eCommerce: United States

eCommerce in the United States: Top Stores, Market Development & Trends

Discover the leading online stores, market developments, and emerging trends in the U.S., the world's second largest eCommerce market and largest economy.

Article by Cihan Uzunoglu | August 15, 2024Download

Coming soon

Share

eCommerce in the United States: Key Insights

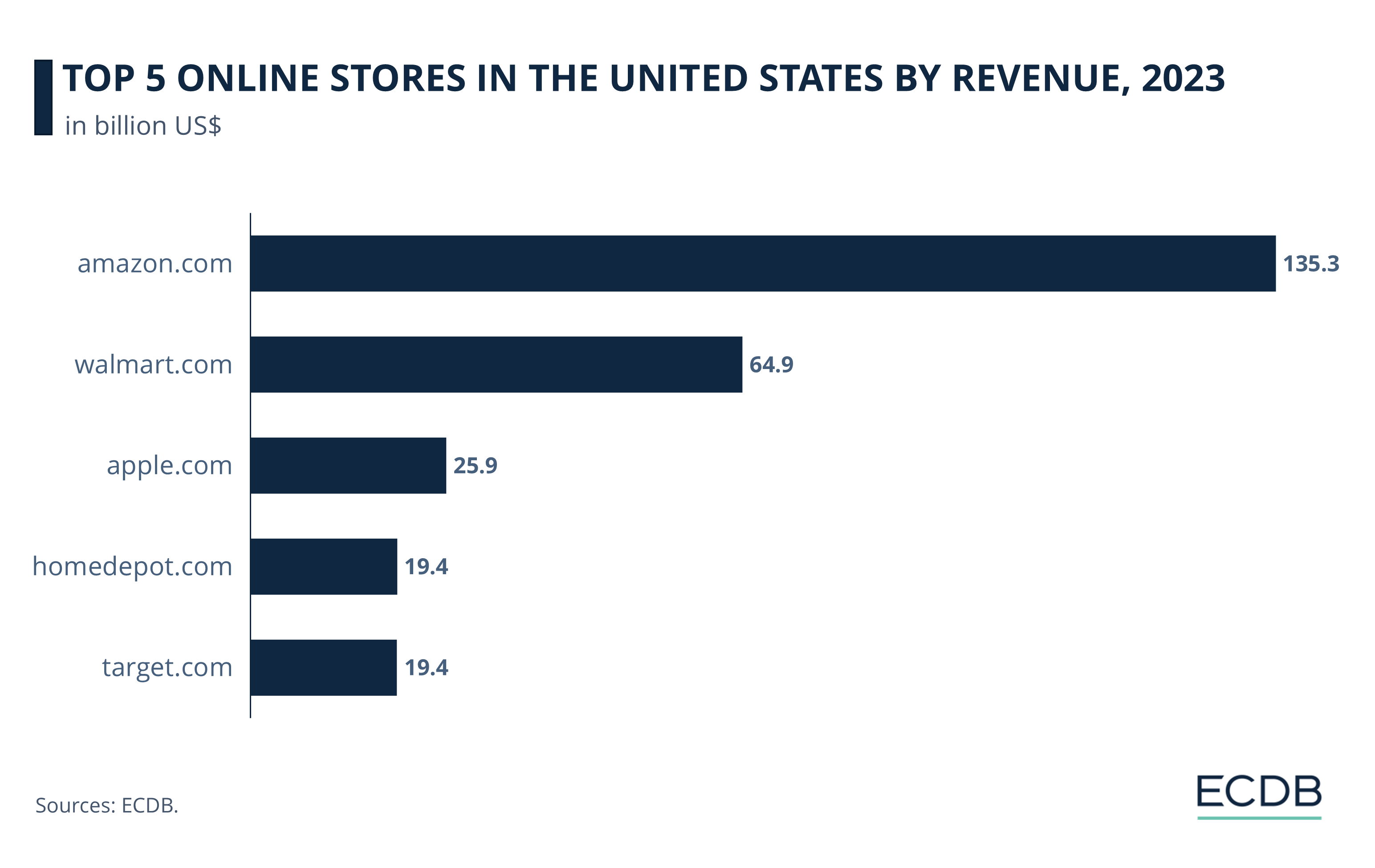

Market Leaders: Amazon leads the U.S. eCommerce market with US$135.3 billion in 2023, followed by Walmart at US$64.9 billion. Apple, Home Depot, and Target trail with US$25.9 billion, US$19.4 billion, and US$19.4 billion, respectively.

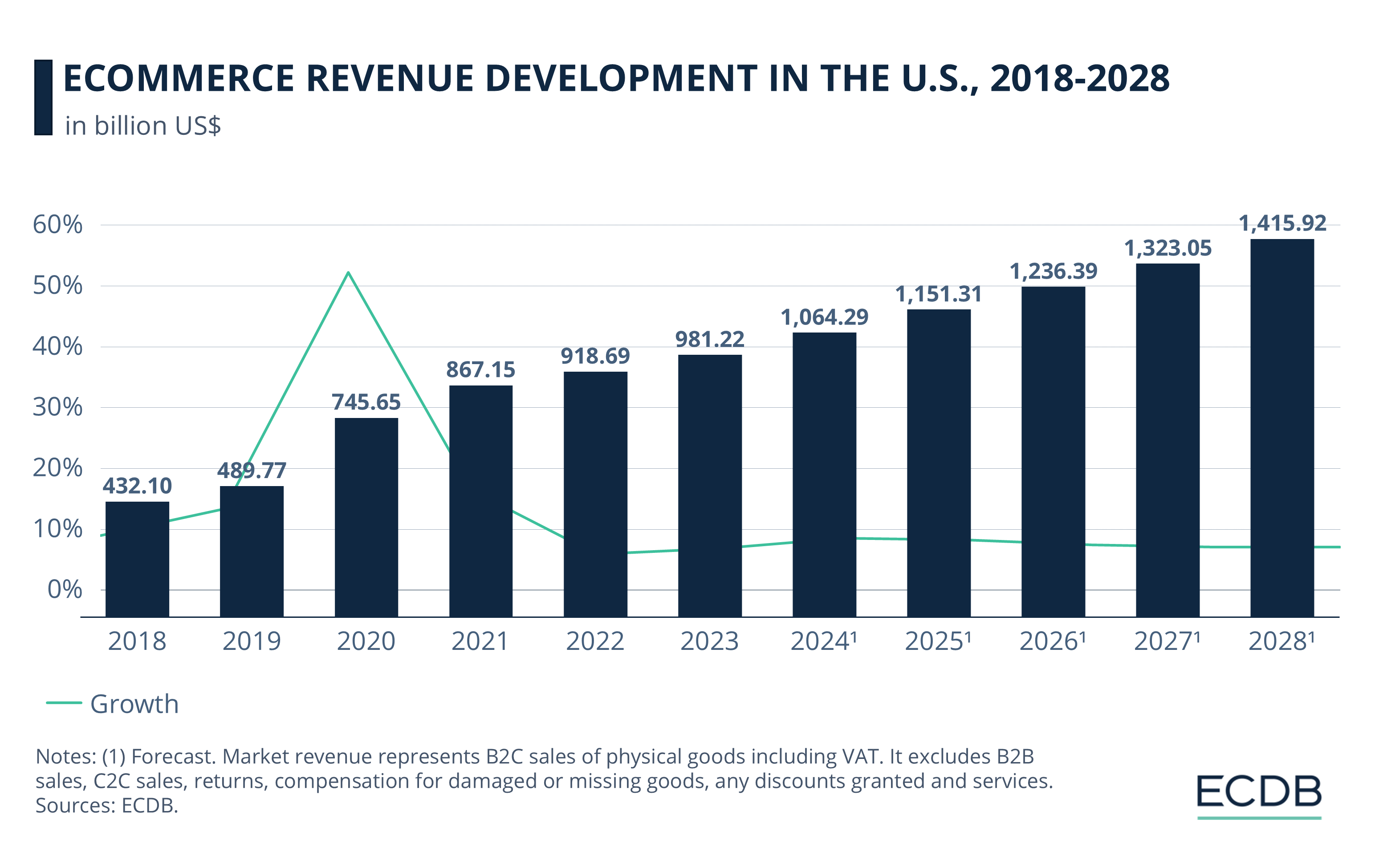

Market Growth: The U.S. eCommerce market surged to US$745.65 billion in 2020 but slowed to US$981.22 billion by 2023. Despite early 2024 challenges, growth is expected to continue, reaching US$1.41 trillion by 2028.

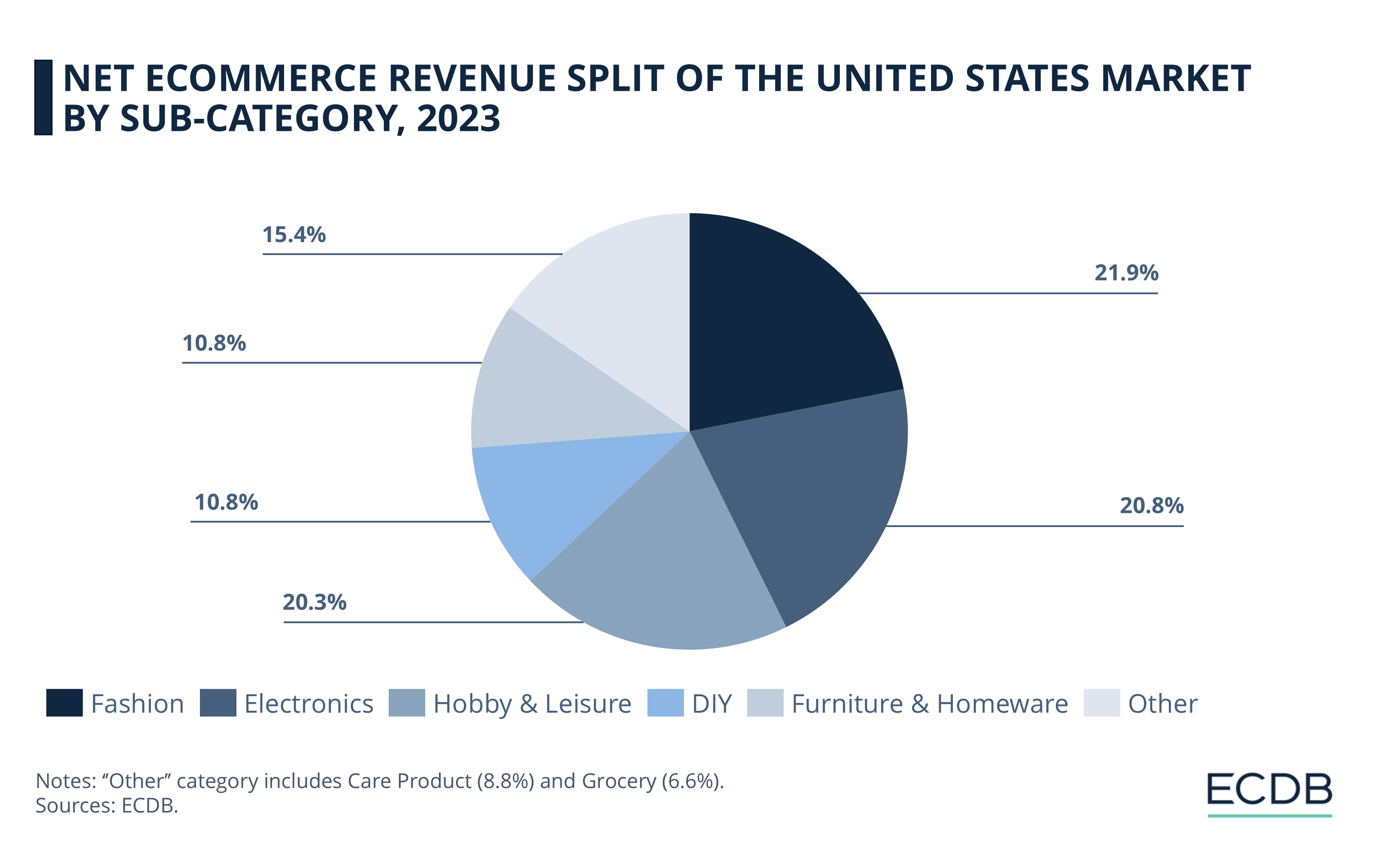

Top Categories: Fashion led U.S. eCommerce in 2023 with 21.9%, followed by Electronics at 20.8% and Hobby & Leisure at 20.3%. DIY and Furniture & Homeware each contributed 10.8%, with Care Products and Grocery at 15.4% combined.

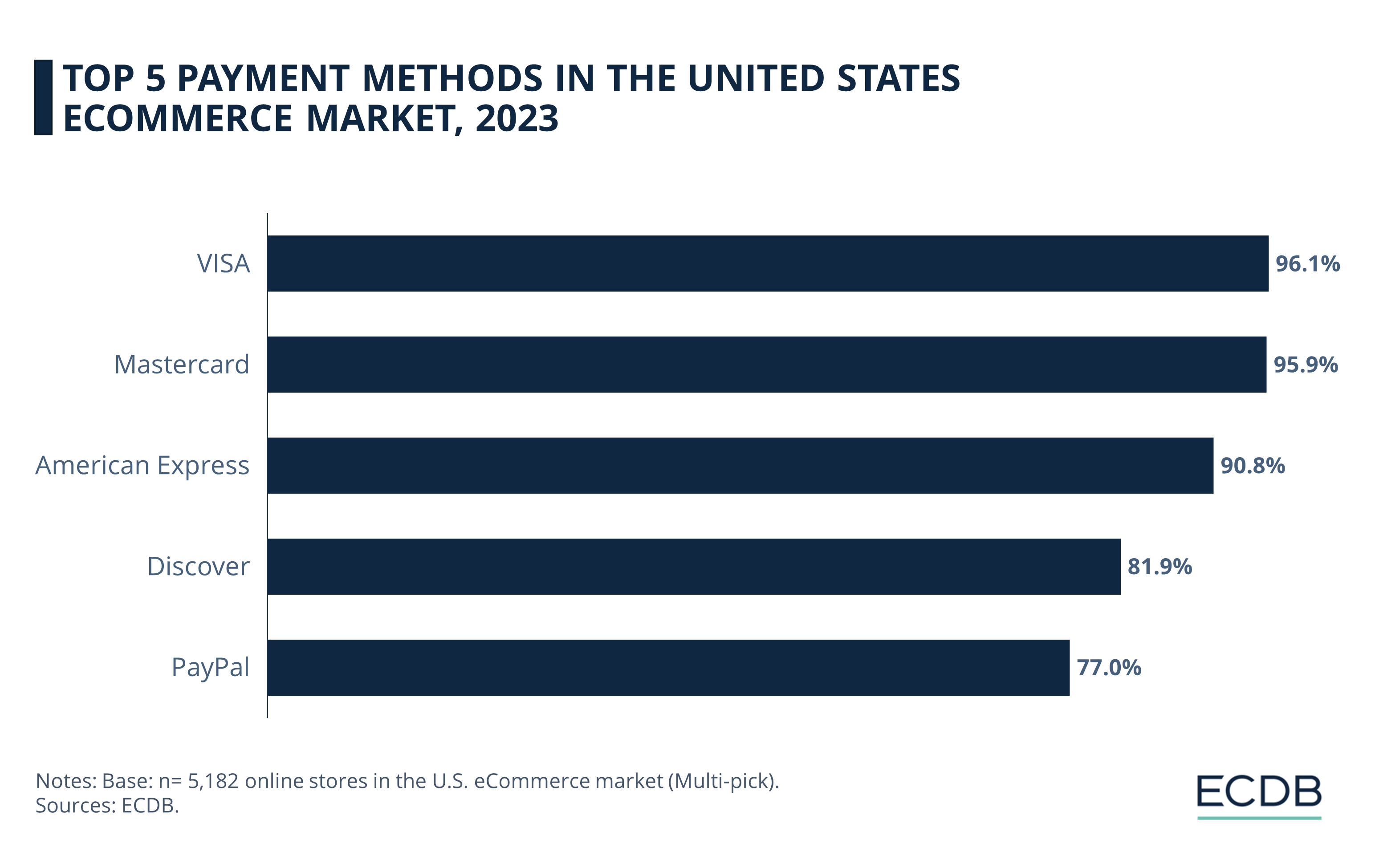

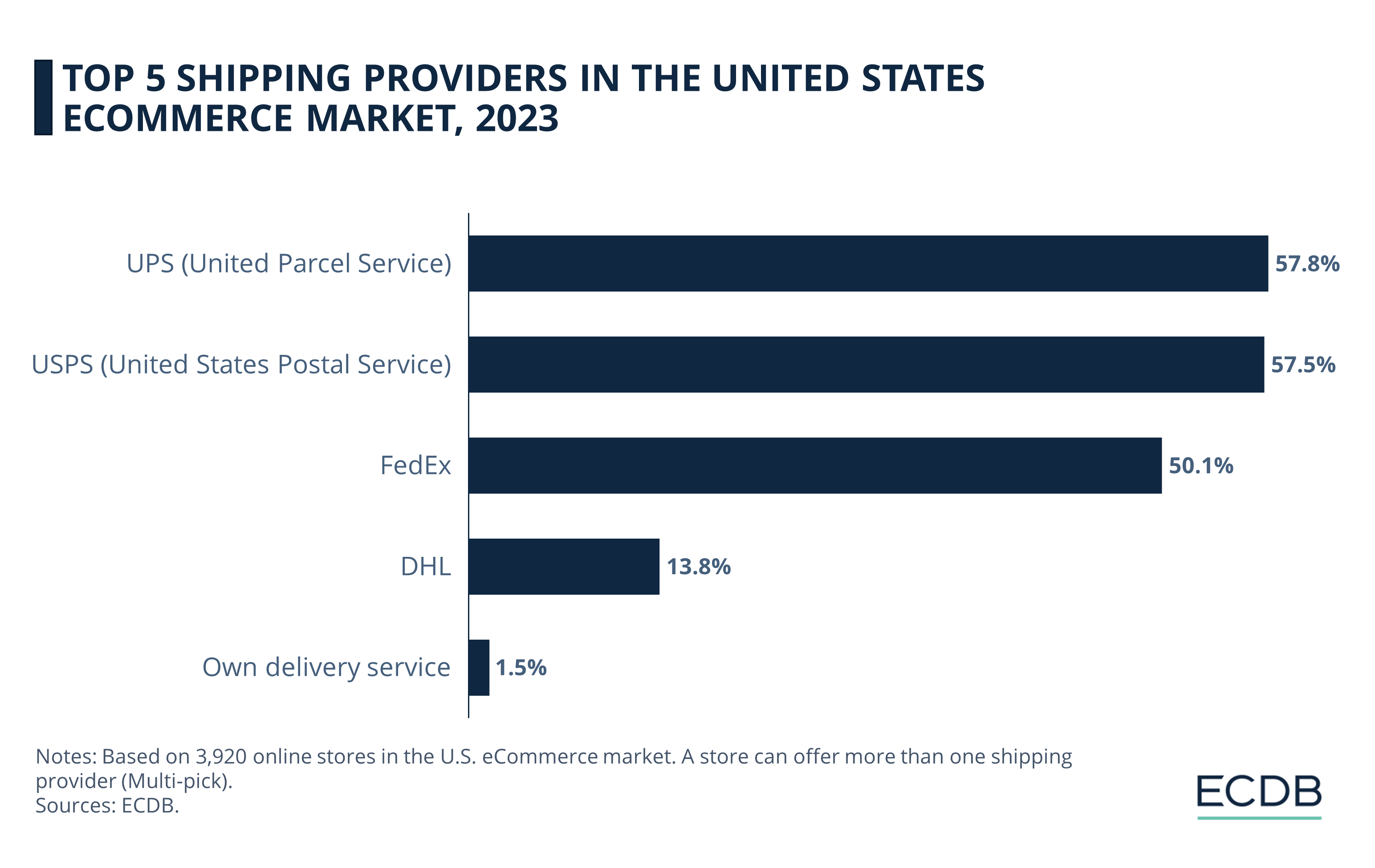

Payments And Shipping: Card payments dominate U.S. eCommerce, with Visa (96.1%) and Mastercard (95.9%) leading. PayPal tops eWallets at 77%. UPS and USPS are the top shipping providers, each used by 58% of stores, while returns fraud is a growing concern.

eCommerce Trends: Key U.S. eCommerce trends include strategic holiday spending, the rise of live commerce led by Amazon, and the growth of recommerce, expected to reach US$275 billion by 2028.

As the world's largest economy, the United States is also the world's second largest eCommerce market. The pandemic sparked a boost in online shopping, but now in-store spending is making a comeback. Giants like Amazon and Walmart lead the market - what gives them the edge?

From there, why do some U.S. online stores dominate while others lag behind? How has eCommerce evolved, and what lies ahead?

In our analysis, we'll take a deep dive into these questions. But first, let's start with the top online stores in the country.

Top Online Stores in the U.S.

When we examine the top online stores in the United States, it’s clear that the competition is tiered, with the top two players operating in their own leagues:

Amazon.com stands far ahead of the competition with a remarkable revenue of US$135.3 billion in 2023.

Walmart.com, while significantly trailing Amazon, still scored US$64.9 billion.

Apple.com, Homedepot.com, and Target.com make up the remainder of the top five, with revenues of US$25.9 billion, US$19.4 billion, and US$19.4 billion, respectively.

To understand what drives the success of these major players, let’s take a closer look.

1. Amazon.com

Amazon.com is the clear leader not only in U.S. eCommerce, but also on the global arena (with close to US$140 billion in net sales last year).

Launched in 1994, Amazon revolutionized online shopping with its vast product range, competitive pricing, and Prime membership perks. Its dominance comes from relentless expansion, a customer-first approach, and a logistics network that few can match. Even with rising competition, Amazon’s scale and continuous innovation keep it at the top.

2. Walmart.com

Although no one can quite reach Amazon's heights, Walmart.com is the one online store that comes closest, generating US$64.93 billion in 2023.

Starting as a brick-and-mortar giant, Walmart has effectively transitioned to eCommerce by leveraging its extensive store network for pickup and delivery services. Its success is built on convenience, competitive pricing, and the seamless integration of online and physical shopping experiences.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

3. Apple.com

The creator of instantly recognizable, iconic products, Apple's online store apple.com brought in US$25.85 billion in 2023.

Apple’s success online mirrors its brand loyalty and the continuous demand for its premium products. With a focus on seamless user experience and direct-to-consumer sales, Apple’s online store thrives on the strength of its product ecosystem and innovative launches like the latest iPhone models.

4. Homedepot.com

The American home improvement retailer's online store, homedepot.com, made revenues of US$19.38 billion in 2023. The online store is known to be the go-to online destination for home improvement needs.

The retailer’s success stems from its vast inventory, DIY resources, and the integration of online orders with in-store pickup. Home Depot has capitalized on the growing demand for home projects, making its online platform a critical part of its overall business strategy.

5. Target.com

The last online store in our top 5 is target.com, with 2023 revenues of US$19.36 billion, closely trailing Home Depot.

Target’s online growth is driven by its convenient order pickup, drive-up services, and competitive pricing. By blending digital and in-store experiences, Target has successfully positioned itself as a key player in the U.S. eCommerce landscape, appealing to a broad customer base with its wide product range.

eCommerce Market Revenue Development

in the U.S.

U.S. eCommerce saw explosive growth during the pandemic, with revenues skyrocketing in 2020. This increase marked a turning point, but the pace of growth has since slowed and is expected to continue on a more gradual path:

The U.S. eCommerce market grew from US$432.1 billion in 2018 to US$489.77 billion in 2019, fueled by the COVID-19 pandemic. This spike in 2020 pushed the market's revenue to US$745.65 billion.

After this spike, growth has been steady, with revenue increasing from US$867.15 billion in 2021 to US$981.22 billion in 2023.

Projections show continued growth, with revenues expected to reach the US$1 trillion mark by the end of this year, US$1.15 trillion in 2025, and US$1.41 trillion in 2028.

Monthly eCommerce Revenue of the U.S. Market

In July 2024, the U.S. eCommerce market showed a 6% growth, reflecting a robust performance that outpaces the global trend.

This marks a recovery from a turbulent year. October 2023 saw a significant increase, but the market faced a downturn towards the end of the year. January and February 2024 experienced a 10% degrowth. However, starting in March, the market stabilized around the 0% growth level before July’s notable 6% uptick, signaling renewed momentum in the sector.

Top eCommerce Categories

in the U.S.

The U.S. eCommerce market is diverse, with different categories contributing to overall revenue in 2023:

Fashion leads the way with 21.9% of the market, closely followed by Electronics at 20.8%.

Hobby & Leisure also plays a significant role, making up 20.3% of the market.

DIY and Furniture & Homeware each hold 10.8%, while the "Other" category, which includes Care Products (8.8%) and Grocery (6.6%), accounts for 15.4% of the total market.

Top eCommerce Payment Methods

in the U.S.

In the U.S. eCommerce market, there’s a strong preference for card payments, though eWallets are gaining traction due to their convenience and security:

Cards dominate the market with Visa leading the pack, accepted by 96.1% of online stores.

Mastercard follows closely at 95.9%, while American Express is also widely used, available in 90.8% of stores.

Discover, known for its cash-back rewards, ranks fourth, accepted by 81.9% of online retailers.

PayPal, the most popular eWallet, rounds out the top five, utilized by 77% of online stores.

BNPL in the U.S.

Despite not being mentioned in the top payment methods, Buy Now, Pay Later (BNPL) has grown rapidly in the U.S., reshaping how consumers approach spending. PayPal leads the U.S. BNPL space, followed by Afterpay and Klarna.

BNPL’s appeal lies in its flexibility and ability to help consumers avoid credit card interest. However, merchant strategies focus on more than just convenience — 27% prioritize reducing fraud, while others seek to boost conversion rates or lower processing costs.

BNPL is particularly popular among younger users, larger households, and urban dwellers, who are drawn to manageable payments. Yet, the rise in BNPL usage raises concerns about potential debt risks, especially among less financially secure consumers.

Top Shipping Providers in the United States eCommerce Market

In the highly competitive U.S. eCommerce market, reliable shipping is essential. Among the top shipping providers in the country:

UPS and USPS lead, each used by 58% of online stores.

FedEx ranks third, with 50% usage, known for fast, reliable international shipping.

DHL, used by 14% of stores, excels in cross-border deliveries.

Lastly, 2% of stores use their own delivery services, a flexible but less common choice.

Returns Fraud in the U.S.

Returns fraud is a growing challenge in U.S. eCommerce. In 2023, 14% of all retail returns were fraudulent, amounting to US$101 billion.

The most common fraud type, "wardrobing," involves buying, using, and returning items. Other fraudulent practices include returning shoplifted goods or using fake e-receipts. As fraud rises, retailers are tightening returns policies, with some leveraging AI to detect patterns and prevent abuse.

The environmental impact of returns also raises concerns, prompting businesses to explore sustainable practices in their returns processes. Balancing fraud prevention with customer satisfaction remains crucial for retailers.

United States eCommerce Trends

The U.S. eCommerce market continues to evolve, shaped by shifting consumer behaviors and emerging technologies. Here’s a look at three key trends:

Holiday Spending Patterns

Our look at holiday spending in the U.S. last year showed that consumers are becoming more strategic, with 54% waiting for better deals before buying. Online shopping still dominates, capturing 63% of holiday spending, while in-store shopping sees a slight rebound to 37%.

Despite this, the number of physical stores visited by shoppers is decreasing, and Buy Online, Pick Up In Store (BOPIS) usage is also down. Free shipping remains a critical factor, with 80% of online shoppers willing to meet minimum purchase requirements to avoid shipping fees.

The Rise of Live Commerce

Live commerce, blending online shopping with live streaming, is slowly gaining traction in the U.S. Amazon is leading this charge with its Amazon Live platform, allowing sellers to demonstrate products and interact with shoppers in real time.

Although live commerce is still in its early stages compared to markets like China, its potential for growth is significant. Amazon’s focused approach could drive wider adoption in the U.S., especially as social media platforms step back from this space.

Growth of Recommerce

Recommerce, or secondhand shopping, is becoming mainstream, driven by consumer demand for sustainability and affordability.

In 2023, 76% of U.S. consumers believe secondhand shopping has shed its stigma, with 41% even viewing it as a status symbol. The recommerce market is growing faster than overall retail, expected to reach US$275 billion by 2028. Platforms like Facebook Marketplace and eBay dominate the space, offering a wide range of products.

This trend highlights a shift toward more conscientious shopping habits and presents a growing opportunity for businesses focused on resale.

eCommerce in the United States:

Closing Thoughts

The U.S. eCommerce market was reshaped by the pandemic, experiencing rapid growth that has since leveled off. Looking ahead, the market will likely continue to expand, but at a more measured pace.

The dominance of giants like Amazon and Walmart will continue, but competition from across the ocean will change the market dynamics in the coming years.

The sustainability of this market depends on how well it adapts to evolving consumer behavior and technological advances. Over the next decade, we can expect a more balanced, integrated approach between online and in-store experiences, with continued innovation driving the industry forward.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics