Online Hot Drinks Market in Germany

Download

Coming soon

Share

The global upheaval caused by the COVID-19 pandemic has brought significant changes across many industries and trends, including eCommerce. This is particularly apparent in the online hot drinks market, which has seen substantial growth in many countries. As the world's 5th biggest eCommerce market, Germany is among the countries where this growth has been most noticeable. With changes in daily routines and lifestyles, the German online hot drinks market has experienced a significant surge, undergoing a dramatic transformation.

As offices made the shift to homes and brick-and-mortar cafes closed their doors, digital platforms gave consumers in Germany the opportunity to receive their hot drinks without going to their local grocery store, complying with social distancing measures in the process. Combining both necessity and convenience, the online hot drinks market has moved beyond its traditional limitations. Based on a 2021 survey, over half (55%) of home-based working coffee drinkers in Germany reported consuming more coffee during the pandemic. Meanwhile, 30% of the respondents said their coffee consumption remained the same, and 15% indicated they drank less coffee.

The online coffee market, accounting for 97% of the revenue of the German online hot drinks market in 2022, stands as by far the largest sub-market within the online hot drinks market. To gain a deeper insight into this subject, let's first examine the growth pattern of the online hot drinks market in Germany, its connection to the country's overall eCommerce growth, and then delve into its sub-markets – specifically, coffee, tea, and cocoa.

Online Hot Drinks Market in Germany Grew by 66% in 2021

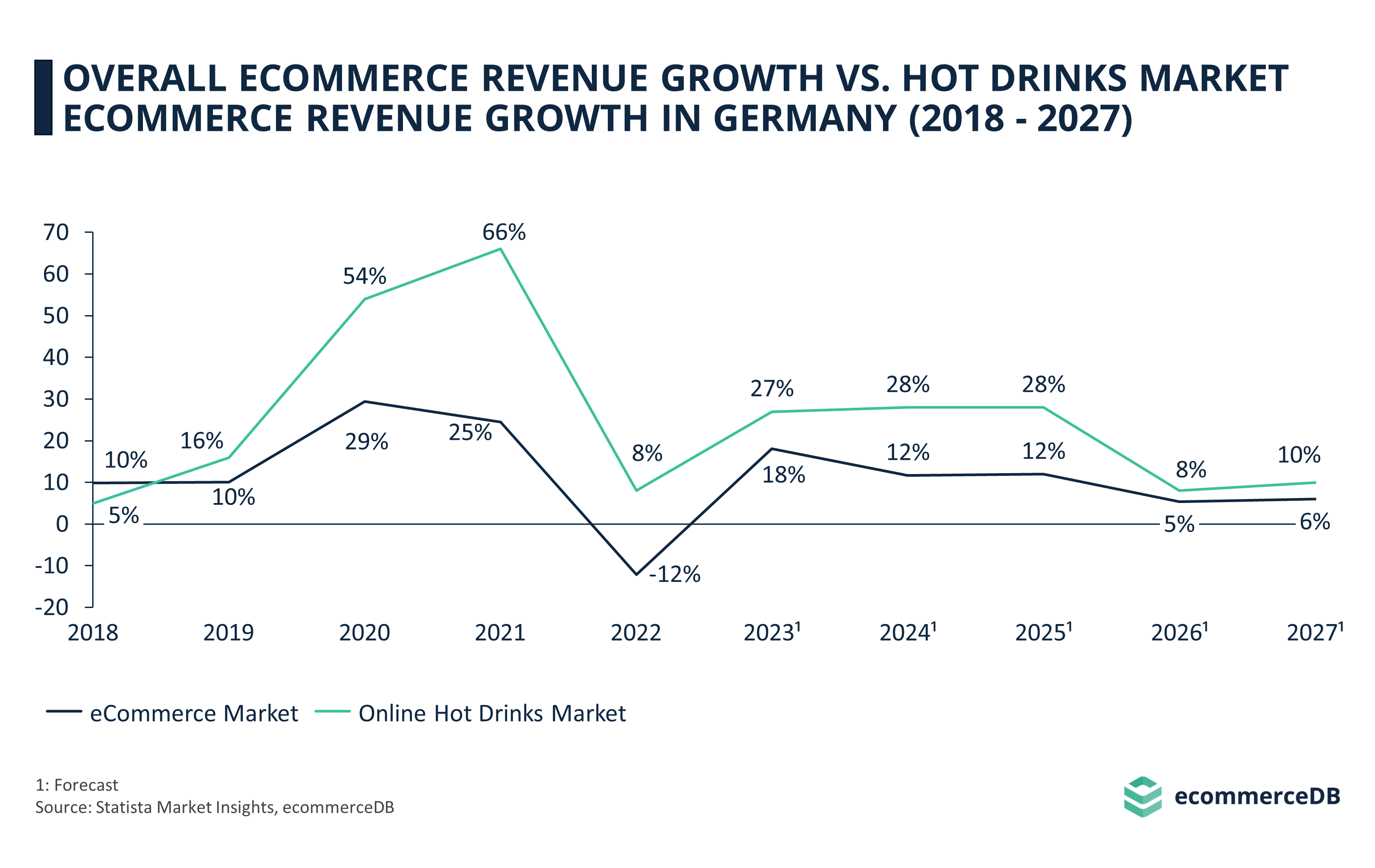

As many other markets, the online hot drinks market in Germany experienced a substantially higher growth in 2020 and 2021, in comparison to previous years. After 16% growth in 2019, the market reached 54% growth in 2020, hitting as high as US$357.6 million in total revenue. The next year’s growth rate went even higher, elevating the hot drinks market up to US$591.9 million in 2021 with an impressive 66% growth. 2022’s growth, however, was not as impressive: displaying an 8% growth, which is lower than the pre-pandemic level, the online hot drinks market in Germany was reported to reach US$640 million. As for the coming years, the German online hot drinks market is projected to have varying levels of growth. By the end of this year, the market is expected to reach US$815.4 million with 27% growth. While a slightly higher annual growth rate (28%) is expected until 2026, the market will experience much lower levels of growth at 8% and 10% in 2026 and 2027, respectively.

To fully comprehend the paradigm shift here, it's crucial to recognize that in the last five years, the growth of the online hot drinks market in Germany has generally exceeded that of the broader eCommerce sector. Although the growth rate of the online hot drinks market lagged behind the overall eCommerce market in 2018, the dynamics reversed in the following year: the rise of the eCommerce market continued at a constant pace, while the online hot drinks market experienced a leap of 11 percentage points in its growth. With the onset of the pandemic, the discrepancy between the two growth rates began to expand: 25 percentage points in 2020 and 41 percentage points in 2021. In the past year, even as the German eCommerce market faced a degrowth, the online hot drinks market managed to keep afloat with an 8% development.

Although a smaller disparity between the two growth rates is expected by the end of the current year, the years 2024 and 2025 are projected to witness a 16-percentage point difference. This figure is expected to drop to a range of 3 to 4 percentage points in 2026 and 2027.

Coffee, Tea and Cocoa Markets

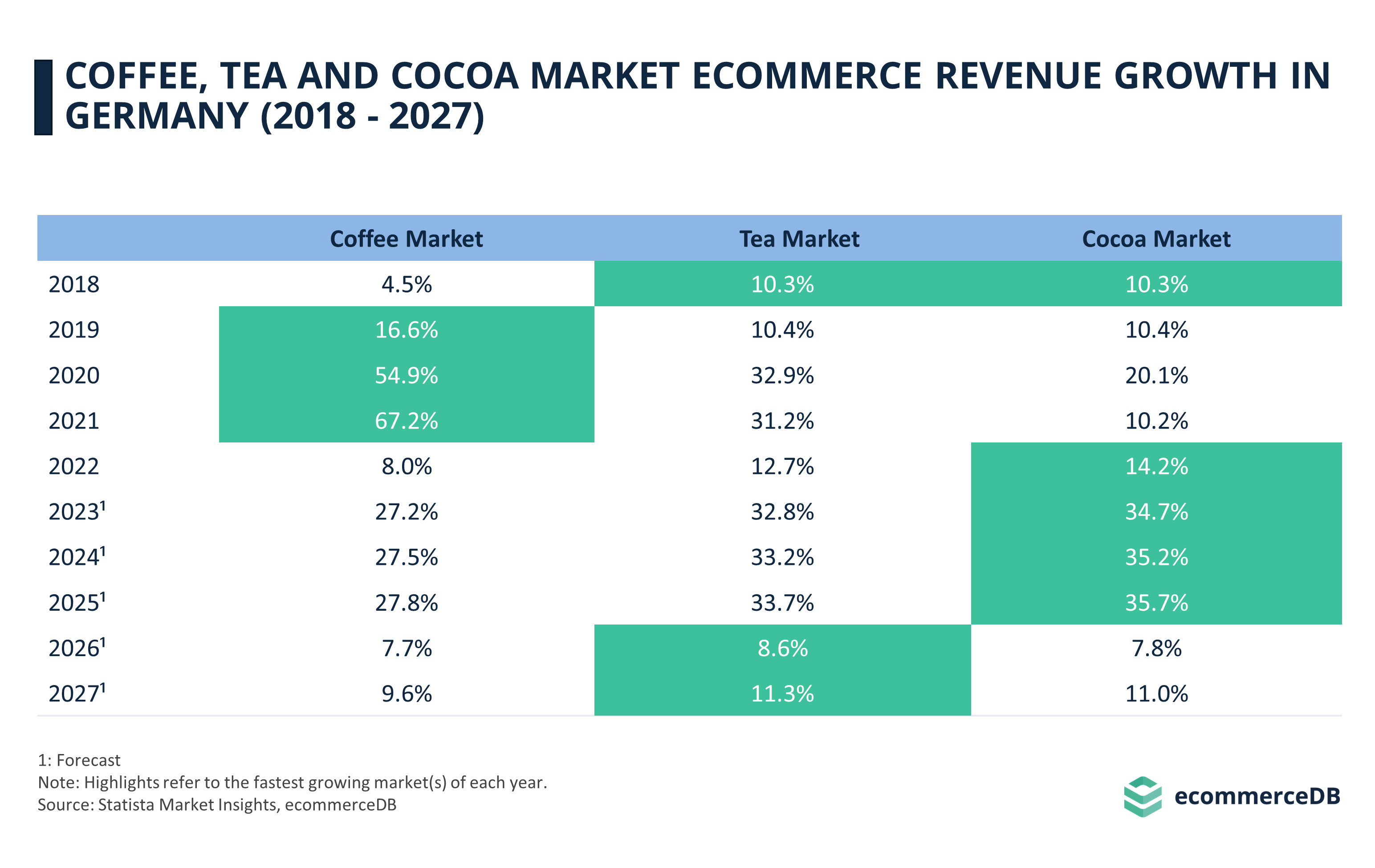

In order to have a more granular view of the market, let’s also have a look at its lower level markets. Since the coffee sub-market makes up a large majority of the German online hot drinks market, its growth trajectory is almost identical to the numbers mentioned above. The second biggest sub-market in this context, the tea market, experienced a more modest development during the 2020-2021 period with respective 32% and 31% growth rates, while 2022’s growth stayed above the pre-pandemic level (10%) with 12%. Lastly, the smallest sub-market of the hot drinks market, the cocoa market, saw respective 20% and 10% growth rates in the 2020-2021 period, before surpassing the pre-pandemic level (10%) with 14% growth in 2022.

Casting our gaze forward, the coffee sub-market continues to closely align with the broader hot drinks market trends. The tea and cocoa sub-markets, in comparison, are forecasted to exhibit higher growth rates up until 2026, ranging between 32% and 35%. Like the coffee sub-market, these sub-markets are predicted to see a deceleration in growth in 2026 and 2027, with rates fluctuating between 7% and 11%.

Hot Drinks Growth Expected to Stay Above the Pre-Pandemic Level Until 2026

The global disarray caused by the COVID-19 pandemic has led to remarkable transformations in various sectors, particularly in eCommerce and more specifically, in the online hot drinks market in Germany. These changes have been shaped by evolving lifestyles, the shift to remote work, and the closure of physical cafes, driving consumers in Germany to rely heavily on digital platforms for their hot drinks, thereby boosting the online coffee sub-market, among others, as a vital revenue source.

In the context of recent years, the German online hot drinks market and its sub-markets have witnessed significant growth, especially during 2020 and 2021, although the pace has somewhat decelerated in 2022 with projections of variable growth in the years ahead. Crucially, this market's growth has generally outpaced the broader eCommerce sector over the past five years, maintaining resilience even when the wider sector encountered degrowth. However, the gap between these growth rates is expected to narrow in the future.

Drilling down into the sub-markets, the coffee sub-market, being the largest, mirrors the overall hot drinks market's growth pattern. In contrast, the smaller tea and cocoa sub-markets demonstrated more modest growth rates, while still surpassing pre-pandemic levels. Looking ahead, these sub-markets are forecasted to maintain considerable growth rates until 2026, after which a slowdown is anticipated, aligning with the projected trajectory of the coffee sub-market.

As we move into the future, these sub-markets will certainly continue to play crucial roles in shaping the dynamics of the German online hot drinks market. While they surpassed their peak during the pandemic, they will continue to develop in more moderate levels.

Sources: ecommerceDB, Statista Market Insights, Statista Consumer Insights

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Back to main topics