eCommerce: Holiday Season

Holiday eCommerce Sales Expected to Climb Despite Inflation

The holiday season is one of, if not the, most important time of the year for eCommerce. How will this year's sales perform? A Deloitte report shows promise.

Article by Cihan Uzunoglu | September 16, 2024Download

Coming soon

Share

Holiday Season Online Sales 2024: Key Insights

Growth in Holiday Sales: Holiday shopping sales in the U.S. are anticipated to increase slightly in 2024, with eCommerce leading the growth, though higher credit card debt and reduced savings could limit purchases of non-essential goods.

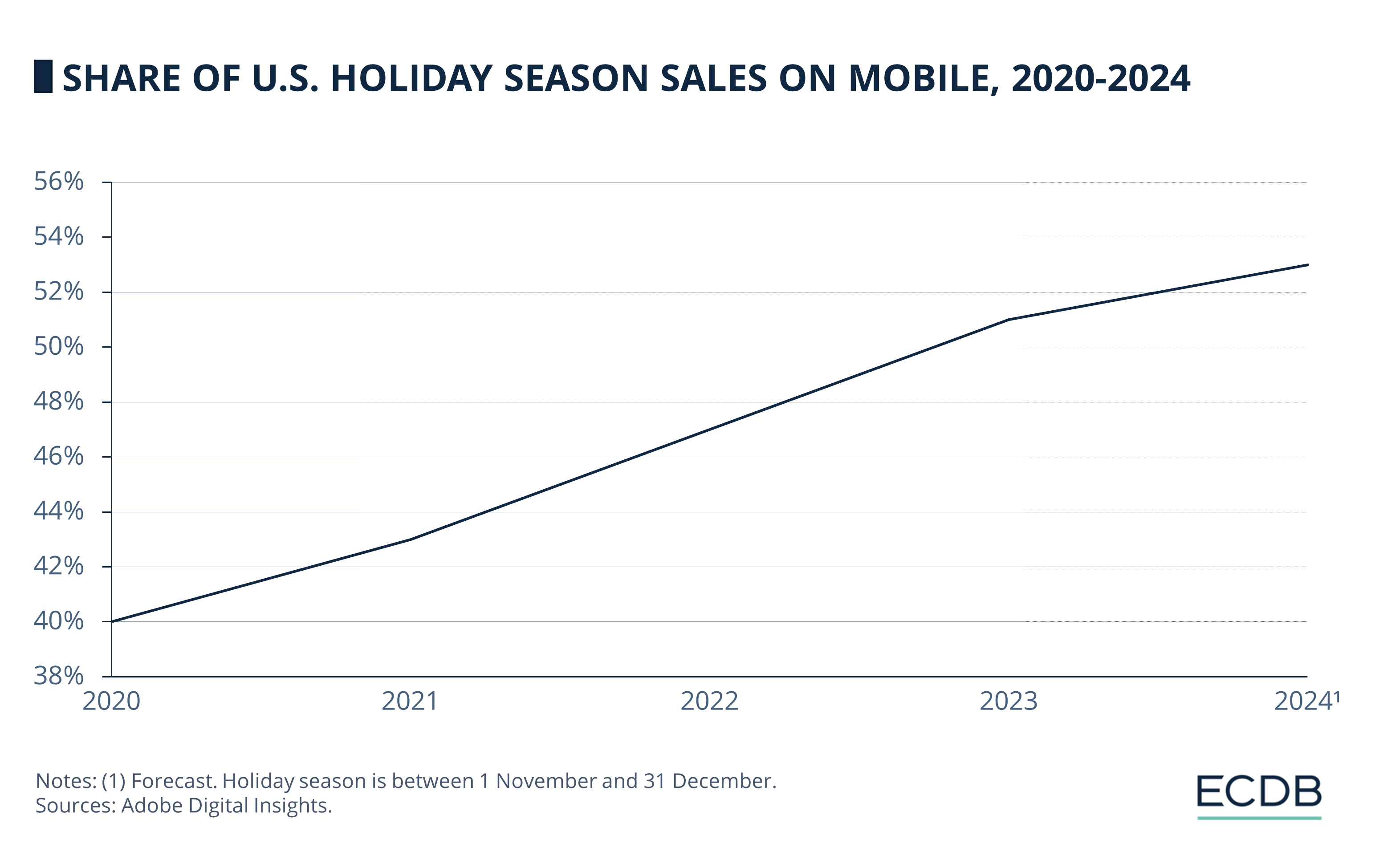

Mobile's Expanding Influence: Mobile shopping is set to play a bigger role in holiday spending, expected to jump from 40% in 2020 to 53% in 2024.

Focus on Deals: As inflation and debt affect purchasing power, retailers may need to focus on well-timed promotions and discounts to attract budget-conscious shoppers this holiday season.

Holiday shopping season sales in the United States are projected to grow modestly in 2024, increasing between 2-3% to reach US$1.58 trillion, according to Deloitte’s annual holiday forecast.

While this growth is slower than last year’s 4% rise, healthy disposable income and a steady labor market will drive consumer spending.

Online Holiday Shopping Will Grow

One key growth area in this year’s holiday season shopping will be eCommerce, expected to grow by 7-9%, totaling somewhere between US$289-294 billion in sales.

Consumers will continue to seek out online deals to maximize their spending as inflation, while easing, still pressures household budgets. Deloitte's Michael Jeschke emphasized that retailers focusing on loyalty and trust will be best positioned for success.

As we covered before, mobile’s role in U.S. holiday shopping is expected to become even more significant, moving from 2020’s 40% to 53% this year.

Inflation and Debt Could Impact Holiday Sales

Despite the positive outlook for eCommerce, Deloitte’s report also warns that rising credit card debt and depleted pandemic savings could impact overall holiday spending growth. Increasing costs in areas like shelter and dining out could limit spending on discretionary items like apparel and electronics.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

As consumers continue to prioritize value, retailers may need to rely on strategic discounts and promotions to capture sales during this year’s holiday season. With inflation slowing to a three-year low but still affecting purchasing power, the focus for many will be finding the best deals to stretch their budgets.

Retailers that build strong connections with shoppers and deliver competitive online offers will be well-positioned in this holiday season.

Sources: PYMNTS, PR Newswire, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Factors That Impact U.S. Holiday Shopping in 2024: Election, Deals, Weather, Number of Days

Factors That Impact U.S. Holiday Shopping in 2024: Election, Deals, Weather, Number of Days

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

Walmart Introduces Prescription Deliveries, Outpacing Drugstores CVS and Walgreens

Walmart Introduces Prescription Deliveries, Outpacing Drugstores CVS and Walgreens

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Consumer Confidence Index (CCI) in the United States: eCommerce Analysis

Consumer Confidence Index (CCI) in the United States: eCommerce Analysis

Back to main topics