Flexibility Is the Top Reason for Buy Now Pay Later Shoppers in Germany To Use the Service

Article by Cihan Uzunoglu | May 08, 2023

eCommerceDB and Statista conducted a survey in Germany to investigate the preferences of online shoppers regarding Buy Now, Pay Later (BNPL) services. The results of the survey provide valuable insights into how consumers perceive and use this payment method. Keep on reading to find out more about why online shoppers in Germany are using BNPL as a payment method.

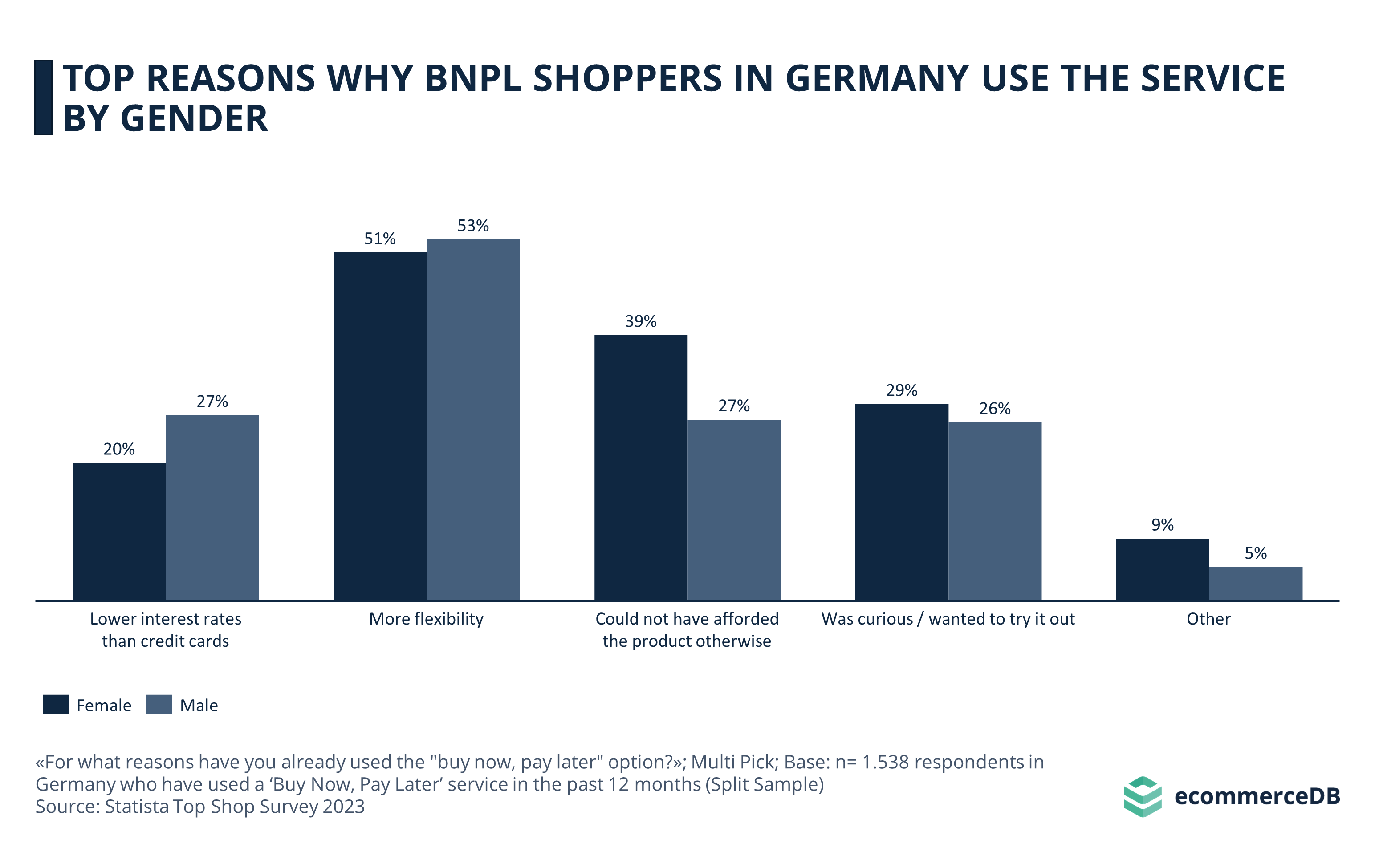

According to the survey results, more than half of BNPL shoppers* said they used the service because of the greater flexibility offered by installment purchases, while one third of them stated they could not have afforded the product otherwise. Although male and female BNPL users are equally likely to cite flexibility as a reason for using the services, female users are more likely to state that they could not have afforded the product otherwise.

