eCommerce: Shopping Days

Amazon Prime Day Dominates Summer Sales Events

How did Amazon Prime Day stack up against other summer sales events? Discover why Amazon dominated with a 46% sales surge, and how competitors like Wayfair fared.

Article by Cihan Uzunoglu | August 13, 2024Download

Coming soon

Share

Amazon Prime Day Analysis: Key Insights

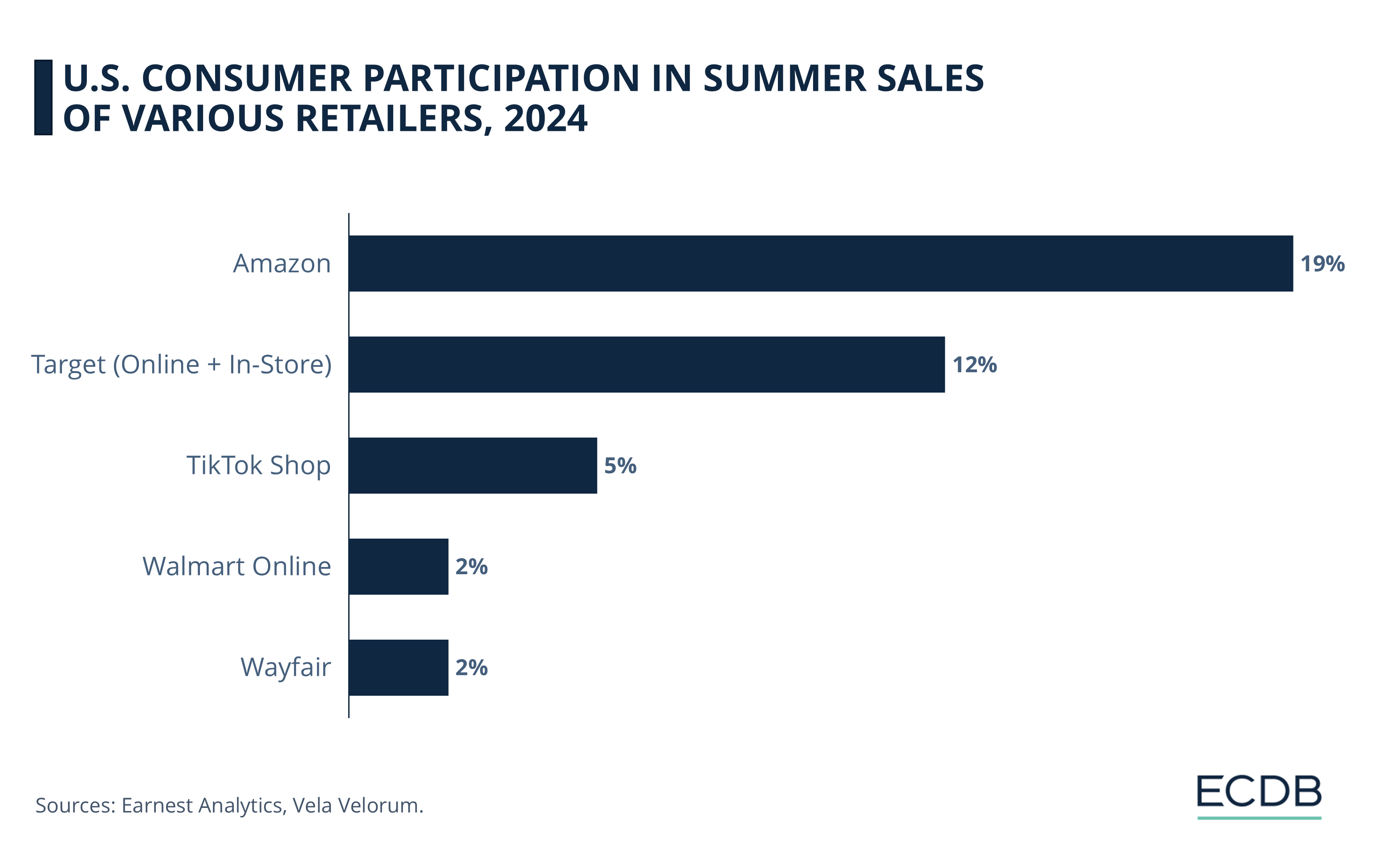

Prime Day Participation: Nearly 20% of Amazon shoppers from the past 12 months took part in Prime Day, while participation was lower at other retailers, with 12% at Target, 5% at TikTok Shop, and only 2% at both Walmart online and Wayfair.

Sales Surge vs. Spend: Amazon saw a 46% sales surge during Prime Day, leading summer events, but Wayfair surpassed others in average customer spend, reaching US$281.

Amazon Prime Day returned this summer, taking place from July 16 to 17 across 22 countries, with Amazon offering extensive discounts to Prime members. The event exemplified Amazon’s stronghold on eCommerce, where fast delivery, vast product choices, and major sales events set the standard, leaving other retailers trying to keep up.

But how does it compare to other summer sales events held by retail giants? A recent report sheds light on the subject.

One Fifth of Amazon Shoppers Shopped in Prime Days

According to a report by Earnest Analytics, 84% of shoppers who participated in the recent round of summer sales events made their purchases exclusively on Amazon. Only 16% of shoppers bought items from Amazon and another retailer's promotional event.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

The data highlights Amazon’s strong customer retention:

Nearly one in five Amazon shoppers who purchased from the retailer in the past 12 months also participated in the Prime Day sale.

By comparison, other retailers struggled to match Amazon's pull: Only 12% of recent shoppers made purchases during Target's sales event.

This share was 5% at TikTok Shop, and a mere 2% at both Walmart online and Wayfair.

Summer Sales Event Boost

Amazon's sales during Prime Day week surged by 46% compared to four weeks prior, leading the pack of summer sales events. Wayfair followed with a 42% increase during its Black Friday in July event, while TikTok Shop saw a 32% rise, and Target Circle Week experienced a 30% boost. Walmart, however, saw only a 3% increase during its Walmart's Deals sale, reflecting a relatively modest impact.

While Amazon led in participation, Wayfair took the top spot in average spend per customer, with US$281, compared to US$101 at Walmart online, US$89 at Amazon, US$76 at Target, and US$53 at TikTok Shop.

Sources: Retail Dive, Earnest Analytics, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics