Payment Option Strategies: Balancing Fraud Prevention and Conversion Rates

May 26, 2023

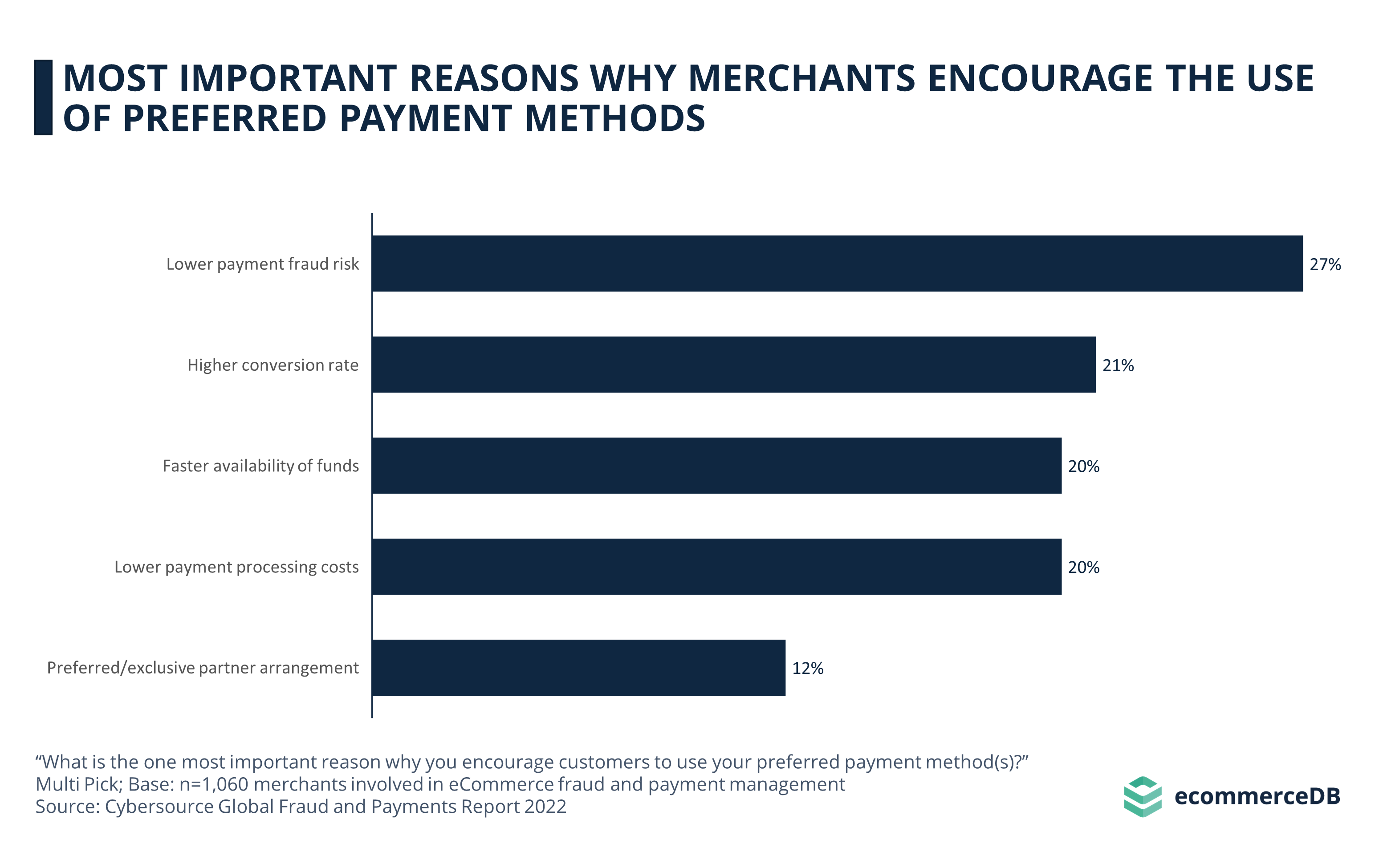

Payment options play an important role in preventing eCommerce payment fraud, but fraud is not the only reason merchants have their preferred payment methods. Cybersource’s 2022 Global Fraud and Payments survey asked merchants about their reasons for offering a particular set of payment options, while excluding other methods. The chart below shows the most common answers provided by merchants.

At 27%, reducing the risk of payment fraud is the top reason merchants choose to display certain payment methods while ignoring others. Because invoice payment and newer options such as Buy Now, Pay Later increase the risk of non-payment by encouraging delayed settlement, merchants may be reluctant to offer these types of payment options.

On the other hand, offering concessions to customers can lead to a higher conversion rate, an undeniable benefit for businesses looking to reduce their cart abandonment rates. As Covid-19 has increased the availability of digital payment methods in eCommerce, consumers have become accustomed to the increased convenience and larger choice of payment methods. A business that doesn’t meet consumer standards can easily be replaced by competitors. As a result, 21% of merchants cited a higher conversion rate as an important reason for their preferred payment methods.

Another concern for merchants is the availability of funds. Certain digital payment methods transfer funds in real-time, such as eWallets and mCommerce mobile payment options. Obviously, this is an advantage for merchants who prefer immediate payment over delayed transfers. For this reason, 20% of survey respondents cited faster availability of funds as a reason to offer their preferred payment methods.

A further 20% of merchants named lower payment processing costs. There are processing fees associated with certain types of online payments, such as credit cards, PayPal, and rewards or signature cards. The costs attached to popular online payment methods can reduce a business’s revenue, so setting a minimum price threshold for card payments can help mitigate the loss of funds in the payment process.

The least common reason, cited by 12% of merchants, is an exclusive partner arrangement. Agreements and partnerships between eCommerce channels can reduce payment processing costs and can thus help merchants offer a wider range of payment options to their customers, benefiting all parties involved.

Payment Methods Are Most Often Used to Prevent Fraud, but Customer Preferences Should Not Be Ignored

Payment fraud is a major concern for merchants, and reducing the risk of fraud is the top reason for choosing preferred payment methods.

However, merchants also consider other factors such as higher conversion rates, availability of funds, and lower payment processing costs when choosing their preferred payment options.

With the increasing availability of digital payment, businesses that fail to meet consumer standards may lose potential customers. As the eCommerce industry evolves, it is best for merchants to continually evaluate and update their payment strategies to stay competitive.

SOURCES:

Related insights

Article

eCommerce Market in Europe 2024: On Its Way to 1 Trillion Dollars

eCommerce Market in Europe 2024: On Its Way to 1 Trillion Dollars

Article

Cryptocurrencies in the United States: Revenue Development, Top Currencies, Acceptance in eCommerce

Cryptocurrencies in the United States: Revenue Development, Top Currencies, Acceptance in eCommerce

Article

Global PayPal Usage: Germany Leads in Online Store Acceptance

Global PayPal Usage: Germany Leads in Online Store Acceptance

Article

Tencent Holdings: Business Model, Strategy & Revenue Development

Tencent Holdings: Business Model, Strategy & Revenue Development

Article

Online Payment Methods in the U.S. in 2023: Challenges, Market Development & Trends

Online Payment Methods in the U.S. in 2023: Challenges, Market Development & Trends

Back to main topics