Deep Dive

Ocado.com’s Success Driven by High AOV and Connections to Grocers

Ocado.com’s Success Driven by High AOV and Connections to Grocers

Deep Dive

Can Luxury Fashion Sold on Online Marketplaces Remain Successful?

Can Luxury Fashion Sold on Online Marketplaces Remain Successful?

Deep Dive

TikTok Shop Launched in Germany, France and Italy - What's to Be Expected Next?

TikTok Shop Launched in Germany, France and Italy - What's to Be Expected Next?

Deep Dive

Love Your Pet: Chewy.com Prevails Over Petsmart.com and Petco.com

Love Your Pet: Chewy.com Prevails Over Petsmart.com and Petco.com

Back to main topics