As online shopping has become the new normal for shoppers around the world, eCommerce-related fraud is on the rise. Fraud attacks range from consumer perpetrators to organized crime. They include stealing personal information to make purchases in the victim’s name, and exploiting company policies to obtain larger discounts. Schemes to cover the tracks of illegal activity by mimicking a legitimate exchange of goods for payment account for another substantial number of fraudulent attacks.

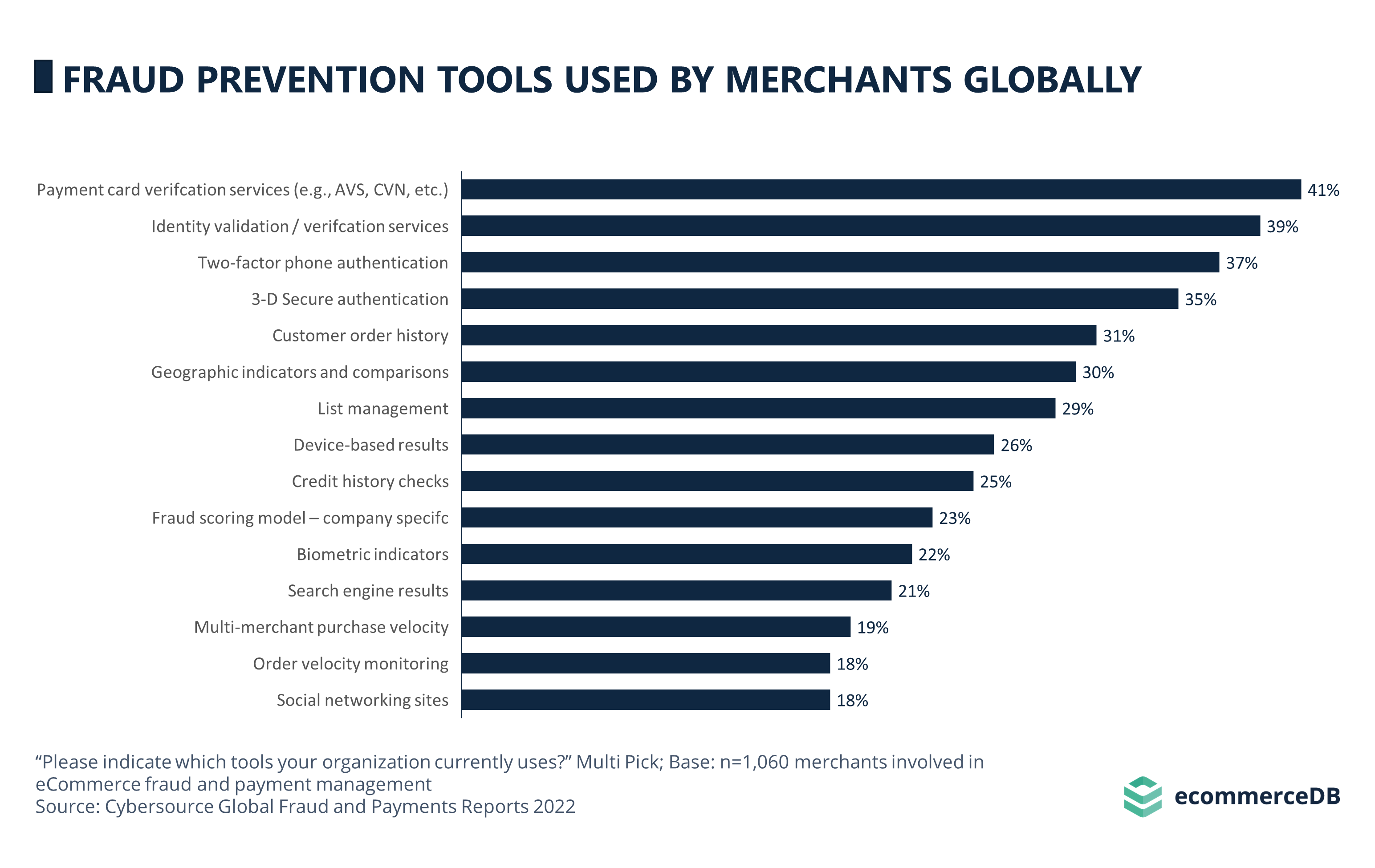

Merchants are no strangers to fraudulent activity in their organizations, and that’s why, according to Cybersource’s 2022 Global Fraud and Payments Report, they use an average of four different tools and services to identify fraud early on and take the necessary steps to prevent it. The following chart shows the most common fraud prevention tools used by merchants.

The Most Commonly Used Fraud Prevention Tools

According to Cybersource, 41% of global merchants use card verification tools such as Card Verification Numbers (CVN) and Address Verification Services (AVS). CVN are essential for online payments. The three or sometimes four digits on a card’s magnetic stripe or card security feature make it harder for hackers to conduct fraudulent payments when the card is not physically present. AVS or Address Verification Services check the billing address against the shipping address to detect deviations from usual purchases. Of course, these security measures also have their risks. Alternative methods are as follows:

Identity Validation Services is the second most commonly used fraud prevention method, cited by 39% of respondents. There are several ways to verify a customer’s identity, either by using official documents or by referring to other accounts that are verified, such as bank accounts.

Another 37% of merchants offer Two-Factor Phone Authentication (2FA), a service where users receive a code via SMS, email, or phone call, or they install an app that generates a code. On the one hand, it’s efficient to tie authentication processes to users’ mobile phones, because mobile phones are usually situated within the user’s reach and can centralize key payment processes in one place. However, this also leaves customers vulnerable to theft or hacking.

Another common fraud prevention tool is 3-D Secure Authentication (3DS), a service currently used by 35% of merchants. 3DS takes customers directly to their bank’s authentication page, where they verify their identity by entering their personal banking information.

31% of respondents review their customers’ order history to detect unusual activity, while 30% look for geographic indicators that indicate fraudulent purchases, and 29% collect information about their customers, also known as list management. The latter describes the process of verifying customer information and to weed out fake accounts and bots.

An anti-fraud software can create a Fraud Scoring Model that calculates the likelihood of a user being a fraudster. It combines all available information on the user, such as IP address, email address, devices used, and so on. When a new account is registered and the user has already been blacklisted on other platforms, the system can route the data for manual review by an employee. 23% of merchants in the Cybersource survey use this type of fraud prevention tool, which is company-specific and can take many forms.

Biometric indicators such as face ID, voice recognition, fingerprint technology and others are used by 22% of retailers. Search Engine Results are preferred by 21% of respondents, a research method that can be automated and may thus become more efficient over time, taking into account the use of AI and machine learning.

The three least cited methods include two types of velocity checks. These look at the number of transactions that have taken place in a given time frame, looking for irregularities. Performing these checks across merchants (19%) can help catch fraudsters early. Monitoring the number of completed orders (18%) can also indicate fraudulent purchases if an unusually high number of transactions have taken place. Finally, 18% of merchants use Social Networking Sites to identify fraud schemes, as fraudsters communicate on social networks to educate interested participants on how to defraud businesses most effectively.

Once Bitten, Twice Shy

Online shopping has opened up new opportunities for fraudsters around the world, and merchants are responding with a variety of tools and services to detect and prevent fraud. From card verification tools to identity validation services, Two-Factor Phone Authentication, and biometric indicators, there is a wide range of fraud prevention methods available to merchants. While some of these methods are more commonly used than others, they all play an important role in protecting merchants and customers from fraudulent activity. Going forward, merchants are expected to continue exploring new and innovative fraud prevention methods, such as AI-powered search engine results and machine learning algorithms, to stay ahead of the curve and keep their customers' data safe.

Sources

Related insights

Article

eCommerce Market in Europe 2024: Worth 1 Trillion Dollars Soon

eCommerce Market in Europe 2024: Worth 1 Trillion Dollars Soon

Article

In-Game Purchases Analysis: Walmart Dives Into Roblox

In-Game Purchases Analysis: Walmart Dives Into Roblox

Article

Top Online Payment Methods in the UK: Digital Wallets Challenge Cards

Top Online Payment Methods in the UK: Digital Wallets Challenge Cards

Article

Cryptocurrencies in the United States: Revenue Development, Top Currencies, Acceptance in eCommerce

Cryptocurrencies in the United States: Revenue Development, Top Currencies, Acceptance in eCommerce

Article

Global PayPal Usage: Germany Leads in Online Store Acceptance

Global PayPal Usage: Germany Leads in Online Store Acceptance

Back to main topics