eCommerce: Growth Trends

Fastest-Growing Online Stores in Germany: Children’s Entertainment, Health Products & Discounters

Which German online stores outran all the others in 2023? Considering only those stores with eCommerce net sales over US$50 million and primary sales market in Germany, here are the ones that stood out.

Article by Nadine Koutsou-Wehling | July 05, 2024Download

Coming soon

Share

Fastest-Growing Stores in Germany: Key Insights

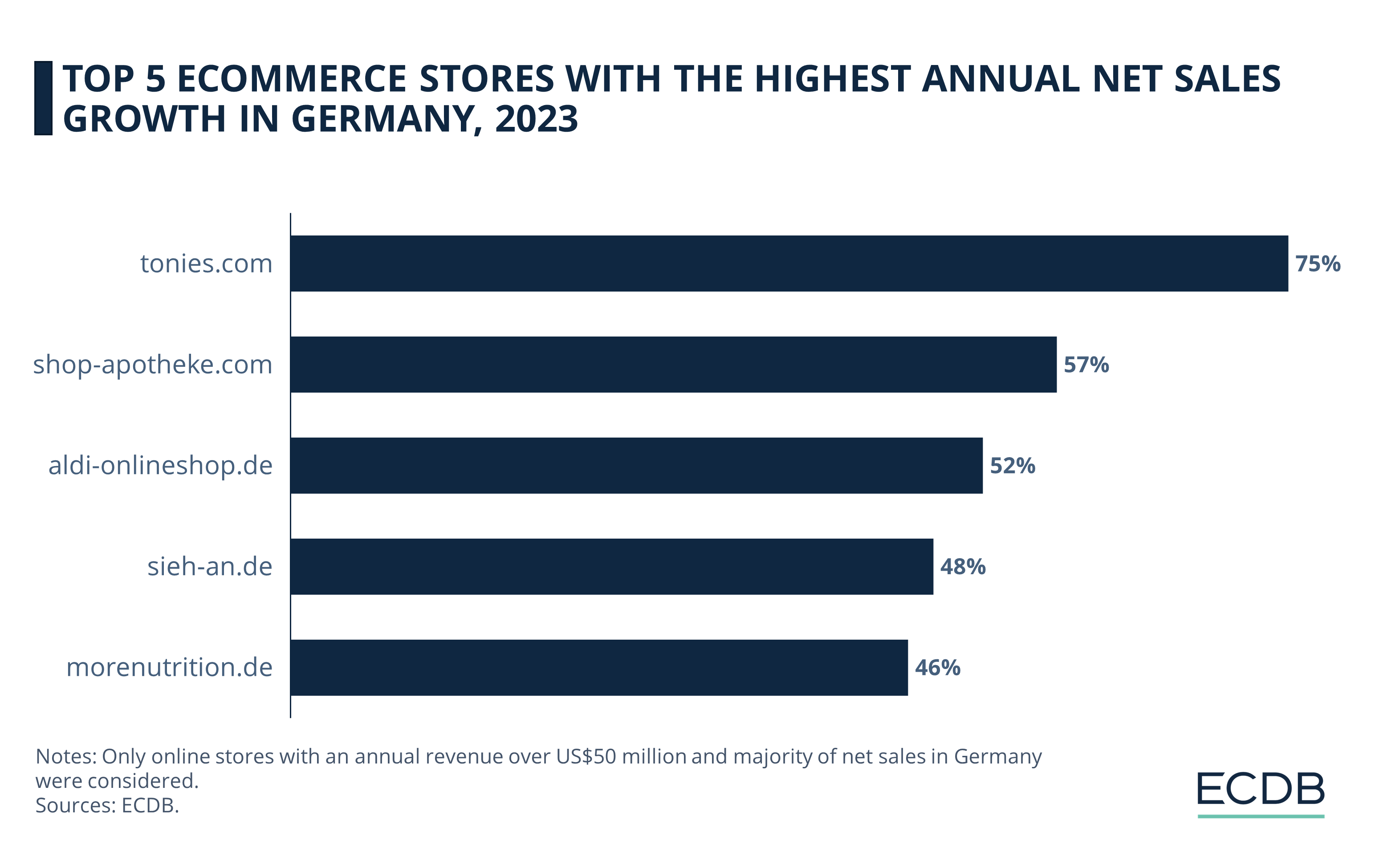

Top 5 Online Stores in Germany That Grew Highest in 2023: Children's entertainment media retailer tonies.com, with a 75% increase in net sales, ranks highest in 2023. It is followed by shop-apotheke.com (57%), aldi-onlineshop.de (52%), sieh-an.de (48%), and morenutrition.de (46%).

Common Trends: A health-conscious lifestyle and low prices unite some of the fastest growing stores in the market. Tonies stands out for its innovative approach and unique flagship product, the "Toniebox".

Retailer Affiliations: Shop Apotheke is operated by Redcare Pharmacy, a European conglomerate in the health products industry. Aldi Onlineshop belongs to one of the biggest discounter chains in Germany, while Sieh an! is affiliated with the Otto Group.

Germany is a flourishing eCommerce market, the 6th largest in the world. It is home to a number of successful eCommerce companies, many of which have expanded internationally.

At ECDB, we use our extensive dataset to answer relevant industry questions, benchmarking company performance. One of the data points you can benefit from is company growth rates.

Which online stores grew fastest in Germany in 2023? Looking only at stores with more than US$50 million in annual net sales and a primary market in Germany, here are the players that stand out.

What Is an Online Store? What Growth Are We Talking About?

Online stores differ from online marketplaces, which act as intermediaries between sellers and consumers. Online stores are sellers' websites that offer their own products to shoppers. The key metric here is net sales.

Net sales provide a clear view of revenue by subtracting returns, allowances, and discounts. By tracking net sales over time, companies can identify trends, enhance operational efficiency, and lower costs. Net sales are also useful for setting revenue targets and evaluating new initiatives. They aid in informed decision-making and investment by assessing financial health and growth potential.

Fastest Growing Online Stores in Germany

Two conditions determine the ranking of the fastest-growing online stores in Germany: 1. stores must generate more than US$50 million in annual revenue, and 2. the store’s primary market must be Germany.

Tonies is a German toy retailer that is known for the “Toniebox”, a cube that plays audio books and children’s stories. It grew by 75% in 2023, ranking first among the fastest growing stores in German eCommerce.

Shop Apotheke is a German online pharmacy that has been active since 2004. Just in recent years, however, growth took off on a major scale, making shop-apotheke.com the second-fastest growing online store in 2023.

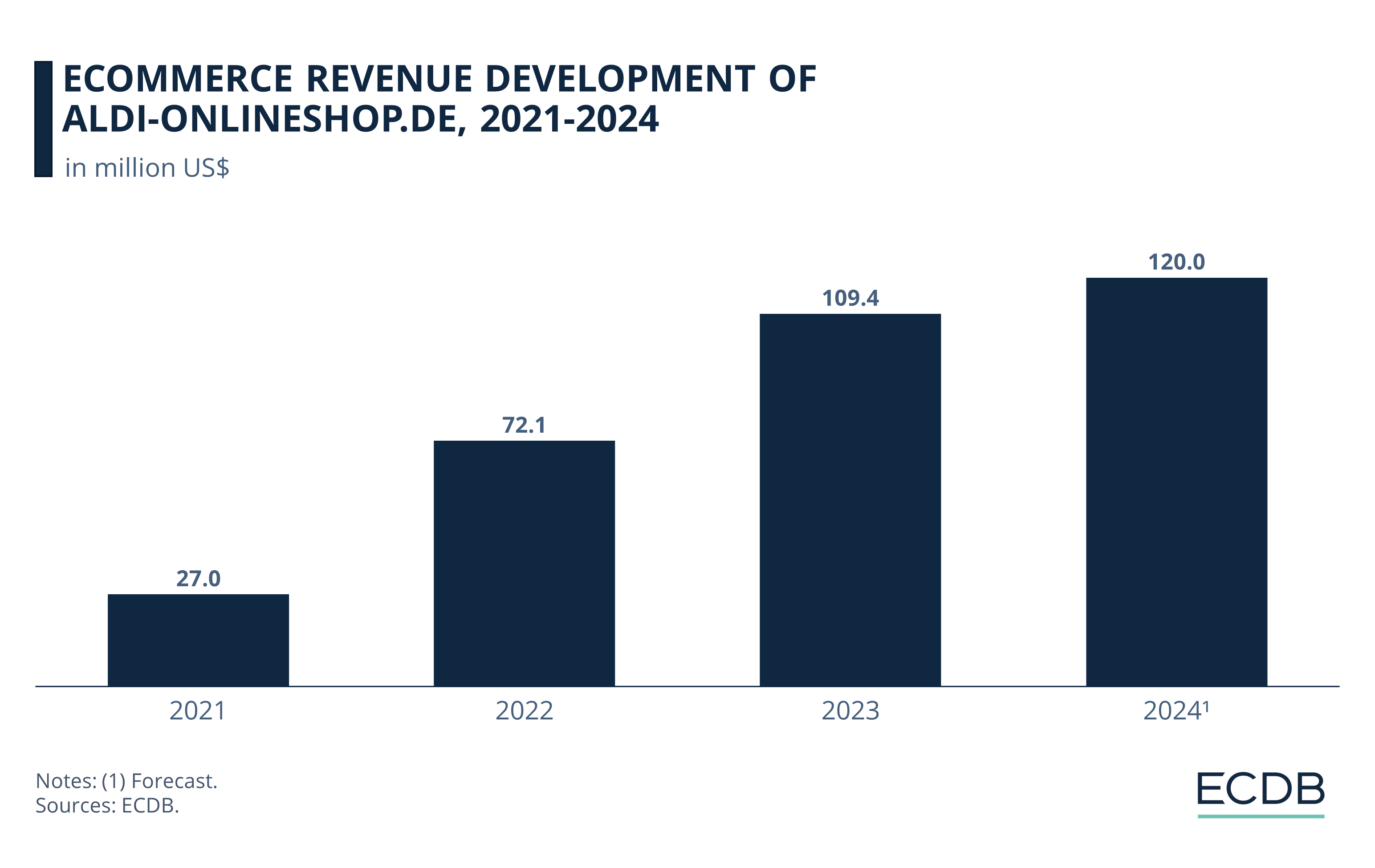

Aldi Onlineshop is the integrated online shop of the two German discounters Aldi Süd and Aldi Nord, which are geographically divided throughout their physical operations. In 2023, aldi-onlineshop.de increased net sales by 52%.

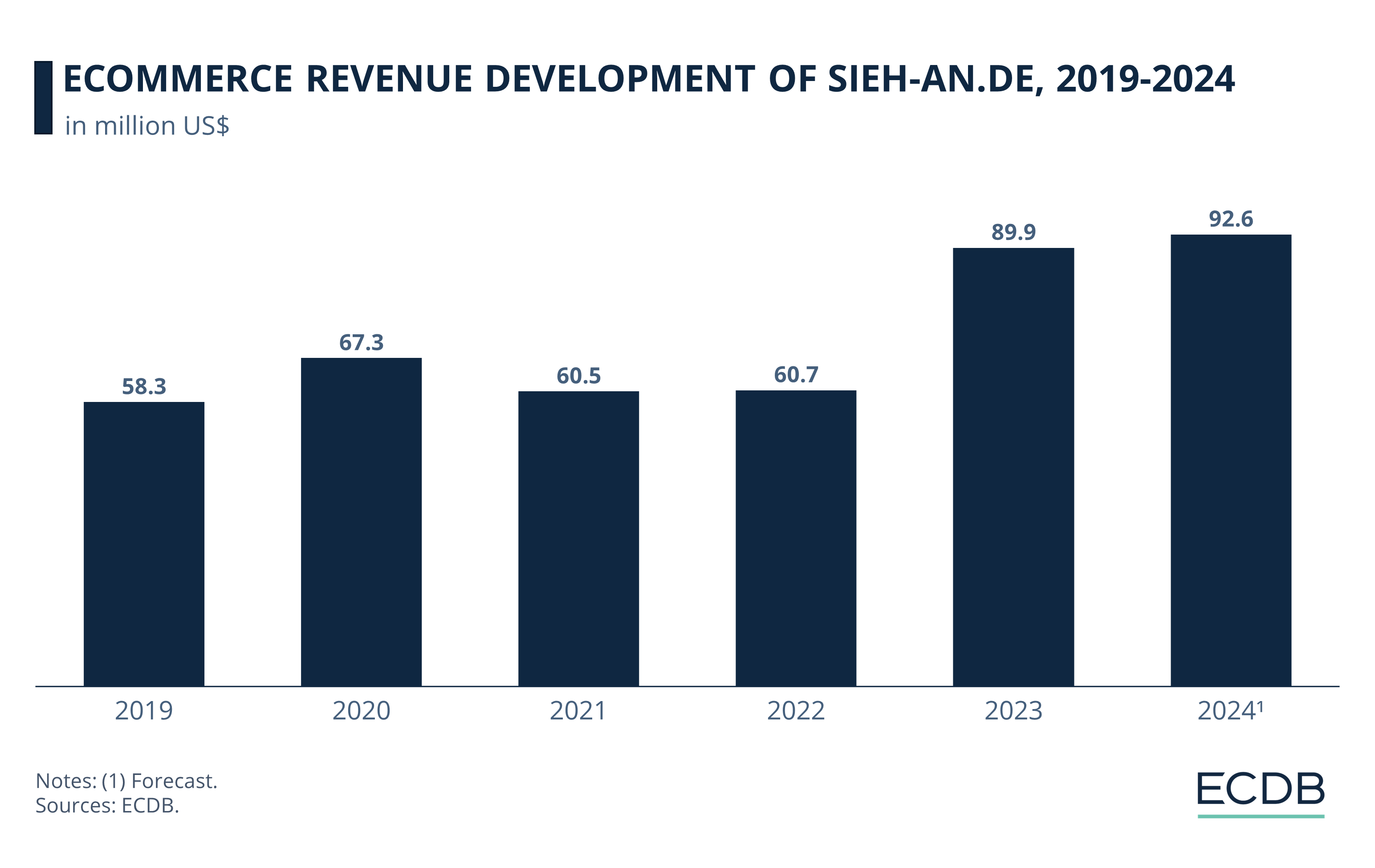

Sieh an! is a German fast-fashion online store targeting an older female audience and a subsidiary of the Otto Group. Net sales at sieh-an.de grew by 48% in 2023.

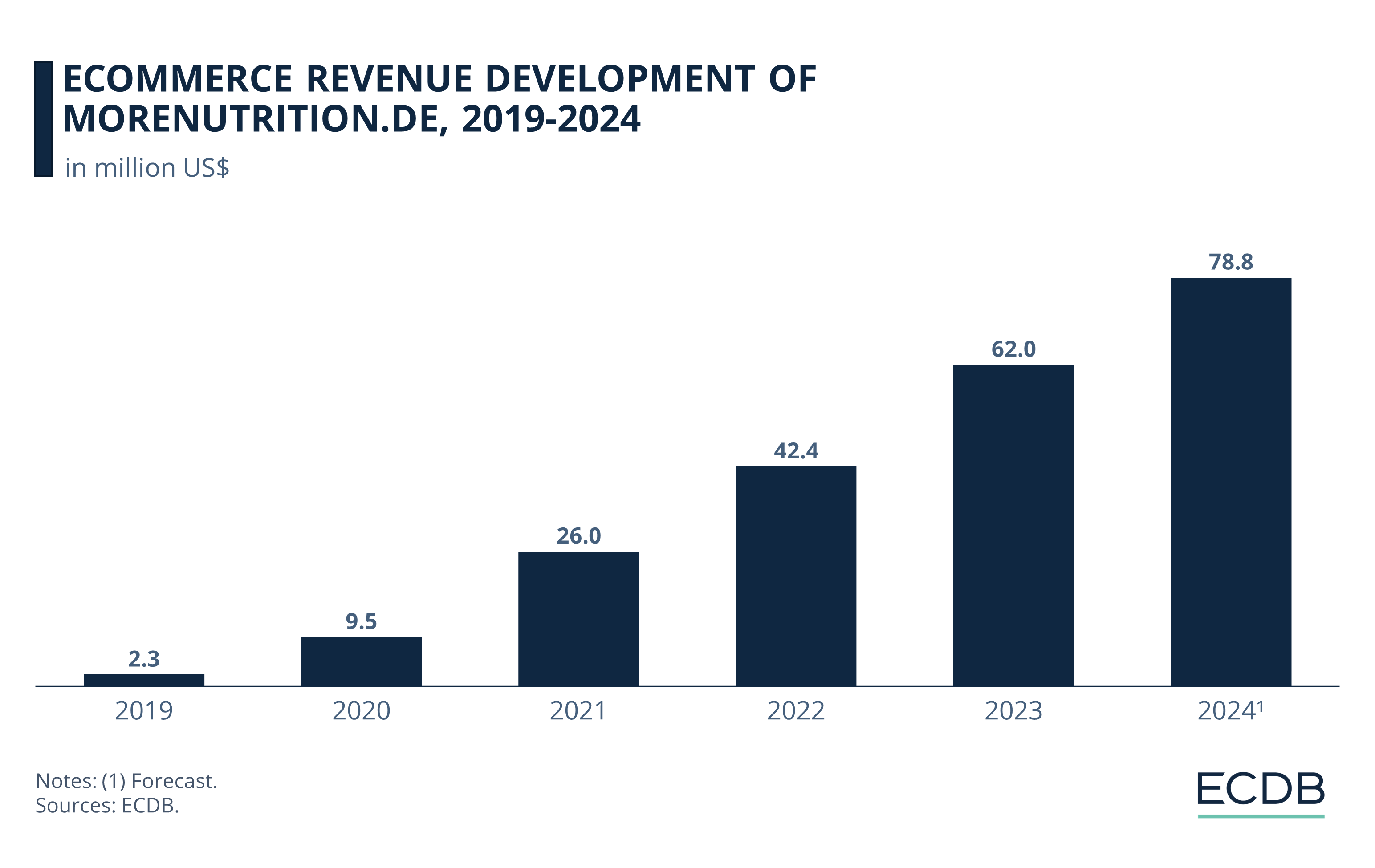

Fifth rank among fastest-growing online stores in Germany is More Nutrition, a German brand of nutritional supplements and low-calorie products. Morenutrition.de’s online net sales increased by 46% in 2023.

Here are the underlying factors that contributed to the store's growth.

1. Tonies.com (74.5%)

Tonies is a retailer specializing in children’s products, best known for the “Toniebox”. The brand’s sales channels are both offline and online, with eCommerce accounting for 63% of total revenues in 2023. The remaining share is generated by sales in drugstores, supermarkets and toy stores.

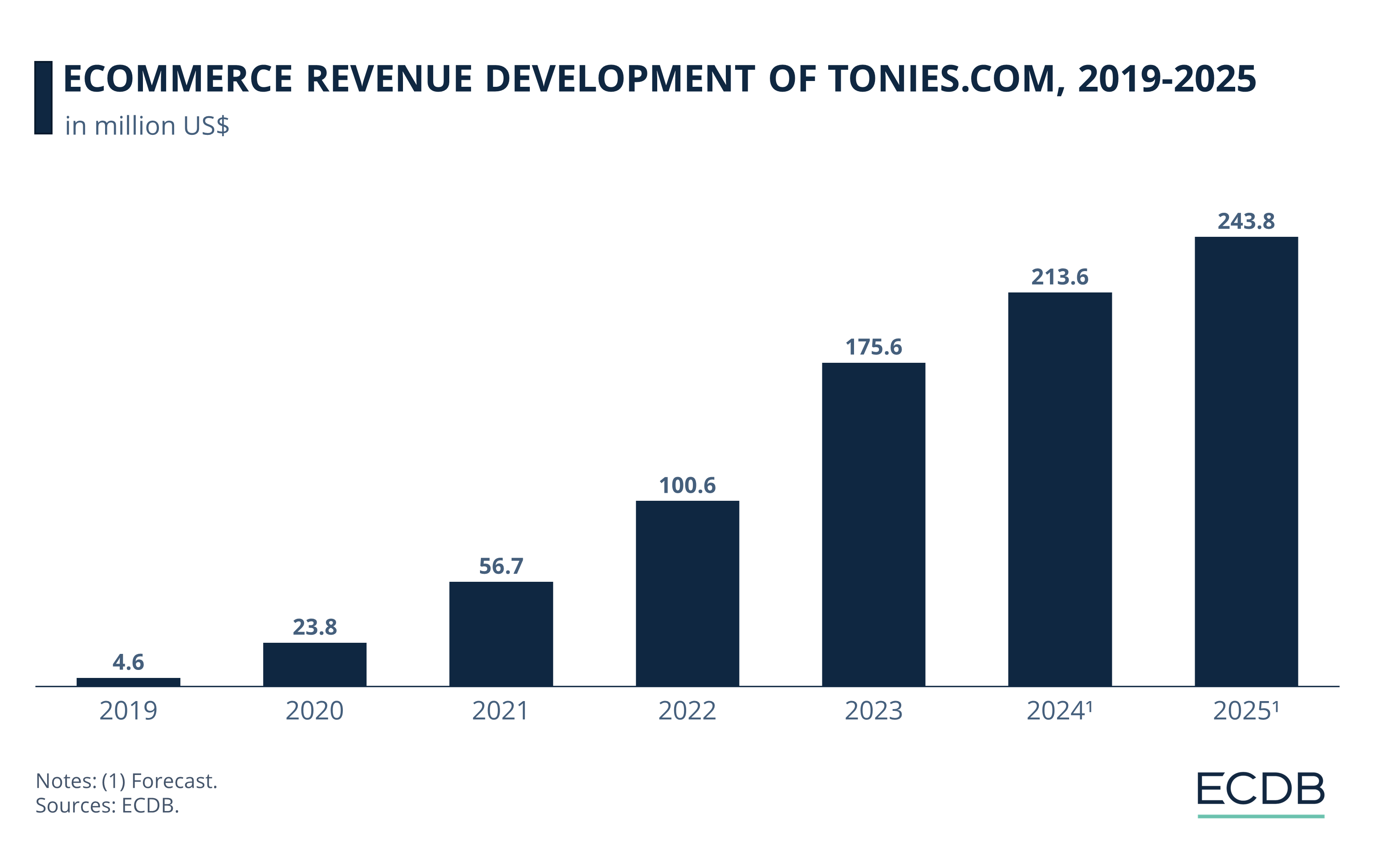

The brand is of German origin, and most of its online net sales are generated in its home market (42.5%). The United States follows in second place with 26.3% and Switzerland is third with 9.6%. See how the brand's popularity and net sales have grown over the past few years:

eCommerce net sales on tonies.com gained traction during the pandemic, when net sales increased from US$4.6 million to US$23.8 million in 2020.

Growth continued to accelerate in subsequent years. In 2022, net sales exceeded US$100 million for the first time, and just one year later, in 2023, net sales reached US$175.6 million. This results in a growth rate of 74.5%.

Forecasts for 2024 and 2025 expect the positive trend to continue: By 2025, online sales are expected to approach US$250 million.

Tonies' growth is driven by strong consumer demand for screen-free children’s entertainment and products that are seen as innovative but safe. The next market in the ranking has a very different product focus, but still operates under the premise of helping consumers make healthy choices.

2. Shop-Apotheke.com (57.2%)

Shop Apotheke is an expanding online pharmacy whose parent company, Redcare Pharmacy, operates eCommerce stores across Europe. Its Italian domain is even one of the fastest-growing online stores in the world.

Shop-apotheke.com operates exclusively in Germany and is also in the ranking of the top 10 specialist online pharmacies, where it places third behind Walgreens and CVS.

While the pandemic certainly increased global awareness of online pharmacies and accelerated net sales, Shop Apotheke's net sales jumped after the pandemic:

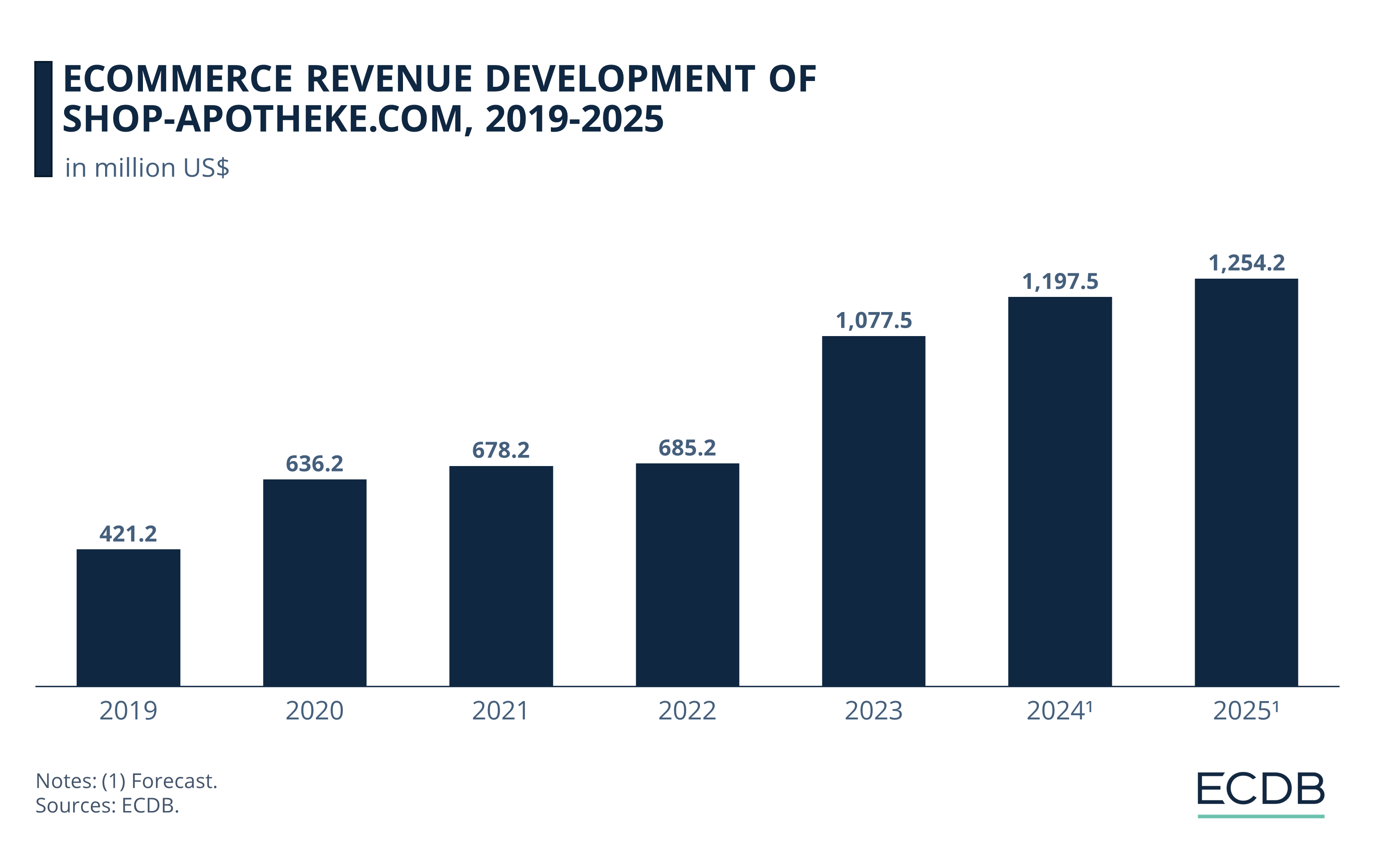

Shop-apotheke.com already generated substantial net sales before the start of the pandemic, with US$421.2 million in 2019. While revenues increased during the health crisis, they surged in 2023.

From around US$650 million in online net sales between 2020 and 2022, they reached US$1.1 billion by 2023. This marks a year-over-year increase of 57%.

The high revenue level is expected to remain throughout the following years: By 2024 and 2025, forecasts expect eCommerce net sales to reach US$1.2 billion and US$1.3 billion, respectively.

3. Aldi-Onlineshop.de (51.7%)

Aldi Onlineshop was launched in 2021 and combines the offers of the two related discounters Aldi Süd and Aldi Nord under one roof. Before the launch, the online store was accessible under the domain aldi-liefert.de, which is now closed. Aldi Onlineshop operates entirely in Germany, but Aldi has other domains in other countries, such as aldi.us, aldi.ie, and aldi.co.uk.

Although Aldi is a supermarket chain that primarily sells groceries, Aldi Onlineshop only sells non-grocery items in the categories of DIY, furniture & homewares, hobby & leisure, electronics, and personal care products. The international Aldi domains, on the other hand, focus on groceries.

The lack of grocery sales by Aldi Onlineshop likely reflects the general difficulty in establishing a viable quick commerce infrastructure in the market.

The launch of the domain in 2021 resulted in net sales of US$27 million, which grew steadily in subsequent years: In 2022, net sales were already at US$72 million, and then US$109.4 million in 2023.

Moderate growth is forecast for 2024, with US$120 million in online net sales.

Aldi is a discount chain that is particularly attractive to consumers looking for a bargain. This is something it shares with the next ranked company, sieh-an.de.

4. Sieh-An.de (48%)

As mentioned above, sieh-an.de is a subsidiary of the Otto Group. Like many companies in the Otto portfolio, Sieh an! is a former mail-order company that has only recently fully committed itself to eCommerce.

Customers are attracted by the low prices of the products offered on sieh-an.de. The site is expected to have a fairly loyal following, taking over customers from the former mail order business.

Sieh-an.de saw consistent sales over the years, with revenues increasing slightly during the pandemic at a temporary peak of US$67.3 million in 2020.

An increased focus on eCommerce is reflected in an accompanying revenue growth: The site achieved online net sales of US$89.9 million in 2023.

Slight increases are forecast for the following year: Revenues are projected to reach US$92.6 million by 2024.

Last on the list is a company with a more contemporary focus that has gained traction by using influencer marketing campaigns to reach health-conscious and younger users.

5. Morenutrition.de (46.1%)

A brand of nutritional supplements and dieting products, More Nutrition has made its way through social media and gained awareness with a pervasive influencer marketing strategy. More recently, however, scandals shaped a large part of the discourse around More Nutrition.

Consumer protection agencies examined the health claims of the brand, counterclaiming that many of the advertising statements were untrue or based on doubtful assumptions. Despite these hiccups, it is believed that the negative press only heightened awareness of the brand and thus helped increase revenues nonetheless:

The nutritional supplements brand fostered a substantial revenue development over the course of the pandemic, growing first from US$2.3 million in 2019 to US$9.5 million in 2020.

Steady increases followed, first US$26 million in 2021 and US$42.4 million in 2022. Despite widespread media coverage of false claims by More Nutrition, revenue continued to grow throughout 2023, with annual net sales of US$62 million.

Forecasts for 2024 expect revenues to advance further, likely to approach US$80 million.

More Nutrition is an exemplary case of an online brand that effectively uses influencer marketing and UGC (user-generated content) to build brand awareness and foster a community of consumers with shared interests. Its significant growth rate comes against a backdrop of controversy, demonstrating that even bad press can help build brand awareness.

Fastest-Growing Online Stores in Germany: Wrap-Up

Examining the online stores with annual net sales over US$50 million and primary market in Germany reveals certain market trends: It becomes apparent that low costs and a health-conscious lifestyle manage to capture consumer interest, which is reflected in high net sales growth.

Tonies is little of an outlier, not only in terms of the larger growth rate in 2023, but also the innovative product mix it offers. Because educational and screenless children’s entertainment in times of iPad kids and social commerce for the youngest users calls for counter-movements into the other direction, Tonies success in these times can be attributed to this fact.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Wayfair’s Shopping Way Day: Analysis & Market Insights

Wayfair’s Shopping Way Day: Analysis & Market Insights

Deep Dive

Inside Apple Revenue: Latest Sales Figures and Key Insights

Inside Apple Revenue: Latest Sales Figures and Key Insights

Back to main topics