eCommerce: Payment

Cryptocurrencies in eCommerce: Revenue, Top Currencies, Acceptance in the U.S.

The cryptocurrencies market is predicted to reach US$56.7 billion in 2024. As an alternative to traditional money, is cryptocurrency on track to becoming a leading payment type in eCommerce? We use data on the U.S. market to answer this question.

Article by Nashra Fatima | August 19, 2024

Cryptocurrencies in eCommerce: Key Insights

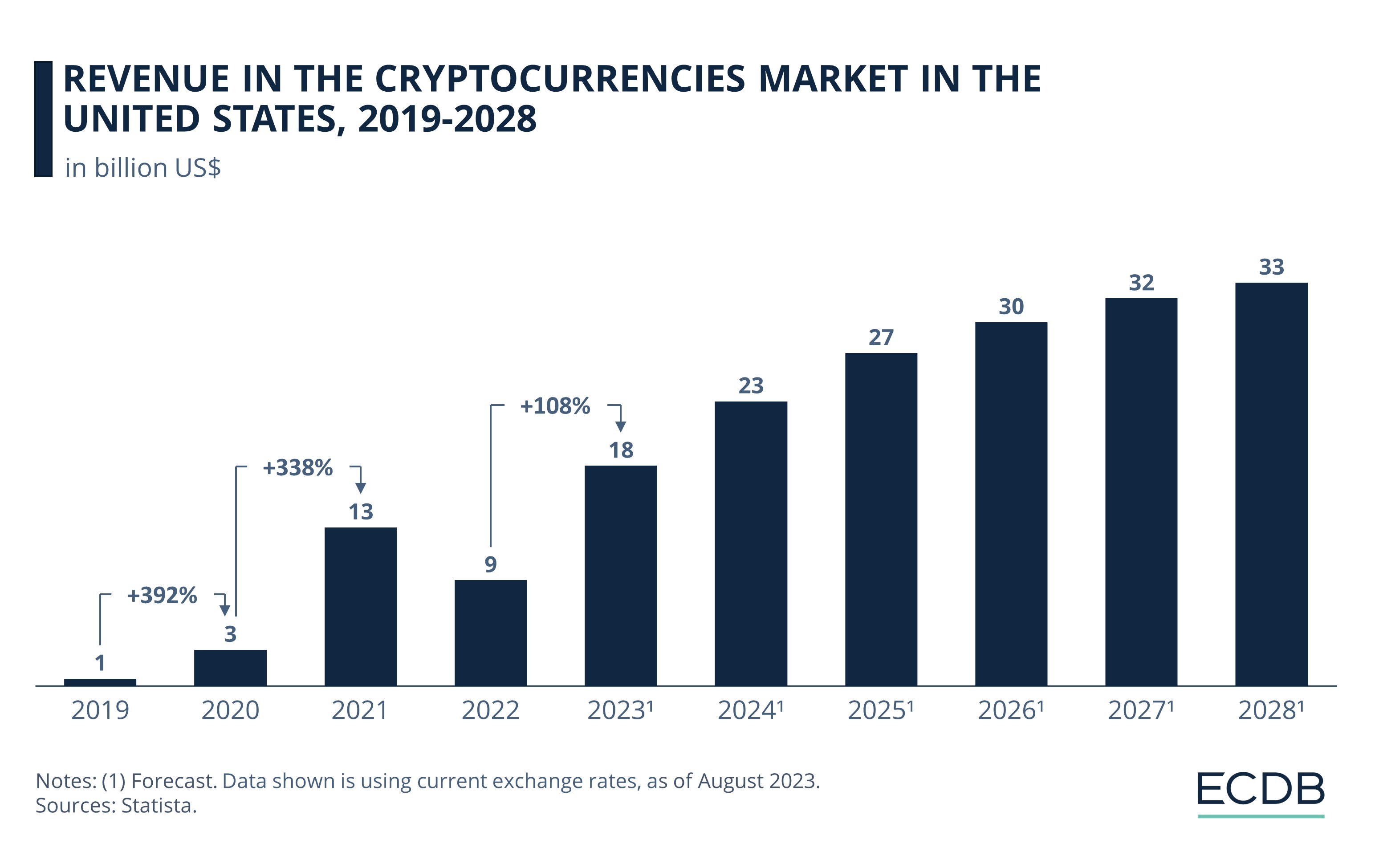

Revenue Growth in the United States: Revenues generated from cryptocurrency use in the U.S. are estimated to be US$18 billion in 2023. A projected annual growth rate (CAGR 2024-2028) of 9.1% puts the expected market size at US$33 billion by 2028.

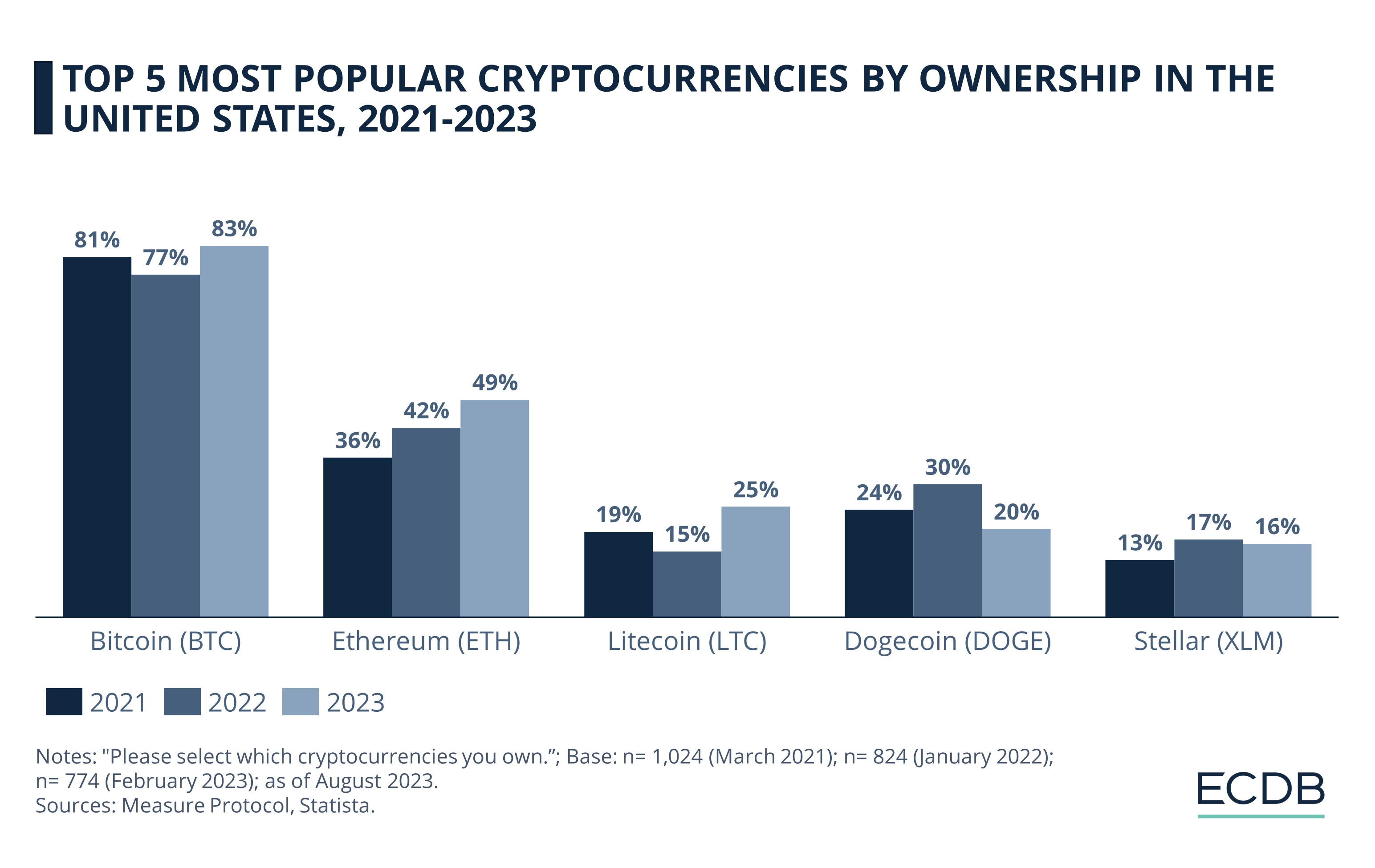

Leading Cryptocurrencies: Bitcoin is the top cryptocurrency in the U.S., owned by 83% of users in 2023. At second position but far behind is Ethereum, followed by Litecoin.

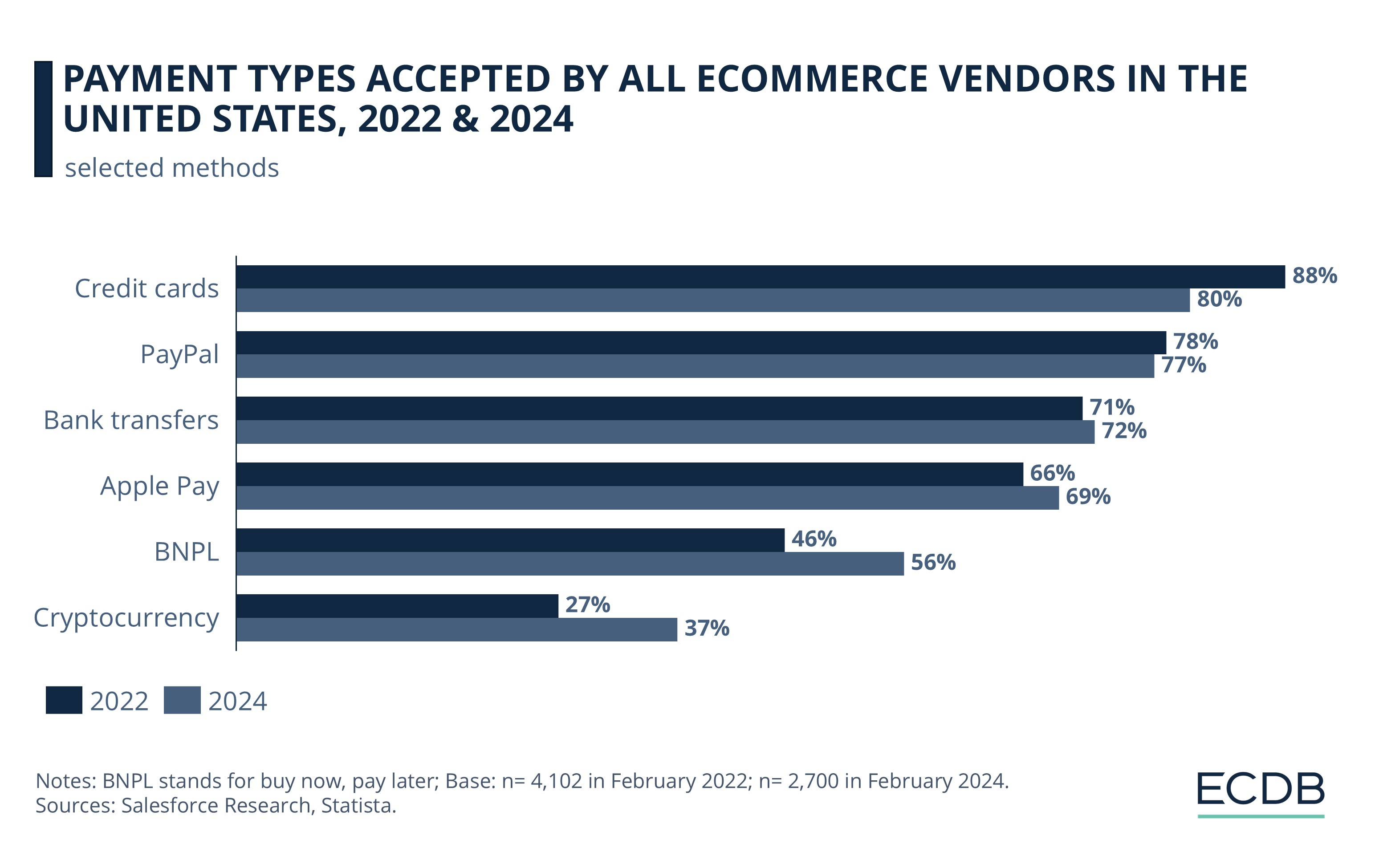

Acceptance in eCommerce: In 2024, 37% of all eCommerce vendors in the United States accept cryptocurrency as a payment method. This is an improvement of 10 percentage points from 2022.

Cryptocurrency recognition may be on the rise, but how it works in eCommerce remains unclear to many online shoppers and retailers.

Most users associate cryptocurrency with investment and savings. But among this technology’s diverse applications is its use in eCommerce payments.

We explain how cryptocurrencies are used in eCommerce, their benefits and limitations. The United States is the world’s largest market for cryptocurrency. We use it as a case study to assess how cryptocurrency’s revenue has developed, the top currencies, and crypto’s acceptance in eCommerce.

How Is Cryptocurrency Used in eCommerce?

Cryptocurrency is a decentralized digital currency, which lies outside of direct government control. It is being adopted in various industries, from banking to healthcare to eCommerce.

Online shoppers who want to use cryptocurrencies must first set up a crypto wallet, which are apps for storing virtual coins. Examples of wallets are Coinbase and Trust.

eCommerce retailers that directly accept cryptocurrency may integrate a third-party crypto payment gateway like BitPay. A button saying “Pay with Crypto” directs shoppers to checkout, where they can view the total amount in cryptocurrency and complete the transaction using the coins in their wallet.

Alternatively, shoppers can use cryptocurrency debit cards. Payment through them works exactly like bank-issued credit or debit cards – only, they are topped with a cryptocurrency rather than fiat money.

Benefits of Using Cryptocurrencies

In eCommerce, the use of cryptocurrencies offers benefits such as:

Cross-border transactions: Crypto payments allow cross-border transactions without currency conversion and remove third-party intermediaries like banks.

Speed: Payment through cryptocurrencies is faster. They have shorter processing times, unlike traditional methods like credit cards or bank transfers.

Low transaction fees: Cryptocurrencies incur low to no transaction fees. This could motivate small and medium-sized vendors to accept it as a payment type.

Limits fraud: The use of blockchain technology ensures that crypto transactions are transparent and hard to dispute, thus minimizing fraudulent chargebacks.

Secure: Online shoppers are able to carry out purchases anonymously and without revealing personal information. It also reduces the risk of cyberattacks.

Drawbacks of Using Cryptocurrencies

Cryptocurrency usage comes with some limitations:

Instability: The cryptocurrency market is unstable. The price volatility can cause cash-flow problems for retailers, and they may end up insisting on established payment types.

Fluctuating value: The value of different cryptocurrencies can fluctuate wildly, which makes accepting one coin over another risky for businesses.

Low awareness: Recognition of crypto among online shoppers is limited. They do not fully understand it, and thus tend to distrust it as a payment method.

No buyer protection: Cryptocurrencies lack buyer protection, which means online shoppers cannot reverse a transaction or get refunds. This is not the case for methods like credit cards or eWallets.

These reasons contribute to lower acceptance rates of cryptocurrency in eCommerce, where it lags dominant payment methods, both traditional ones like cards and newer ones like digital wallets.

Cryptocurrencies in the United States: Revenue Development from 2019 to 2028

The United States is globally the biggest market for cryptocurrencies by revenue. In 2024, its value is estimated to be nearly ten times that of the UK – crypto’s second largest market.

Revenue from cryptocurrency refers to the income generated from the usage of cryptocurrencies in activities including payment for goods and services, investment, and trading in cryptocurrency (buying or selling it) on an online exchange market, among others.

Revenues in the U.S. cryptocurrency market skyrocketed between 2019 and 2021, with annual growth of more than 300%. The demand peaked during the pandemic, when cryptocurrencies became attractive as a hedge against inflation, trade restrictions, and political instability.

A decline occurred in 2022, with revenue falling to US$9 billion from US$13 billion in the previous year. This is the time when the Federal Reserve increased interest rates in response to high inflation. These developments cast a doubt on crypto’s ability to maintain its value and act as a shield against inflation, as it became clear that cryptocurrencies, too, are subject to macroeconomic influence.

In 2023, revenues from cryptocurrency are projected to reach US$18 billion in the U.S. This yearly growth of more than 100% comes after a decline seen in 2022, when the market shrunk by 33%.

Going forward, the cryptocurrency market size is expected to grow at a compound annual growth rate of 9.1% and reach a total amount of US$33 billion by 2028.

In addition to market size, in just a two-year period, the number of cryptocurrency users in the U.S. also multiplied rapidly: from 9.7 million in 2020 to 51 million in 2022.

A survey also found that, in 2023, 20% of the U.S. population owned a cryptocurrency, 76% of whom agreed that cryptocurrency and blockchain technology (on which cryptocurrency is built) are the future.

However, the expanding user base does not translate to even market growth. As the data illustrates, the cryptocurrency market is highly volatile and vulnerable to external events. Such intense market swings happen because cryptocurrency is still a new digital asset. While it works as both a virtual currency and an investment, its long-term utility remains uncertain. This causes investor sentiment to fluctuate, which ends up impacting its market worth.

Factors likely to bolster cryptocurrency’s growth include advancement in the blockchain technology, increasing interest in decentralized finance (DeFi) which seeks to remove centralized institutions and third parties from financial transactions, and the rising popularity of virtual currencies like Bitcoin.

Top Cryptocurrencies in the U.S: Bitcoin Leads, Followed by Ethereum

While many cryptocurrencies are available in the market, only a handful rise to the top from an ownership perspective. Moreover, each cryptocurrency’s ownership rate has seen noticeable changes in a short period, underscoring the unstable nature of the crypto market.

The top-owned cryptocurrencies in the United States in 2023 are:

Bitcoin: By a large margin, the top-owned cryptocurrency in the United States is Bitcoin. 83% of people who are crypto owners own it in 2023. Its ownership, like the cryptocurrency market, has seen variations: the 2023 surge comes after a 2022 decline.

Ethereum: At 49%, the second-most owned cryptocurrency is Ethereum. The adoption rate for this currency has been on an upward trend since 2021, with no dips recorded.

Litecoin: As the third-most owned cryptocurrency, Litecoin is owned by a quarter of all crypto owners in the U.S. Its ownership rate has improved by 10 percentage points compared to 2022 (15%).

Other cryptocurrencies are comparatively less popular and have also seen uneven adoption rates. For instance, Dogecoin, ranked fourth, is owned by just 20% of respondents in 2023 compared to 30% in 2021.

Bitcoin, the top-owned currency, is also the oldest. It has a maximum supply of 21 million coins, is resistant to government control, and has garnered credibility. With a large user base, it remains one of the most widely accepted cryptocurrencies globally, particularly in eCommerce.

Well-known names like PayPal, Shopify, Etsy, and BigCommerce now have cryptocurrency payment integrations. In fact, the increasing adoption of cryptocurrencies not only by users but also businesses is a key factor driving its growth.

Cryptocurrency in eCommerce: 37% of U.S. Merchants Accept It in 2024

eCommerce merchants in the United States are diversifying the payment types that they accept. Alongside credit cards and eWallets, cryptocurrencies are also being offered by a small but growing number of vendors in the U.S.

In 2024, 37% of companies accept cryptocurrencies as payment for all types of eCommerce. This is a notable improvement from just two years ago, when a smaller 27% accepted payment in crypto.

The share of businesses that offer credit cards has declined since 2022 but is still the largest at 80%.

PayPal and Apple Pay have seen only moderate changes in their acceptance rates. This is likely because these digital wallets have already established themselves in the market, and their room for growth is not as vast as the newer methods.

Cryptocurrency and BNPL (buy now, pay later), both comparatively new, have seen greater increase in acceptance by eCommerce vendors, with both their acceptance rates rising by 10 percentage points in a two-year period.

While cryptocurrency usage in U.S. eCommerce has increased in recent years and may expand further, its growth largely depends on consumer demand. Overall, its adoption in eCommerce is unlikely to be rapid enough to overtake dominant payment types like cards and eWallets in the near future.

Closing Remarks

After two consecutive years of increase, the cryptocurrencies market in the United States plummeted in 2022. Despite growth projections for 2023 and onwards, it is predicted to remain uncertain. The share of businesses that accept cryptocurrencies for eCommerce payments has grown in past years but is still low compared to other payment methods.

2023 was marked by lawsuits and penalties against crypto companies in the U.S. As the country pushes for formal legislation frameworks to monitor digital currencies, the developments stand to impact the adoption of cryptocurrencies in the U.S. eCommerce market.

Measures to regulate crypto were already introduced in Europe in May 2023, when the EU Parliament passed the world’s first comprehensive regulatory framework called Markets in Crypto-Assets Regulation (MiCA). As the global impetus for regulating cryptocurrency continues, its market as well as use in worldwide eCommerce will likely remain irregular.

Sources: Statista: 1, 2; Coinbase; CLS Blue Sky

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Deep Dive

Klarna’s Impact Is Strongest in Sweden and Norway

Klarna’s Impact Is Strongest in Sweden and Norway

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Back to main topics