eCommerce: Vegan Products

Top Online Vegan Stores in Germany: Customer Base, Top Products & Consumer Insights

Veganism is rising in Germany as people choose plant-based lifestyles for health and ethical reasons. Which online vegan stores lead the market? Find out why Veganz is at the top.

Article by Cihan Uzunoglu | June 14, 2024Download

Coming soon

Share

Top Online Vegan Stores in Germany: Key Insights

Top Online Stores:

Veganz is the most popular online vegan shop in Germany, especially favored by young female shoppers. Keimling Naturkost ranks second, appealing to higher-income, larger households. Reformhaus, third, is popular among single-person households in large cities. Vekoop, fourth, shares a similar customer base with Keimling Naturkost. Le Shop Vegan, fifth, leads in milk substitute sales among higher-income families.

Demographic Trends:

Younger online shoppers in Germany are significantly more likely to buy vegan products, with female shoppers and those from higher-income households and larger cities also showing higher purchase rates, especially online.

Product Categories:

In Germany, 24% of online shoppers have bought vegan products online in the past year, with 14% purchasing meat substitutes, followed by milk substitutes (11%), vegan cosmetics (9%), and vegan clothing (7%). Among dedicated vegan shoppers, about two-thirds buy meat substitutes and half buy milk substitutes.

Shopping Motivations:

The main motivation for purchasing vegan products online in Germany is the large product selection, with shoppers of milk substitutes and vegan clothing also driven by lower prices, product availability, and ingredient transparency.

Veganism is becoming increasingly popular in Germany, with more people embracing plant-based lifestyles for health, environmental, and ethical reasons. As demand for vegan products grows, a variety of online stores have emerged to meet the needs of vegan shoppers. But which of these stores are the most popular, and what makes them stand out?

Based on survey data from ECDB and Statista, we explore the top vegan online stores in Germany. Learn how factors like age, income, and household size influence shopping preferences and discover why Veganz leads the pack, along with insights into other favored stores across different demographics.

Top Online Vegan Stores in Germany:

Veganz Leads

Based on the forementioned survey results, here are the top vegan online stores in Germany:

1. Veganz

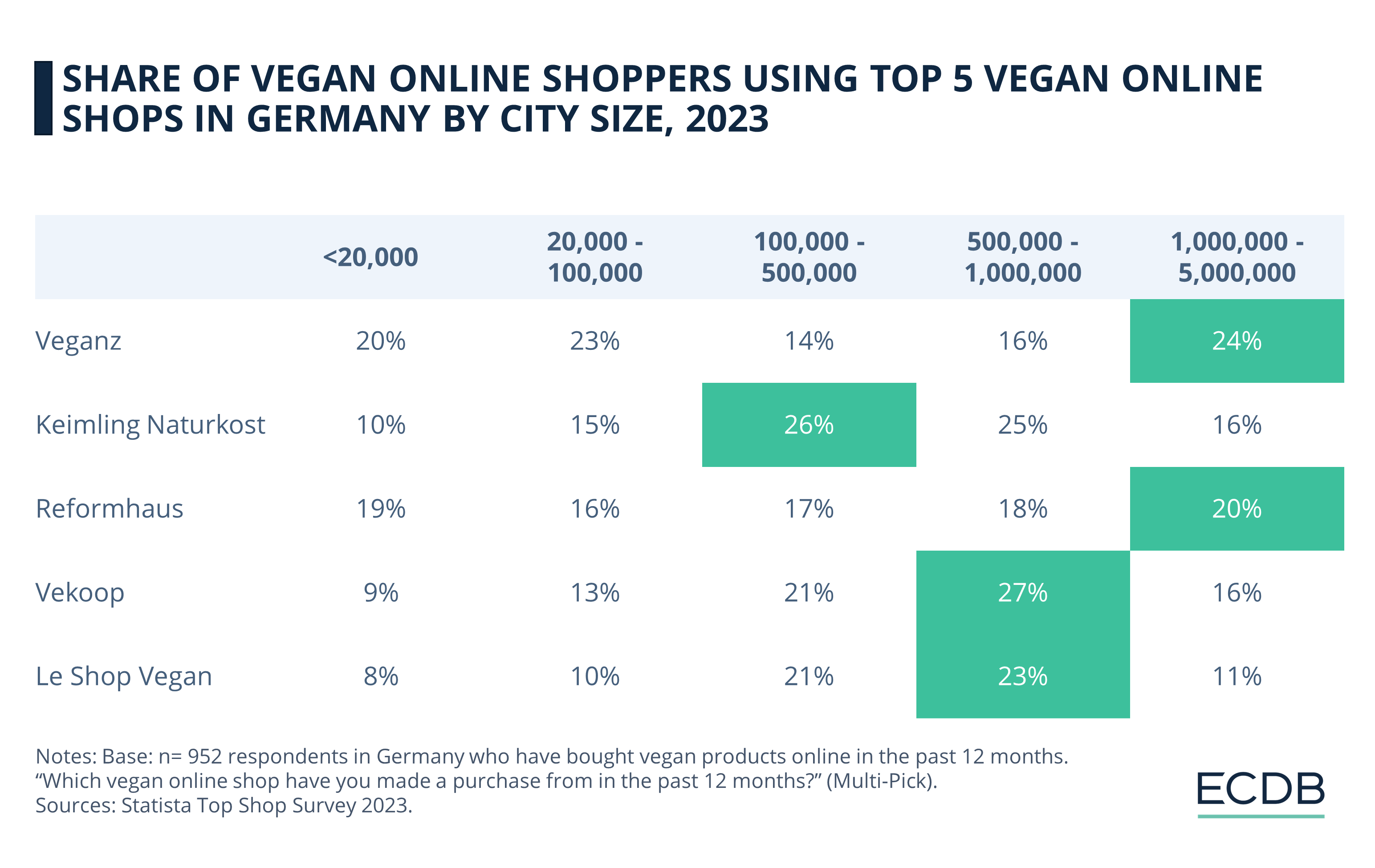

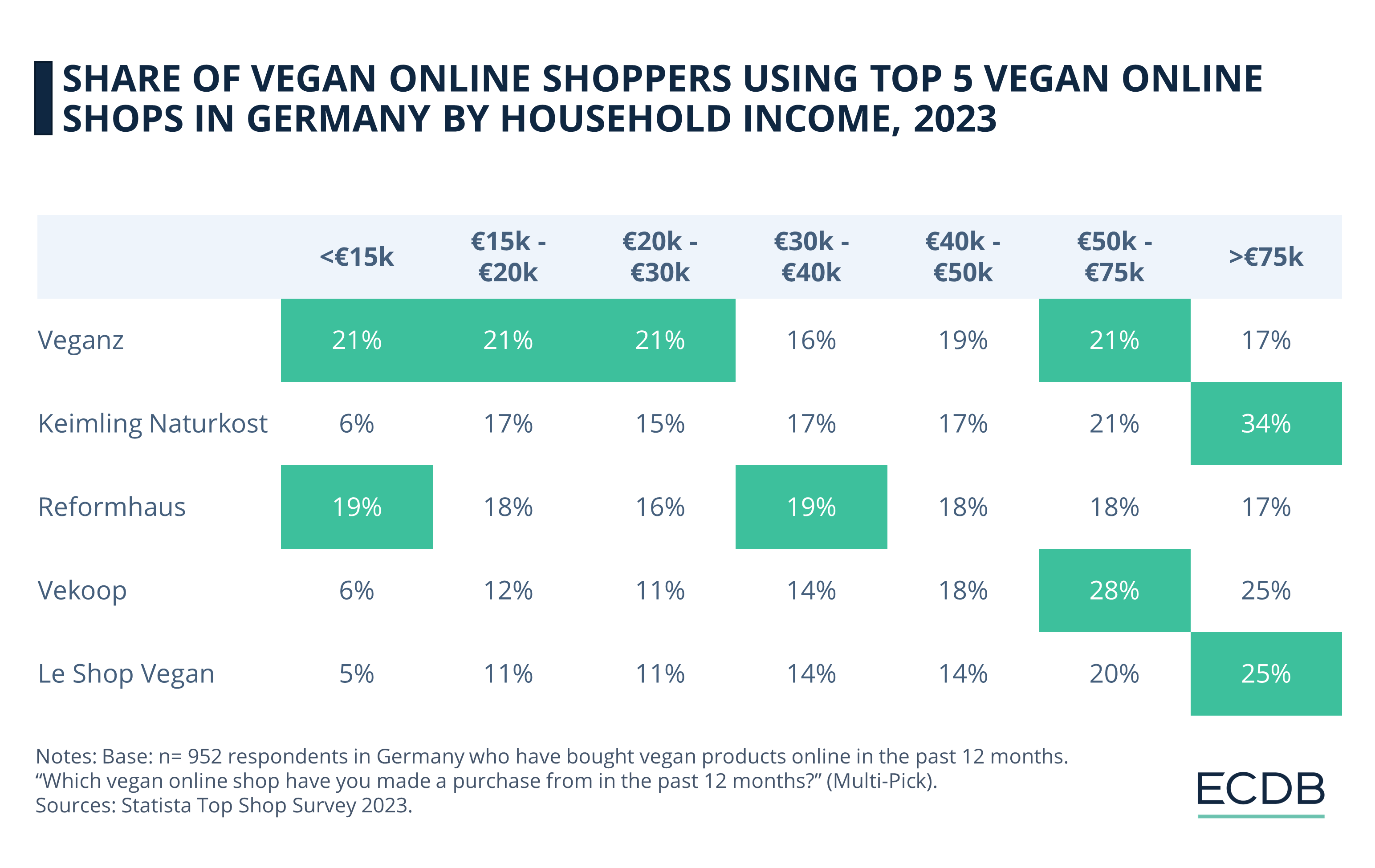

Veganz ranks number one, with 19.5% of surveyed vegan online shoppers having made a purchase within the past year. It is the most popular vegan online shop among female shoppers in Germany (with almost a quarter preferring Veganz), particularly among those aged 25-34 and those living in both small cities (under 100,000 inhabitants) and large cities (over 1 million inhabitants). Veganz is also favored by single-person households and those with a yearly net income of US$15,000 to US$30,000.

Founded in Berlin in 2011, Veganz was Europe’s first vegan supermarket chain. Initially focused on physical stores, it transitioned to an online and product-focused business model. Today, Veganz offers over 470 products, including sweets, snacks, plant-based proteins, and cheese alternatives. The company has been a pioneer in sustainable practices, introducing compostable packaging and the Eaternity Sustainability Score, which highlights the environmental impact of its products. Veganz products are now available in over 22,000 stores across 28 countries.

2. Keimling Naturkost

Keimling Naturkost is the second most popular, with 17.8% of vegan online shoppers having made a purchase in the past year. It is particularly favored in cities with populations between 100,000 and 1 million. This store is popular among households with incomes over US$50,000 and those with three or more members. Male users tend to prefer Keimling Naturkost over other shops, with one fifth of them having opted for the online store.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

Keimling Naturkost has built its reputation on offering a wide range of natural and raw vegan foods. The store is known for its high-quality kitchen appliances and health foods, catering to a niche market of health-conscious vegans. Recently, Keimling has expanded its product line to include more ready-to-eat vegan meals and snacks, reflecting the growing demand for convenience in the vegan market.

3. Reformhaus

Reformhaus ranks third, with 17.5% of vegan online shoppers having made a purchase within the past year. Like Veganz, it is popular in large cities and among single-person households. Reformhaus is particularly preferred by the 35-44 age group, who value natural products.

Reformhaus has a long history as a trusted retailer of natural and organic products in Germany. It has been a go-to for health and wellness products since its inception. Recently, Reformhaus has focused on increasing its online presence and expanding its range of vegan products, including supplements and natural cosmetics, to cater to the growing vegan population.

4. Vekoop

The fourth most popular online store in our list is Vekoop, with 16.2% of vegan online shoppers having made a purchase in the past year. It shares similarities with Keimling Naturkost in terms of popularity in mid-sized cities, higher-income households, and male shoppers with larger households.

Vekoop offers a wide range of vegan products, from groceries to personal care items. Known for its commitment to sustainability, Vekoop has recently enhanced its product line to include more eco-friendly and organic options. The store also emphasizes local and small-batch producers, ensuring high-quality products with minimal environmental impact.

5. Le Shop Vegan

Le Shop Vegan is the fifth online store in the survey ranking, with 14.2% of vegan online shoppers having made a purchase within the past year. Like Keimling Naturkost and Vekoop, it is popular among higher-income households and larger families. Le Shop Vegan leads in the sale of milk substitutes, with 73% of shoppers purchasing these products from the store.

The online store has carved out a niche by offering a curated selection of stylish vegan products, including fashion, accessories, and cosmetics, alongside food items. The store focuses on ethical and sustainable brands, making it a favorite among conscious consumers. Recently, Le Shop Vegan has expanded its offerings to include more zero-waste and plastic-free products, catering to the growing demand for sustainable living solutions.

Who Buys Vegan Products Online in Germany?

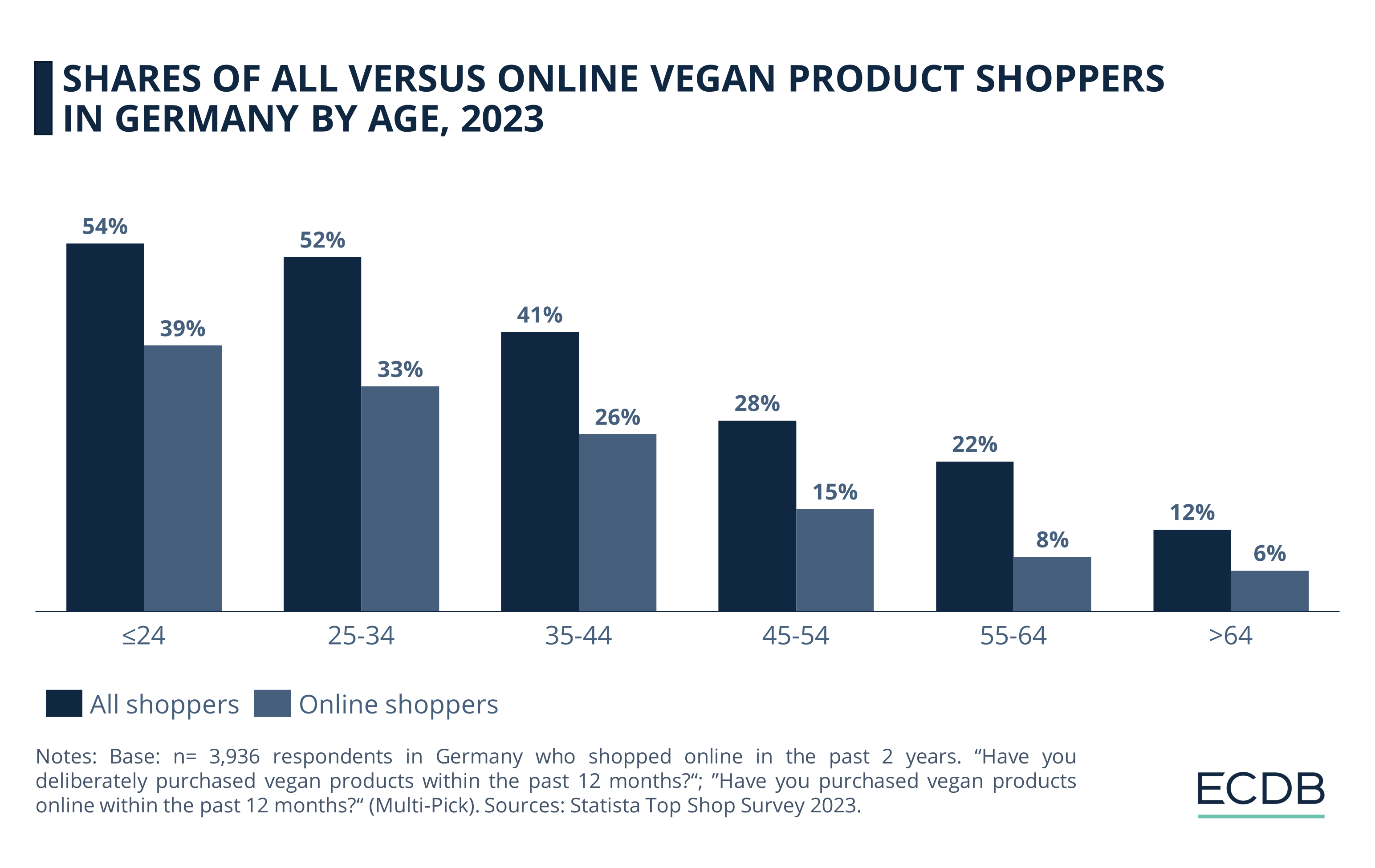

According to the survey results, 4 out of 10 of online shoppers in Germany reported having deliberately purchased vegan products in the past 24 months (all channels — both offline and online), while the same rate drops to a quarter when only online purchases are considered.

Here are some key insights from the survey results:

More than half of online shoppers under 24 have made a vegan purchase, where only one tenth of those above 64 reported such a purchase. So, the younger the user, the more likely they are to have purchased vegan products. In addition, younger vegan product shoppers were also found to be more likely to have purchased vegan products online instead of offline.

Regarding both overall and exclusively online vegan purchases, female online shoppers are more likely to have deliberately purchased vegan products. Despite the fact that male online shoppers have a lower purchase rate, male vegan product shoppers are reportedly more likely to have purchased vegan products online instead of purely offline.

For the most part, household income is in direct proportion to both overall and exclusively online vegan product purchase rates, as well as the likelihood of opting for shopping online instead of offline.

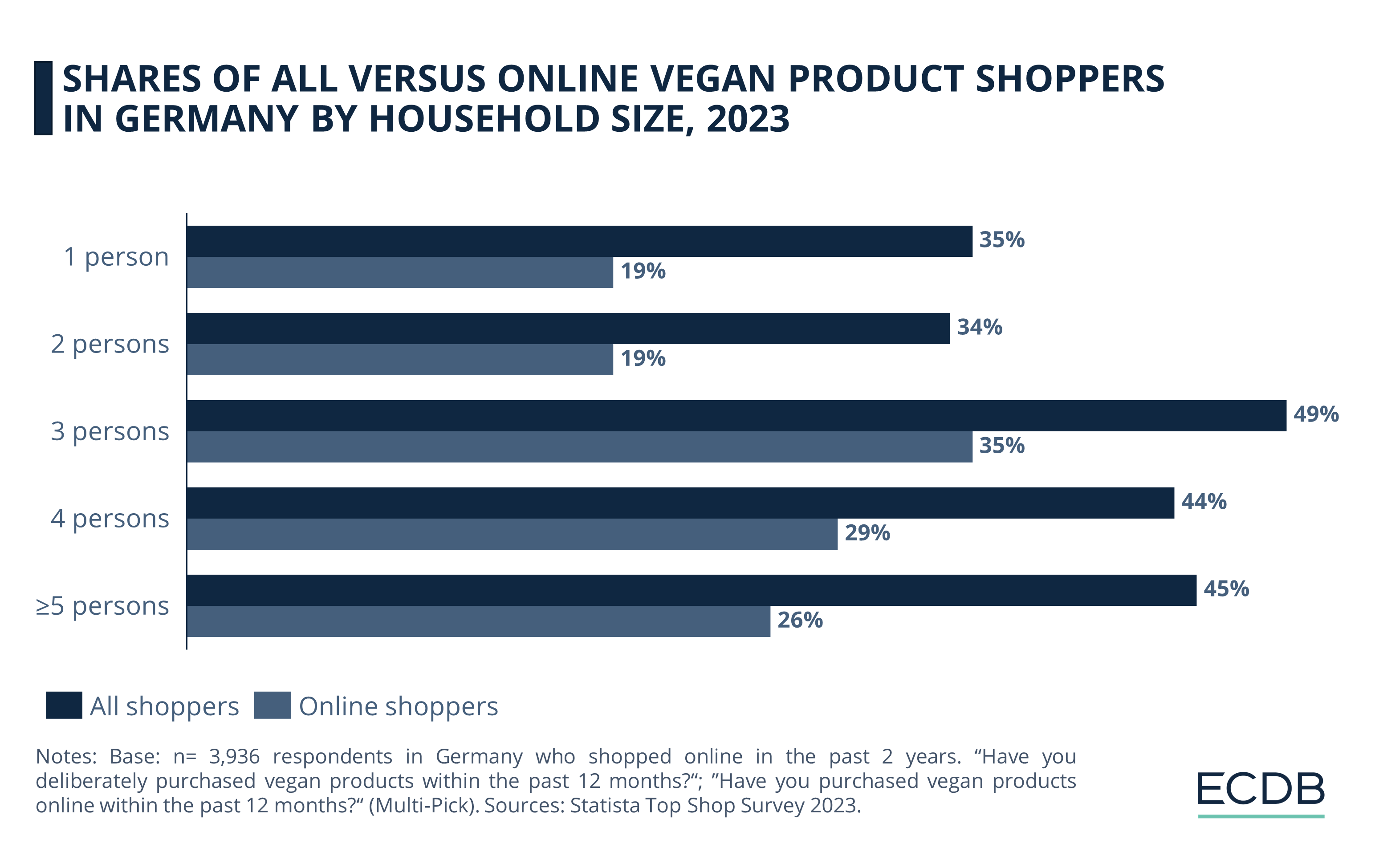

Almost half of online shoppers living in 3-person households reported having deliberately purchased vegan products in the past year, compared to one third of online shoppers in 2-person households.

Looking solely at online purchases, we see that 3-person households are also in the lead here, as more than one third of them have deliberately purchased vegan products online in the same time period, compared to one fifth of online shoppers living in 1-person and 2-person households. Furthermore, vegan product shoppers from 3-person households were also reported to be more likely to have purchased vegan products online than offline.

In regards to both overall and exclusively online vegan purchases, online shoppers living in cities with more than 20,000 inhabitants are more likely to deliberately buy vegan products compared to smaller cities. What's more, vegan product shoppers from cities with more than 100,000 inhabitants were found to be more likely to have purchased vegan products online than offline.

Going more granular, we will now focus on the type of vegan products users purchase online in Germany.

Top Vegan Products Purchased Online

in Germany

While 24% of all online shoppers in Germany have deliberately purchased vegan products online over the past year, the share of online shoppers having purchased meat substitutes online is 14%.

Looking at the other vegan product categories, we see that the purchase rate for milk substitutes is 11%, followed by vegan cosmetics with 9% and vegan clothing with 7%.

Two Thirds of Vegan Online Shoppers in Germany Purchased Meat Substitutes Online

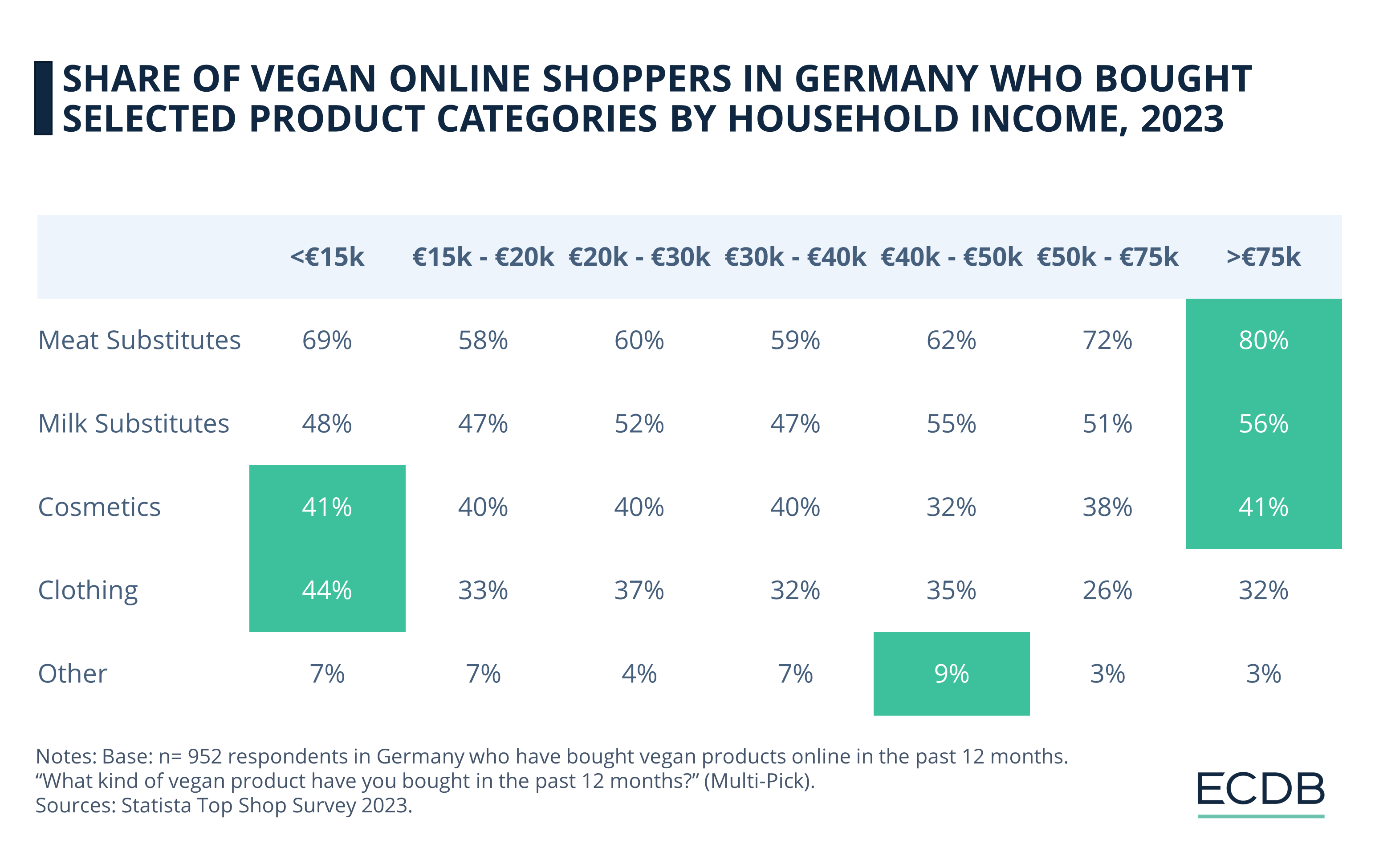

Focusing exclusively on vegan online shoppers in Germany from here on, we see that about two thirds of them have purchased meat substitutes online, while half of them opted for milk substitutes, 39% for vegan cosmetics and one third for vegan clothing.

Findings indicate that vegan online shoppers who purchase milk substitutes are also likely to purchase meat substitutes online. In a similar way, those who purchase vegan cosmetics online were found to be also likely to purchase vegan clothes online.

Survey results reveal much more regarding demographics:

Female vegan online shoppers are more likely to purchase vegan cosmetics and clothing online.

Vegan online shoppers younger than 35 are more likely to purchase milk substitutes online, while those older than 35 are more likely to purchase vegan fashion and meat substitutes online.

Vegan online shoppers from high-income households are more likely to buy meat or milk substitutes online. Households with lower income, on the other hand, were found to be more likely to buy vegan cosmetics and vegan clothing online.

While the popularity of meat and milk substitutes, as well as vegan clothing, doesn’t fluctuate all that much in different household sizes, larger households were found to be more likely to buy vegan cosmetics.

Meat substitutes are more likely to be purchased by vegan online shoppers living in cities with populations of 1 to 5 million, while milk substitutes are more likely to be purchased by those living in cities with populations of 100,000 to 1 million. As for vegan cosmetics and clothing, the former are more likely to be purchased in cities with more than 1 million inhabitants, while the latter are more likely to be purchased in cities with less than 100,000 inhabitants.

Large Product Choice is the Top Motivation for

Shopping Vegan Online

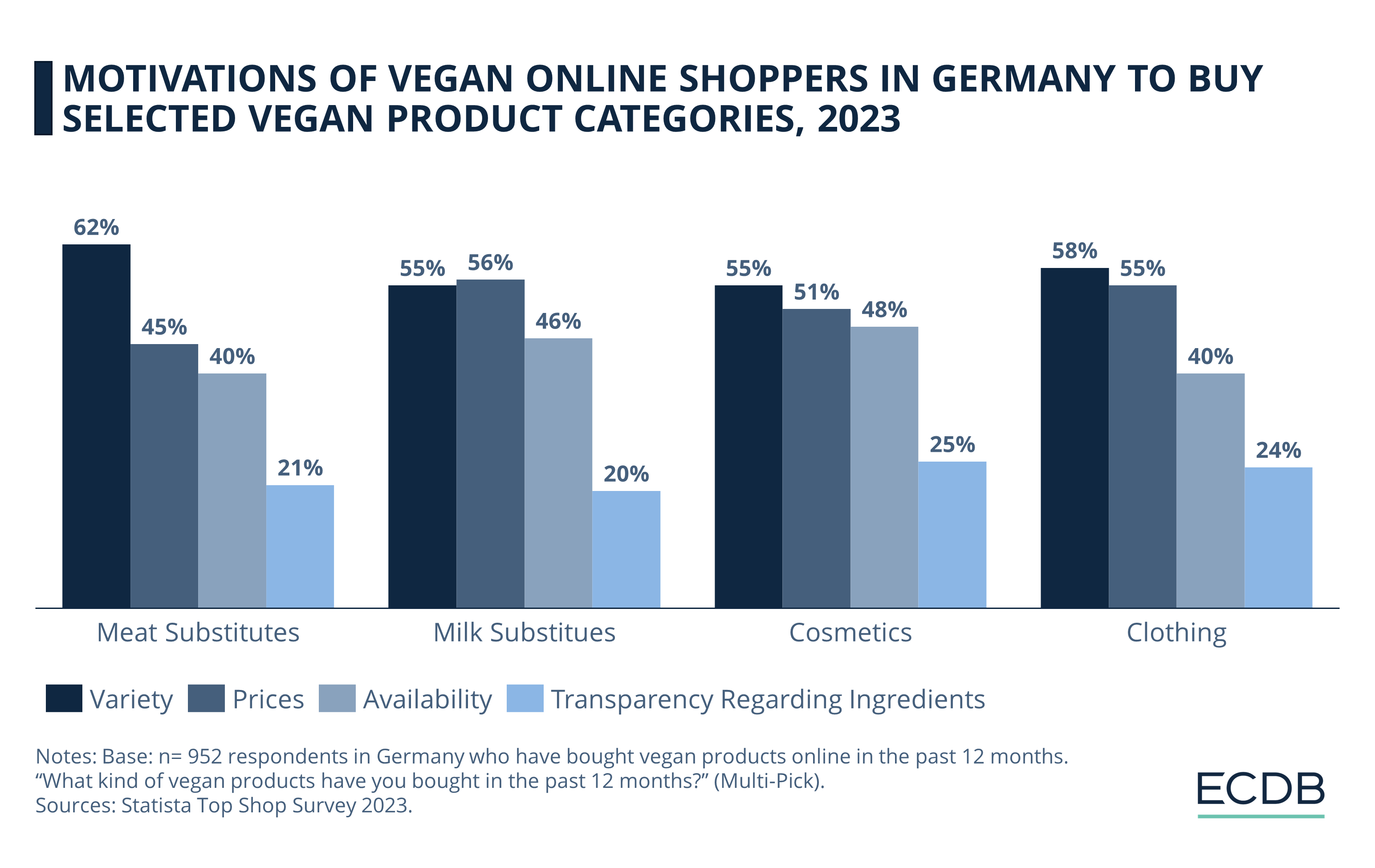

Overall, survey results suggest that the biggest motivation to purchase vegan products online is the large choice of products.

In addition, shoppers of milk substitutes and vegan clothing are particularly motivated by online prices as well, while other reasons include availability of products and transparency regarding ingredients.

Top Online Vegan Stores in Germany:

Final Thoughts

The future of the vegan online market in Germany and globally looks promising. With increasing awareness about health, sustainability, and animal welfare, more consumers are turning to plant-based products. This trend is expected to grow, driven by younger generations and urban dwellers.

Online vegan stores, with their extensive product ranges and commitment to sustainability, are well-positioned to meet this demand. As technology and logistics improve, accessibility and convenience will further boost online vegan shopping.

Sources: Veganz, Keimling Naturkost, Reformhaus, Vekoop, Le Shop Vegan, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Back to main topics