eCommerce: Most Popular Payment Methods in the U.S.

Most Popular Payment Methods in the U.S: Challenges, Market Development & Trends

Explore top online payment methods in the U.S., including Mastercard and PayPal, and learn about challenges, market development, and trends in merchant choices.

Article by Cihan Uzunoglu | July 24, 2024

Most Popular Payment Methods in the U.S:

Key Insights

Top Payment Methods:

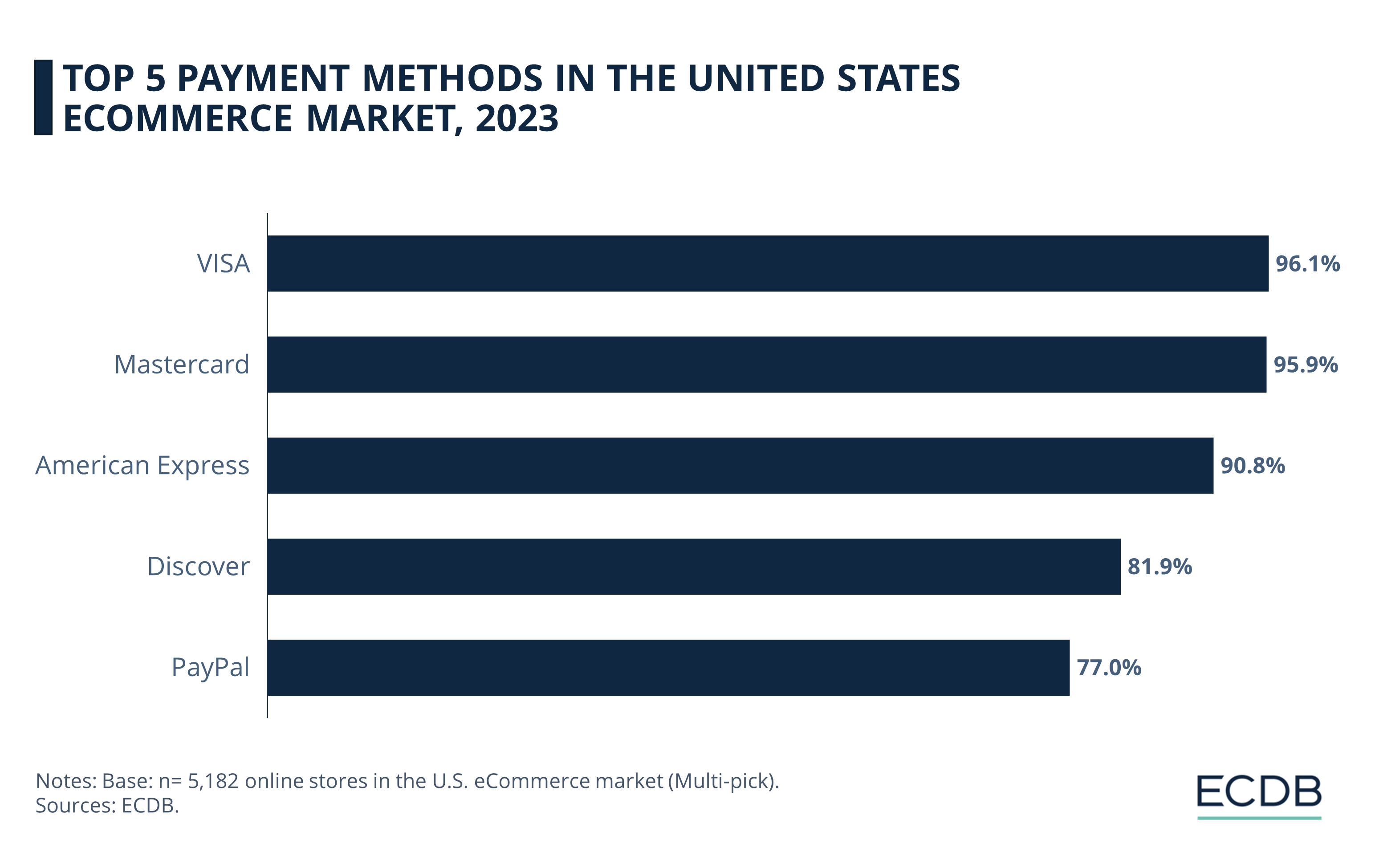

Visa (96.1%), Mastercard (95.9%), American Express (90.8%), Discover (81.9%), and PayPal (77%) are the top eCommerce payment methods in the U.S.

Merchant Preferences:

Merchants prioritize fraud risk reduction (27%), conversion rate boosts (21%), immediate fund availability via eWallets (20%), and lowering payment processing costs (20%).

Robust Growth:

Last year, Mastercard achieved an 18% rise in net revenues, with a notable 45% increase in cross-border volumes. Visa and Mastercard continue to dominate the industry, despite global challenges, while eWallets like PayPal and Apple Pay are fiercely competing for market share.

Changing Market Shares:

PayPal remains dominant in the U.S. (81%) and several European countries but has seen a 1-point drop in the U.S. and an 8-point decline in the UK, with competitors like Apple Pay (34%), Google Pay (31%), and Amazon Pay (30%) gaining traction, especially among younger demographics and in regions like France and Germany.

We often breeze through the online checkout process on our favorite shopping sites, entering payment details without considering why we chose a particular method. We usually stick to familiar options like Mastercard, PayPal, or Visa out of habit or convenience.

However, the range of available payment methods is rapidly expanding, including electronic systems and eWallets. Digital wallets are especially gaining popularity as alternatives to traditional methods like bank transfers or invoicing.

The United States hosts major payment providers, but which ones are leading the online payment trends? Is it Visa, American Express, PayPal, or Apple Pay? Let's explore the leaders in the U.S. online payment landscape.

Most Popular Payment Methods in the U.S: Cards at the Top

Based on ECDB data, cards dominate the U.S. Commerce, with eWallets also being popular. Here are the top 5:

Visa, offered by 96.1% of online stores in our database, is the leading payment method in U.S. eCommerce.

Mastercard is a close second, available in 95.9% of online stores.

American Express, offered by 90.8% of online stores, ranks third in popularity.

Discover is fourth on our list, used by 81.9% of online stores.

PayPal, an eWallet platform, rounds out the list, utilized by 77% of online stores in the U.S.

Let's take a closer look at each payment method to better understand the market dynamics.

1. Visa

In the U.S. eCommerce payment space, Visa is highly favored, being utilized by 96.1% of online stores in our database. The company has greatly improved transaction security and efficiency through its advanced tokenization technology. By 2024, this tokenization had contributed to generating over US$40 billion in additional eCommerce revenue and preventing US$650 million in fraud globally.

Tokenization: This security process substitutes sensitive payment details, such as credit card numbers, with a unique identifier or "token." The token is used during transactions, rendering the actual payment data virtually inaccessible to hackers. Essentially, even if intercepted, the token is useless without the associated payment information, which is securely stored by the payment provider.

Visa’s dedication to innovation includes enhancing its infrastructure to promote a more seamless and secure transaction process. By replacing sensitive payment information with cryptographic keys, Visa's tokenization has made digital transactions safer and increased approval rates globally. At present, 29% of all Visa transactions utilize tokenization, demonstrating its widespread adoption.

Furthermore, Visa has improved the payment experience through its interoperability efforts, integrating various payment methods and networks. This ensures Visa remains a preferred choice for consumers and merchants alike, offering convenience and reliability in every transaction.

2. Mastercard

Mastercard is another major payment provider in the U.S. eCommerce market, with 95.9% of online stores accepting it. This broad acceptance stems from Mastercard’s innovative digital payment strategies, which prioritize security, convenience, and the latest technology.

Old Rivalry: The competition between Visa and Mastercard dates back to the 1950s. Visa originated in 1958 as the BankAmericard credit card program by Bank of America, in response to the rival Master Charge, now known as Mastercard.

Artificial intelligence (AI) is another area where Mastercard is making strides, transforming the payment process. AI is utilized to boost security, identify fraudulent activities, and tailor user experiences. In 2023, Mastercard's AI-driven systems protected more than 125 billion transactions.

Moreover, Mastercard is at the leading edge of the open banking trend. Collaborating with companies such as Nexi, Mastercard ensures secure, seamless account-based payments throughout Europe. This technology allows consumers to make payments directly from their bank accounts, enhancing both speed and security.

Mastercard's innovative approach also includes adopting new payment methods like contactless payments, biometrics, and digital currencies.

3. American Express

American Express, commonly known as Amex, is offered by 90.8% of U.S. online stores in our database. The high spending power of Amex cardholders makes it especially attractive to premium and high-end brands.

To protect customer data and prevent fraud, Amex employs advanced security measures such as encryption, tokenization, and multifactor authentication. The SafeKey 3D Secure feature further strengthens the security of online transactions.

