eCommerce: Fashion Brands

Mango’s Business Strategy: Why the Fashion Brand’s Online Sales Are Growing

Mango is currently on an expansion path, increasing the number of its online markets as well as its physical store network. The company's most recent earnings report for 2024 shows that this half year was the most successful in the company's history. Learn more with our ECDB data.

Article by Nadine Koutsou-Wehling | September 23, 2024Download

Coming soon

Share

Mango's Business Strategy: Key Insights

Success in Second Quarter of 2024: Mango is currently growing, reporting its most successful six-month financial period since the company's inception. In addition, Mango's online platform is entering 12 new markets and the number of physical stores is increasing.

Nearly US$1 Billion in eCommerce Net Sales: Since the pandemic, mango.com's online net sales have remained steady at approximately $950 million.

Timeless Styles at Reasonable Price Points: Despite being under the fast fashion umbrella, Mango offers minimalist styles at prices that discourage mindless spending. This responds to an industry-wide shift in response to the emergence of low-cost brands.

Mango is a Spanish fast fashion retailer with a successful strategy in a highly competitive online market. As a brick-and-mortar retailer with a complementary eCommerce offering, Mango has managed to effectively navigate both channels to remain relevant in global fashion.

In Mango's most recent Q2 2024 financial report, the company reported the highest six-month sales in its entire 40-year history. While this includes both offline and online channels, eCommerce is clearly contributing to Mango's success. This is evidenced by the company's announcement to enter 12 new online markets this year.

What are Mango’s factors for success? Here is a look at how the brand makes money, the role of eCommerce, and factors for its continued relevance.

How Does Mango Make Money?

Mango is a fashion-focused brand that sells categories entirely within that product range. The detailed mix consists of apparel (52%), bags & accessories (30%), and accessories (18%).

Founded in the 1980s, Mango started out as a brick-and-mortar brand and later moved into eCommerce. Its store website mango.com serves all of the brand's markets, rather than having a domain for each country.

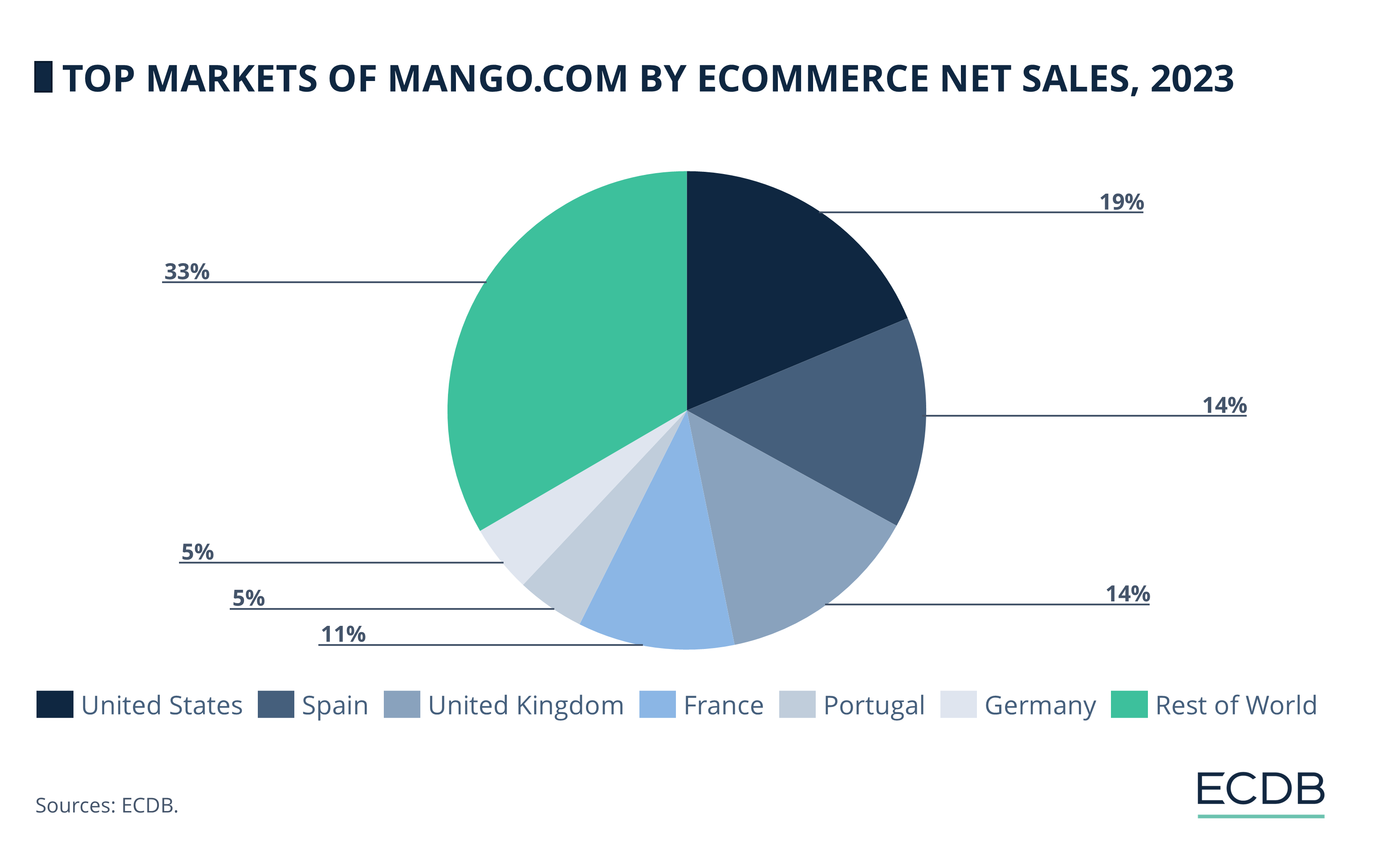

The U.S. is the largest market: Mango.com generated 19% of its eCommerce net sales in the U.S. in 2023, making it the brand’s number one market.

European markets are highly relevant: As a brand of Spanish origin, European markets are in close operational proximity. Therefore, the second to sixth places are all in Europe: Spain (14%), United Kingdom (14%), France (11%), and Portugal and Germany, both with 5%.

But the majority of the market is made up of many smaller markets around the globe. The rest of mango.com’s top 10 consists of Italy (4%), Poland (3.4%), the Netherlands (3.1%) and Canada (2.9%).

In early September 2024, Mango’s corporate news center released the information that mango.com is going to serve 12 new markets. These include Angola, Belize, Brunei, Gabon, Gambia, Equatorial Guinea, Honduras, Laos, Mongolia, New Zealand, Papua New Guinea and Togo.

In line with the company’s global expansion, Mango’s Q2 2024 earnings report reveals that the fashion brand is highly successful at the moment. Here are the details.

Business Intelligence: Our rankings, updated regularly with fresh data, offer valuable insights to boost your performance. Which stores and companies are the leaders in eCommerce? What categories are generating the most sales? Explore our detailed rankings for companies, stores, and marketplaces.

Mango.com on the Verge of US$1 Billion Online Net Sales

Mango’s total revenue grew by 6.3% year-over-year in the first half of 2024. Official company statements credit positive consumer response to the clothing collections as a driving factor in the company’s success. This is particularly true for the Mango Kids and Mango Men segments, which have become increasingly relevant, but Mango Women remains the most important sector for the brand.

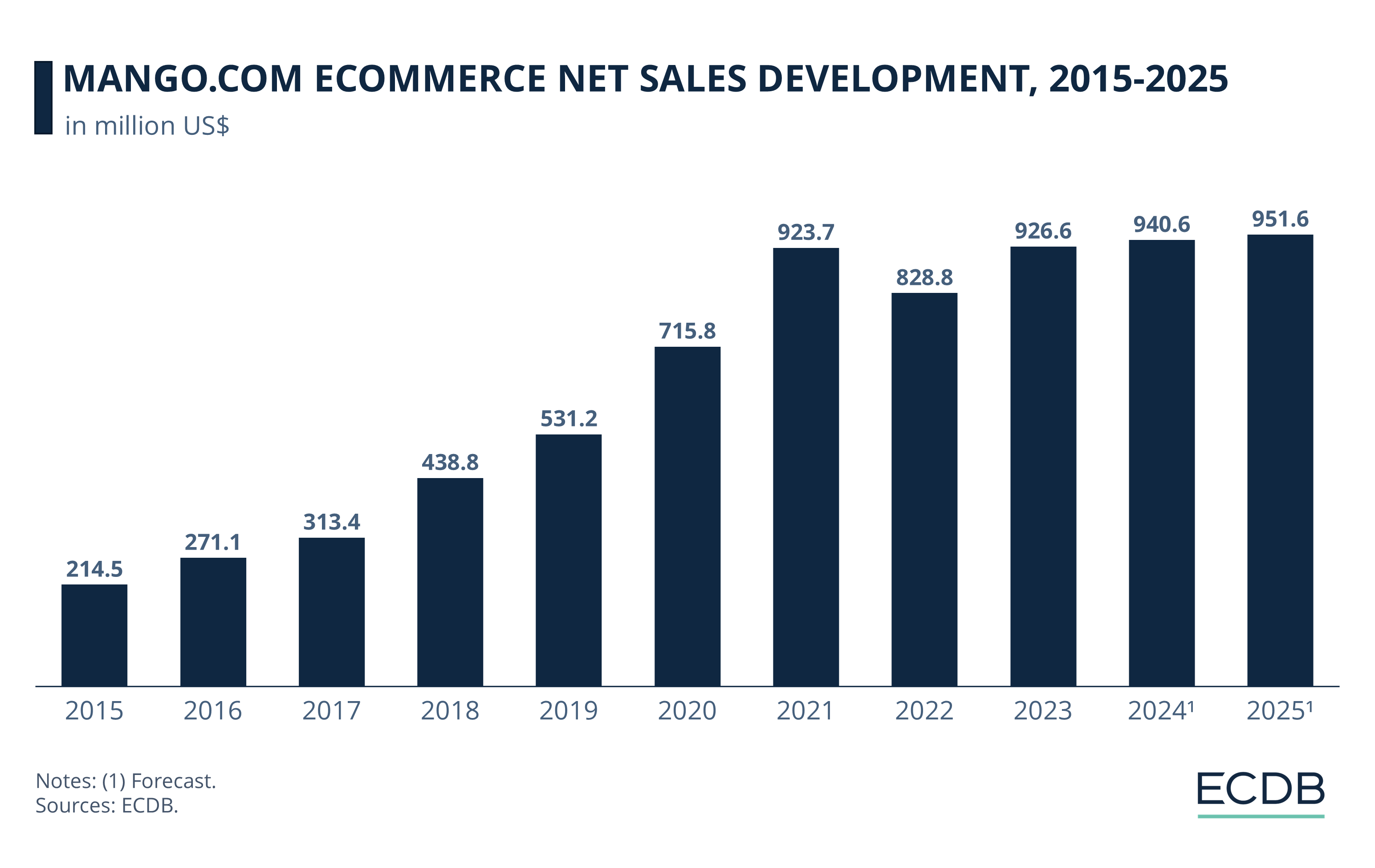

Mango's online sales surged during the pandemic, and with a slight dip in 2022, sales are on a slow but steady recovery path in 2023 and 2024.

Online sales grew slowly through 2020: From US$214.5 million in 2015, mango.com saw steady growth up to US$531.2 million in 2019.

Pandemic surge: 2020 and 2021 saw the highest growth rates, at US$715.8 million and US$923.7 million, respectively. These are rates of 34.7% and 29%.

While other fashion retailers, like H&M and Zara, are reducing the number of physical stores, Mango is taking the opposite approach: It recorded a net opening of 57 stores in the first half of 2024, bringing its global store count to 2,743. By the end of this year, Mango plans to exceed 2,800 stores.

Factors Driving Mango’s Success

Mango is a fast-fashion label, which means that it produces its collections at low cost and changes its styles frequently. However, the price points are not unreasonably cheap, showing a similar turn to higher prices against competitors like Temu or Shein that H&M and Zara have also made.

The collections are minimalist and chic, offering an alternative to the screamingly colorful designs of other brands. This minimalist style also applies to Mango’s website. Together with the prices it is an inviting aspect to inspire consumers to be more mindful of what they are buying.

Social media is an important marketing tool for Mango, and the brand’s presence on TikTok and Instagram is seen as a major contributor to consumer interest. Mango not only showcases styles and outfit inspiration on these platforms, but also responds to online trends by using high-profile influencers and models to wear the clothes.

Environmental publications, however, have criticized Mango's tendency to "green wash," adding labels and names to garments that mislead consumers about the actual environmental impact of their purchase.

Mango Business Strategy: Wrap-Up

Mango is on an expansion path, widening its online reach into 12 new markets and increasing the number of physical stores it serves. This comes at a time when online fashion is being highly competed for, by low-cost brands threatening to snatch market share from established brands. But Mango has found distinguishing traits for its brand that ensure its relevance to customers. ECDB forecasts for the coming years are optimistic.

Sources: Mango – Socialinsider

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Secondhand Fashion Online Market in the UK: Categories, Preferences by Generation, Top Stores

Secondhand Fashion Online Market in the UK: Categories, Preferences by Generation, Top Stores

Deep Dive

European eCommerce Market Size 2024: Top Players & Market Size

European eCommerce Market Size 2024: Top Players & Market Size

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Back to main topics