ECOMMERCE: PAYMENTS

From Cash to Cards in Latin America: Consumer Preference for Digital Payments

ECDB data shows that in 2023, cards were the leading payment method in many Latin American eCommerce markets. But have Latin American consumers really given up cash? Here are the top payment providers in Latin America, and leading reasons why shoppers are opting for digital payments.

Article by Nashra Fatima | June 03, 2024

Digital Payments in Latin America: Key Insights

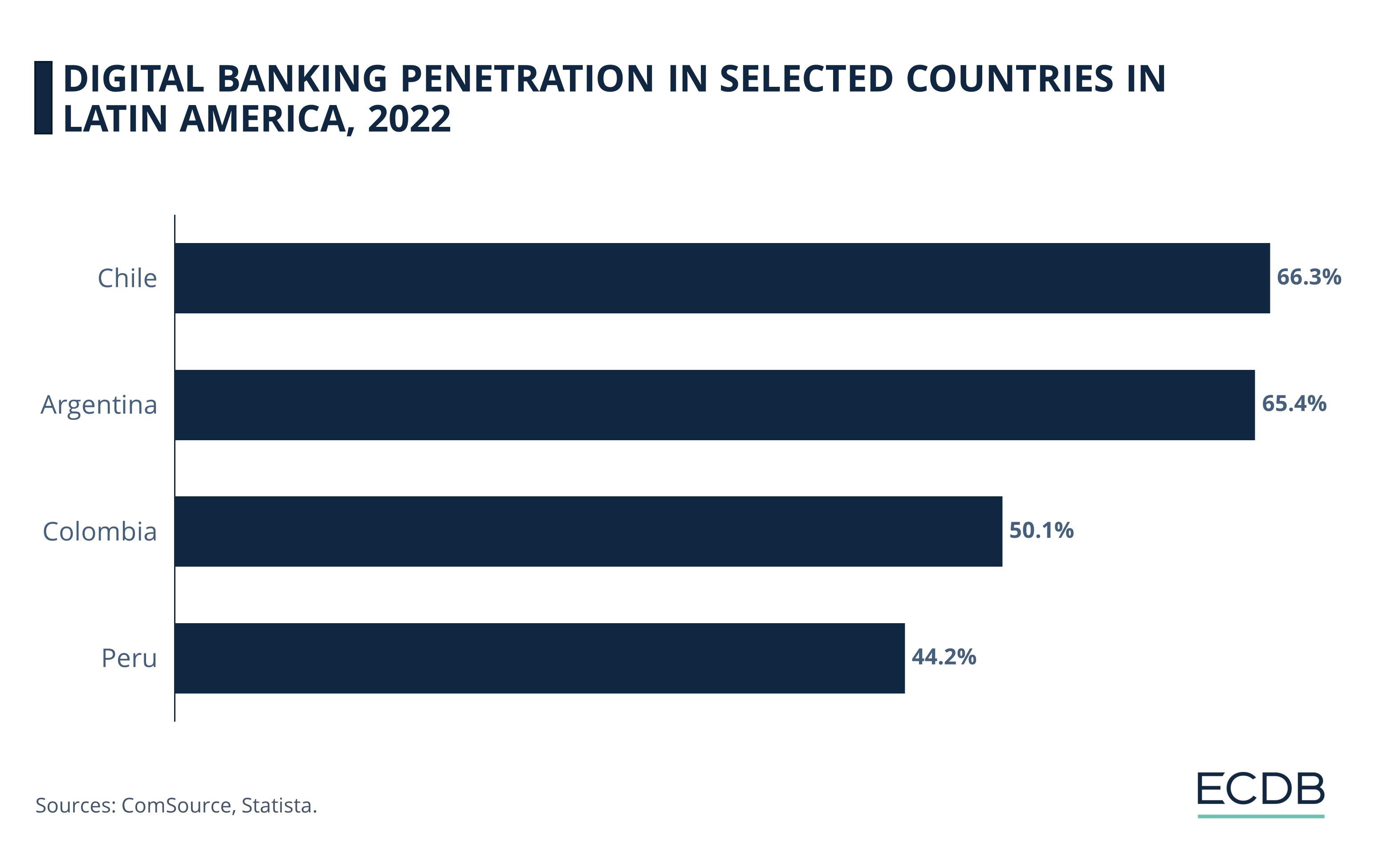

Digital banking penetration: Among Spanish-speaking countries in Latin America, Chile has the highest digital banking penetration, at 66%. Argentina follows close, while Peru is third at 50%.

