Growth Markets in eCommerce

Southern & Eastern Countries Show Greatest Growth Potential in Europe

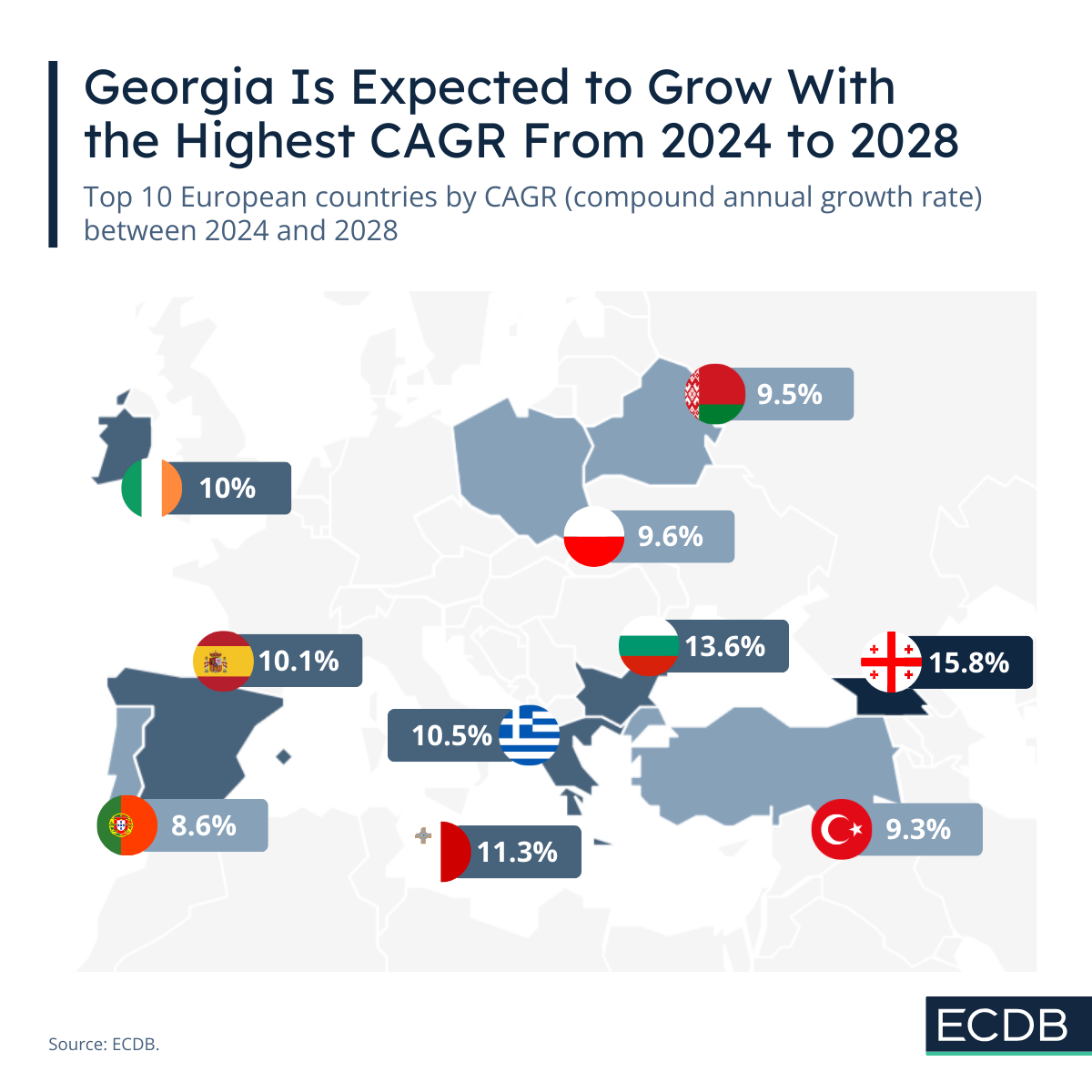

Smaller European economies have the greatest growth capacity in the coming years.

Article by Antonia Tönnies | December 17, 2024

Time flies and another year passes. As 2024 draws to a close, it is all the more interesting to look into the crystal ball. Here at the ECDB, we are always interested in the future, and forecasting is an essential part of our analysts' work. From a European perspective, a key question is which markets will be at the forefront of eCommerce development.

Among the top 10 countries with the highest percentage growth potential over the next four years, a country with less than 4 million inhabitants heads the list: Georgia.

Georgia Sticks Out With Strongest CAGR Development

in Europe

When it comes to eCommerce, Georgia is not necessarily the first country that comes to mind. This is partly due to the fact that it is a relatively small economy. The country's GDP was around US$30.5 billion in 2023 – a little more than Cyprus' US$29.8 billion. However, between 2024 and 2028 the eCommerce market of Georgia is expected to grow by a CAGR of 15.8%. With that prediction, the market may jump from an eCommerce revenue of US$127 million in 2024 to US$228 million in 2028.

There are several factors behind its expected success: Firstly, internet penetration and the country's digital infrastructure continue to improve. This is also reflected in the online share, which is forecast to increase from 7.9% in 2024 to 12.4% in 2028.

A further factor is the young population. According to the Statistical Office of the European Union, the average age in Georgia in 2023 stood at 38.1 years – compared to the highest average age in Italy at 48.4 years. A young population leads to a greater interest in adopting new and digital technologies, and eCommerce tends to be used more naturally by younger users who grew up online.

Low Online Penetration in Bulgaria and Malta Points

to High CAGR

Bulgaria and Malta are growing a bit slower, but still making impressive progress. In Bulgaria, eCommerce is expected to hit its stride, almost doubling revenues in four years at a CAGR of 13.6%. Meanwhile, the microstate Malta is predicted to increase by a CAGR of 11.3%. Despite its small size, the market shows strong growth opportunities.

In both cases, the growing online shares also play a role. It is expected to increase by 3.3% in Bulgaria and by 4.9% in Malta. Both these countries, and Georgia, start in 2024 from a lower base than the leading eCommerce markets in terms of online share, such as the United Kingdom with 24.9%. These are potentially underserved markets that offer a greater opportunity for future expansion in online commerce.

Additionally, Georgia, Bulgaria and Malta are at a different stage of economic development compared to markets such as the UK and Germany. The focus is more on developing an eCommerce presence. This makes the countries attractive for investment, as there is still plenty of room for maneuver.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Deep Dive

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Deep Dive

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Deep Dive

Why eCommerce and Luxury Sales Are Tough to Unite

Why eCommerce and Luxury Sales Are Tough to Unite

Deep Dive

What Countries Are Driving Revenues in the Global Online Smartphones Market?

What Countries Are Driving Revenues in the Global Online Smartphones Market?

Back to main topics