eCommerce in Australia

eCommerce in Australia: Market Expected to Hit US$75.2 Billion by 2028

After economic booms and busts, the Australian eCommerce market is starting a new upward trajectory and is projected to reach a new high of US$58.2 billion in revenues by 2025. Find out about the latest industry developments in Australia and who the leading online stores are.

Article by Yokany Oliveira | July 30, 2024Download

Coming soon

Share

eCommerce in Australia: Key Insights

Pandemic gains and losses: Online delivery services and eCommerce played a vital role in boosting sales and helping businesses recover during the Covid-19 pandemic in Australia.

The Largest Categories: The top online shopping categories in Australia are Electronics (22.8%), Fashion (21.7%), Grocery (14.7%), Hobby & Leisure (13.9%), Furniture & Homeware (13.8%), DIY (7.4%), and Care Products (5.7%).

Australian eCommerce Sector Set to Grow: Australia's eCommerce market is expected to grow at a compound annual growth rate (CAGR) of 9.1%, reaching a market volume of US$75.2 billion by 2028.

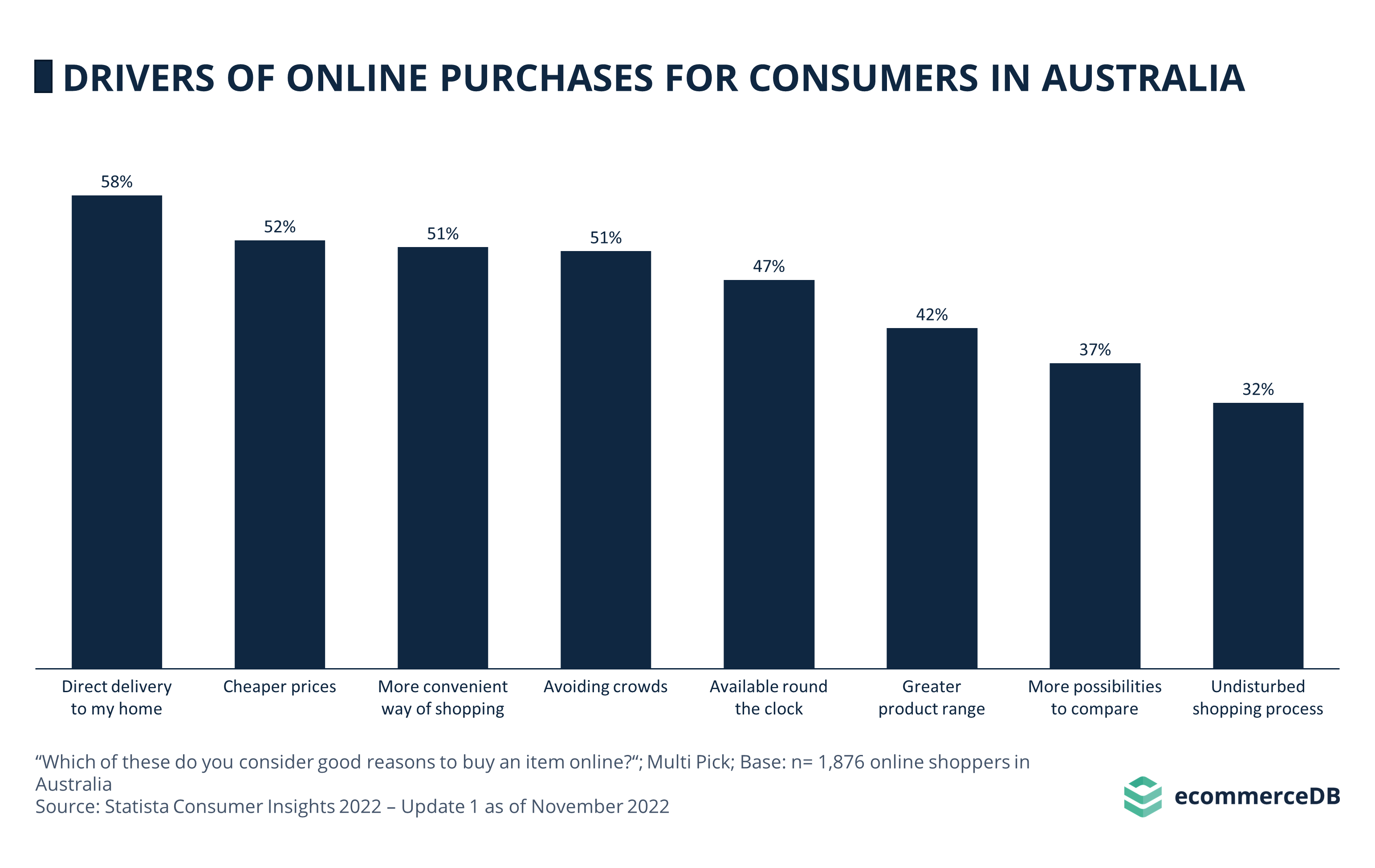

Consumer Motivations: Convenience, lower prices, and free delivery are the top three motivations driving Australian consumers to shop online, emphasizing the importance of multichannel service options.

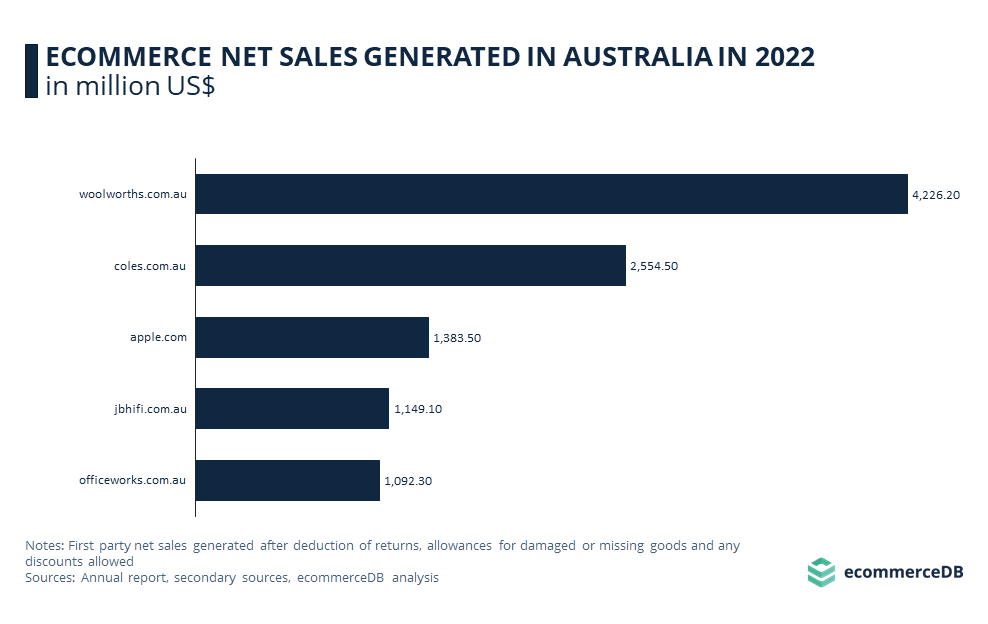

Top Players' Secret to Success: The success of major players like Woolworths, Coles, Apple, JB HiFi, and Officeworks can be attributed to their consumer-centric strategies, investments in digital platforms, and a multichannel approach that includes direct-to-consumer (D2C) sales.

The Australian eCommerce sector counts as the twelfth largest market worldwide, just behind Canada. Australia's economy took a few hits during the COVID-19 pandemic, although as in so many countries, the eCommerce sector benefited from the coronavirus years.

Online delivery services became the lifeline for businesses to boost sales and recover. For the consumer, buying groceries online, home entertainment solutions such as a new TV or taking up new hobbies were all in the spotlight during the peak of the pandemic.

Looking at our markets section, the top five players by net sales in 2023, namely Woolworths, Coles, Apple, Amazon, and Shein, cater to the needs and wants of the Australian consumer.

eCommerce in Australia: Woolworths & Coles Lead the Market

Before diving into the market, let's take a look at the top 5 online stores in Australia by eCommerce net sales in 2023:

1. Woolworths.com.au

Woolworths, which has been in the retail business since 1924, is the leading player with a revenue of US$3.5 billion in 2023. Despite its scale advantage, the retailer has maintained a competitive edge by implementing consumer-centric strategies and investing in physical store upgrades. In addition, investments in its digital platforms over the years, such as the Woolworths App and Wpay, have led to a standalone payments business and one of the largest card payment processors in Australia. They were launched in 2011 and 2021 respectively.

In September 2021, the multichannel retailer also launched the Everyday Market, making more products available to consumers and expanding beyond Food & Personal Care essentials into other areas such as Home Appliances and Consumer Electronics among others. While weekly store visits return to pre-pandemic levels, engagement with their online store continues to grow exponentially.

2. Coles.com.au

In second place follows the Australian domain coles.com.au of the Coles Supermarkets Australia Pty., Ltd. In 2023 the online store achieved a net sale of US$1.9 billion – 54% of the leading online store, Woolworth. The nationally focused online retailer generated its eCommerce net sales to 69% in the grocery category.

The grocery chain announced earlier this year that it is working on its relationship with customers through the use of AI. Among other things, AI is intended to help Coles provide its customers with a more personalized shopping experience.

3. Shein.com

Next up is fast-fashion giant shein.com, which recorded an eCommerce net sale of US$1.5 billion in Australia in 2023. This sum represents 4% of its global revenue (US$36.5 billion) in the same year. Overall, the focus of the eCommerce player lies on fashion at 77%, with 56% of the focus in this category of mode on clothing.

Shein is often criticized for its ultra-fast-fashion business model, whereby fashion is produced fast and cheaply under questionable conditions and then sold at knock-down prices around the world. But not only has the company been criticized for this sales model and its working conditions, it has also been criticized for its environmental impact, prompting France, among others, to take action.

4. Apple.com

Fourth on the list is the electronics specialist apple.com has been in the Australian market for 41 years. The California-based company generated eCommerce net sales of US$1.3 billion in 2023 – merely US$175 million less than third-placed fashion retailer Shein. With 2.7% of its net sales generated in Australia, the country is Apple's sixth most important eCommerce region worldwide.

In general, 2023 has been a rough year for Apple, with its YoY-growth shrinking by 16.6%. Reasons for the latest downward trend are among others, sales problems in China and disappointments of the latest product releases. Apple hopes that developments like the release of Vision Pro will turn things around this year.

5. Amazon.com.au

The ranking is completed by another U.S. giant: Amazon.com.au. The Australian domain, operated by Amazon Commercial Services Pty., Ltd. generated in 2023 an eCommerce net sales of US$1.1 billion. The company contributes 1.1% to the ultimate parent company, Amazon.com, Inc.

Amazon recently struck a new deal with part of the Australian government. Australia's national security agency is working to move top-secret intelligence data to a new cloud service run by Amazon Web Services. The deal will cost about US$1.3 billion, according to the Financial Times.

What Are the Main Categories for Online Shopping in Australia?

We distinguish a total of seven main categories, which in turn have further subcategories. In 2023, the major groups ranked as follows in the Australian eCommerce market:

Electronics 22.8%,

Fashion 21.7%,

Grocery 14.7%,

Hobby & Leisure 13.9%,

Furniture & Homeware 13.8%,

DIY 7.4%,

Care Products 5.7%.

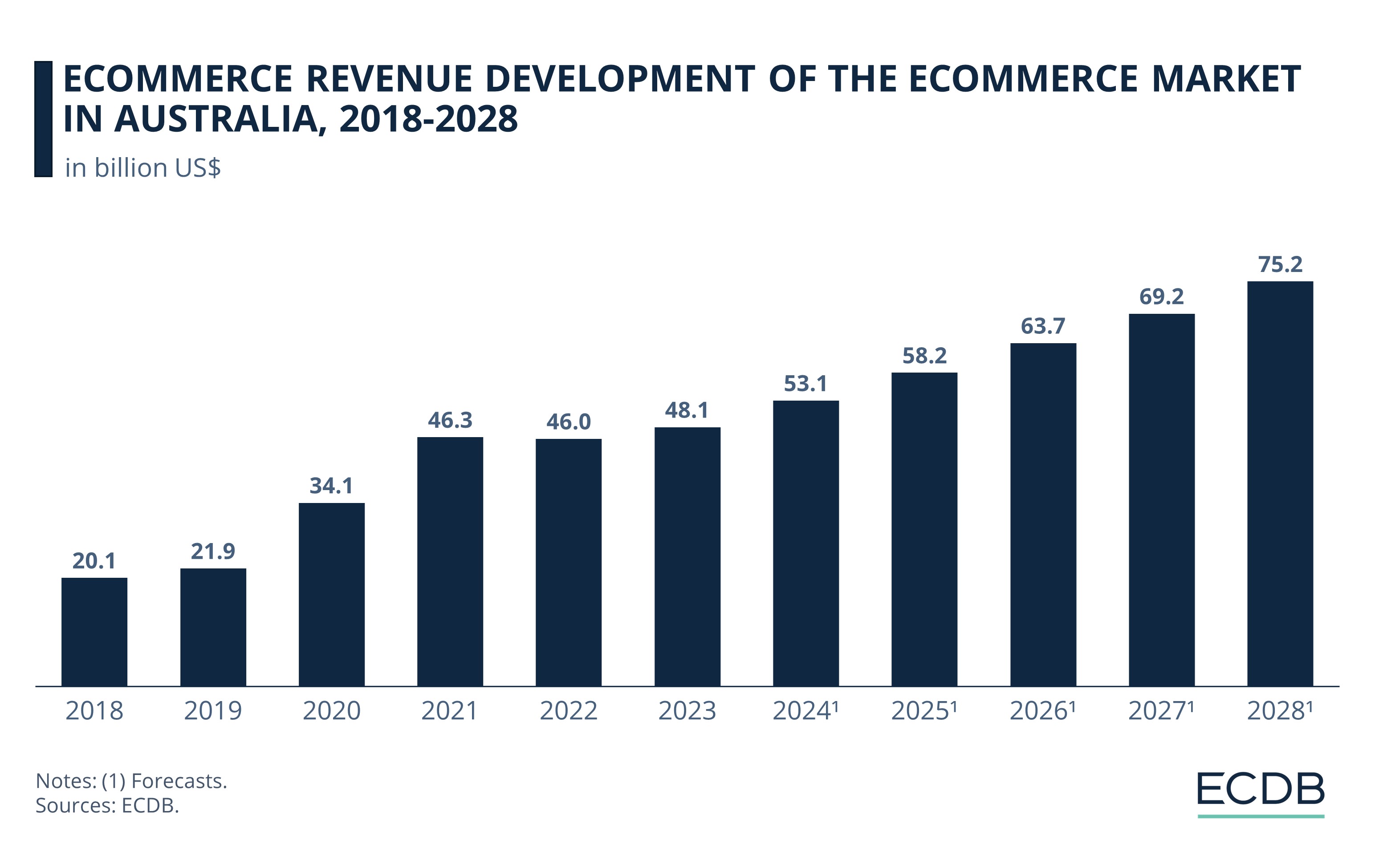

eCommerce Revenue Development in Australia

Grounds for eCommerce in Australia are fertile, with revenue from eCommerce in the country expected to grow at a compound annual growth rate (CAGR) of 9.1% between 2024 and 2028. The market is expected to reach a volume of US$75.2 billion by 2028, according to our analysis.

In the past, this country has seen as a lot of eCommerce industries highs and downs in growth and revenue:

2018-2019: Prior to 2020, Australia's eCommerce sector saw some decline in its year-over-year annual growth rate. It slowed from 21.7% in 2018 to 8.8% in 2019, with revenues of US$21.9 billion.

2020-2021: With the arrival of COVID-19 in Australia in 2020, the revenue soared by 55.5% in 2020 until it hit a new record back than of US$46.3 billion in 2021.

2022-2023: The high is followed by a decline to reach US$46 billion in 2022. Despite this, the eCommerce sector subsequently reaches a new peak with revenues of US$48.1 billion in 2023.

2024-2028: The future development is projected to continue the increasing trend and is expected to crack the US$70 billion mark by 2028.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

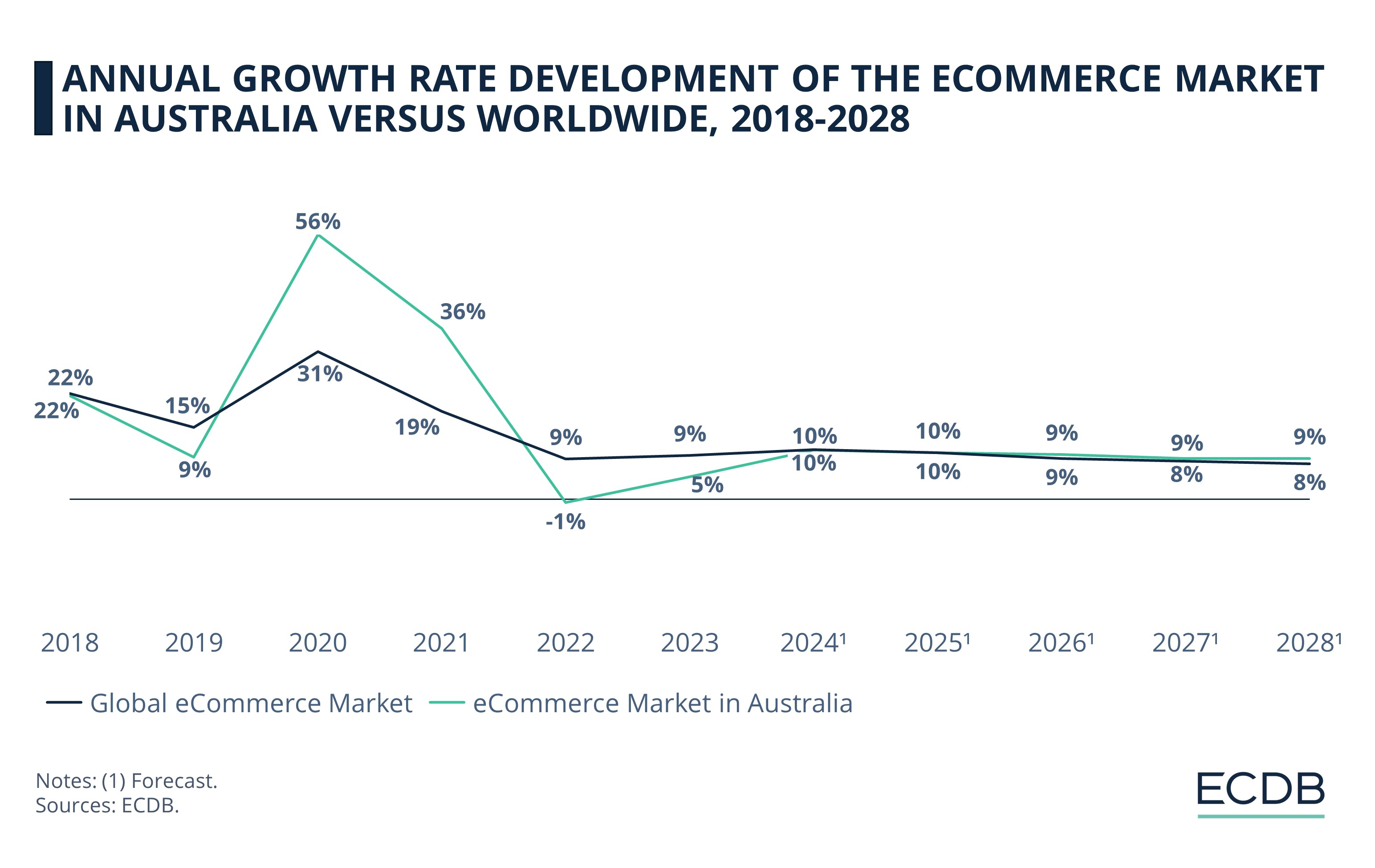

eCommerce Market in Australia vs. Global eCommerce Market

If we compare the annual development of digital commerce industry in Australia with the global market development of eCommerce, we can see that Australia has seen much bigger changes. Looking at the chart, the peak of 56% in 2020 is immediately noticeable. Let us dive into the details:

While in 2018, both markets had a similar annual growth rate of 22%, the differences are getting bigger thereafter. In 2019, the Australian market was at 9%, while the global eCommerce market was at 15%.

The biggest difference comes in 2020, with Australia leading the way with 56% growth, and the global section rushing to 31%. In the second pandemic year, the rates slow down a bit, with 36% in the Australian eCommerce market and 19% in the global eCommerce market.

After that, Australia's year-over-year growth rate shrinks to -1% in 2022, while globally, the market looks to stabilize at a 9% increase.

The two markets are converging. According to our projections, both seem to be stabilizing at 8% to 9%, recovering from the past eCommerce boom.

Multichannel Service Options Continue to Entice Online Shoppers in Australia

Australian consumers who shop online have three main motivations. According to the results of IAB Australia and Pureprofile, the first is convenience, with 67% of online shoppers agreeing that it offers convenience and ease. Second, the prospect of lower prices attracts 48% of consumers who appreciate the potential cost savings associated with online shopping. Finally, free delivery is a major driver, with 46% of Australian shoppers recognizing the time-saving benefits and flexibility that online shopping offers.

A clear trend among all of these stores was their multichannel approach, selling products through multiple avenues, with eCommerce being one of the most dominant channels. Another trend is that they all conduct commerce through their own website, i.e., they sell directly to consumers (D2C) without a third-party intermediary involved. This strategy is not only useful for sales, but also for companies to maintain a higher level of autonomy over their brand.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Walmart eCommerce Revenue: The U.S. Retail Giant Surpassed US$100 Billion

Walmart eCommerce Revenue: The U.S. Retail Giant Surpassed US$100 Billion

Deep Dive

Top Online Supermarkets Worldwide: Market Share, Growth & Sales

Top Online Supermarkets Worldwide: Market Share, Growth & Sales

Deep Dive

Top Categories for Online Shopping in Spain: Food and Beverages Lead

Top Categories for Online Shopping in Spain: Food and Beverages Lead

Deep Dive

Top Online Wine and Liquors Online Stores in France

Top Online Wine and Liquors Online Stores in France

Deep Dive

Live Commerce Market China: GMV to Exceed US$1 Trillion by 2026

Live Commerce Market China: GMV to Exceed US$1 Trillion by 2026

Back to main topics