eCommerce: Supermarkets

Top Online Supermarkets Worldwide: Market Share, Growth & Sales

Why is online shopping, and online grocery shopping in particular, growing in popularity? And which loyalty programs work best around the world? Explore the reasons behind changes in market share and find out who is leading in sales.

August 28, 2024Download

Coming soon

Share

Top Online Supermarkets Worldwide: Key Insights

Online Grocery Shopping: The dominance of marketplaces and supermarkets are diminishing, while branded and specialty sites are gaining ground. These changes point to loyalty programs as a critical tool for retaining customers.

Loyalty Programs: Supermarkets dominate in the realm of loyalty programs with a 47% share, outpacing marketplaces and other retail sectors, highlighting the pivotal role of such schemes in retaining customer trust and engagement.

Top 10 Worldwide: Online grocery rivalry intensifies in the UK and U.S. as Sainsbury's remains before Tesco for the top spot in 2023.

Category Focus: Except for Asda, RT-Mart, and Kroger, all supermarkets in our top 10 focus at least 50% on the Grocery category for the majority of their sales.

Shopping in general, as well as purchasing groceries online, has become a trend. What was once commonplace in the offline world is gradually moving into the digital world. Especially during the COVID-19 pandemic, online supermarkets gained popularity and revealed their strengths and weaknesses.

Where do consumers like to shop? How important are loyalty programs for different online shopping channels? Explore the top online grocery stores worldwide, their strategies for keeping customers coming back, and what their financial success reveals about the online grocery business.

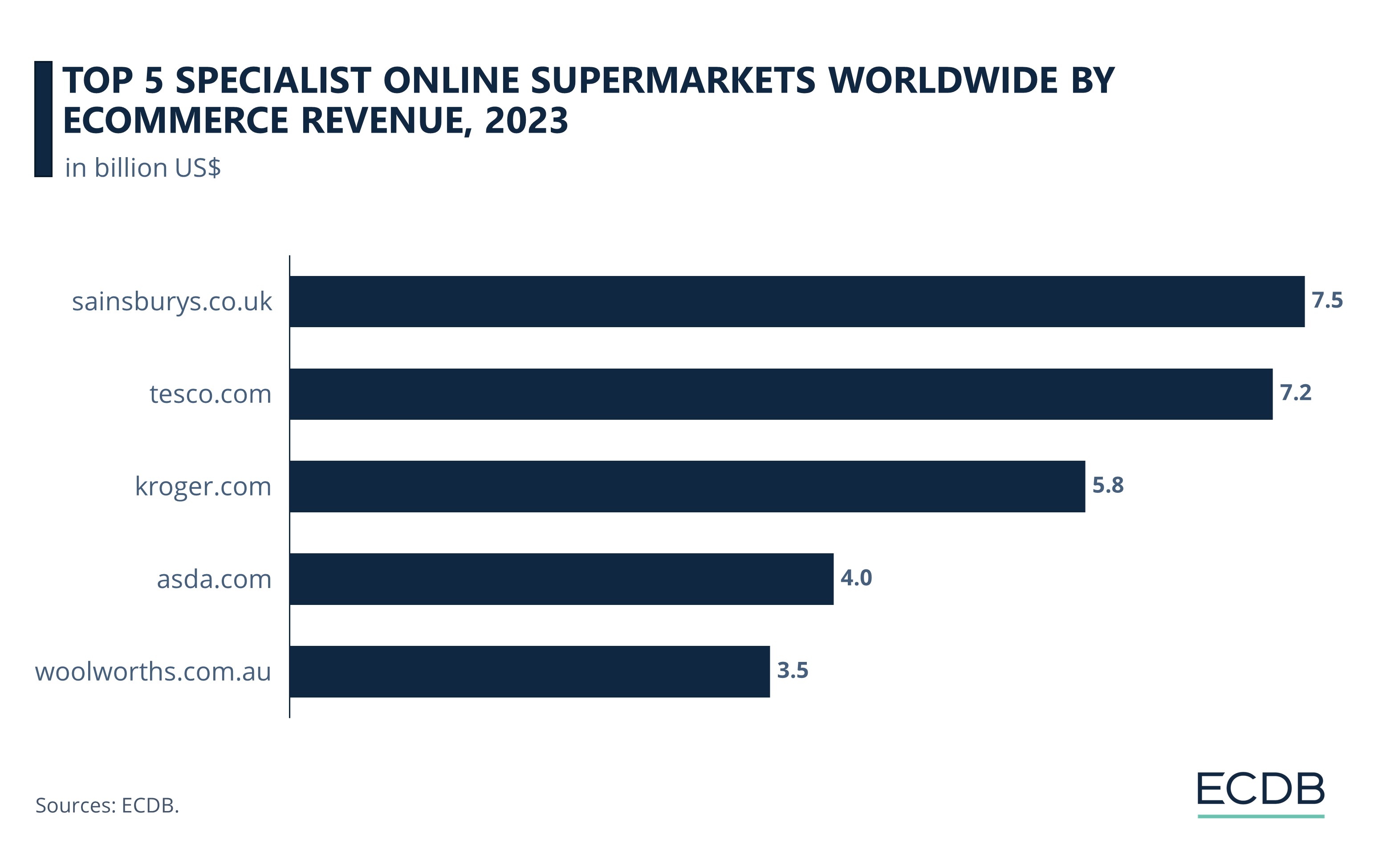

Top Online Supermarkets: Sainsbury's, Tesco, Kroger Top the Competition

The online grocery sector is currently a hotbed of fierce competition, particularly in the UK and the U.S., which dominate the top spots. Let’s take a closer look at the top 5 supermarkets worldwide in terms of their eCommerce revenue.

Sainsburys.co.uk and tesco.com are in a tight race, but in 2023 it is Sainsbury's that takes the lead.

In third place follows korger.com, with a little more distance to the leading online stores.

Similarly, far behind are asda.com in fourth place and woolworths.com.au in fifth.

1. Sainsburys.co.uk

The number one online supermarket in the world is sainsburys.co.uk, with global net sales of US$7.5 billion in 2023. Compared to 2022, revenue has increased, albeit minimally, by 2.1%. As in 2022, sainsburys.co.uk remained the number one online supermarket in 2023.

As part of J Sainsbury Plc, the online store concentrates entirely on the UK eCommerce market, focusing on Grocery (58%), and Fashion (31%). Meanwhile, Sainsbury has recently been in the news for surprising their customers with the appearance of Ed Sheeran in their offline stores.

2. Tesco.com

In second place is tesco.com, another UK-based online store, which reached a total revenue of US$7.2 billion in 2023. This represents a difference of approximately US$230 million from the leading store. As part of the company Tesco Plc, the online store achieved 11.6% year-on-year growth and is closing in on Sainsbury. After being overtaken by sainsburys.co.uk in 2022, tesco.com positions itself in second place in the 2023 ranking.

The online retailer generates most of its net sales in the categories Grocery (65%) and Fashion (14%), all in the UK. Other categories include Personal Care (10%), Furniture & Homeware (8%) and Hobby & Leisure (3%).

3. Kroger.com

Next in the ranking is kroger.com, operated by The Kroger Co. In 2023, the U.S. online retailer increased its global net sales by 9.2% to US$5.8 billion, surpassing the peak of the COVID-19 pandemic in 2020 (US$5.4 billion). Kroger.com grew to third place in 2022 and remains here for the second year in a row.

Kroger is focused exclusively on the eCommerce market in the United States. In addition, the online store offers products across five different categories: Grocery (37.8%), Care Products (35.2%), Furniture & Homeware (13.5%), Hobby & Leisure (10.2%), and DIY (3.3%).

4. Asda.com

In fourth place, we find another UK-based online store, asda.com, owned by ASDA Stores, Ltd. Last year, the online retailer generated global net sales of US$4 billion, a decrease of 3.3% compared to 2022. In 2023, asda.com climbed from fifth place in 2022 to fourth place last year.

Asda has its main focus on the United Kingdom with 99.3%, but also generates a small portion of its revenue in Ireland (0.3%) and the rest of the world (0.4%). Meanwhile, the supermarket specialist offers items from a range of categories, mainly Fashion (27%) and Food (26%).

5. Woolworths.com.au

Last but not least, woolworths.com.au comes in fifth, hitting a total revenue of US$3.5 billion in 2023 with a year-over-year growth of 0.2%. Thus, the online supermarket is almost at its pandemic high of US$3.5 billion. Compared to 2022, the online store moved up one position, from sixth to fifth place in 2023.

Operated by the company Woolworths Group, Ltd., the online store has its target entirely in Australia. Similar to Sainsbury and Tesco, Woolworths offers mainly Grocery products (53%).

Top Online Supermarkets: Market Share Declining

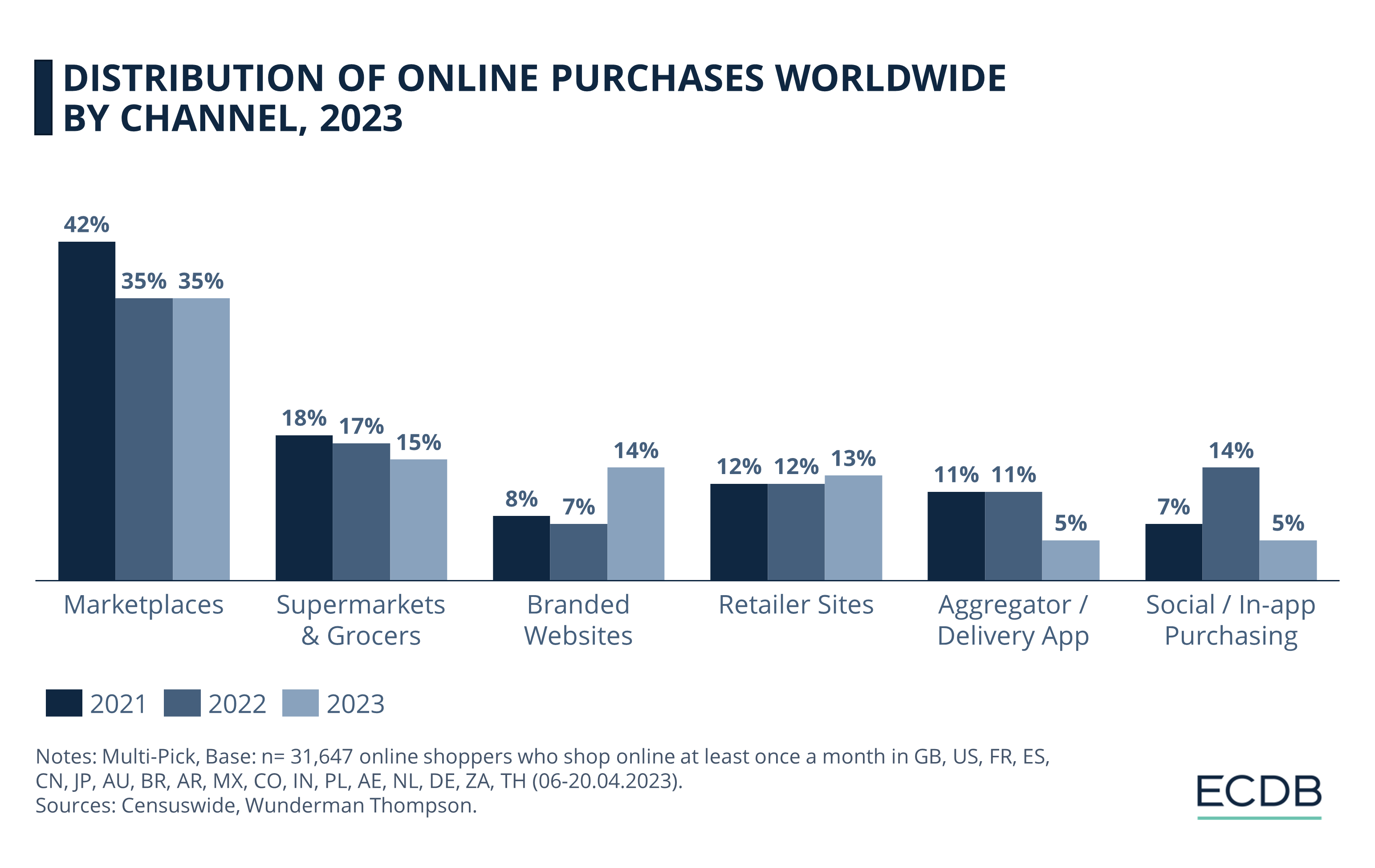

Recent data from Wunderman Thompson reveals nuanced shifts in online grocery shopping over recent years:

Marketplaces have seen their dominance erode, dipping from a 42% market share in 2021 to 35% in 2023.

Online supermarkets are also experiencing a decline, but it's less dramatic, dropping from 18% in 2021 to 15% in 2023.

On the flip side, branded websites (e.g. Apple, Nike) are gaining traction, increasing their market share from 8% in 2021 to 14% in 2023.

Similarly, specialized retailer websites inched up, from a 12% share in 2021 to 13% in 2023.

Additionally, aggregator and delivery apps, as well as in-app purchasing options, have taken a hit, plummeting to just a 5% market share in 2023.

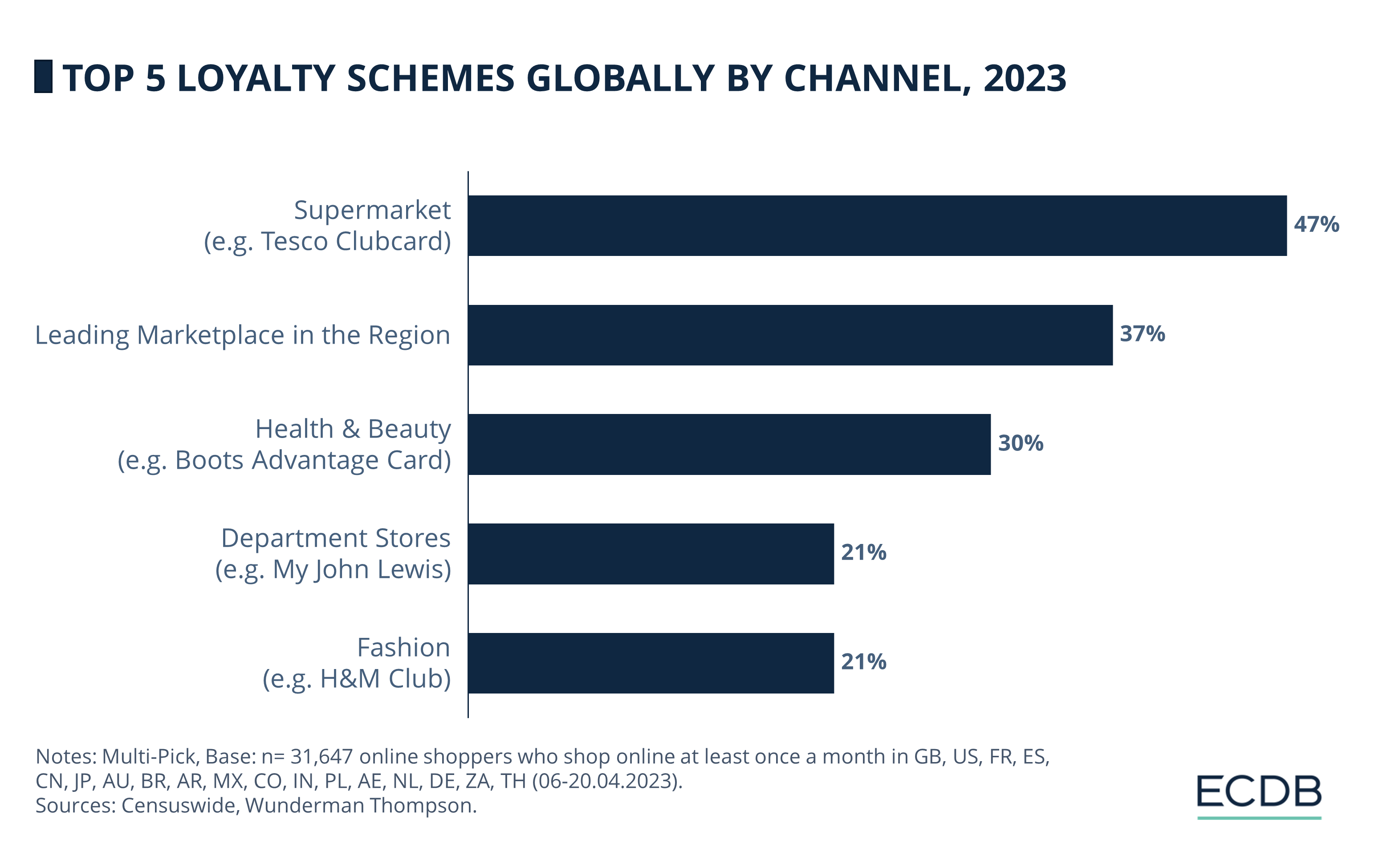

eCommerce Loyalty Programs: Supermarkets Most Popular Globally With 47%

Loyalty schemes are a significant aspect of modern retail, and supermarkets lead the pack in this arena. The same Wunderman Thompson report mentioned earlier provides further useful insights into the topic:

With a 47% share, supermarket loyalty programs like the Tesco Clubcard are the most popular among consumers globally.

By comparison, the leading marketplaces in various regions trail behind at 37%.

Health & Beauty schemes, represented by programs like Boots Advantage Card, take the third spot at 30%.

Department store-based programs like My John Lewis and fashion-oriented ones such as H&M Club are tied in the fourth position, each capturing a 21% share.

The ranking underscores the trust and reliability that shoppers associate with their favorite supermarkets. It demonstrates the success of a loyalty program that keeps shoppers engaged through rewards and exclusive offers.

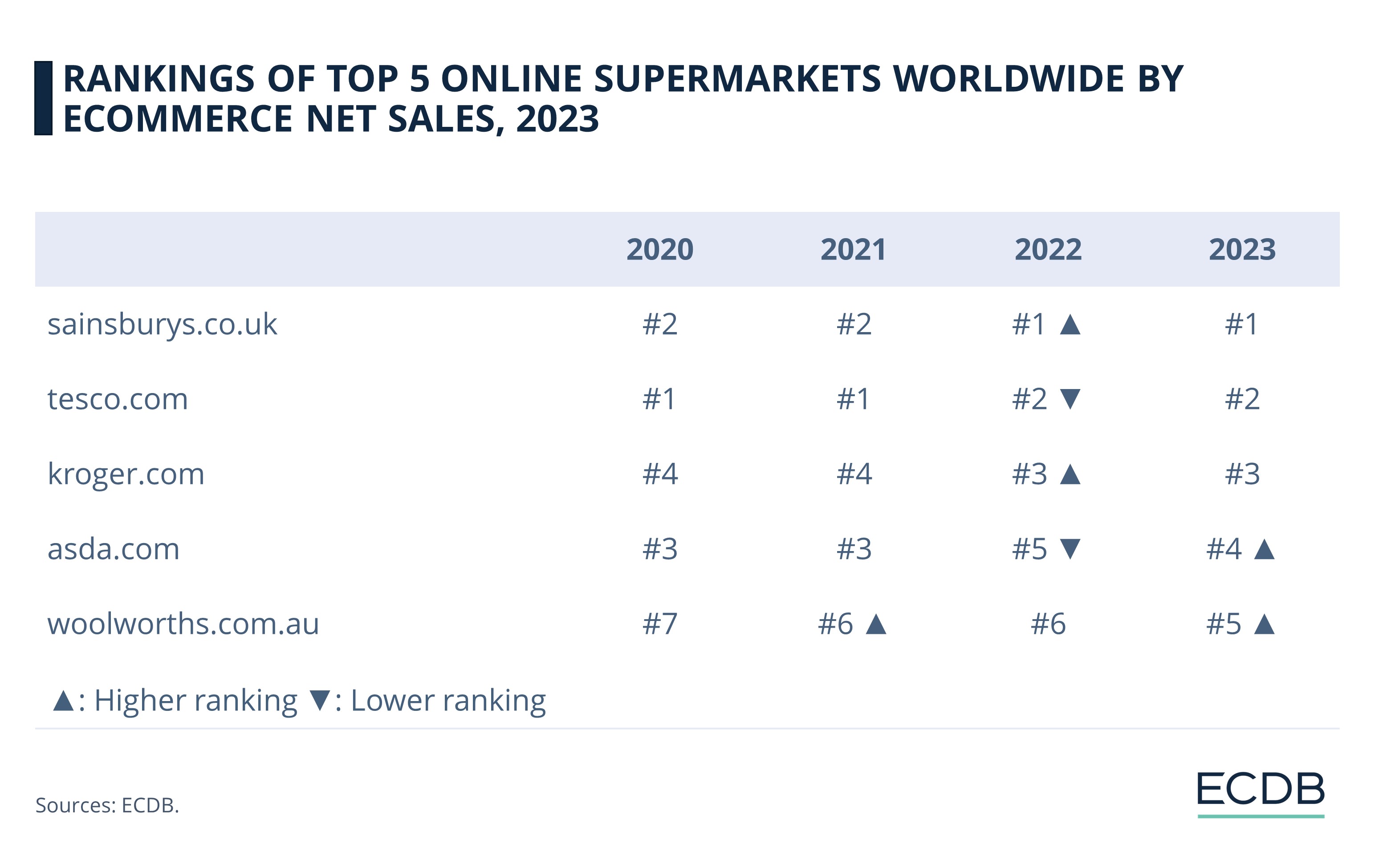

Sainsbury's Takes Top Spot from Tesco

Looking at the changes in the global market rankings, we see that the top three spots in the online supermarket rankings have been held by the same players for the past several years: Sainsburys.co.uk, Tesco.com and Kroger.com.

Already knowing where the top 5 online supermarkets are positioned, let's take a closer look at the latest development of the top 5 online supermarkets worldwide by eCommerce net sales:

In first place is sainsburys.co.uk, which has gradually climbed from second place in 2020 and 2021 to first place in 2022, where it remains today.

Next comes tesco.com, which has dropped from first to second place in 2022, and also holds the ranking for the time being.

For the second year in a row, kroger.com remains in third position, after having been fourth in 2020 and 2021.

After falling to fifth place in 2022, asda.com climbed to fourth place in the ranking of the world's top 10 online supermarkets.

Finally, after having climbed up from seventh in 2020 to sixth in 2021 and 2022, woolworths.com.au reached in 2023 the fifth position.

Tesco.com: Grocery Makes

Over 60% of Its Revenue

Tesco.com and sainsburys.co.uk lean heavily on Grocery, accounting for 65% and 58% of their sales, respectively. Woolworths.com.au also generate over 50% of its revenue from the Grocery category, with 53%.

The remaining two online stores all make less than half of their revenue through the Grocery category. Namely, kroger.com stands at 37.8%, while Asda.com follow with the respective percentages of 27%.

Sources: Wunderman Thompson, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics