eCommerce Product Categories

High Growth Rate, Low Online Share: Grocery eCommerce on Track for Future Expansion

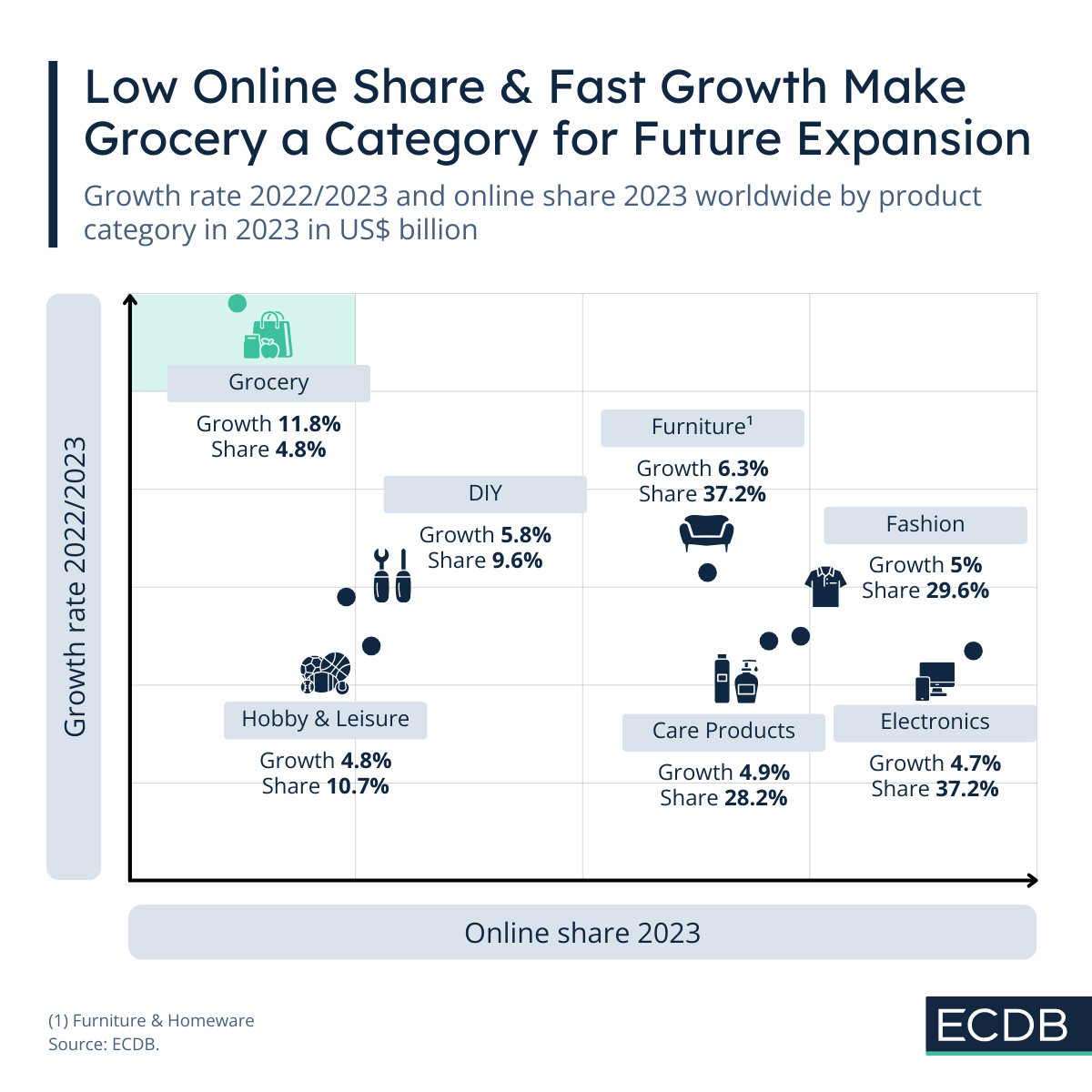

Some product categories are easier to buy online than others. By comparing growth rates with online share, you can predict which industries are worth investing in.

Article by Antonia Tönnies | December 10, 2024

eCommerce offers something for everyone, from the ultimate fashion item to a customized smartphone. In 2023, one product category in particular came into focus: Grocery.

With a growth rate of 11.8% between 2022 and 2023, Grocery is distinguished as the fastest growing eCommerce category. Meanwhile, the online share – the proportion of retail volume transacted via an internet-connected website, mobile or app – is the lowest, in comparison to other categories.

Grocery as the Fastest Growing eCommerce Category Worldwide

Such a distribution is outstanding among the eCommerce categories and points to significant untapped potential that is already evident in the earliest forecasts: Market forecasts conducted by our analysts at ECDB estimate the Grocery market to reach US$763 billion by 2028 – doubling its 2023 revenue of US$391 billion. The online share will also grow rapidly from 4.8% in 2023 to 8.3% in 2028, reflecting the development of Grocery into an online product.

For a better overview, ECDB generally differentiates products in eCommerce across seven main categories, including Grocery, DIY (Do-It-Yourself), Hobby & Leisure, Furniture & Homeware, Fashion, Care Products, and Electronics, which in turn have further sub-categories.

The Grocery category represents a unique mix: high growth potential with a low starting base in online adoption, making room for future revenue growth in eCommerce as well as innovation.

Q-Commerce and COVID Boosted Online Grocery Shopping

One event that brought eCommerce innovation to the fore in the grocery market, as well as other categories, was the COVID-19 pandemic. Quick commerce, also known as q-commerce, experienced a gold rush in 2020 with the launch of various fast delivery services such as Flink and Gorillas, but also the success of other players such as Getir, Uber Eats or Just Eat Takeaway. The market profited strongly, in particular during 2020, when it generated US$282.9 billion in revenue – a jump of 41.5% compared to 2019.

As the pandemic situation subsided, demand for online grocery subsided briefly in 2022, but growth rates picked up again in 2023. Once encouraged by lockdowns and social distancing, other factors such as convenience, time saving or availability are now driving online grocery shopping.

Online Grocery Trends Vary by Region: India with Strong Trend for Ultra-Fast Delivery

Online stores such as chaoshi.tmall.com, walmart.com, and tesco.com are top providers. These players offer different models to make online grocery shopping as convenient as possible, including different click-and-collect and delivery systems. The latter is particularly evident in India, where the market leans towards ultra-fast delivery, in some cases less than 10 minutes. Players like Blinkit are challenging traditional stores, raising the question whether the approach is viable in the long term.

While q-commerce is still on the rise in some countries, such as India, the concept has proven to be less than lucrative in European countries. Instead, supermarket chains such as Carrefour S.A. and REWE Group have invested in home delivery within a few days. Although these options are slower than q-commerce, they attract customers with flexible delivery times.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Who Are the Number One Shop Software Providers in Each European Country?

Who Are the Number One Shop Software Providers in Each European Country?

Deep Dive

The United States Takes the International Lead in eCommerce Revenue per Capita

The United States Takes the International Lead in eCommerce Revenue per Capita

Deep Dive

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Deep Dive

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Deep Dive

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Back to main topics