eCommerce: Market & Consumer Insight

eCommerce in India: How Young Consumers Like to Shop and Engage Online

India, the world’s most populous nation, also has one of the fastest growing digital economies. Find out how India’s young online consumers – Gen Y and Gen Z – are shaping their country’s eCommerce market.

Article by Nadine Koutsou-Wehling | April 30, 2024Download

Coming soon

Share

Gen Y and Gen Z in India: Key Insights

Internet Usage: Both Gen Y and Gen Z in India are online. More users from both generations expect a 5G connection in 2024 than last year.

eCommerce Preferences: While both Gen Y and Gen Z shop online, their behavior differs when it comes to using online marketplaces. The differences are less obvious for practices like researching a product online before purchase or online shopping via a mobile device.

Social Commerce: In terms of their interaction with brands and influencers, there exists a visible difference, with Gen Y more active in their social commerce interactions than Gen Z.

More people under the age of 35 live in India than anywhere else in the world. In numeric terms, the country is home to more than 910 million¹ Gen Z and Gen Y, also known as Millennials.

A high digital awareness and increased internet access means these younger segments are not only digitally savvy but also influential online shoppers able to shape eCommerce.

We bring you a consumer behavior analysis of Gen Y and Gen Z in India – from their attitude towards the internet to how they shop online to how they engage with social media in 2024.

Generations Y and Z in India

Millennials, or Gen Y (1980-1994) is also known as the first digitally native generation. They are followed by their younger siblings, Gen Z (1995-2012) who have learned the use of digital technology at an even younger age.

Similarities Between the Two Cohorts

There are several factors that are similar between members of both generations. Generations Y and Z in India are the first two cohorts to have benefited from India's transition to a more prosperous society at a young age. This development has been driven by the growth of India’s middle class, the entry of women into the workforce enabling both parents to work, and an overall increase in access to education.

But there are still structural barriers that lead to socioeconomic disparities in wealth, and education remains inadequate in many parts of the country, leading to high youth unemployment² and negative net migration (meaning more people leave the country than enter it).

Gen Y: Daily Internet Use More Common

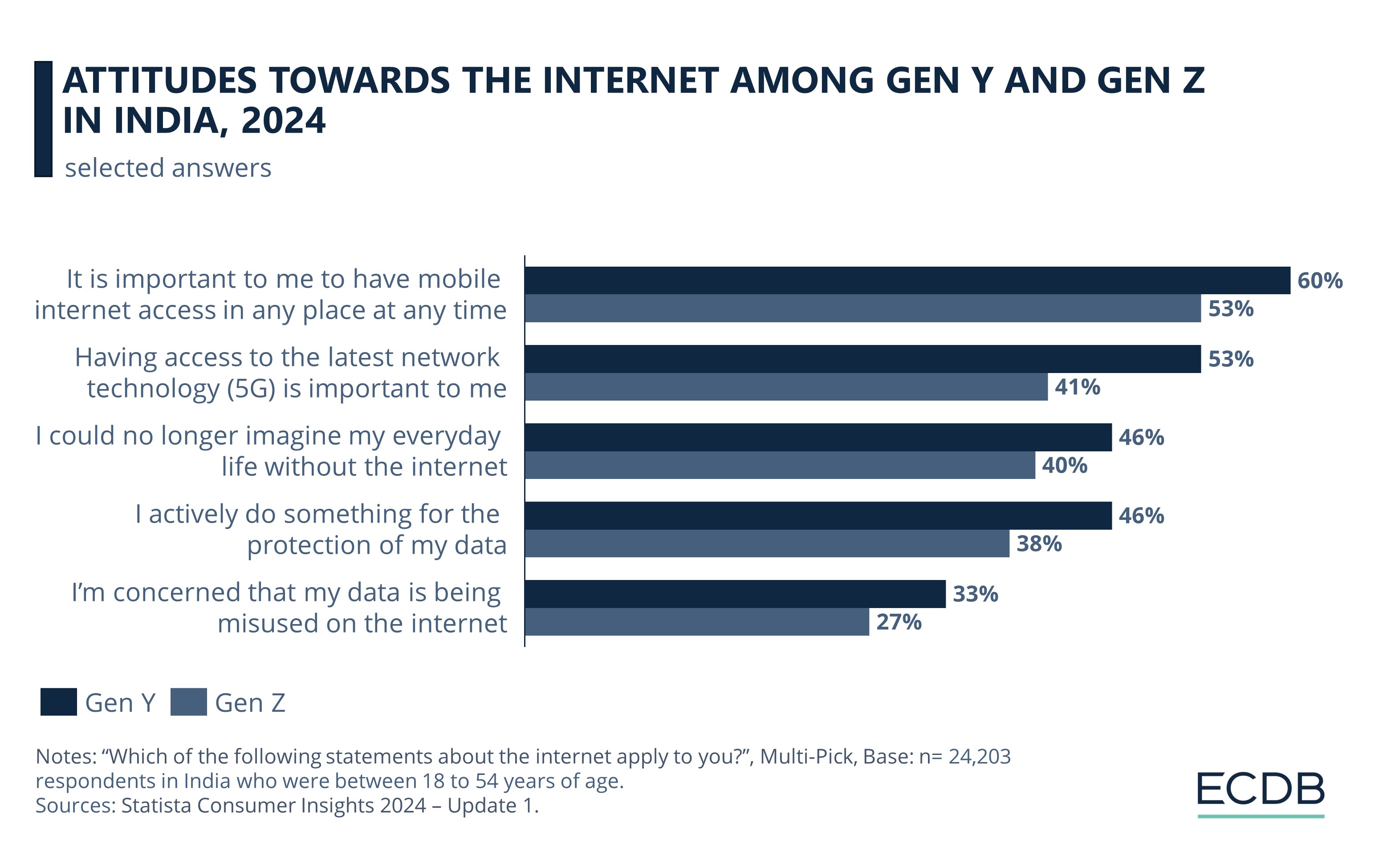

Both Gen Y and Gen Z consider the internet to be an integral part of their daily lives. Statista’s 2024 Consumer Insights asked users in India about their attitudes towards the internet.

Most respondents said that having mobile internet access at all times is important to them, with 60% of Millennials and 53% of Gen Z consumers agreeing. Gen Y consumers (46%) are also more likely than Gen Z (40%) to say they could no longer imagine everyday life without the internet.

The Indian government is responding to these online preferences by providing widespread internet connectivity to India’s population through programs such as Digital India.

A high-speed internet connection is becoming increasingly important to both generations. 53% of Millennial users in 2024 said that a 5G connection is important, compared to 41% in 2023. Gen Z is less inclined to agree – but at 41%, the share of respondents who agree in 2024 has climbed significantly from 2023 (29%).

Concerns about privacy and data protection also vary between the two cohorts, with Gen Y more concerned (33%) than their younger counterparts (27%).

Gen Y: More Positive Views but Also Cautious

Gen Y and Gen Z have experienced similar developments during their formative years in India, such as the proliferation of the internet and growing societal prosperity. However, there are still differences in the prevailing generational mindsets that are observed among large sections of both groups:

While Gen Y respondents appear to have a more positive attitude toward the internet and tend to see it as an integral part of their everyday lives, they are also the ones who are more inclined to say they are apprehensive about its perils, such as data theft and loss of privacy.

Gen Y: Typical Online Shopping Behavior

Millennials tend to be highly interested in new technologies. Having been introduced to the internet at an early age, they sift through large amounts of information about a product online and are familiar with information or choice overload.

Gen Y (53%) and Gen Z (49%) consumers are more or less equally inclined to research a product online before making a major purchase. Also similar is their expectation towards express shipping of their online orders.

However, bigger differences emerge in the two generations’ use of online marketplaces. While 53% of Gen Y shoppers prefer buying from multiple sellers in an online marketplace, a comparatively smaller 43% of Gen Z do the same.

Millennial respondents also exhibit a slightly higher likelihood to manage their recurrent orders via a mobile device (32%) than Gen Z (25%). Additionally, they are more excited about experimental technology integration in eCommerce (34%) than Gen Z (27%).

Gen Z: More Frugal and Less Engaged

Gen Zers share Millennials’ ease in the digital world, but this does not mean both exhibit the same behavior as online consumers.

A first pattern that emerges is that Gen Z consumers appear more cautious in their purchasing decisions and less likely to make impulse purchases.

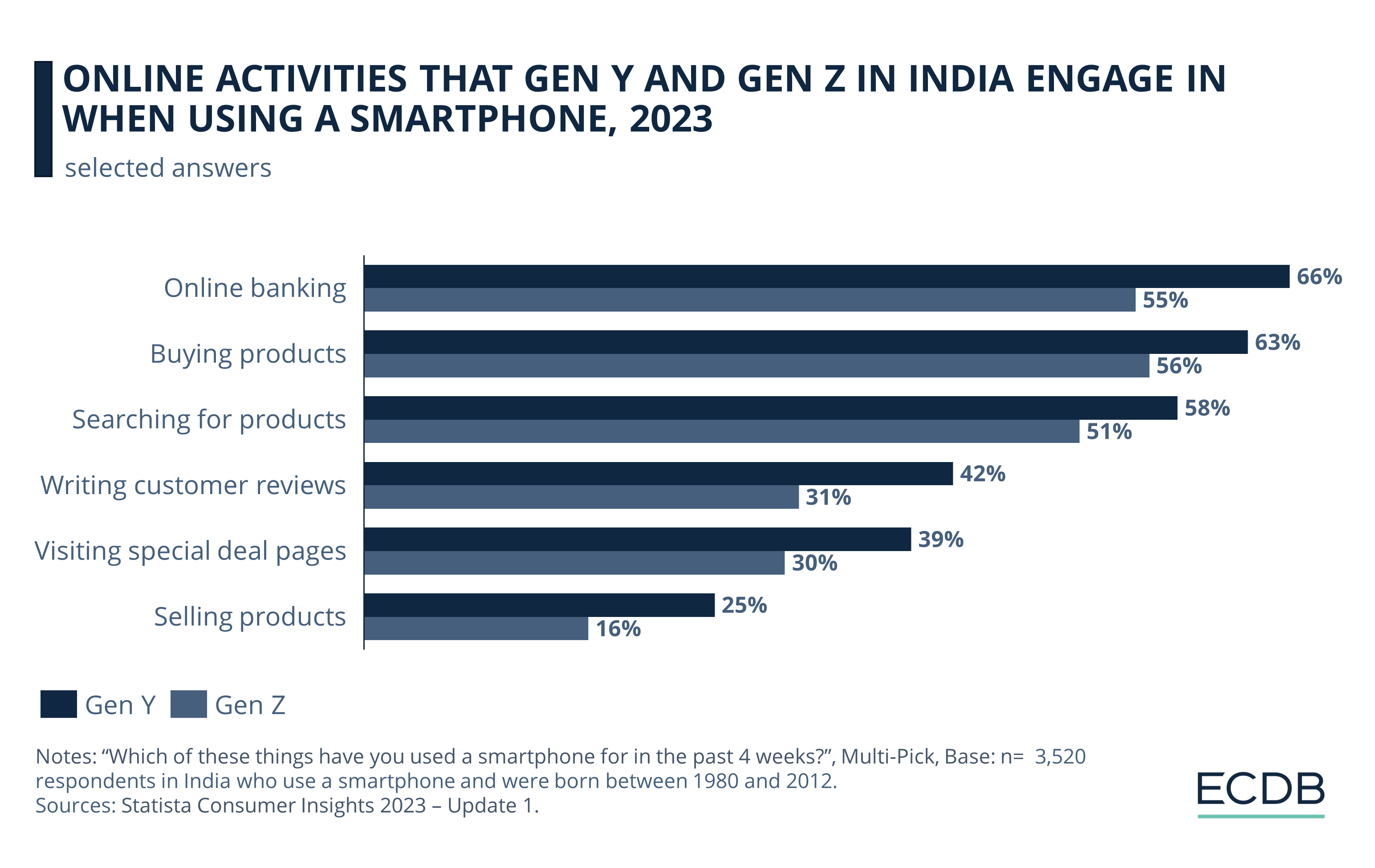

Regarding the online activities that users in India engage in when using a smartphone, it appears that Millennials have higher shares in each category, although the ranking of their common activities stays the same.

One factor that is important to note when interpreting these numbers: A 2018 report published by CBRE³ on youth housing across global regions shows that 82% of Millennial Indians were living with their parents.

This is attributed to the prevailing culture in the Asia-Pacific region, where it is common for people to live with their parents until they get married. Accordingly, it is to be expected that a large number of Gen Z Indian consumers will also be living with their parents, which significantly impacts the way they shop online.

While more than half of Gen Z respondents to the 2023 Statista Consumer Insights use their smartphones for online banking, buying products, and researching products, they are less interested in writing customer reviews, visiting special deal pages, or selling products.