Visa, Mastercard, and American Express are ranked 16th, 22nd, and 77th respectively, making these top eCommerce payment providers among the largest companies in the world by market cap.

American Express offers various financing options, including the "Plan It" feature, which allows cardholders to pay for purchases in installments. This can help increase sales by making expensive purchases more manageable.

Additionally, Amex provides detailed transaction reports and data insights, helping merchants better understand customer behavior and effectively tailor their marketing strategies.

4. Discover

Discover Card, introduced by Sears in 1985, quickly became notable for its cash-back rewards and lack of an annual fee. Today, Discover cards are issued by Discover Financial Services and are accepted at 81.9% of U.S. online stores in our database.

Discover’s business model is distinct from many other credit card brands, as it directly issues cards and manages its payment processing network. This approach allows Discover to earn interest income from its credit card customers and charge merchants payment processing fees.

One of Discover’s significant features is its generous cash-back rewards program. Cardholders can earn 5% cash back on rotating spending categories up to a quarterly maximum, and 1% on all other purchases. Additionally, Discover offers a unique first-year cash-back match, doubling all cash-back earned in the first year.

Discover has also made strides in the open banking movement, partnering with financial institutions to expand its reach and improve transaction security. This ensures that Discover remains a competitive choice for both consumers and merchants, providing robust features and reliable service.

5. PayPal

PayPal is a major player in U.S. eCommerce payments, utilized by 77% of online stores. Renowned for its user-friendliness and robust security, PayPal offers numerous features to enhance the shopping experience. It supports various payment methods, including credit cards, debit cards, and bank transfers, and integrates smoothly with leading eCommerce platforms such as Shopify and WooCommerce.

Security is paramount for PayPal, employing encryption and fraud detection tools to safeguard transactions. Additionally, PayPal offers buyer and seller protection policies to cover eligible transactions in cases of disputes or fraud. The platform's Buy Now, Pay Later option has gained popularity, attracting consumers looking for flexible payment options.

Operating in over 200 countries and supporting multiple currencies, PayPal helps businesses access a global audience, making it indispensable for international eCommerce.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

Top Online Payment Methods: Avoid Fraud, Boost Conversion

Payment options serve as a critical tool in tackling eCommerce fraud, but fraud prevention is just one among various considerations for merchants when selecting which payment methods to offer.

According to Cybersource's 2022 survey, 27% of merchants prioritize payment methods that lower fraud risk, such as delayed options like Buy Now, Pay Later. About 21% prefer methods that boost conversion rates, reflecting growing consumer digital payment use. Another 20% value immediate fund availability through eWallets, and an equal percentage focuses on reducing payment processing costs linked to credit cards and PayPal.

To encourage the use of their preferred methods, merchants deploy various strategies. Tied at 42% are advertising preferred options on websites and displaying them before reaching the payment selection stage. Both tactics aim to cut down on cart abandonment. Additional methods include offering customer incentives like discounts or cash-back rewards, cited by 40% of merchants. Surcharges for non-preferred methods are less common, used by only 28% of merchants, possibly due to regulatory constraints.

Visa & Mastercard: Steady Growth Amid Market Fluctuations

The U.S. companies Mastercard and Visa are well-known companies in the payment industry with electronic payment systems that enjoy great popularity. These players have shown robust growth, despite global crises and inflationary pressures.

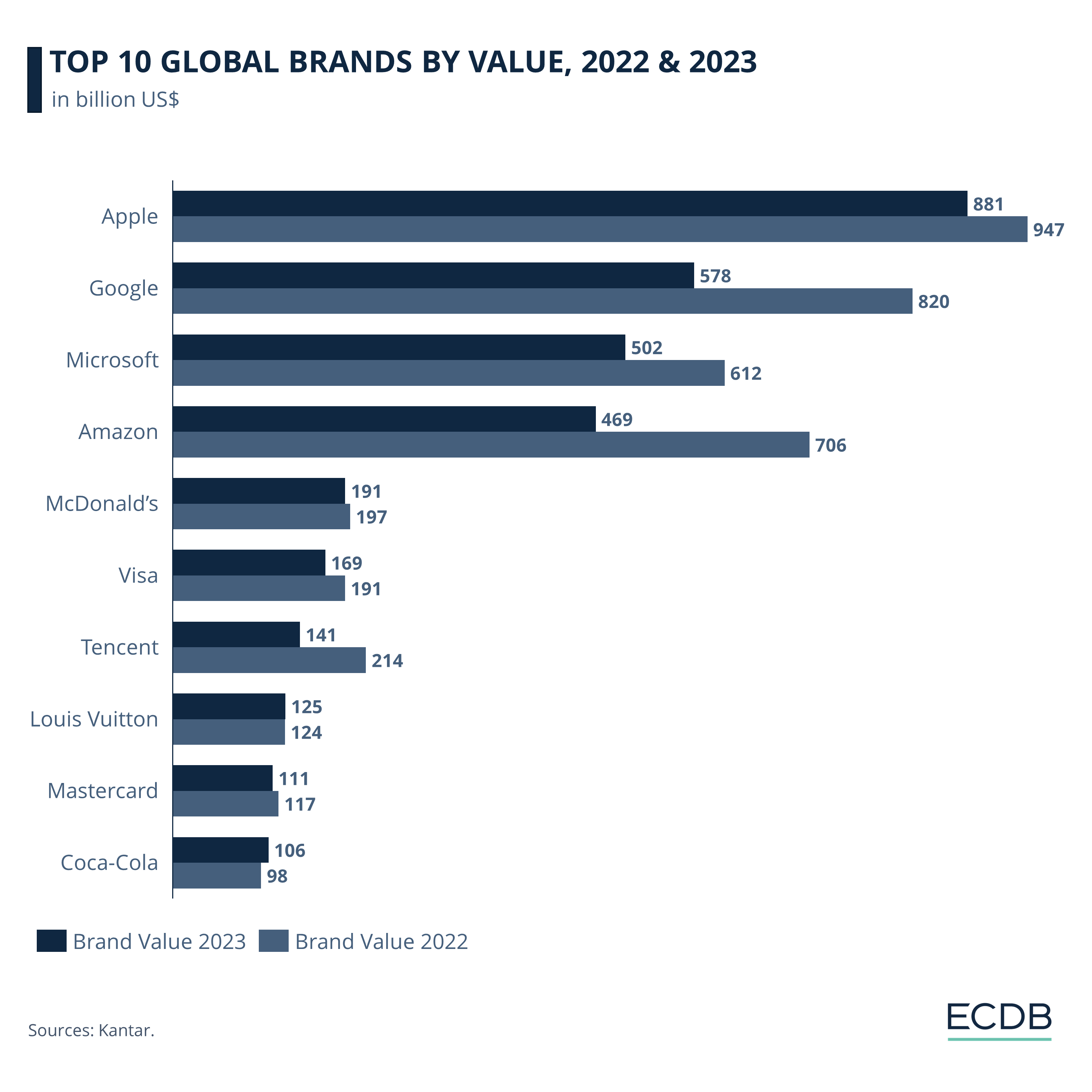

Last year, Mastercard saw an 18% growth in net revenues, highlighted by a 45% increase in cross-border volumes. Its net operating margins are nearing pre-Covid levels, standing two percentage points shy at 55.2% in 2022. The company’s brand value isn't lost on industry experts and analysts. It was listed as the ninth most valuable brand in the Kantar BrandZ Most Valuable Global Brands Report for 2023.

Just as established providers like Visa and Mastercard serve as the industry's bedrock, upstarts like PayPal and Apple Pay are the wind in its sails. As these eWallet services battle for market share in different regions, they highlight the complexity of consumer preferences and the challenges facing the eWallet industry.

PayPal's Popularity Challenges in Markets

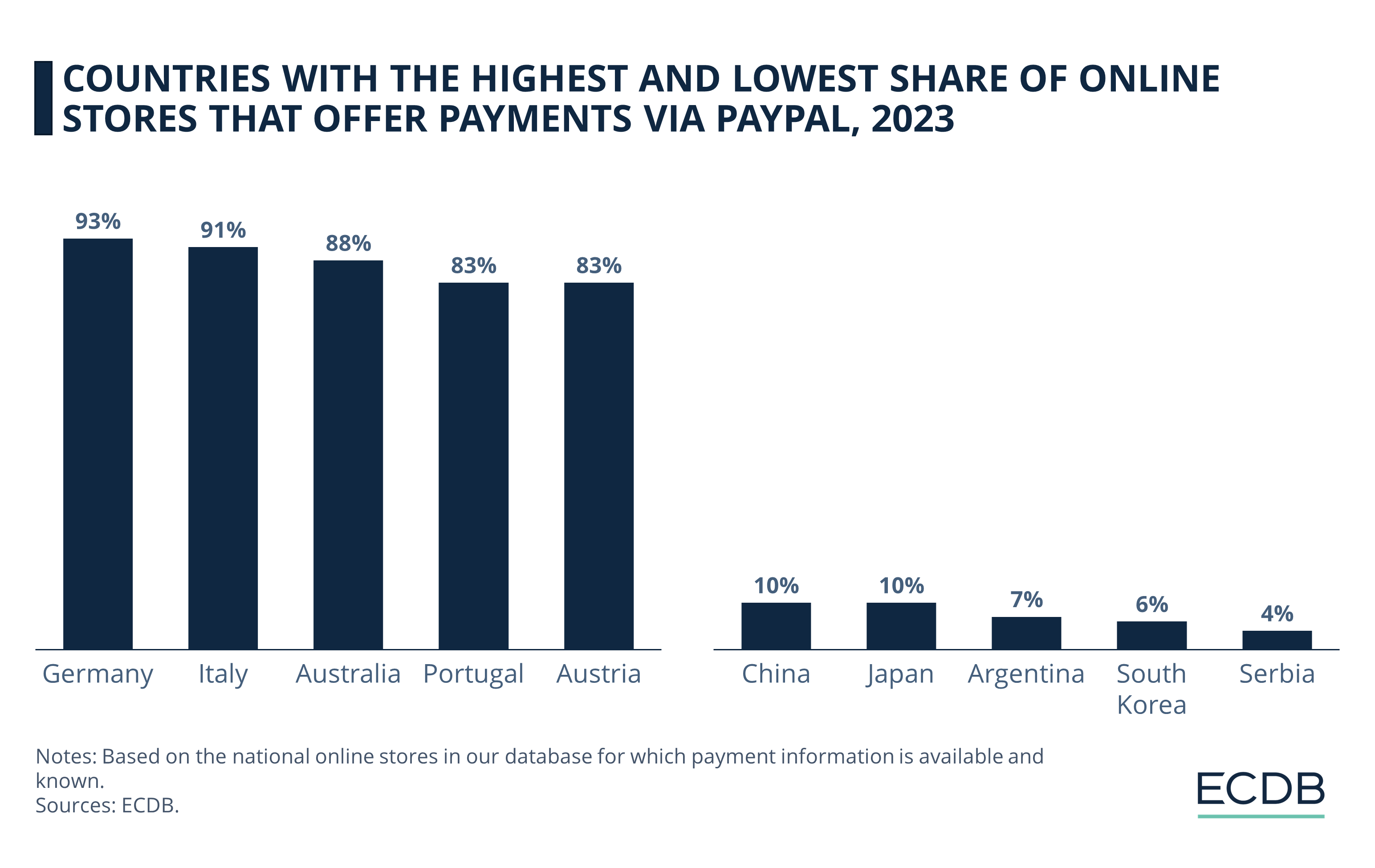

Amid shifting dynamics in the electronic payment sector, eWallets are contending for user preference across various geographies. While PayPal continues to be the dominant payment service in the United States – as well as European countries such as Germany, France, Italy, the United Kingdom – the company is not immune to market pressures. This year, the company’s share has dipped by 1 percentage point in the U.S. and a more notable 8 points in the UK.

Other significant players in the digital payments race, Apple Pay, Google Pay, and Amazon Pay are almost equally vying for market share in the U.S., capturing 34%, 31%, and 30% respectively, while PayPal stands at 81%.

Furthermore, Apple Pay has seen a surge in France—moving from a 12% to a 19% market share – while leading the UK with a 37% share. Amazon Pay takes the lead in Germany with a 28% share.

Differing demographic preferences are also affecting market dynamics. Baby boomers overwhelmingly favor PayPal, with 89% sticking to this service. Millennials lean toward Google Pay and Amazon Pay, while Gen Z is showing a strong affinity for Apple Pay and the least for PayPal.

However, PayPal faces limitations in markets like China and Japan, where its presence is notably lower. In these countries, as well as in Argentina, South Korea, and Serbia, PayPal's expansion is inhibited by the prevalent use of cash and strong preferences for indigenous platforms.

Most Popular Payment Methods in the U.S:

Closing Thoughts

The growing diversity of payment methods is a positive trend for e-commerce. It shows that retailers are listening to their customers and offering them a variety of options to make it easy and convenient to shop online.

At the same time, it is probable that the preference towards card payments will remain as presented, while the popularity of digital and online purchase methods is expected to continue to grow.

Sources: Visa: 1, 2, Mastercard: 1, 2, 3, 4, PayU Global, Adyen, Amex, Stripe, The Paypers, CompaniesMarketCap, Statista: 1, 2, 3, 4, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics