Qatari eCommerce

eCommerce Market in Qatar: Revenue, Growth & Market Development

High GDP and wide internet use make Qatar an emerging eCommerce hub. While much smaller in market size, it rivals U.S. and China in eCommerce penetration.

Article by Cihan Uzunoglu | October 20, 2023Download

Coming soon

Share

Amid a backdrop of high GDP per capita and virtually universal internet penetration, Qatar is quietly yet convincingly becoming an eCommerce hub worth keeping an eye on.

While its market size may not outshine global behemoths like China or the United States, its high levels of digital adoption position Qatar shoulder to shoulder with these giants in some regard, making it a compelling story of potential and growth.

Qatari eCommerce Market to Grow to Almost US$5 Billion by 2027

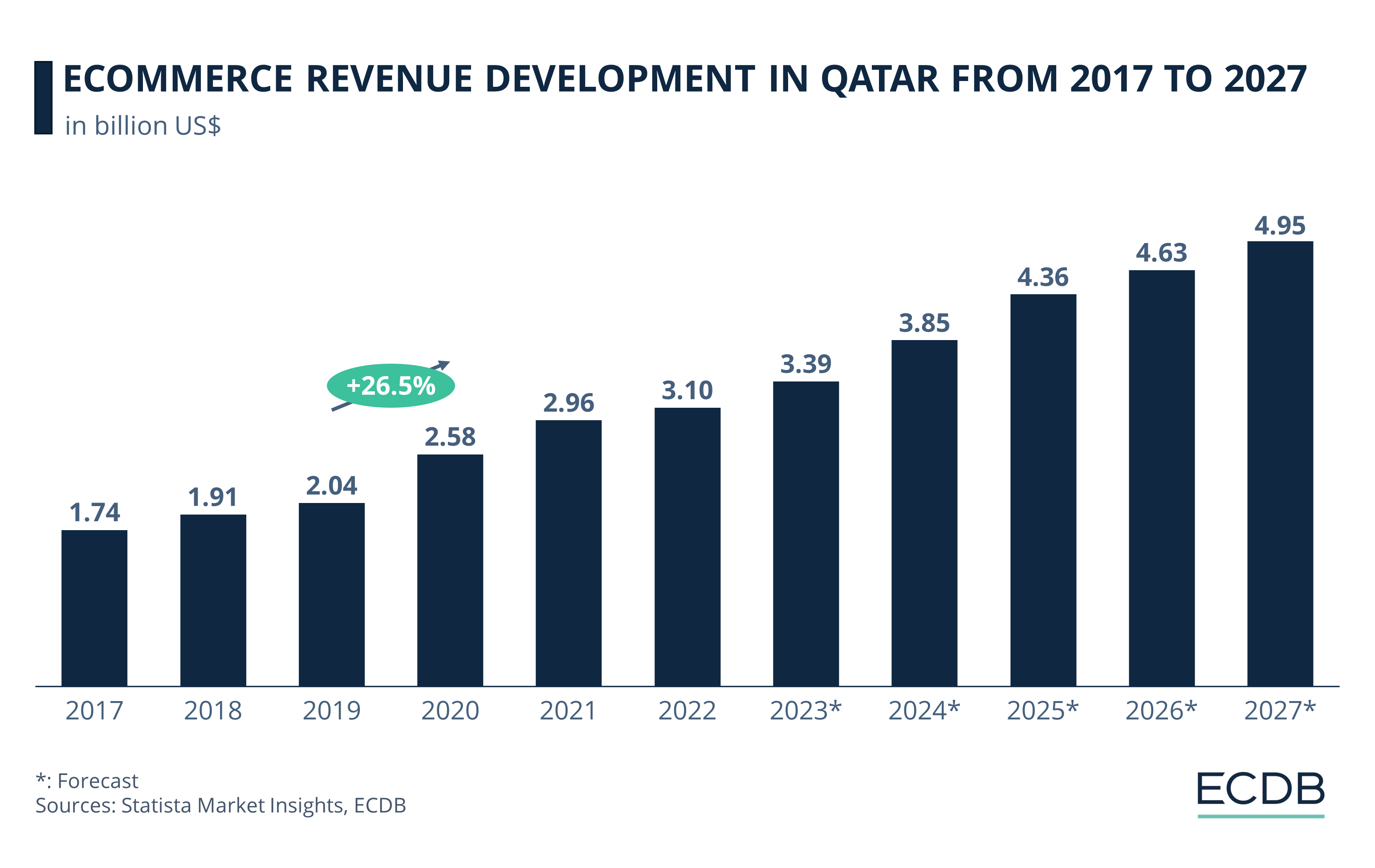

Qatar is the 52nd largest market globally for eCommerce. The revenue from the country’s eCommerce market has seen consistent growth over the past years.

From 2017’s online revenue of US$1.74 billion, there was a notable increase to US$2.04 billion in 2019, marking a significant YoY growth of 26.6% that year. The revenue continued its upward trajectory with the help of the pandemic, reaching US$2.58 billion in 2020. While 2021 saw a moderate growth of 14.6%, taking the revenue to US$2.96 billion, the subsequent years are forecasted to maintain this momentum.

This year, the market is projected to generate US$3.39 billion, a growth of 13.6% from the previous year, and this upward trend is anticipated to continue, with the revenues reaching US$4.36 billion in 2025 and an expected US$4.95 billion by 2027.

High GDP Per Capita Signals Strong Potential for eCommerce Growth

While Qatar might not exactly be under the spotlight in the eCommerce arena, some metrics show the country’s potential in growing stronger in the coming years.

When it comes to GDP per capita, Qatar is a standout performer among MENA (Middle East and North Africa) countries. According to IMF estimates for 2022, Qatar's GDP per capita is US$84,424, significantly ahead of its closest regional competitors, Israel at US$54,710 and the United Arab Emirates at US$51,305.

The country's economic prowess is not limited to its regional context. On a global scale, Qatar is also among the top five countries in terms of GDP per capita for 2022. With a figure of US$84,424, it trails only Luxembourg, Norway, Ireland, and Switzerland. This places Qatar in an elite economic group, emphasizing its substantial per capita income.

Examining Qatar's overall GDP trajectory, the country has been on an upward path, despite some fluctuations. From US$144.41 billion in 2020, it saw a steep increase to US$179.68 billion in 2021. According to IMF estimates, this figure grew further to US$236.42 billion last year and is projected to reach nearly US$295 billion by 2028, pointing to a steadily growing economy, reinforcing Qatar's strong position both regionally and globally.

Qatar: Demographic Challenges

When looking into the eCommerce market of a country, it is essential to keep its demographical dynamics in mind. While some markets such as Germany and China might have a balanced gender distribution in their populations, for instance, this is not so much the case when it comes to Qatar. We will also dive into the age aspect of the discussion, seeing how this might play out in the country’s eCommerce market.

Gender Imbalance Requires Tailored Strategies

According to data from Qatar's Planning and Statistics Authority (PSA), the country's population has experienced significant growth over the past few decades, alongside a notable gender imbalance.

As of 2019, the male population stood at 2,064,276 compared to 734,926 females. The gender gap becomes even more pronounced when examining the economically active population. In 2019, 1,847,860 males were economically active, vastly outnumbering the 284,001 economically active females.

This demographic landscape could have implications for various sectors, including eCommerce, where gender-specific consumption patterns may be worth considering for market players. Overall, Qatar's demographic and economic profiles indicate a complex market, albeit one with significant potential for growth and diversification.

20-39 Age Group Key for Qatari eCommerce

Age is another factor we have to take into account, as it plays a significant role in catering to consumers of a market. Further 2019 population data from PSA offers a window into Qatar's age demographics, showing a concentration in the age groups ranging from 20 to 39.

Specifically, the 30-34 age group has the highest population at 503,080, followed closely by the 25-29 age group at 445,130. These age brackets are typically considered to be economically active and are likely to be the primary earners in their households. The 20-24 age group also stands out with a population of 250,240, indicating a younger generation that's coming into economic activity.

The substantial concentration of individuals aged 20 to 39 is particularly noteworthy for Qatar's eCommerce market. Given their economic activity and likely digital savviness, this age group is a key target for online retailers, especially in a country with a significantly high internet penetration rate, which we will delve into in the next section. Focusing on this demographic could be a strategic move for eCommerce businesses in Qatar.

Qatar's High Internet Penetration Boosts eCommerce

In the realm of internet usage, Qatar has shown remarkable growth over the past decade, as per data from Statista. Standing at an 82.19% penetration rate in 2013, this figure surged to 98% by 2021. What's noteworthy is the stability in these rates moving forward; forecasts predict that the penetration rate will hold steady at 98% through 2028. This plateau suggests a nearly universal adoption of the internet among Qatar's population, creating fertile ground for digital activities, including eCommerce.

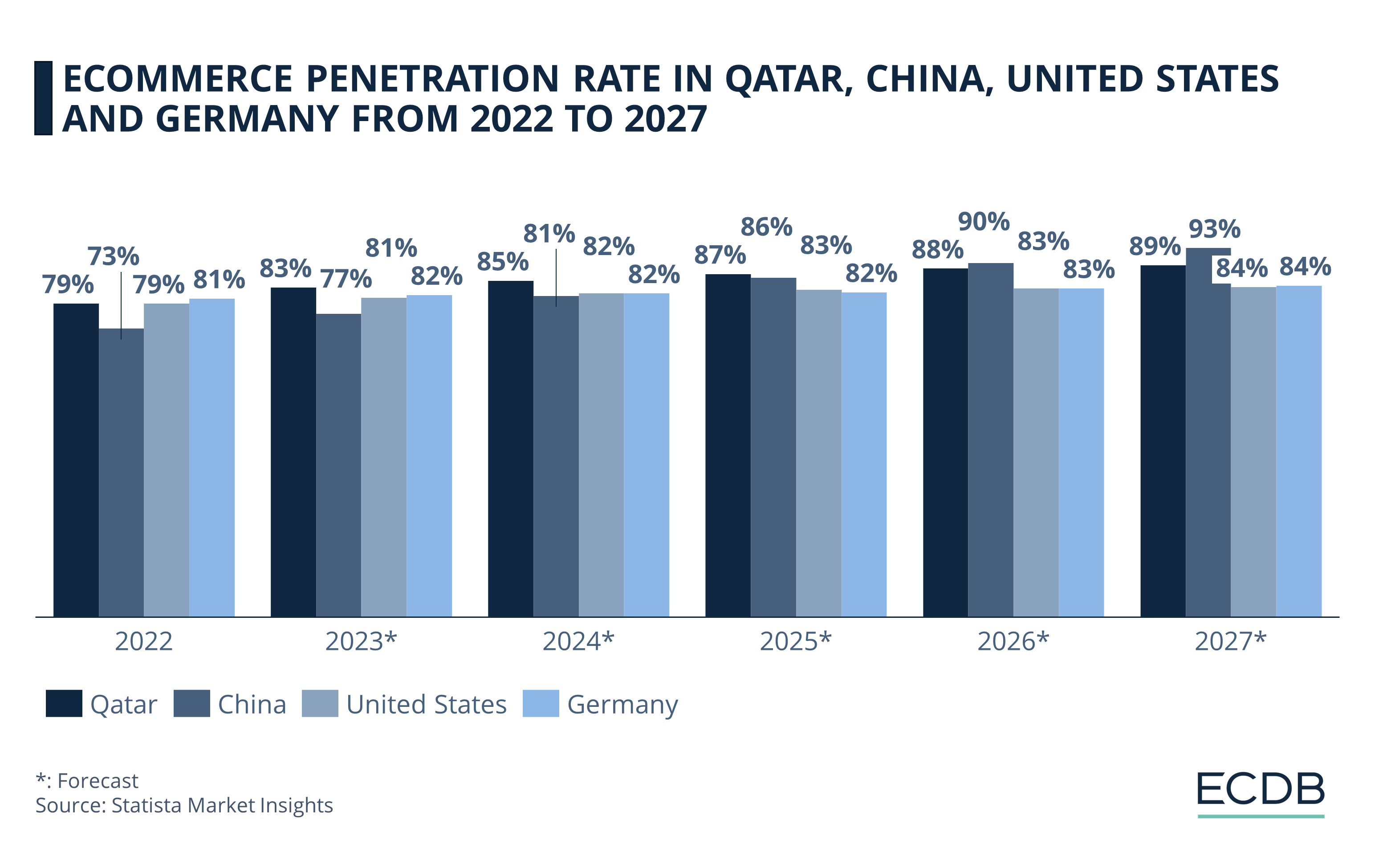

The consistently high level of internet usage sets the stage for Qatar's performance in eCommerce penetration, allowing it to stand shoulder to shoulder with major global economies.

Statista Market Insights data points to an intriguing observation - the eCommerce penetration rate in Qatar is closely aligned with those in major economies such as China, the United States, and Germany. In 2022, Qatar had a penetration rate of 79%, comparable to 73% in China, 79% in the United States, and 81% in Germany. Forecasts suggest that by 2027, Qatar's rate is expected to climb to 89%, essentially matching the rates in these larger economies.

While China shows the most aggressive growth among the countries compared, climbing from 73% in 2022 to a projected 93% in 2027, Qatar's rate is also rising steadily. Meanwhile, the United States and Germany display a more stagnant growth trajectory, hovering around the early 80s throughout the forecast period.

What stands out is Qatar's ability to keep pace with leading economies in terms of adopting online shopping. This could be indicative of a mature digital infrastructure and a consumer base that is increasingly comfortable with online transactions. While these high penetration rates place Qatar in elite company, the country's actual market size for eCommerce remains proportionately smaller than the giants it matches in penetration.

Qatari eCommerce is Set to Diversify and Improve

Qatar’s eCommerce market is advancing through substantial investments in AI and IoT (Internet of Things) technologies, though it remains concentrated with key players such as Baqaala, Amazon, IKEA Qatar, AlAnees Qatar, etc.

As was the case in many markets around the world, the Covid-19 pandemic has ushered the retail industry into a new phase, driving many brands to shift their focus to online operations. In addition to this, following the influx of visitors for the 2022 FIFA World Cup, the country is capitalizing on other major events like the Formula One Grand Prix and Expo 2023 to bolster business.

As Qatar's eCommerce sector continues its expansion, the last years have seen several significant developments that underscore this growth and diversification. These range from new online platforms for electronic and automobile shopping to initiatives in logistics.

Samsung & Mercedes-Benz Launch eCommerce Platforms in Qatar

In October 2022, Samsung Gulf Electronics stepped into Qatar's eCommerce scene with the launch of its online platform. This new digital storefront allows consumers to directly purchase mobile phones, tablets, and other accessories from the brand. This move not only broadens consumer choice but also incentivizes online shopping with additional discounts.

Following suit, Nasser Bin Khaled Automobiles (NBK) launched a Mercedes-Benz eCommerce store in November 2022. As the authorized general distributor of Mercedes-Benz in Qatar, NBK's online platform simplifies the car-buying experience. Customers can browse available stock effortlessly and reserve their preferred models online.

These new platforms are timely additions to Qatar's market, particularly when considering the country's projected eCommerce revenue growth to US$3.39 billion this year.

Ooredoo Launches Business WhatsApp Service

In a move to enhance customer service and streamline operations, telecommunications firm Ooredoo rolled out its Ooredoo Business WhatsApp service in January 2023. The service empowers business clients to manage their accounts on a digital platform, irrespective of their location.

Simplifying interactions with Ooredoo's business team, this feature enables quicker resolution of queries related to orders. The launch of this service reflects the wider push for digitization in Qatar, a country already boasting a near-universal Internet penetration rate of 98%.

Qatari eCommerce: Key Takeaways

Qatar's online shopping scene is growing and has a lot of potential. Many different factors are shaping it, like new technology and more.

Qatar's eCommerce market is on a strong growth trajectory, projected to nearly triple its 2017 revenue of US$1.74 billion to an expected US$4.95 billion by 2027.

Despite not being a high-profile player in the eCommerce sector, Qatar's robust GDP per capita and growing overall economy signal its potential for significant eCommerce expansion in the years ahead.

Qatar's eCommerce market presents unique demographic challenges and opportunities, with a pronounced gender imbalance and a focus on the economically active 20-39 age group, suggesting that tailored marketing strategies could unlock significant growth potential.

Impressive Internet and eCommerce penetration rates of the country, comparable to major economies like the United States, China, and Germany, indicate a mature digital infrastructure and a public ready for online shopping, even though its actual eCommerce market size is smaller in comparison.

Qatar's eCommerce sector is diversifying and becoming more sophisticated, with major brands like Samsung and Mercedes-Benz launching online platforms and initiatives like Ooredoo's Business WhatsApp service enhancing customer experience, all against the backdrop of strong Internet penetration and projected revenue growth.

Source: IMF, Statistisches Bundesamt, National Bureau of Statistics of China, Qatar's Planning and Statistics Authority (PSA), Mordor Intelligence, Samsung, Qatar Day, The Peninsula, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics