eCommerce: Holiday Season Trends

Holiday Spending in the United States in 2023

Explore how holiday spending in 2023 looks like in the United States, through our latest analysis.

Article by Cihan Uzunoglu | November 14, 2023Download

Coming soon

Share

Holiday Spending in the United States in 2023: Key Insights

In 2023, consumers are more strategic in online shopping, waiting for deals, with fewer gifts purchased on average.

Online shopping leads in U.S. holiday spending, but in-store purchases are rising, indicating a balance in preferences. In addition, the frequency of store visits and Buy Online, Pick-up in Store (BOPIS) usage is declining.

Free shipping greatly influences online shopping; 80% of consumers aim to qualify for it. Unexpected shipping fees cause 60% to abandon carts, challenging retailers to balance costs and customer expectations.

Social media's role in holiday shopping is stable at 34%, with a rising trend in direct purchases, indicating its growing integration in eCommerce.

As the festive season approaches, one question looms large: How are Americans planning their holiday spending in 2023? This period, rich in traditions and gifting, offers a unique window into the evolving habits and preferences of consumers. But what lies beneath the surface of these holiday shopping patterns? How are the dynamics of online and physical store purchases changing, and what does this mean for retailers and consumers alike?

In our previous article on Black Friday 2023, we touched upon the evolution of this mega shopping event from primarily in-store frenzy to a significant online phenomenon, highlighting how the pandemic has accelerated online sales and shaped consumer preferences towards digital shopping platforms.

As for the holiday season in the U.S., the Holiday Retail Survey 2023 published by Deloitte provides a valuable outlook, detailing consumer behavior and changing trends. Though the study focuses on both online and offline data, this article will talk about the online aspects of the report.

Majority of Consumers Wait for Better Deals in Holiday Season Purchases

Navigating through the ebb and flow of consumer preferences, let’s see what the report reveals in terms of consumer spending and the impact of worldwide inflation.

In the year 2023, more than half of the surveyed consumers, precisely 54%, reported a strategy of populating their wish lists or online shopping carts and patiently waiting for deals. This marks a noticeable increase compared to the 48% who employed this tactic in the preceding year.

Moreover, the survey reveals a subtle yet telling shift in purchasing behavior. The average count of gifts or gift cards procured by consumers dipped to 8 in 2023, a slight decrease from the previous year's average of 9.

Share of In-Store Holiday Spending Reaches Pre-Pandemic Levels

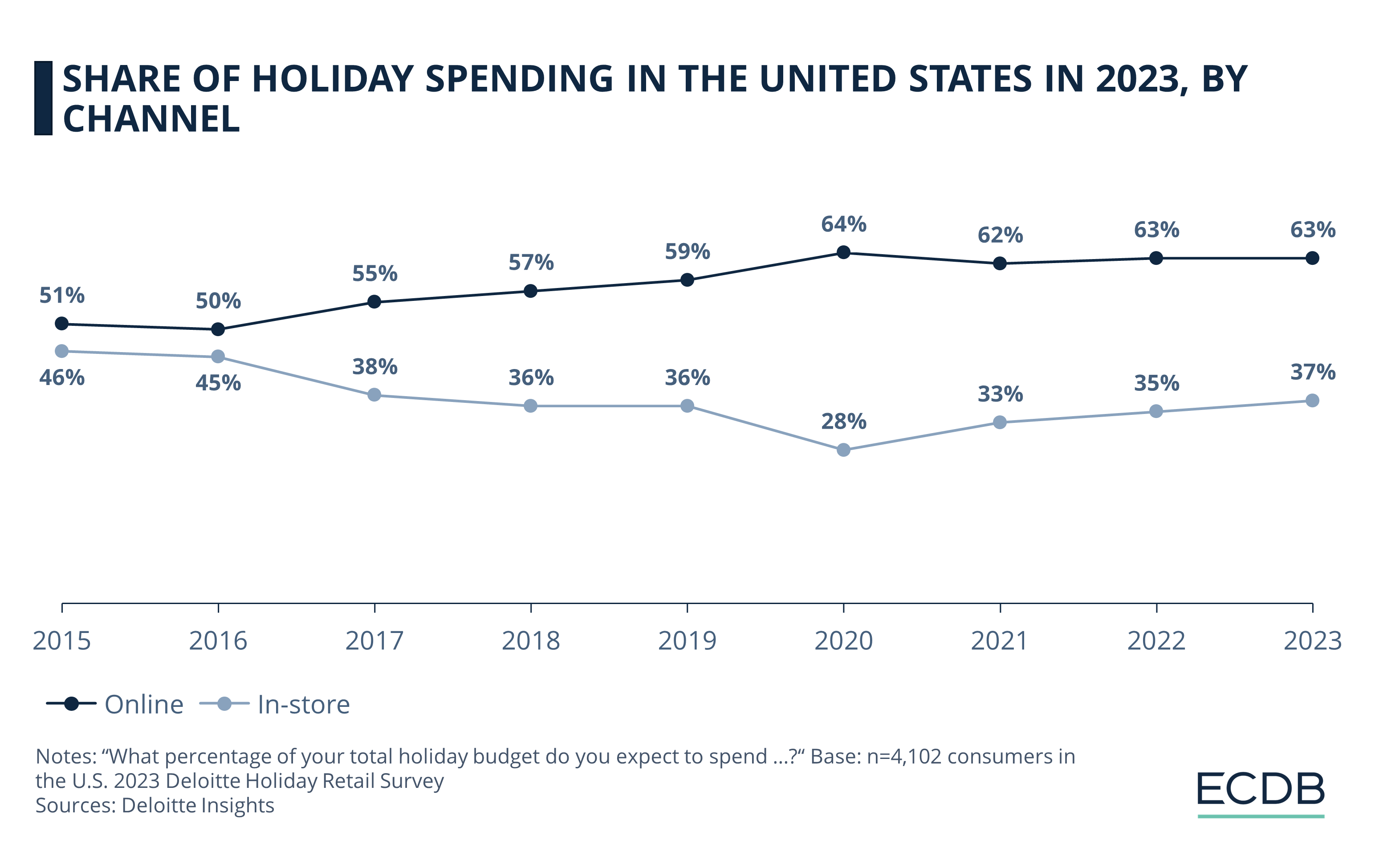

In evaluating the allocation of holiday spending across different shopping avenues in the United States, a clear shift can be seen. In 2015, a slight majority of 51% of holiday expenditures occurred online compared to 46% in physical stores. This trend toward digital shopping gained momentum, with online figures reaching 59% by 2019 and peaking at 64% in the pandemic-stricken year of 2020, while in-store shopping dipped to 28%.

The subsequent period, however, indicates a stabilizing pattern. By 2021, online spending slightly receded to 62%, and in-store spending saw a modest rebound to 33%. This adjustment persisted into 2022, where online purchases accounted for 63% and physical stores captured 35% of holiday expenditures.

As of 2023, the distribution has remained consistent with the previous year, with online spending holding at 63% and in-store purchases seeing a slight uptick to 37%. This data suggests a balancing out of consumer preferences, with a substantial segment continuing to favor the convenience of online shopping, while a growing proportion opts for the in-person retail experience.

Number of Physical Stores Visited During Holiday Season Decreases

Although the share of holiday spend through in-store channels increased this year, the same cannot be said for the number of physical stores consumers expect to visit this holiday season. While the average number was 5.9 last year, this year’s survey revealed a lower number of 4.2.

On another note, the inclination towards BOPIS has seen a downturn, with only 28% of consumers planning to utilize this approach for gift acquisitions this year, a decrease from 35% in 2022.

Most Consumers Seek Free Shipping for Holiday Season Purchases

It’s no secret that consumers like free shipping when they shop online. As per the Deloitte survey, 80% of online shoppers are willing to reach a minimum purchase amount to secure free shipping, underscoring the value consumers place on this perk, often viewing it as a deciding factor in their purchasing decisions.

Interestingly, the tolerance for hidden shipping costs is notably low, with 60% of consumers likely to abandon their shopping carts upon encountering unexpected shipping fees at checkout. This highlights a critical point for retailers — transparency in shipping costs is not just a courtesy, but a necessity to maintain customer loyalty.

The willingness of consumers to spend for free shipping varies significantly. Consumers show varying thresholds for the amount they are willing to spend to qualify for free shipping. This threshold correlates with their income levels. For instance, those earning below US$50,000 annually are willing to spend up to US$32, while those with incomes between US$50,000 and US$99,000 are comfortable with a US$38 threshold. Higher income brackets, such as those earning between US$100,000 and US$199,000, and over US$200,000, are willing to spend US$46 and US$53, respectively, to avail free shipping.

On the flip side, the average minimum purchase requirement set by retailers for free shipping in 2023 stands at US$64. This figure has seen an upward trend from US$52 in 2019, reflecting either an adjustment to increased logistical costs or a strategic move to boost average order values. This gap between what consumers expect and what retailers offer presents a delicate balancing act for businesses.

Finding the right balance between shipping costs and customer satisfaction is crucial, as it not only influences immediate sales but also impacts long-term customer loyalty and brand perception.

Social Commerce for Holiday Season is on the Rise

The utilization of social media in the context of holiday shopping presents a stable landscape, with usage rates holding steady at 34%, mirroring last year's figures. This plateau follows a significant surge during the pandemic years, reflecting a normalization of consumer habits post-pandemic. Despite this leveling off, social media continues to play a crucial role in holiday shopping, primarily as a source of research and inspiration for potential purchases.

Revealed by Deloitte’s survey data, in 2019, a modest 7% of consumers used social platforms for actual purchases during holiday season. The pandemic years saw a rise in this behavior, with the figure climbing to 9% in 2020 and slightly receding to 8% the following year. A notable uptick occurred in the subsequent period, with 12% of consumers embracing social media as a shopping channel in both the last year and 2023.

This stability in social media usage and the gradual increase in its role as a direct purchasing platform highlight an optimistic outlook for social commerce. Despite the stabilization in usage rates, the growing percentage of consumers turning to these platforms for purchases suggests a deepening integration of social media in the eCommerce ecosystem.

Sources: Deloitte, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics