eCommerce: Marketplaces

Kaufland Increases Fees for Marketplaces and Opens New Domains

Kaufland is one of Germany's physical retail networks with a notable online presence. Its recent expansion into European markets mirrors similar ventures by other stores. Here is how the changes in sales commissions relate and what Kaufland's product mix has to do with it.

Article by Nadine Koutsou-Wehling | April 24, 2024

Kaufland Marketplaces: Key Insights

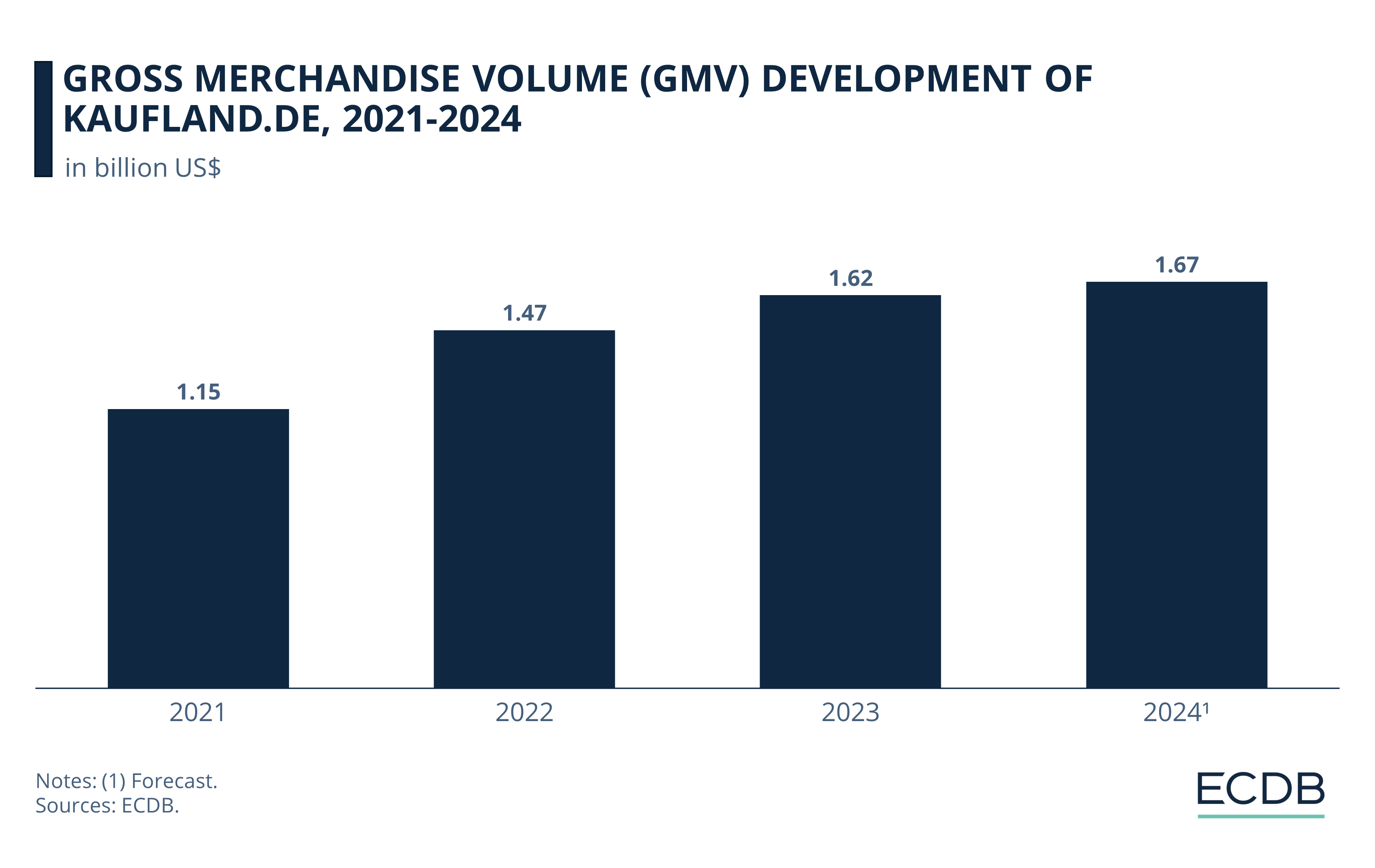

Kaufland's GMV Growth: After acquiring competitor real.de's online store in 2021, Kaufland built on existing infrastructure and traffic to generate consistent growth projected through 2024.

Online Development Underway: Kaufland launched its Czech and Slovak domains in 2023 and opens Austrian and Polish online markets in 2024. Sales commission fee increases reflect the retailer's confidence in the success of these efforts.

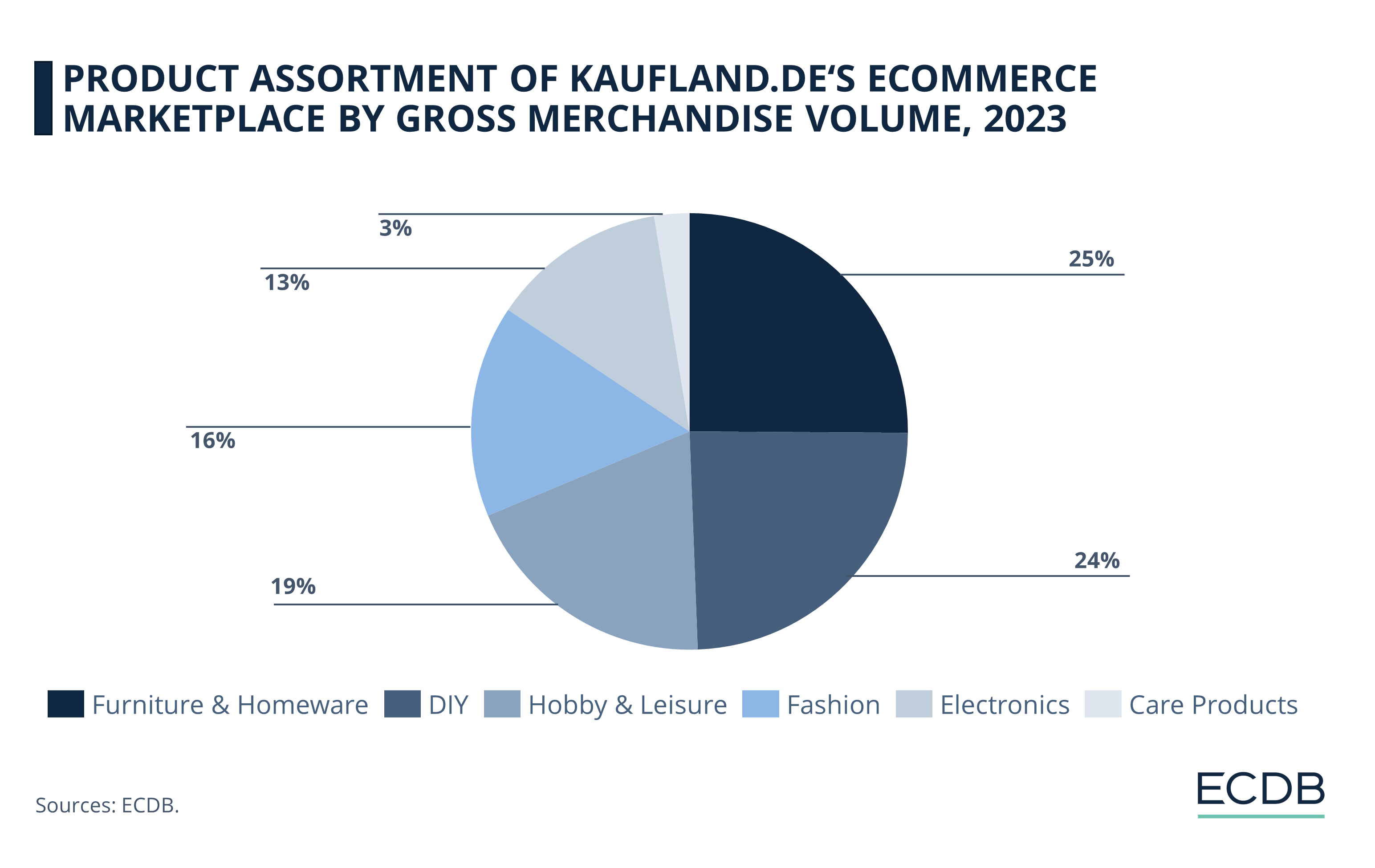

Product Range on ECDB: Using ECDB data, we present Kaufland's product mix and how it relates to seller success.

Kaufland.de is Germany’s 6th largest eCommerce marketplace by GMV, behind Media Markt and ahead of About You.

A subsidiary of the Schwarz Group, a food retail conglomerate that also owns grocery chain Lidl, Kaufland is currently expanding its offline and online business in Europe. The marketplace's popularity is reflected in the increase in sales commissions for several categories sold on kaufland.de.

Check below to see the product range available at Kaufland.

GMV on Kaufland.de: Surpassing US$1.6 Billion in 2023

Retail network Kaufland acquired its online business from competitor real.de in 2021. Using pre-existing infrastructure, kaufland.de’s achieved a transactional value of US$1.15 billion GMV in its first year.

Marketplace activity grew in the subsequent years, and in 2023, US$1.62 billion worth of products were sold on kaufland.de. ECDB forecast expects steady progress this year.

Kaufland 2024: Launches Austrian and Polish Domains

Kaufland operates a network of physical retail locations in Germany and Europe. Following the example of its sister company Lidl, the parent company Schwarz Group plans to expand its retail network into various European countries.

In 2023, the domains kaufland.cz and kaufland.sk launched, followed this year by Austria and Poland. As an exception, Austria does not have any physical Kaufland stores and will thus be an online-only market for the retailer.

Sales Commission Fees Up for Several Product Categories

Starting in May 2024, Kaufland has announced changes in sales commissions for some of the product categories sold on its respective national marketplaces. Changes to the fees include household appliances (7% to 13%), garden supplies and fashion (13% to 14%), and other 15% to 14% decreases such as for pet supplies.

Evidently, Kaufland is expecting corresponding sales increases/decreases in these categories with new market launches this year. In Poland, however, a preliminary commission catalog has been launched to serve new customers who expect to find low prices and high availability at kaufland.pl.

The Product Mix of Kaufland.de: Furniture & DIY

The ECDB Marketplace Page for kaufland.de shows that a basic merchant account costs €39.95 per month, excluding a link to own shop. Seller success on Kaufland depends on factors like high search volume for their product, low sales commission fees, and a small number of similar products.

Furniture & Home is the top-selling product category on kaufland.de, along with DIY, with GMV shares of 25% and 24%, respectively.

Hobby & Leisure (19%), Fashion (16%) and Electronics (13%) contribute another substantial portion of transactions. Care Products are relatively niche, with 3%.

Kaufland Marketplaces: Wrap-Up

Kaufland’s expansion into European markets follows the development of larger stores, like Otto and Zalando. A large number (>5,000) of sellers meets a growing audience, and Kaufland is an alternative to larger marketplaces, able to compete in price but not always in quality.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Top Categories for Online Shopping in Spain: Food and Beverages Lead

Top Categories for Online Shopping in Spain: Food and Beverages Lead

Deep Dive

Top Amazon Competitors in the UK: GMV, Market Share & Growth

Top Amazon Competitors in the UK: GMV, Market Share & Growth

Deep Dive

eCommerce in Australia: Market Expected to Hit US$75.2 Billion by 2028

eCommerce in Australia: Market Expected to Hit US$75.2 Billion by 2028

Deep Dive

Secondhand Online Market in Europe 2024: Marketplaces, Stores & Product Categories

Secondhand Online Market in Europe 2024: Marketplaces, Stores & Product Categories

Deep Dive

Which Product Categories Are Growing The Fastest in Global eCommerce?

Which Product Categories Are Growing The Fastest in Global eCommerce?

Back to main topics