eCommerce: Musical Instruments

Top Online Stores for Musical Instruments

One of the hobbies that the pandemic encouraged was music. How has the online market for musical instruments changed globally since then? We use the latest ECDB data to assess its market development, top stores, and trends.

Article by Cihan Uzunoglu | July 19, 2024

Top Online Stores for Musical Instruments: Key Insights

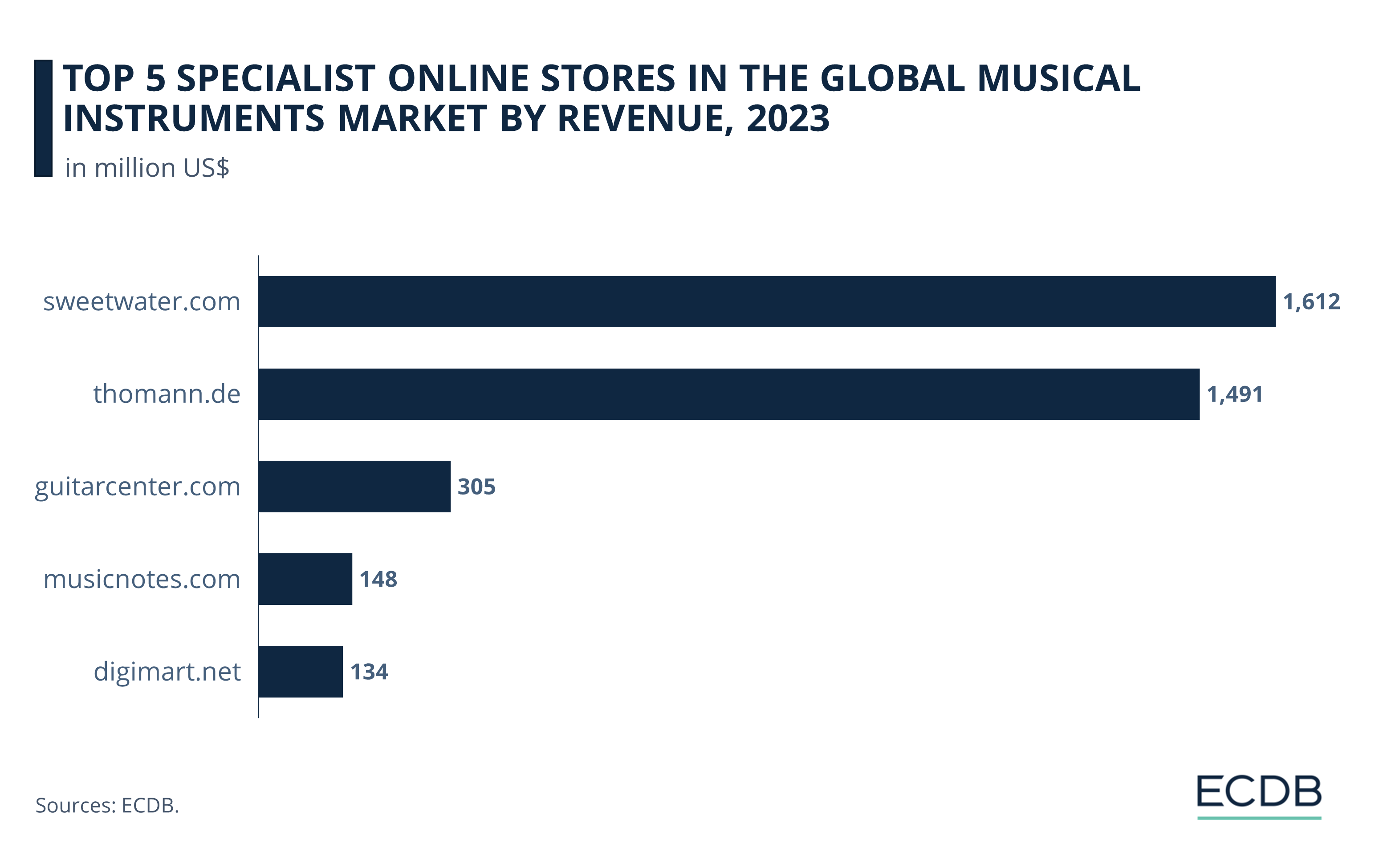

Top Online Stores: Sweetwater.com leads the global online musical instruments market with US$1.61 billion in net sales for 2023, followed by Thomann.de, Guitarcenter.com, Musicnotes.com, and Digimart.net.

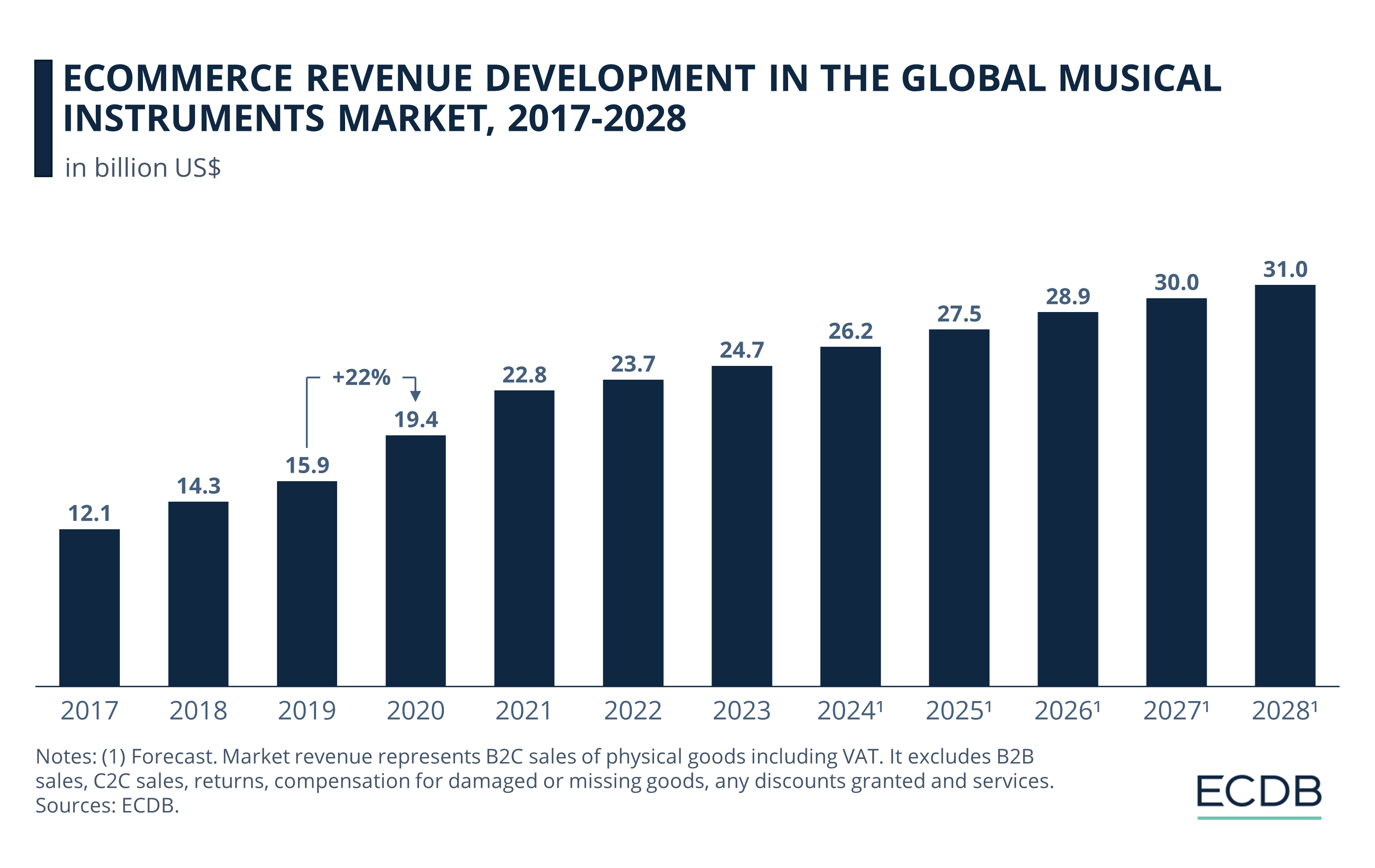

Consistent Market Growth: The market has shown consistent growth from US$12 billion in 2017 to a projected US$31 billion by 2028, despite occasional dips and fluctuating growth rates compared to the overall eCommerce market.

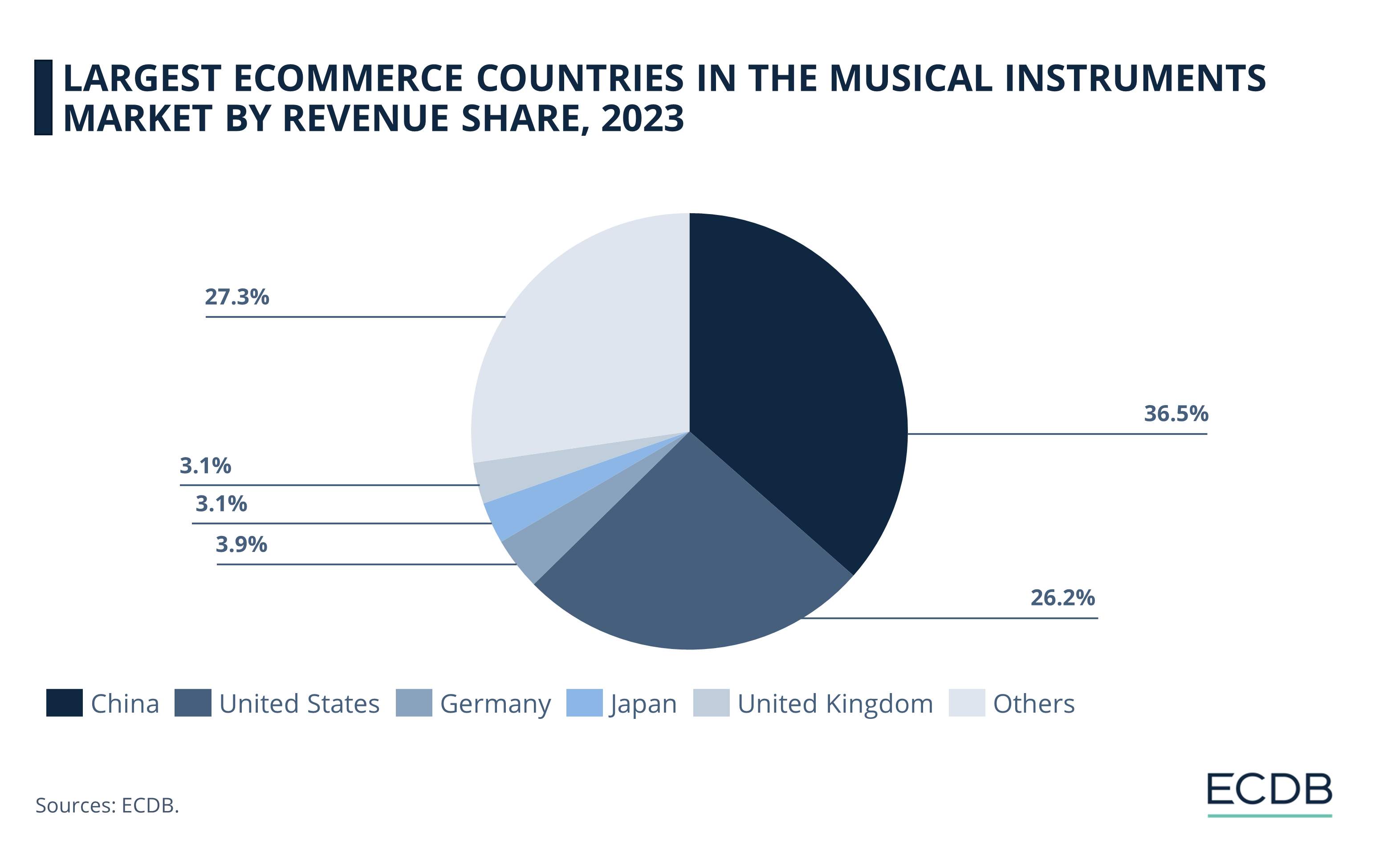

Leading Countries: China leads the market globally with a substantial US$9 billion in 2023, followed by the U.S. at US$6.5 billion. Germany, Japan, and the UK also make significant contributions.

Market Developments: Technological advancements, niche marketplaces, and the pandemic-driven shift to online shopping have significantly transformed the market, though challenges like high-tech costs and the need for tactile interaction remain.

Where do music enthusiasts buy their instruments today? With the ease of online shopping, many turn to the internet for their perfect guitar, keyboard, or drum set.

How do top stores like Sweetwater, Thomann, and Guitar Center attract millions of customers, and what sets them apart? Our analysis reveals the key players in the online musical instruments market, their success strategies, and the impact of recent global trends.

But first, what exactly do we mean by Online Musical Instruments Market?

What is Online Musical Instruments Market?

The Online Musical Instruments Market is a segment of the Hobby & Leisure market, focusing on the sale of various musical instruments.

This includes guitars, keyboards, pianos, drums, percussions, wind instruments, string instruments, electronic instruments, DJ equipment, amplifiers, and effects. However, it excludes music software and technology, instrument maintenance and repair, and music lessons or educational resources.

Top Online Stores for Musical Instruments: Sweetwater and Thomann Dominate

The global musical instruments market has seen impressive net sales from its leading online stores. Below are the specialist online stores with the highest musical instruments net sales in 2023:

Topping the list, sweetwater.com achieved net sales of US$1.61 billion and became the market leader.

With net sales of US$1.49 billion, thomann.de followed closely, reflecting its strong market presence.

Guitarcenter.com secured the third position, achieving net sales of US$304.7 million and showcasing its significant share in the market.

Musicnotes.com came in fourth with US$148.4 million, demonstrating steady growth and consumer appeal.

Rounding out the top five, digimart.net earned US$133.8 million in net sales.

Turning the focus from specialists to all stores changes the ranking: Sweetwater.com and thomann.de stay in their ranks, but guitarcenter.com drops down to fifth place, leaving its position to amazon.com with net sales of US$972.6 million. Costco.com also replaces musicnotes.com in the fourth spot, having made net sales of US$396.9 million in 2023.

Having these figures in mind, we will now break down what makes these online stores successful.

1. Sweetwater.com

Sweetwater.com, launched in 1995, continues to lead the online musical instruments market, boasting net sales of US$1.61 billion in 2023. Founded by Chuck Surack, Sweetwater evolved from a small recording studio into the largest eCommerce site for musical instruments and audio gear.

The company experienced a remarkable 42% increase in eCommerce net sales in 2020, fueled by the pandemic-driven surge in online shopping. After selling to Providence Equity Partners in 2021, the company maintained its growth, expanding offerings and opening a new distribution center in Arizona.

Sweetwater's success is driven by its customer-centric approach, with nearly 600 sales engineers providing personalized service. This strategy, coupled with a strong online presence, ensures Sweetwater remains a top choice for musicians globally.

2. Thomann.de

Thomann.de, operated by Thomann GmbH, is an internationally-focused online store generating eCommerce net sales primarily in Germany, France, and the United Kingdom. Launched in 1996, Thomann.de has become Europe's largest online seller of musical instruments.

The company has experienced notable growth trends, with substantial increases in recent years, despite a slight dip in 2022. Thomann's digital transformation project, initiated in 2019, includes innovative digital signage and personalized in-store technology, enhancing customer experience.

Employing over 1,700 musicians, Thomann maintains its reputation by offering quality service and products, and continues to thrive in the competitive online retail market.

3. Guitarcenter.com

Guitarcenter.com, launched in 2006 and operated by Guitar Center Stores, Inc., generates eCommerce net sales primarily in the United States.

The company has seen fluctuating growth trends over the past decade, where its eCommerce net sales grew by 16.5% in 2020 and declined by 14.8% in 2021. Following its exit from bankruptcy in 2020, Guitar Center has focused on strengthening its market position through strategic leadership changes and digital innovation.

Guitarcenter is enhancing its in-store experience with premium products and improving its online platform to better serve serious musicians and beginners alike. Guitar Center's commitment to personalized service, lessons, and instrument rentals helps maintain its competitive edge in the musical instruments market.

4. Musicnotes.com

Musicnotes.com, founded in 1998, has established itself as a leader in the digital sheet music market, serving over 9 million customers with more than 60 million sheet music downloads. The platform offers an extensive catalog of over 500,000 arrangements, which caters to musicians worldwide.

With a payout of US$100 million in royalties to music publishers and songwriters, Musicnotes has significantly impacted the music industry and demonstrated its commitment to protecting musicians' intellectual property rights.

The company’s innovative eCommerce technology and efficient royalty payment system have made it a trusted source for sheet music, ensuring fair compensation for music creators.

5. Digimart.com

Digimart.net, operated by Rittor Music Co., Ltd., is Japan's leading online store for musical instruments, generating eCommerce net sales entirely within Japan.

In 2023, the platform achieved a revenue of US$133.8 million, solidifying its position at the top of the Japanese Musical Instruments market. The store has experienced varied growth over the past few years, with a significant increase of 20% in 2023, following a 12% decline in 2022. Forecasts for 2024 and 2025 indicate continued growth at 18% and 10%, respectively.

Digimart.net's strong market presence and consistent growth make it a key player in Japan’s online musical instrument market, even surpassing the retail giant Amazon.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Online Musical Instruments Market

Despite ups and downs, the global online musical instrument market continues to grow at a stable rate:

From US$12.1 billion in 2017, the market saw substantial increases in subsequent years, notably a 17.4% growth in 2018, reaching US$14.3 billion.

With an impressive 22.3% growth in 2020, the market revenue was pushed to US$19.4 billion.

The upward trend continued with a 17.8% rise in 2021, achieving US$22.8 billion.

Although growth rates dipped slightly in 2022 and 2023, forecasted figures predict continued increases, with revenues expected to reach US$31 billion by 2028.

Largest Online Musical Instruments Markets

Top 5 largest eCommerce countries in the musical instruments market reflect the overall largest markets in the sector:

China leads the eCommerce Musical Instruments market with a substantial market size of US$9.03 (36.5% of the global market) billion in 2023, establishing itself as the largest country in this market.

The U.S. follows closely with a market size of US$6.48 billion (26.2%), reflecting significant consumer demand and a robust eCommerce infrastructure.

Germany, Japan, and the UK also contributed notably, with market sizes of US$971 million (3.9%), US$763 million (3.1%), and US$758 million (3.1%), respectively.

Online Musical Instruments Market Growth vs.

Overall Market Growth

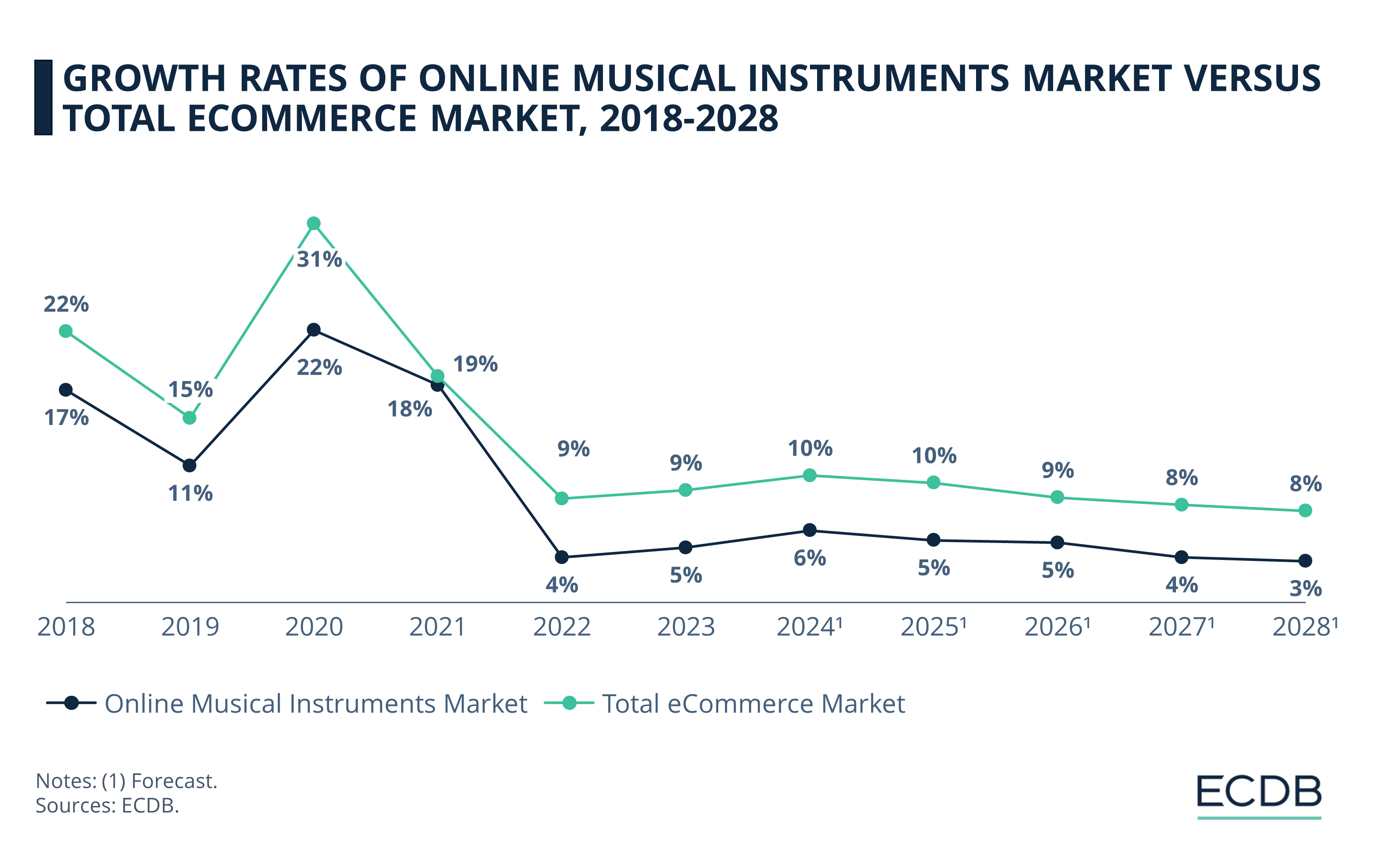

For better context, let’s zoom out and see how the online musical instruments market has been performing in comparison to the overall eCommerce market:

2019: The market grew by 11.2%, below the overall global eCommerce market growth of 15.1%.

2020: The online musical instruments market rose by 22.3%, still lagging behind the overall global eCommerce growth of 31.0%.

2021: The market grew by 17.8%, closely matching the overall eCommerce growth of 18.5%.

2022: Growth slowed to 3.7%, significantly lower than the overall eCommerce market growth of 8.5%.

2023: The market grew by 4.5%, underperforming compared to the global eCommerce growth of 9.2%.

Developments in the Online Musical Instruments Market

Before we close, let's take a look at less numerical factors as well. Technological advances, changing consumer behavior and the rise of eCommerce platforms in general have been instrumental (no pun intended) in the evolution of the market.

1. Rise of Niche Marketplaces

Niche marketplaces have diversified the market by offering musicians platforms to buy and sell new, used, and vintage instruments, enhancing global accessibility.

By focusing on musicians' needs, these marketplaces provide tailored shopping experiences that general eCommerce platforms lack. This specialization helps musicians find rare instruments, expanding the market's reach.

2. Role of Technological Advancements

Technological innovations in eCommerce and digital payments have fueled market growth. Platforms like JD.com and Thomann have adopted advanced digital solutions, improving user experience and efficiency.

This digital transformation has enabled traditional stores to extend their reach globally through enhanced online platforms.

3. Pandemic Effect

The pandemic significantly boosted online shopping, increasing musical instrument sales as people sought new hobbies at home.

Retailers adapted with virtual demos and personalized online consultations, maintaining consumer interest and sales during lockdowns.

4. Online Market Still Misses Some Aspects

The popularity of mobile devices and music production apps has democratized music creation, leading to an increased online demand for instruments. However, challenges remain.

High-tech instruments come with significant costs, making it essential to balance features with affordability. Additionally, the lack of tactile interaction in online shopping can lead to dissatisfaction, highlighting the need for online retailers to replicate the in-store experience digitally.

Top Online Stores for Musical Instruments: Closing Thoughts

Driven by technology, changing consumer habits, and the booming online shopping trend, the online musical instruments market has changed significantly. In the next couple of years, it is safe to expect continued growth, with online platforms becoming even more sophisticated and user-friendly.

However, the challenge of replicating the tactile in-store experience online will persist. The market’s popularity seems set to endure, supported by ongoing technological advancements and the sustained interest in music creation across diverse demographics. Online retailers must keep innovating to meet the evolving needs of musicians worldwide.

Sources: Retail Dive, Inc.com, Indianapolis Monthly, Digital Signage Today, Ecommerce News, MusicRadar, Digital Commerce 360, Retail Dive, RetailWire, Musicnotes: 1, 2, 3, PR Newswire: 1, 2, Technavio, Yahoo Finance, Jd.com, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

High Growth Rate, Low Online Share: Grocery eCommerce on Track for Future Expansion

High Growth Rate, Low Online Share: Grocery eCommerce on Track for Future Expansion

Deep Dive

Online Garden Market: April and May Are the Most Important Months

Online Garden Market: April and May Are the Most Important Months

Deep Dive

European eCommerce Market Size 2024: Top Players & Market Size

European eCommerce Market Size 2024: Top Players & Market Size

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Back to main topics