Gen Z: More Passive Social Media Users

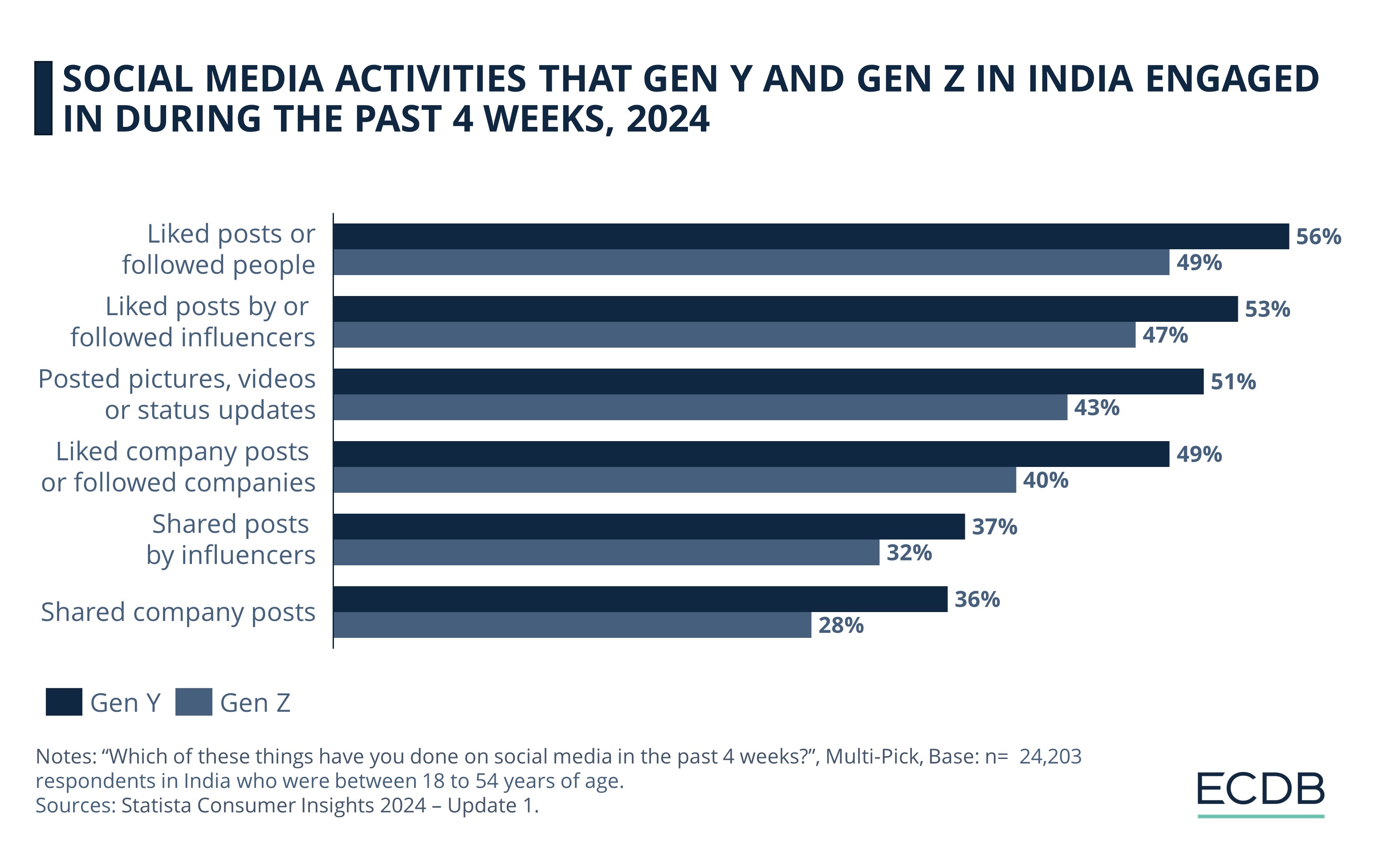

Regarding social media activity, Millennial shares once again outpace Gen Z figures in every way.

More Millennials in India (56%) than Gen Z (49%) follow people online or engage with them through liking their posts. At 51%, they are also much more active in posting status updates or media on their social accounts than their younger counterparts (43%).

Gen Z Respondents Less Likely to Interact With Brands Online

When it comes to interacting with brands or influencers, such as liking or sharing their posts, the gap between the two generations is significant.

Millennial respondents stated that they have shared a company post in the recent past at an 8 percentage points higher share than Gen Z. This difference is even more pronounced when it comes to liking posts or following a company on social media, at 9 percentage points.

The interactions with influencers or content creators online also follows a similar trend – whether it comes to following influencers or liking and sharing their posts, Millennials outdo Gen Z.

Overall, Gen Z users do not appear to be as enthusiastic about the faux-digital sociality of online platforms as is commonly portrayed. Particularly when it comes to business interactions, this cohort is less inclined to participate, reflecting the notion of a growing critique of materialistic values and status concerns.

Gen Y and Gen Z in India: Closing Remarks

With its growing population and improving digital infrastructure, India is an interesting emerging online market. It offers immense potential for eCommerce growth as well as fertile ground for new trends, considering its large base of young consumers.

Going forward, the Indian eCommerce market is expected to keep expanding, per ECDB market data. But the growth rates are projected to decline, compared to the faster pace of the last several years.

In such a scenario, knowing the preferences and behavior of the target consumers – particularly those who are digital shoppers like Gen Y and Gen Z – may empower brands to launch a more sophisticated marketing strategy and gain an edge in the growing eCommerce market.

Sources: Bain & Company - Emerald Insight - Pew Research Center - Times of India - UN – World Population Prospects 2022

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Google's AI Project Jarvis Could Change Online Shopping

Google's AI Project Jarvis Could Change Online Shopping

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

TikTok Shop Expands Operation in the United States

TikTok Shop Expands Operation in the United States

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Back to main topics