eCommerce: Second Hand Trends

German reCommerce: Second Hand Marketplace Trends

The German reCommerce market is growing fast - but it is lacking behind the general eCommerce market. Why is second-hand growth slower and why might that be a good thing?

Article by Nikolai Surminski | September 24, 2024Download

Coming soon

Share

German reCommerce: Key Insights

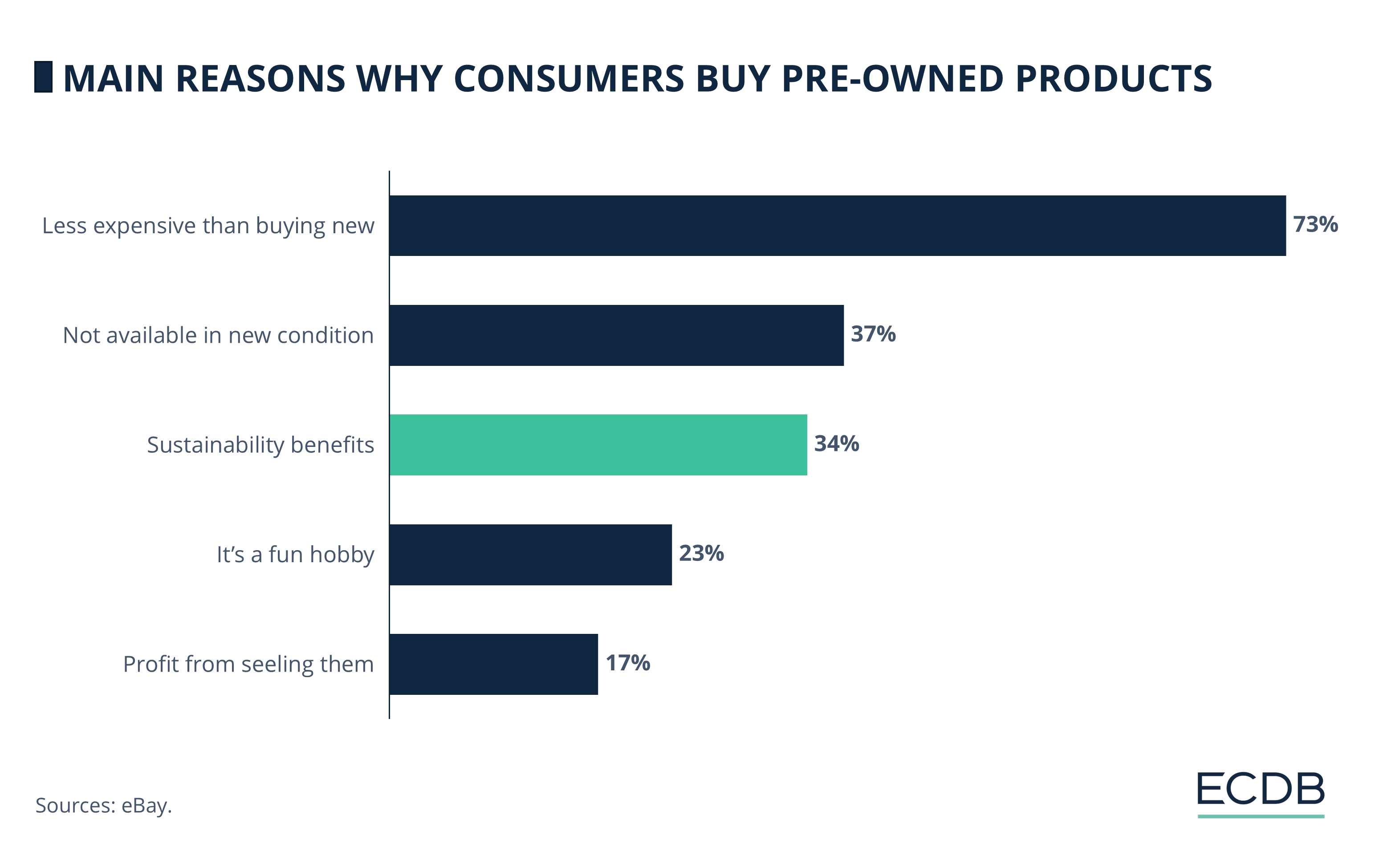

Price as Driver of reCommerce: Most consumers cite affordability as the main reason for purchasing pre-owned goods, ahead of supply issues and sustainability.

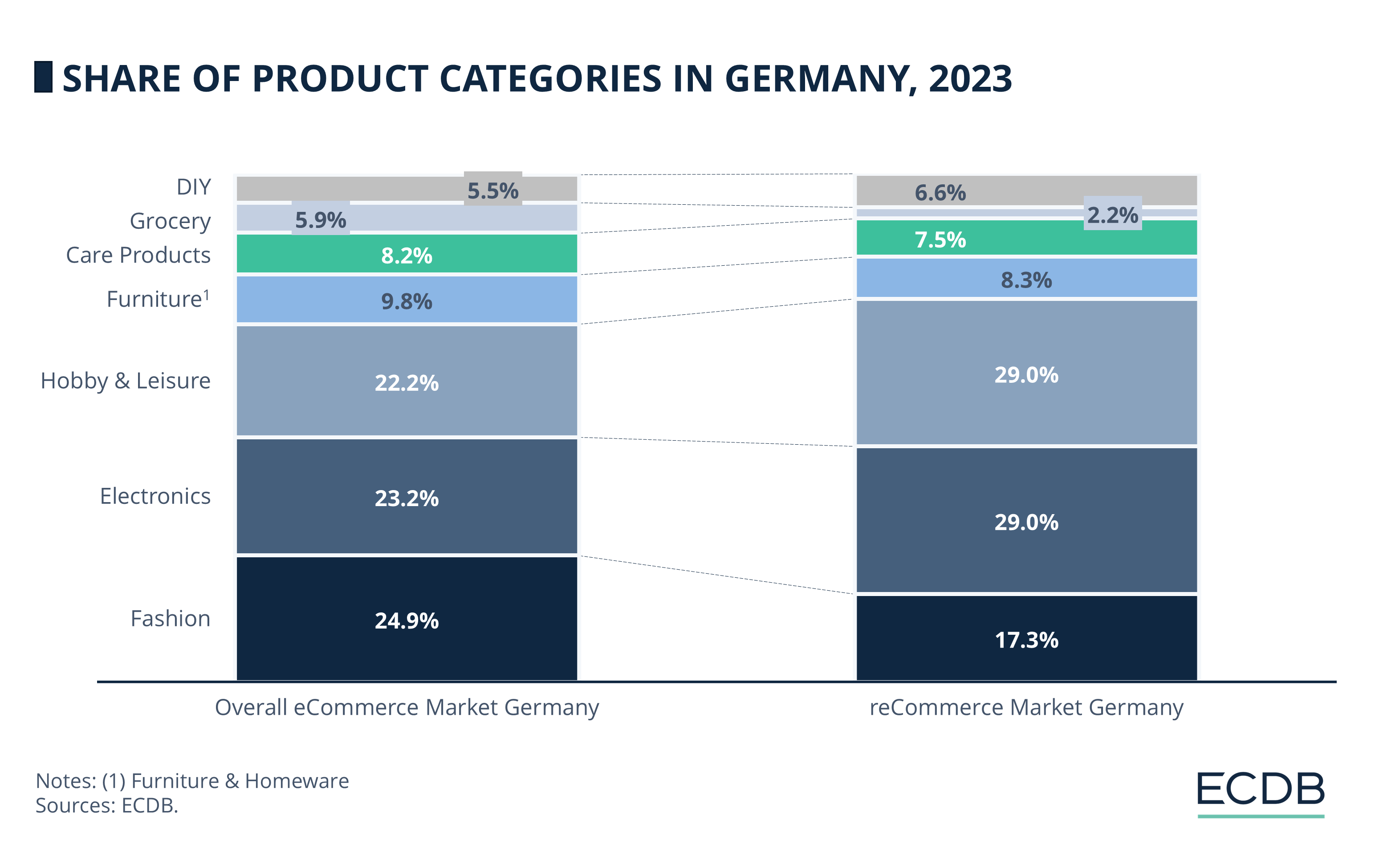

Electronics and Hobby & Leisure Outpace Fashion: Electronics and Hobby & Leisure each contribute 29% of total reCommerce sales, while the share of Fashion is lower than in the overall market.

Steady Growth Path: The growth rate of reCommerce is slower compared to the broader eCommerce market but is also following a less volatile growth projection in recent years.

According to recent surveys, about 85% of consumers have bought pre-owned goods over the last year. And marketplaces all across the world have adapted to this trend. ASOS now has its own marketplace for second-hand fashion. So does Amazon. And Zalando is even talking about opening a physical second-hand outlet.

Understanding the reCommerce market is important, even for retailers that do not sell pre-owned products on their platform. In cooperation with Marketplace Convention, we give you all the important insight on topics like second hand, overstock and a circular economy. And we will tell you why Fashion is not the most important product category in German reCommerce.

Like this insight? This article is part of a series in cooperation with Marketplace Convention 2024. Over the course of multiple in-depth analyses, we highlight the key topics for the convention such as Chinese marketplaces in Germany, cross-border eCommerce in Germany and the drivers of operational success. The largest online marketplace event in the DACH region will open its doors on the 23. and 24. of October in Cologne. During our talk, we will cover the European eCommerce market with our exclusive data and give you valuable insights into the growing importance of marketplaces in Germany.

Sustainability Is Not the Main Reason for reCommerce

Despite all the talk about sustainability and a circular economy, there are more pressing reasons for customers to use reCommerce marketplaces. Almost three-quarters of all consumers state price as the main reason for buying pre-owned products. The fact that second-hand products are less expensive than buying new is significantly more important than all other reasons.

In a time in which low-price marketplaces like Temu are booming and the impact of inflation can still be felt, reCommerce can be an appealing outlet for consumers. This also highlights that second-hand products are an economic necessity for a not unsignificant share of consumers.

Ahead of sustainability, the second-largest driver of reCommerce is supply issues. More than a third of consumers buy pre-owned products because the item is not available in new condition. This partially reflects the current trend of fast fashion with retailers like Shein driving ever shorter windows of availability.

About 34% state sustainability as one of the main reasons for buying pre-owned products while an even smaller share of customers is interested in reCommerce as a hobby or due to profit potential.