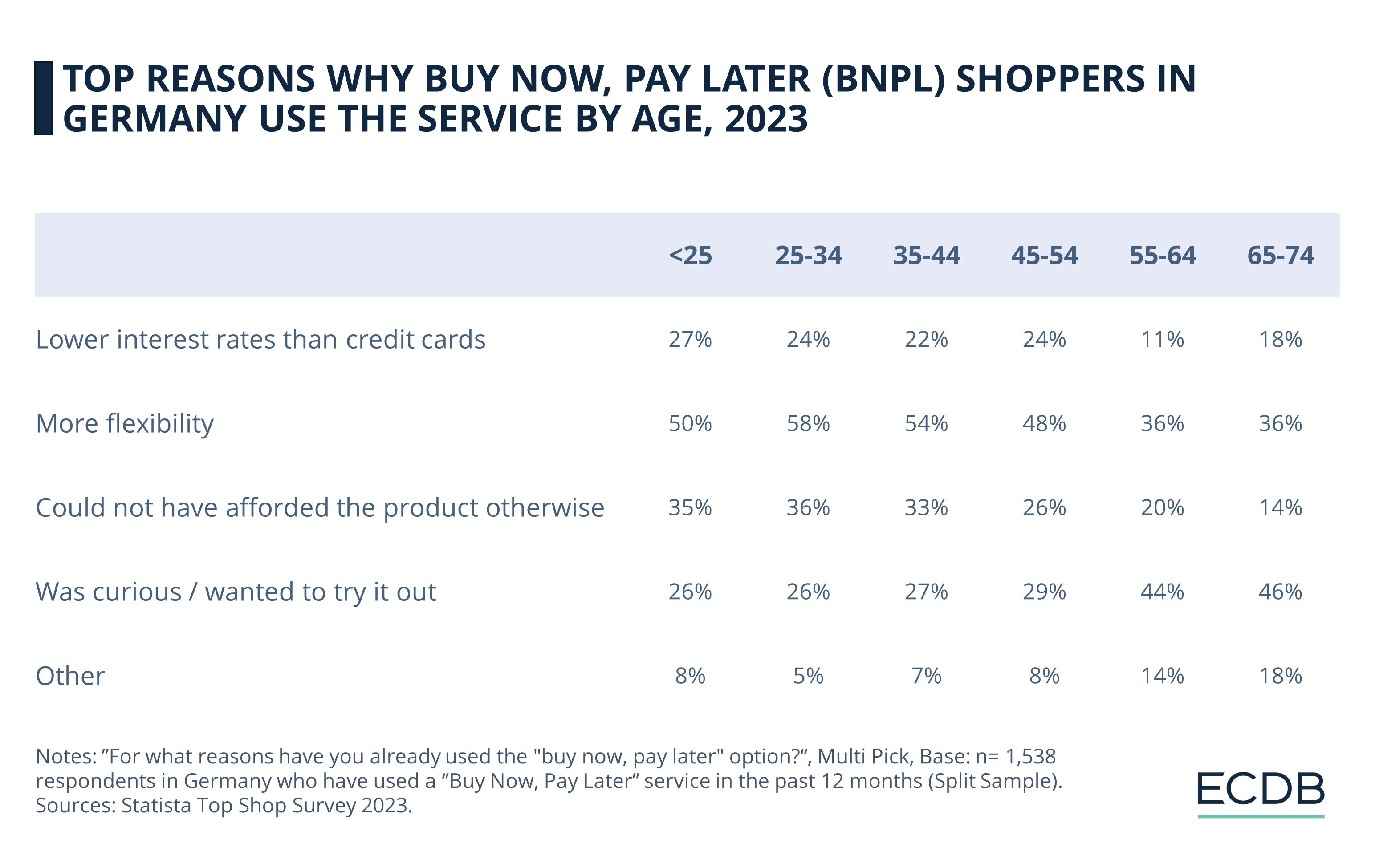

Looking at the reasons for using BNPLs by age group, we see that users under 25 are mainly motivated by budgetary reasons, as they are particularly likely to say that they could not have afforded it otherwise, and lower interest rates further incentivised the use of BNPL. As we move into older age groups, we see that users between 25 and 44 are more likely to cite flexibility. Users over 55, on the other hand, have different motivations than younger users. They are more curious about the service and want to try it out.

It is important to consider users' living conditions in order to properly analyze the reasons for using BNPL. As the survey results show, users with a net annual disposable household income of more than €50,000 are most likely to cite "flexibility" and "lower interest rates compared to credit cards" as motivations, while users with a household income of less than €20,000 are more likely to say that they could not afford the product otherwise.

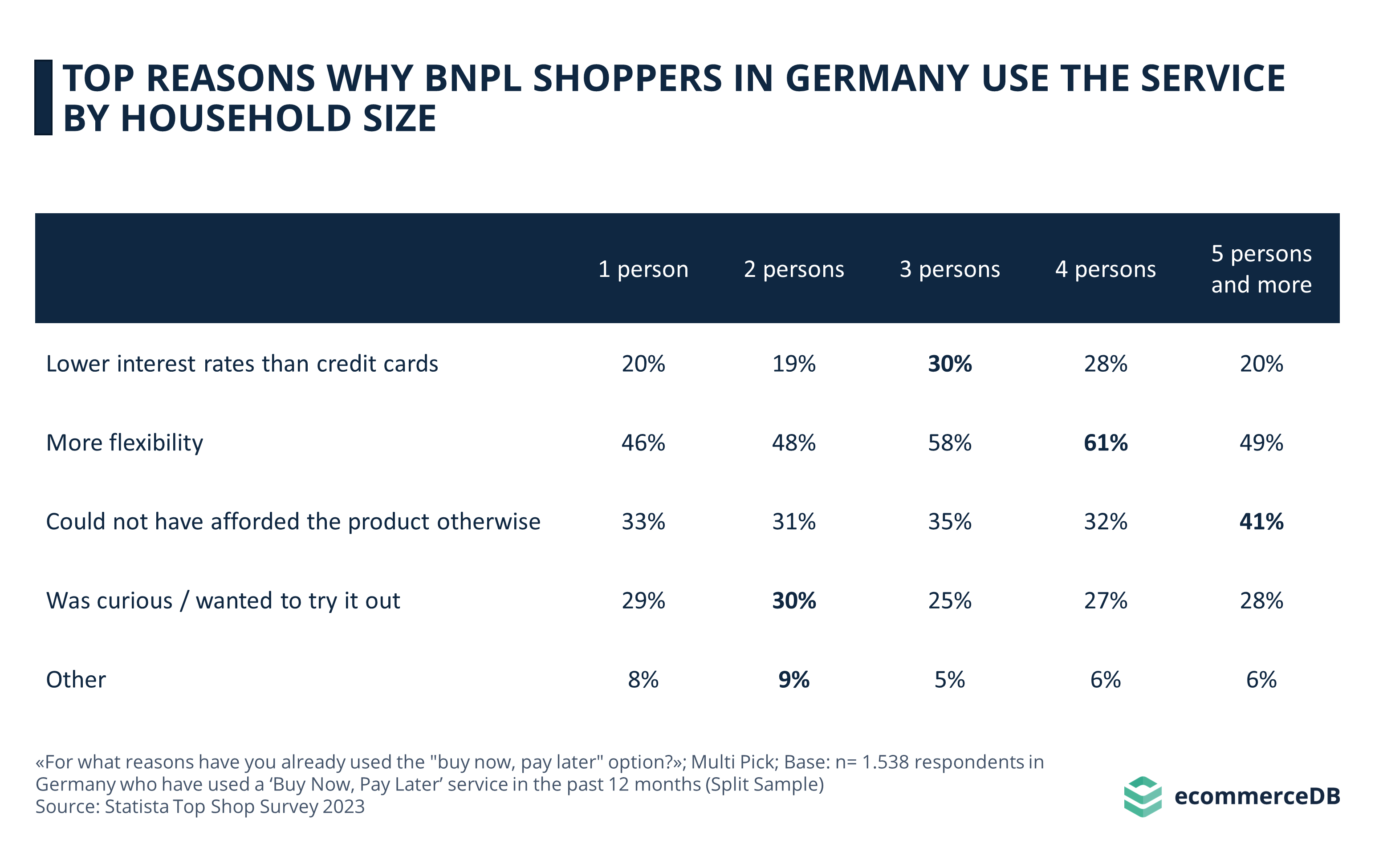

In terms of the number of people in the household, BNPL users in households with 1 and 2 persons are the most likely to say that they were "curious / wanted to try it out", while users in households with 3 and 4 persons are the most likely households to say that they prefer the services because they offer more flexibility and lower interest rates than credit cards. Users in households with 5 or more people, on the other hand, are the most likely group to cite the affordability of the products through installment payments.

Reasons for using BNPL shopping not only vary between household sizes, but also depend on where users live. BNPL shoppers from cities with fewer than 5,000 inhabitants are more likely to say that they were "curious and wanted to try it out". Those from cities with more than 100,000 inhabitants, on the other hand, were the most likely to state lower interest rates, more flexibility and the fact that they couldn’t have afforded the purchase otherwise as their main motivation to use BNPL services.

In conclusion, the survey results reveal that users value the flexibility and affordability that BNPL services offer, with some also citing lower interest rates as a factor. Age, gender, income, as well as household and city size were all found to play a role in how consumers use and perceive BNPL services. As the BNPL market continues to grow, understanding these factors is crucial for providers looking to meet the needs of their customers and stay competitive.

*: Online shoppers in Germany who have used a ‘Buy Now, Pay Later’ service in the past 12 months.

Related insights

Article

eCommerce Market in Europe 2024: On Its Way to 1 Trillion Dollars

eCommerce Market in Europe 2024: On Its Way to 1 Trillion Dollars

Article

Buy Now, Pay Later in Germany: Top Providers & Demographic Factors

Buy Now, Pay Later in Germany: Top Providers & Demographic Factors

Article

Buy Now, Pay Later (BNPL) in the U.S. 2023: Consumer Behavior, Analysis & Providers

Buy Now, Pay Later (BNPL) in the U.S. 2023: Consumer Behavior, Analysis & Providers

Article

Buy Now, Pay Later (BNPL) Explained: What It Is & How It Works

Buy Now, Pay Later (BNPL) Explained: What It Is & How It Works

Article

Poland’s eCommerce Trends 2023: Market Share, Payment Methods & Amazon

Poland’s eCommerce Trends 2023: Market Share, Payment Methods & Amazon

Back to main topics