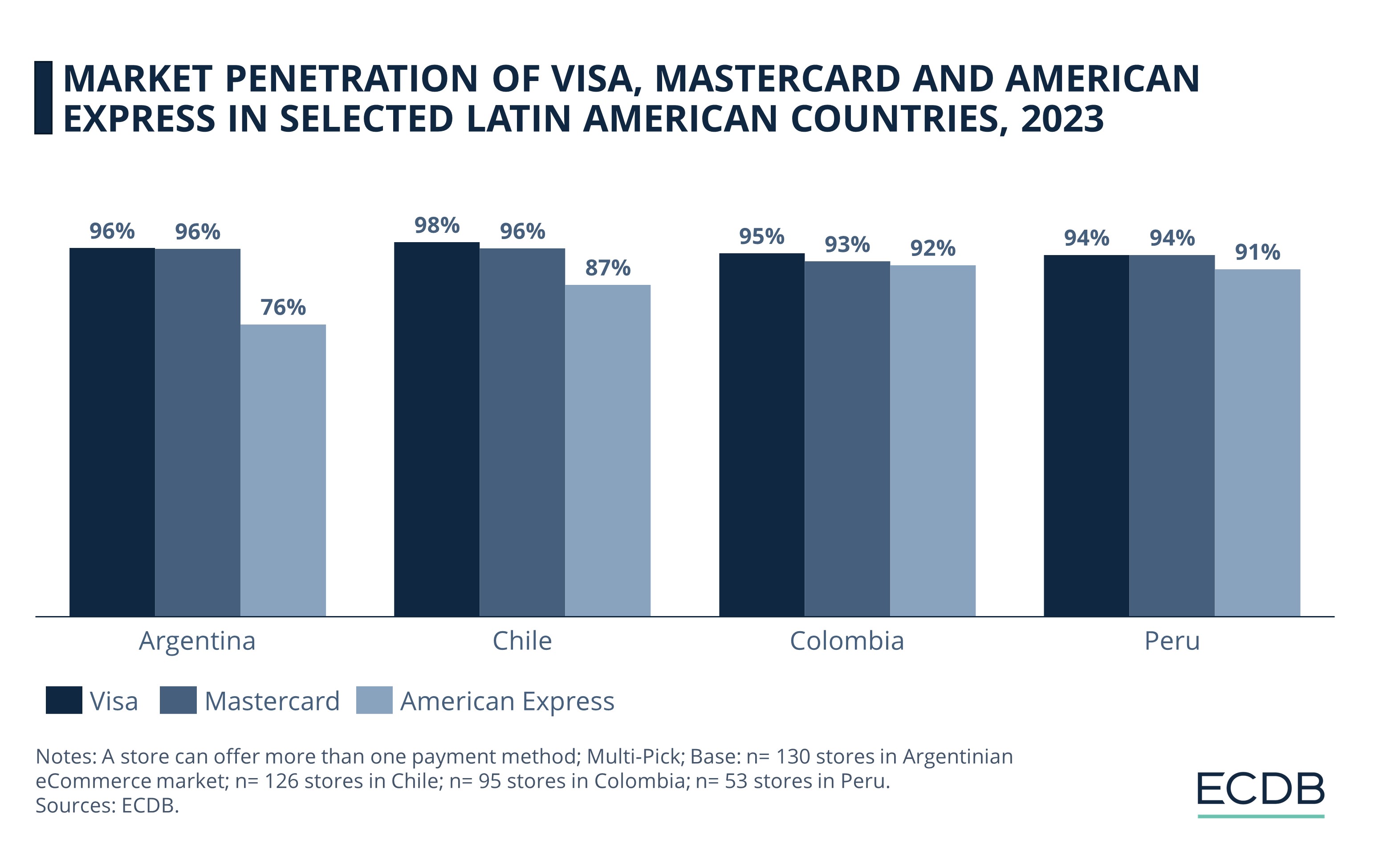

Leading eCommerce payment method: In notable Latin eCommerce markets including Chile, Colombia, Peru, and Argentina, cards are the dominant paying method. Visa, Mastercard and American Express have high usage.

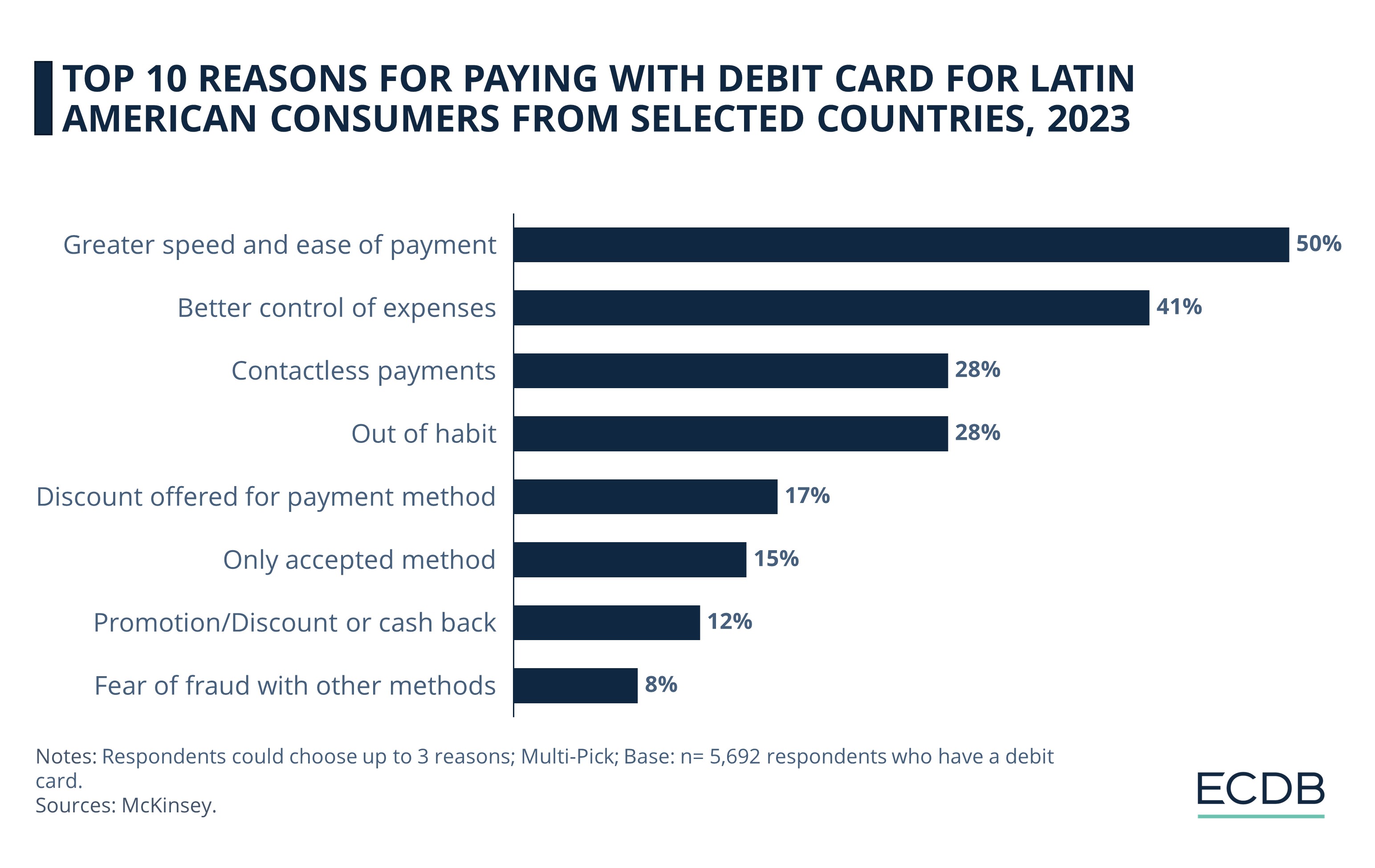

Top Reasons for using digital payments: The three leading reasons why Latin American consumers prefer digital payments are ease of use, access to promotions, and convenience.

Is cash still king in Latin America?

An emerging regional economy, Latin America is a relative newcomer to adopting digital services. Pre-pandemic, financial inclusion was low, with significant shares of the population left unbanked.

On their part, consumers also traditionally preferred cash-based transactions, cementing the perception that cash reigns supreme in Latin American markets.

However, rising digitalization has kickstarted a regional shift. See how digital banking, eCommerce payment, and consumer behavior are evolving in Latin America.

Digital Banking Penetration in Latin American Countries

Latin American countries had a slow start in adopting digital banking. ComSource data further shows noticeable country-level differences in digital banking penetration rates across the region.

As of 2022:

Chile had the highest digital banking penetration, at over 66%. Although this rate is much lower than regional frontrunner Brazil (77%), it is higher than other Spanish-speaking nations.

Argentina is a close second, with a digital banking rate of 65.4%.

Colombia is third, at 50%, although it is much behind third-ranked Argentina.

Peru ranks fourth, with 44.2% online banking rates.

Low digital banking rates and regional disparities are linked to low banking coverage, as well as varying internet and smartphone penetration. For instance, per Statista, 90% of Chile’s population has internet access in 2024. In comparison, 87% of the population in Argentina, 75% in Colombia, and 71% in Peru have access to the internet.

The situation is slated to improve, with the share of internet users – particularly mobile internet users –projected to increase in all Latin American countries, alongside overall banking access.

“Bancarization” in Latin America

The rise of financial technology (fintech) has proved to be a turning point for online banking in Latin America.

Mainstream banks generally had exclusive policies, like a high income threshold and prohibitive fees for opening a bank account. Long distances to bank branches, complicated paperwork, and a lack of trust in financial institutions further excluded lower-income and other groups.

Once fintech companies entered the financial sector, the banking market opened. Governments also introduced legal frameworks to improve banking access, online and offline. The pandemic further prompted people to explore digital banking and payment services, and the trend continued afterwards.

Today, a growing share of the Latin American population is opening bank accounts and using digital banking services. This increase in access to banks, including online banking, is termed as bancarization. Financial inclusion is one of its outcomes, alongside a change in how people are choosing to pay for their online purchases.

What Are the Top Payment Methods for eCommerce in Latin America?

Latin American countries still have predominantly cash-based economies. But online consumers seem to have transitioned away from cash towards cards.

eCommerce stores in Latin American markets are offering digital payment methods over cash, according to our latest ECDB data.

Below, we assess the top payment providers in selected Latin American eCommerce markets:

Argentina

Visa is the most commonly offered payment service provider in Argentinian eCommerce, with 95.4% of all online stores accepting it in 2023. Mastercard has a comparable level of penetration, at 94.6%. American Express has a smaller share of the market, at 76.2%.

Argentina has a large informal market. In retail, including online and offline, cash is still highly used: according to PCMI, cash penetration was 42% in 2022. But factors like currency devaluation and a volatile economy have pushed innovation and interest in fintech and alternative currencies. In Argentinian eCommerce, non-bank wallets are also popular – for example, Cabal is the fifth most used option and offered by 58% of stores.

Chile

Visa has the highest penetration in Chilean eCommerce, with 98% of online stores offering it. Mastercard is next at 96%, followed by American Express, at 87%. All three cards have the highest penetration in Chile, out of all selected countries, while cash does not feature in the top five.

Chile is a traditional market, dominated by a few banks. This curbs fintech expansion, but banks facilitated the process of acquiring cards, leading to their large-scale adoption. Since 2020, the field of digital payment has also become more dynamic, with customers also using Buy Now, Pay Later (BNPL) and digital wallets like Garmin Pay.

Colombia

At 94.7%, Visa is the most used card provider in Colombian eCommerce. Next is Mastercard, offered by 92.6% of online stores. American Express is third, with 91.6%.

While Colombian consumers are adopting new payment methods including digital wallets, the reliance on more conventional payment options is still high. In 2023, invoices, which may also include cash payment, are offered by 82% of online stores. PSE – a bank transfer payment method – is accepted by 77% of Colombian eCommerce stores.

Peru

Visa is the top payment provider in Peru, offered by 94.3% of eCommerce businesses. Mastercard has similar market penetration at 94.3%, followed by American Express at 90.6%. These cards are more used in Peru as banks have been instrumental in driving financial inclusion.

A large share of Peruvian population is still unbanked, which is likely why cash is still frequently used in eCommerce as well: 64.2% of online stores accept cash in advance. But PCMI reports that the digital turn in the country is accelerating. In the last two years, cash usage has fallen by 20 percentage points, while wallet usage has increased to cover almost half of the population.

Thus, a look at the top payment methods suggest that Latin American online shoppers are switching to digital methods - particularly cards - to pay for their online purchases.

A recent McKinsey survey corroborates the same: between 2021 and 2023, the share of people who preferred using cash for retail purchases halved, while those who preferred a digital method, like a card or mobile wallet – more than doubled.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

Top 10 Reasons for Using Digital Payments Amongst Latin American Consumers

The adoption of digital payment – specifically, cards – is not without its reasons. Latin American shoppers have reported a range of factors that motivate them to adopt this payment method.

Here are the top reasons for Latin American consumers to use debit cards for payment in retail:

Greater speed and ease of payment: 50% of respondents prefer debit card payments for its speed and ease. For those who prefer mobile payments as well, ease is the biggest factor (55%) behind their preference.

Better control of expenses: 41% of respondents report expense control as a reason behind paying via debit cards. As a form of digital payment, debit cards offer greater visibility – and thus, control – over one’s expenditure, unlike cash.

Contactless payment: 28% of respondents use debit cards as a means of contactless payment. With this method, they can check out faster, without having to handle cash. It is both efficient and fast.

Only accepted reason: 15% of debit card owners use it for payment because it is the only option available. But the relatively small share indicates that most who do use debit cards are actively choosing it.

Incentives: People are paying through debit cards because of the discounts and promotions (15%), and cash backs (12%) opportunities they offer. This suggests that service providers and merchants are also encouraging digital adoption in payments by incentivizing it.

Digital Payments in Latin America: Closing Remarks

Latin American countries are undergoing “bancarization”, with bank account coverage and online banking penetration both rising. Governments, banks, and fintech companies are also driving the turn towards using cards and mobile wallets.

The acceleration in eCommerce has further persuaded online shoppers to pay digitally. A drawback is that consumers are largely unaccustomed to non-cash payments, which may leave them more vulnerable to online banking fraud.

Latin America has a young demographic, whose access to both the internet and mobile phones is improving. As digitalization continues to strengthen, it will not only bolster the overall digital economy but also eCommerce markets, which benefit from the efficiency and convenience afforded by digital payment methods.

FAQs: Payments in Latin America

What Are Digital Payments?

Digital payment refers to the transfer of money from one account to another through an online channel or digital device.

In contrast to traditional payments such as in cash or check, digital payments enable transactions electronically rather than through physical cash.

What are some examples of digital payments?

Examples of digital payment methods include:

Online bank transfer which facilitates the transfer of funds between two bank accounts.

Credit and debit cards like Visa and Mastercard, which can be used online or in-person.

Mobile payment takes place through a mobile device like smartphone or tablet. A mobile wallet like Apple Pay or PayPal is loaded with credit or connected to a bank account to make transactions.

Cryptocurrency, a decentralized form of payment, is now being accepted by several merchants. An example of a cryptocurrency is Bitcoin.

What are the types of digital payment?

Types of digital payments are:

Partially digital payments: Payer sends cash and the payee receive cash through a third-party agent who facilitates a digital or electronic transaction of funds between the two.

Primary digital payments: Here, the payer uses an intermediary to send a payment digitally, but the payee receives the amount in cash.

Fully digital payments: The payee sends the funds digitally and the payee also receives it digitally. Thus, the payment is fully digital on both ends.

What are the benefits of digital payments?

Some benefits of digital payments are:

Convenience: Digital methods allow transactions from anywhere and at any time. People do not have to worry about carrying cash or writing checks.

Secure transactions: Digital payments utilize advanced security functions like encryption and two-factor authentication. This minimizes risk and fraud, unlike cash-based transactions.

Traceability: In many cases, physical or cash payment is not documented. However, digital payments are recorded and thus, they are easy to track and trace.

Why Are Latin Americans Turning Towards Digital Payments?

The Covid-19 pandemic prompted consumers to explore digital payment methods. The behavior continued after the pandemic, boosted also by improvement in banking coverage and digital banking penetration across Latin American countries.

Sources: JSIS, Payments CMI, McKinsey, Contxto, The Payment Association

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Deep Dive

Klarna’s Impact Is Strongest in Sweden and Norway

Klarna’s Impact Is Strongest in Sweden and Norway

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Back to main topics