Core Market eCommerce Development

Growth Forecasts for Three eCommerce Markets: The U.S., UK and Germany Are Slowing Down

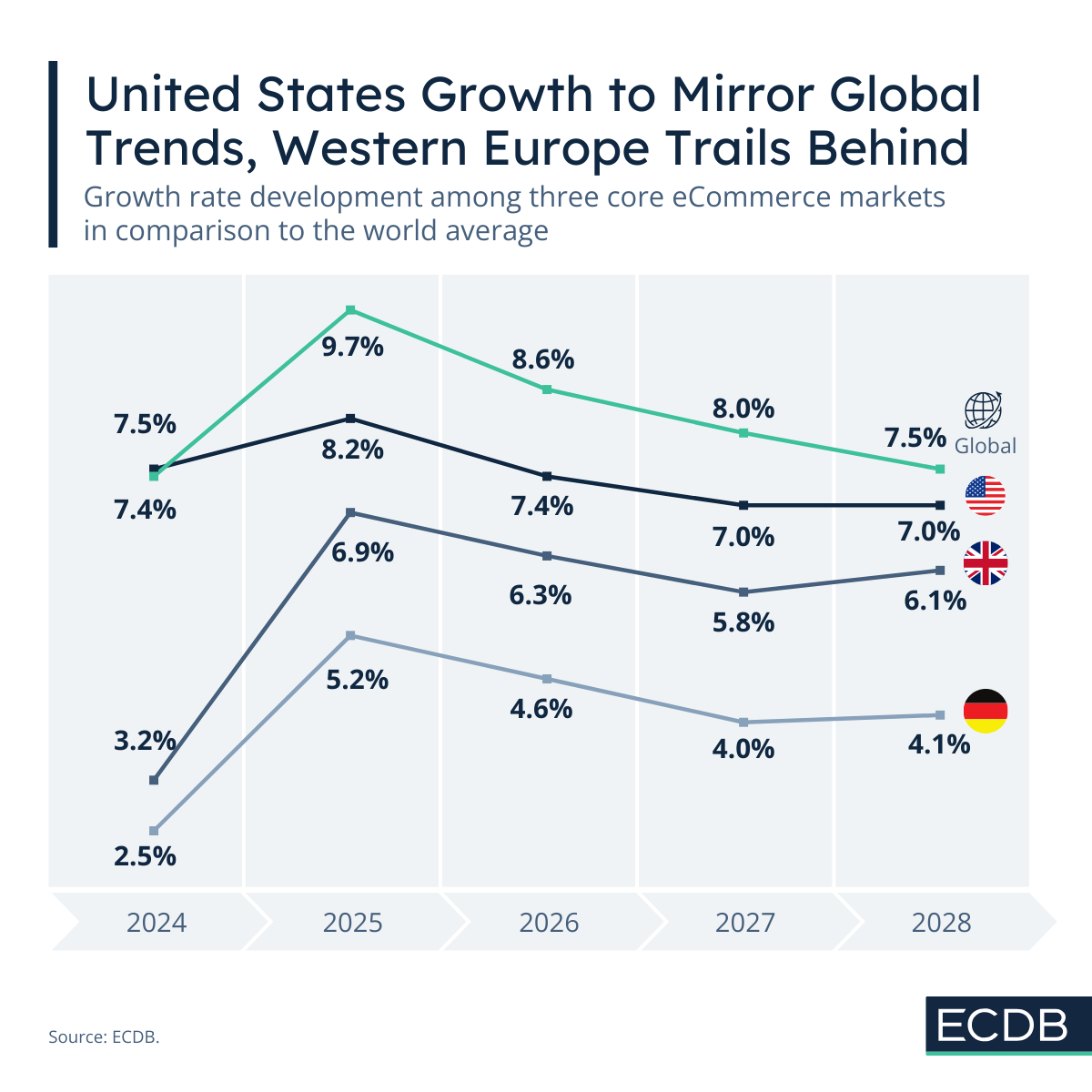

Three core markets are following world trends but are positioned differently, based on their distinct market characteristics.

Article by Nadine Koutsou-Wehling | January 13, 2025

Every new year warrants a forecast, so we plotted the expected development of three major eCommerce markets against one another to see which one comes out on top. Next to the U.S. , Germany and the UK are two countries that are economically impactful, so what do their forecasts for the coming years look like?

Germany Slowly Recovers From a 2024 Slump

Among the three eCommerce markets in this comparison, Germany is the one struggling most clearly. A slowdown in recent years was a 2.5% rate in 2024, which coincided with high energy costs as shoppers in Germany spent more cautiously. The UK experienced a similar development, which affected Western Europe more broadly.

Cautious spending means consumers tend to prioritize saving over consumption in an uncertain economic environment. Not only does that imply that users are more mindful of where they buy online, but they also tend to purchase at marketplaces with lower prices instead of the well-known and trusted online stores that may be more expensive.

Relative to the weak development in 2024, the following years signal a gradual recovery in Germany. However, rates are still lower than the other countries in our focus.

The United States’ Outlook Is Most Positive

The United States have the most optimistic rates in the four-year forecast of this analysis. This is despite the most recent political election, which did not change much of the predictions for the coming years. Overall, U.S. eCommerce is going to follow world average development, meaning that slight declines are expected until 2028, where the growth rate will likely mirror the previous year’s rate of 7.0%.

The United States are the second-largest eCommerce market in the world. Together with the largest market China, the two account for 65% of global eCommerce revenues. That the U.S. still has such a confident prospect for the coming years is a reflection of its positive GDP outlook and global significance, given the international importance of its eCommerce players and innovative power of the market. Together with Chinese companies, U.S. companies are the ones responsible for distributing world novelties that define how consumers purchase and receive their online orders.

UK Stands in the Middle, World Average Growth Driven by Emerging Markets

Despite the below-average growth rates in the U.S. and the UK, both are in a good position, considering the maturity of both markets. The forecast for the UK is a little lower than that for the U.S., with annual rates between 5.8% and 6.9%. In a direct comparison to Germany, however, the UK is in a good position. Growth rates and maturity tend to be negatively correlated, as developed markets with high eCommerce penetration have less room to grow.

The global average includes all emerging markets like India, Mexico, the Philippines, Chile, Indonesia, Poland, Vietnam and Colombia, where eCommerce is in its expansion phase. Their growth rates are therefore much higher by default than those of countries with established eCommerce structures where increases are more marginal.

From a relative low point of 7.5%, where world average growth coincided with U.S. rates, global eCommerce is expected to recover quicker, to approach a 10% rise in the next year. Although a slackening is expected until 2028, average eCommerce market development remains above that of the other countries, which is driven by the accelerating development of emerging countries.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Deep Dive

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Deep Dive

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Deep Dive

Why eCommerce and Luxury Sales Are Tough to Unite

Why eCommerce and Luxury Sales Are Tough to Unite

Deep Dive

What Countries Are Driving Revenues in the Global Online Smartphones Market?

What Countries Are Driving Revenues in the Global Online Smartphones Market?

Back to main topics