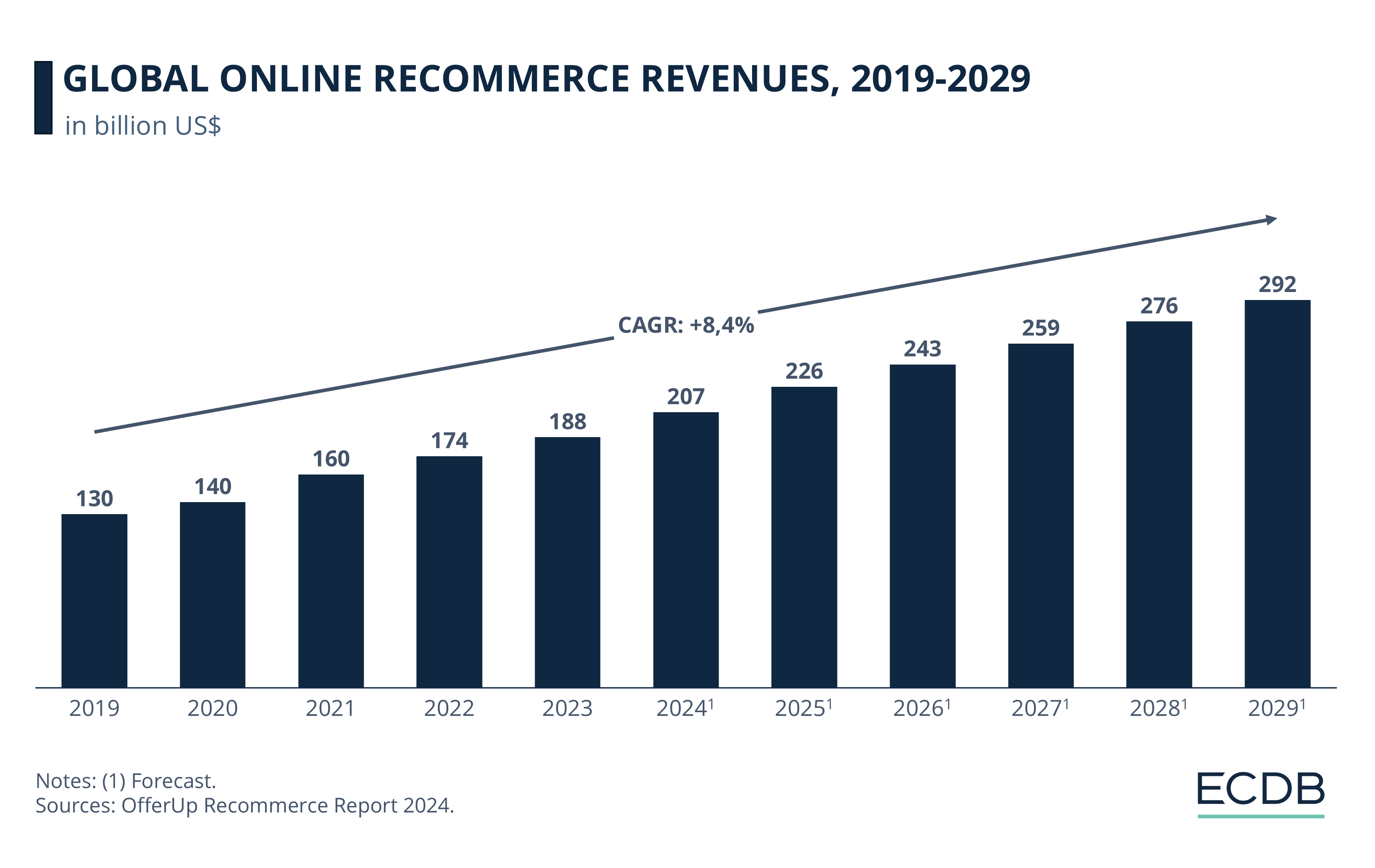

reCommerce Market Growing at Same Speed as Global eCommerce Market

The global reCommerce market has largely followed overall market trends in the eCommerce space. Since 2019, global reCommerce revenues have grown by 44% to US$188 billion in 2023. Over the next years, reCommerce sales are forecast to cross US$200 billion for the first time and reach almost US$300 billion by the end of the decade.

Over the course of ten years, this represents an average annual growth of 8.4%. This is in line with projections for the general eCommerce market which is expected to grow by an annual 8.5% over the next four years. And while reCommerce is generally seen as a growth market, it has grown significantly slower than other sections of the online retail industry.

Over the course of the pandemic, regular eCommerce revenues have increased by an impressive 14% per year with 2020 as a clear growth outlier (market revenues jumped by 30.8% in a single year). This is five annual percentage points above the reCommerce trend line, indicating that the second hand market was not able to capture Covid-driven trends to the same degree as first-party eCommerce.

At the same time, the reCommerce market is expected to keep a more stable growth path now that the pandemic is over. While overall eCommerce growth fell to low single-digit rates in 2022 and 2023, reCommerce still increased by more than 8% in each year.

Furthermore, the projected annual growth rate for the reCommerce market is 7.1%, which represents a drop of just two percentage points compared to the booming pandemic years. In contrast, the general market is experiencing a growth rate drop of around 5% compared to previous years.

There are two separate takeaways from this growth development. While reCommerce marketplaces are on everybody’s mind, it seems that the demand ceiling for first-party eCommerce is still higher. There is simply a larger consumer base that is open to adopting eCommerce into their shopping behavior.

This becomes apparent in moments such as the pandemic, in which traditional online retailers can achieve far higher growth. But it seems that the customer base of and therefore the demand for second-hand products is less volatile and on a more constant growth path.

ReCommerce is not gaining many additional consumers in a time of boom, while simultaneously retaining a higher share of users when growth rates are trending downwards.

The main reasons for using reCommerce offer a partial explanation. ReCommerce is mainly driven by the desire for lower prices. This financial dimension is adapting only slowly, keeping second-hand customers tied to the platforms.

Even during times of market expansion, the most relevant reCommerce platforms are already saturated while the price levels are less likely to experience significant changes that would drive additional expansion.

Hobby and Electronics Are the Most Popular reCommerce Categories in Germany

The German reCommerce market is dominated by the same three product categories that also generate the largest share in the overall market: Hobby & Leisure, Electronics and Fashion. These three categories make up more than 70% of the overall eCommerce market while making up an even higher 75% within reCommerce.

Both Hobby & Leisure and Electronics generate 29% of all reCommerce revenue in Germany. The two categories have an outsized role for reCommerce, with their shares of the market being higher compared to the entire market by 7% and 6%, respectively.

These categories lend themselves particularly well to second-hand marketplaces. Average Order Values for these categories are on an average level, indicating lower prices and therefore a lower exposure to the risks of reCommerce such as product scams or broken items.

These products also support long-term, repeated usage and are far less personalized compared to categories such as DIY. They also present far fewer health and sanitary concerns that lead consumers towards brand new products.

Surprisingly, the share of Fashion in the reCommerce market is significantly lower than in the overall German eCommerce market. Despite the perceived importance of second-hand fashion and the cultural relevance of platforms such as Vinted, Fashion makes up just 17.3% of reCommerce sales in Germany. This is down from the 24.9% that Fashion generates as the largest product category in the market.

Reasons for this lower share are concerns with the quality of pre-owned products as well as hygiene and personalization issues. Fashion in Germany is also dominated by fast fashion products, valued for their low prices and a product selection that is constantly changing.

Especially the low prices present consumers with alternatives that reduce the need to turn to reCommerce for bargains. As price is particularly important for second-hand customers, this lowers the demand for pre-owned fashion in the market.

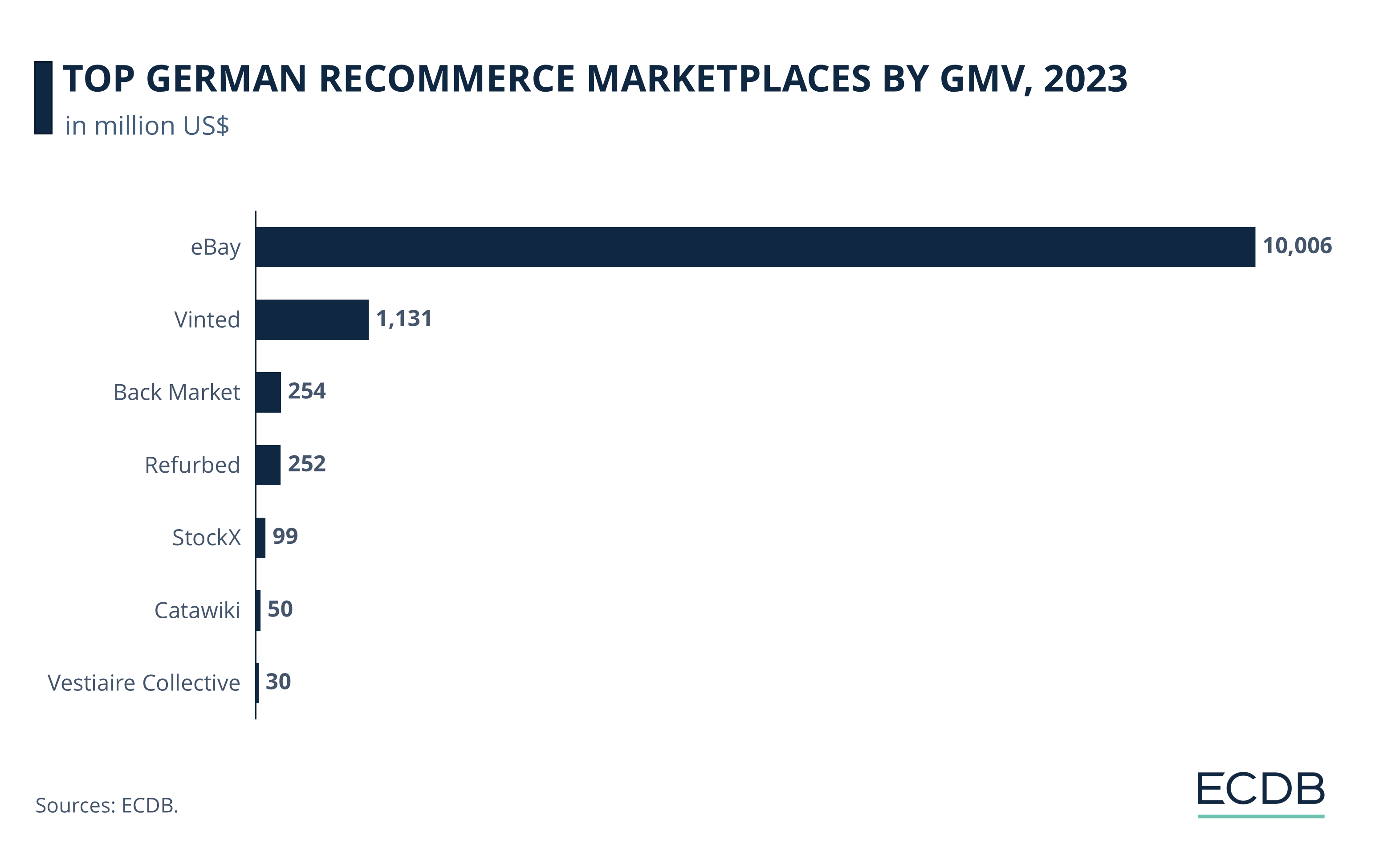

Vinted Has Almost Doubled Its GMV in 2023

And while reCommerce platforms have also experienced growth in Germany, increases in sales are not driven by the market leader. eBay is still by far the biggest reCommerce marketplace in Germany, generating more than US$10 billion in GMV in 2023. Germany is the third largest market for the American marketplace, accounting for 14% of global GMV.

The third-party platform also sells new goods, but according to eBay itself the largest share of items sold on the marketplace are pre-owned. And eBay has not shared in the general growth of the German eCommerce market. Despite being the second largest marketplace in Germany overall, GMV in 2023 is actually below the GMV level in 2014.

In 2023, GMV for eBay decreased by 1.5%, showcasing the retailer’s struggle in a world with both dedicated second-hand platforms like Vinted and more intense low-price competition from China.

Instead, strong growth is driven by retailers like Vinted and their reCommerce-first strategy. While being significantly smaller than eBay, Vinted still crossed the US$1 billion mark in Germany for the first time in 2023, growing by 65.2% year-on-year. It is the only major reCommerce market in Germany with a focus on Fashion, capitalizing on the largest product category in the German eCommerce market. On the back of strong social mechanics and a regional advantage as the largest reCommerce marketplace with European roots, Vinted is forecast to continue its strong double-digit growth over the next years.

Back Market and Refurbed both generate more than US$250 million in the German reCommerce market. Operated by a French and German company respectively, both marketplaces are purely focused on second-hand Electronics and have shown strong GMV growth of around 20% in 2023. This is in line with the outsized role of Electronics in the German eCommerce market.

The rest of the biggest reCommerce marketplaces all occupy an even smaller niche in the market. StockX mostly offers an opportunity to sell sneakers. Catawiki is a platform for special items and collectibles such as comic books, coins and stamps. Vestiaire Collective is a third-party marketplace for luxury fashion which has grown by 32.1% in 2023.

reCommerce Market in Germany: Closing Thoughts

The reCommerce market in Germany is rapidly evolving, giving spotlights to new and coming platforms. While sustainability is often highlighted as the main reason for customers buying pre-owned, it is financial considerations and supply limitations that drive the market. Suitable product categories like Hobby & Leisure and Electronics dominate the market.

In contrast, Fashion makes up a surprisingly small share due to quality concerns and competition from fast fashion.

In the future, reCommerce is projected to continue a stable growth path at a slower pace compared to first-party eCommerce. Some of the biggest platforms, such as Vinted and Back Market, are capitalizing on specific niches at the expense of generalist platforms.

And while demand may not see explosive growth, the consistent growth trajectory offers a stable alternative in a post-pandemic world. With consumers continuing to prioritize affordability, platforms that can offer both value and convenience will shape the future of reCommerce in Germany.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Temu Is the Second Most Visited eCommerce Website in the World

Temu Is the Second Most Visited eCommerce Website in the World

Deep Dive

Indonesia Urges Apple and Google To Restrict Temu

Indonesia Urges Apple and Google To Restrict Temu

Back to main topics