eCommerce: Back-to-School

Back-to-School Shopping: eCommerce Trends & Winning Strategies

Back-to-school season is here, but what percentage of consumers are shopping online? We look at the data and determine the best eCommerce strategies for retailers.

Article by Cihan Uzunoglu | August 23, 2024Download

Coming soon

Share

Back-to-School Shopping: Key Insights

Shopping Trends: Back-to-school shopping started earlier in 2024 than 2023, with more shoppers completing purchases before July and fewer waiting until late August or September.

Preference for Online Shopping: Online shopping is the leading choice for back-to-school purchases, while Back-to-College shopping sees more engagement with department stores and college bookstores.

Online vs. In-Store: While online channels excel in product quality, customer service, and convenience, in-store shopping offers speed and variety, appealing to those needing immediate availability.

Impact on eCommerce: Back-to-school shopping drives significant traffic and conversions in eCommerce sectors like online grocery and personal care, with search engines and social media playing crucial roles in consumer decisions.

Social Media Use: Social media's growing influence in back-to-school shopping varies by generation, with Gen X focusing on promotions and Millennials on product browsing.

As summer ends, families have already begun preparing for the back-to-school season, a crucial time for shopping. But when do most people start, and how do they choose between online and in-store options?

Social media and mobile shopping are changing how parents and students find deals and products. Understanding these shifts can help businesses not only navigate this busy season, but also see how they impact the retail market throughout the year. We provide answers on the key trends, and how they might shape the future of back-to-school shopping.

What is Back-to-School?

"Back-to-school" refers to the period when students prepare to return to school after summer break. This season triggers a surge in shopping for essential supplies like clothing, stationery, electronics, and educational materials. Retailers and eCommerce platforms see a significant increase in sales as parents, students, and educators purchase what’s needed for the upcoming academic year.

The back-to-school season typically runs from late July through early September. It’s one of the most crucial shopping periods, second only to the holiday season.

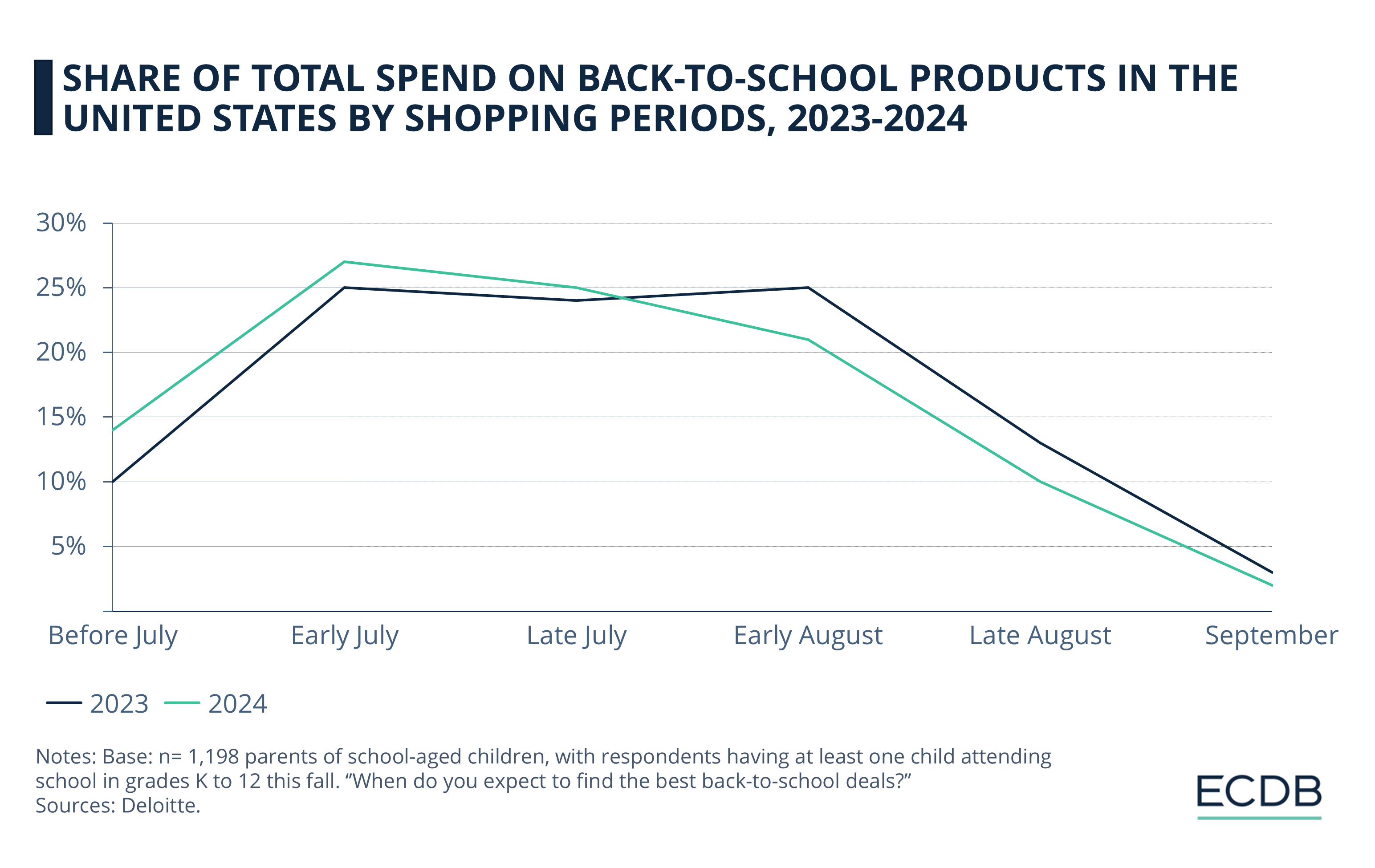

When Do People Shop for Back-to-School?

The timing of back-to-school shopping in the United States has seen notable shifts in 2024. According to a May 2024 survey by Deloitte, shopping behaviors have shifted slightly compared to the previous year. The data reveals key trends in when people are making their purchases:

14% of shoppers are now completing their back-to-school shopping before July, a noticeable increase.

Early July sees 27% of total spending, a small rise from the previous year.

Late July remains a popular period, with 25% of spending, showing stability year over year.

Early August saw a decrease, with only 21% of spending, down from the previous year.

Late August and September see declining shares, with 10% and 2% of spending, respectively.

Back-to-School Shopping: Online or Offline?

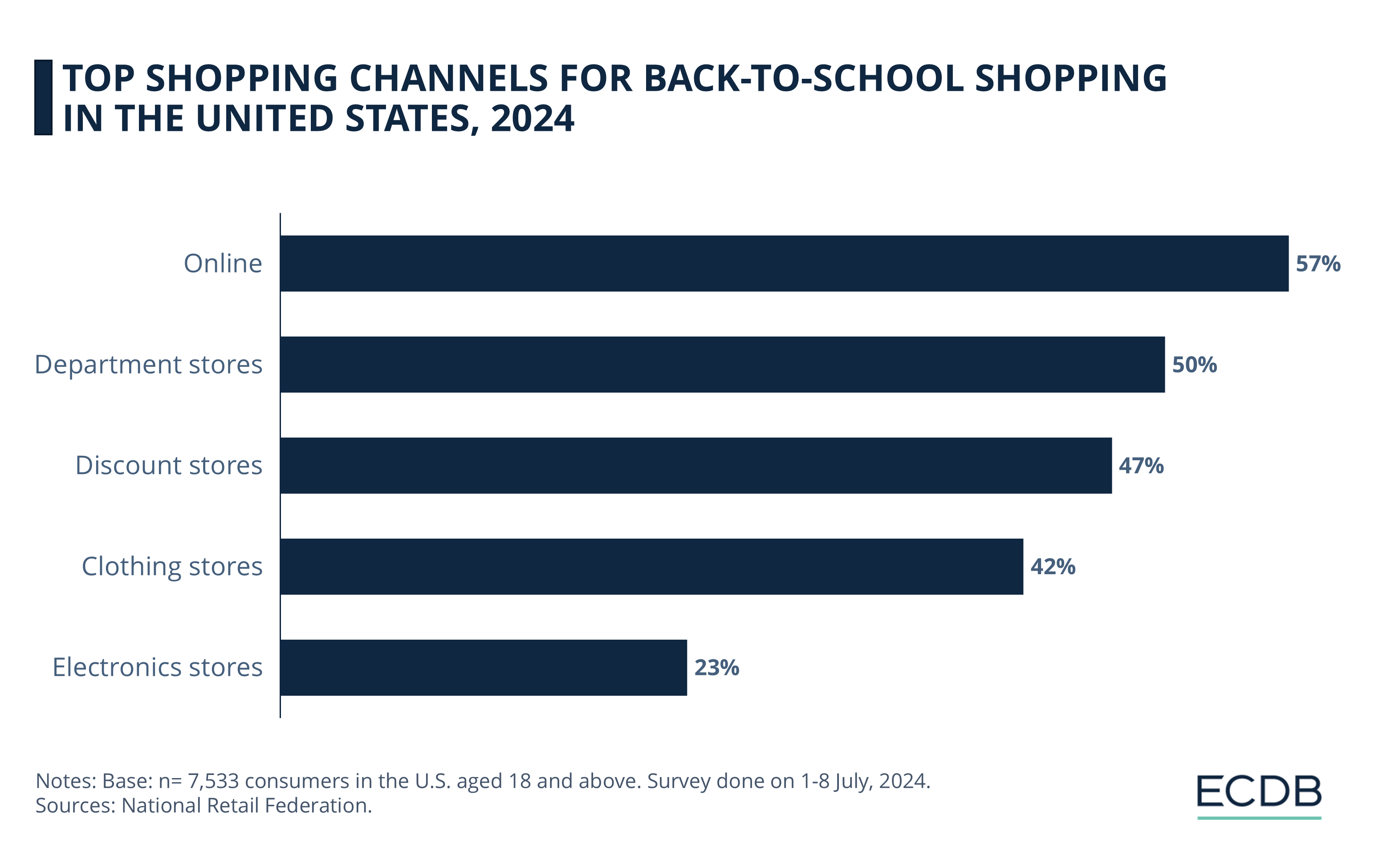

According to the National Retail Federation's 2024 data, online shopping remains the dominant channel for back-to-school in the United States, with 57% of consumers preferring it. Department stores are close behind at 50%, while discount stores attract 47% of shoppers. Clothing and electronics stores are also popular choices, at 42% and 23%, respectively.

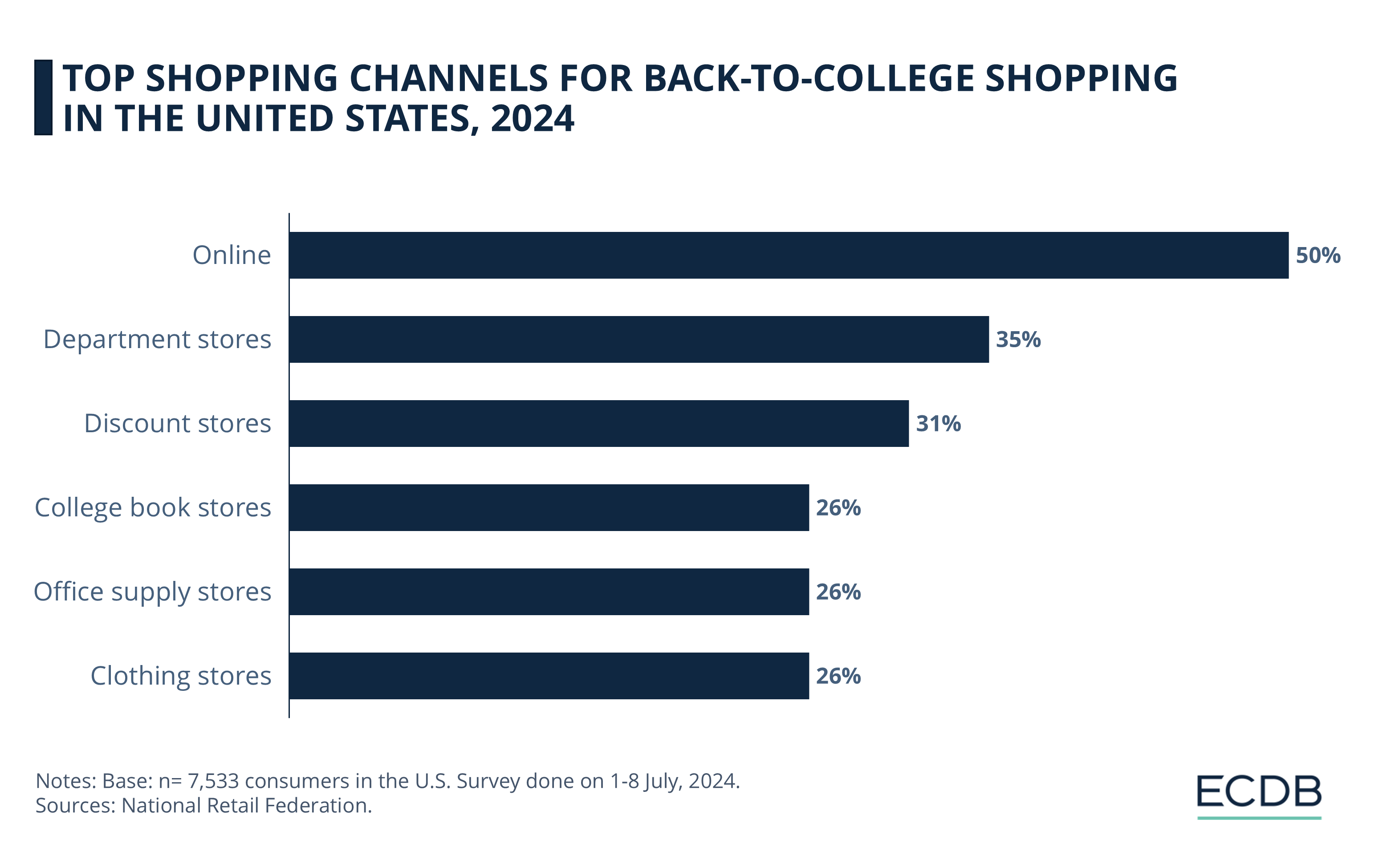

For back-to-college shopping, online channels are slightly less dominant, with 50% of consumers using them. Department stores, discount stores, and college bookstores follow, each serving significant portions of the market. Clothing and office supply stores play a smaller role, each capturing about 26% of the college shopping segment.

When comparing back-to-school shopping with back-to-college shopping, some differences emerge. While online shopping remains a strong choice for both groups, it's more prevalent among back-to-school shoppers (57% vs. 50%). Department and discount stores also see higher engagement from the back-to-school crowd.

In contrast, back-to-college shoppers are more likely to visit college bookstores and office supply stores, each attracting 26% of this group, indicating a shift in needs as students prepare for more specialized academic requirements.

But what’s in it for parents to do their back-to-school shopping online, anyway?

Advantages of Online

Back-to-School Shopping

When it comes to back-to-school shopping, the advantages of online shopping versus in-store shopping differ significantly, according to 2024 data. Online shoppers prioritize certain benefits that contrast with those valued by in-store shoppers:

Product quality is the top benefit for online shoppers, with 70% prioritizing it, compared to only 30% of in-store shoppers.

Responsive customer service is also highly valued online (66%), much more than in-store (34%).

Easy returns rank similarly high for online shoppers (63%), showing that the convenience of handling returns without visiting a store is a significant draw. This is slightly higher than the in-store experience (37%).

Enjoyment is nearly equal between the two channels, with 61% of online shoppers and 39% of in-store shoppers citing it as a benefit.

At the lower end, timesaving is only a benefit for 26% of online shoppers, whereas it is the most valued benefit in-store (74%).

Overall, the U.S. data shows that while online shopping is valued for quality, service, and convenience, in-store shopping still holds an edge in speed, variety, and inspiration.

How about Europe, why do consumers use online channels for back-to-school shopping?

Back-to-School Shopping in Europe:

Convenience and Prices Drive Online Sales

In 2022, over half of shoppers in the UK preferred online channels for back-to-school shopping, primarily due to the convenience they offered. Additionally, 43% of UK shoppers felt that buying products online provided a safer option. About 40% also believed that the overall shopping experience was superior online.

In Germany, almost 60% of shoppers chose to do their back-to-school shopping online, largely because it allowed them to compare prices easily. Convenience was the next most important factor, and 51% of respondents cited lower prices online as a key reason for their choice.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

Back-to-School Impact on

the eCommerce Market

As back-to-school shopping ramps up, its effects ripple across various eCommerce sectors, affecting consumer behavior and driving traffic in specific categories. This season doesn't just boost sales in expected areas; it also significantly impacts online grocery and personal care markets.

Search Drives Grocery Purchase Intent

Grocery is a significant category impacted by back-to-school shopping. MikMak's Purchase Intent Clicks metric shows that:

Media displayed in Search drives the most in-market traffic for Grocery shoppers, accounting for 38.6% of Purchase Intent Clicks.

Brand Websites have the highest Purchase Intent Rate at 28%, indicating a strong likelihood of conversion.

Meta dominates Grocery category traffic on social platforms, driving 65.3% of Purchase Intent Clicks. TikTok is second with 18.3%, followed by YouTube (12.7%), Pinterest (7.8%), and Snap (5.3%).

Despite lower overall Purchase Intent Rates on social media, YouTube shows the highest conversion likelihood with a Purchase Intent Rate of 2.3%.

Social Platforms Power Personal Care Traffic

Personal Care brands also see a high volume of traffic from social platforms:

80.7% of Purchase Intent Clicks originate from social sources. Meta leads in traffic, driving 65.4% of Purchase Intent Clicks, followed by Pinterest (14.2%), TikTok (10.8%), YouTube (5.3%), and Snap (4.3%).

Brand Websites and Search ads yield the highest Purchase Intent Rates for Personal Care brands, both just above 19%.

On social platforms, Meta is most likely to convert with a Purchase Intent Rate of 6.2%, followed by Pinterest (4.4%) and YouTube (4.2%).

Social Media Use in Back-to-School Shopping

Social media has become a powerful driver in the eCommerce space, particularly through social commerce, where shopping is directly integrated into social platforms.

From 2018 to 2023, the revenue share of social commerce in total eCommerce grew from 5.5% to 18.5%. Statista estimates show 20% by 2025. The number of social commerce users worldwide also saw a massive increase, rising from around 200 million in 2018 to 1.4 billion by 2023.

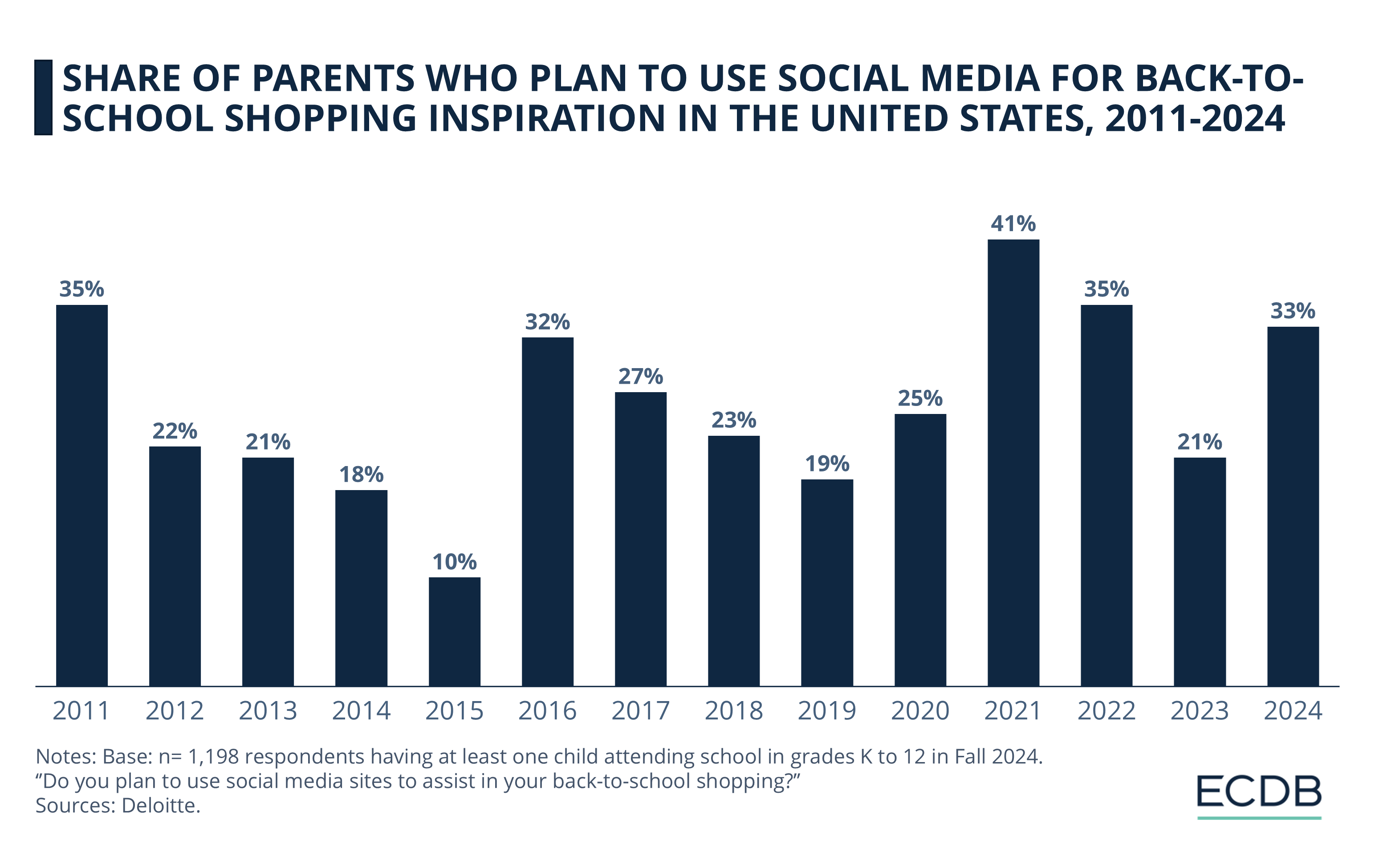

Over the years, social media has played a fluctuating role in back-to-school shopping inspiration among parents in the United States:

After a low point in 2015, where only 10% of parents used social media for back-to-school shopping inspiration, its influence began to rebound.

By 2016, social media's impact had surged to 32%, and despite some fluctuations, it remained a key source of inspiration, peaking at 41% in 2021.

However, in recent years, there has been some volatility. The share of parents turning to social media dropped to 21% in 2023 but rebounded to 33% in 2024.

To better understand consumer behavior here, we need generational data to see what's resonating with them the most.

Gen X Seeks Deals, Millennials Browse Products

on Social Media

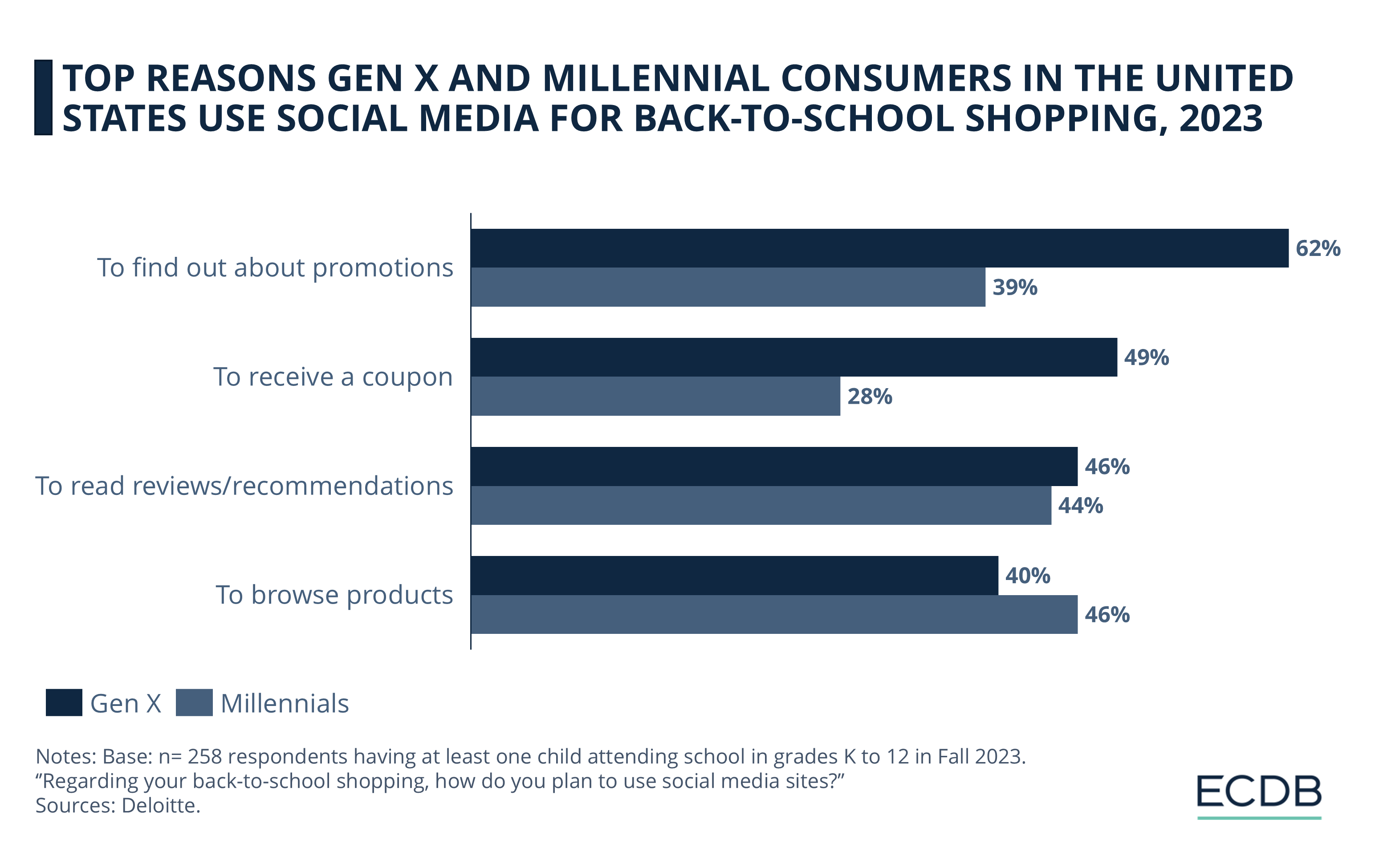

Gen X and Millennial consumers approach social media differently when it comes to back-to-school shopping.

For Gen X, the primary motivation for using social media is to discover promotions, with 62% of them turning to these platforms for that purpose. Millennials, on the other hand, are less focused on promotions, with only 39% using social media for this reason. Instead, Millennials are more likely to browse products, with 46% using social media for this purpose compared to 40% of Gen X.

Both generations value social media as a tool for reading reviews and recommendations, with 46% of Gen X and 44% of Millennials engaging in this activity. However, when it comes to receiving coupons, Gen X is much more motivated by this, with 49% citing it as a reason for using social media, compared to 28% of Millennials.

Strategies for Back-to-School

eCommerce Success

As the back-to-school season approaches, retailers have a prime opportunity to boost their eCommerce performance and capture a significant share of consumer spending. This period, second only to the holiday season, demands strategic planning and execution.

By leveraging the right tactics, businesses can not only maximize short-term sales but also build lasting customer relationships that extend beyond September.

1. Leverage Social Media for Direct Engagement

As mentioned, social media platforms are crucial during the back-to-school season for reaching and engaging with target audiences. By showcasing trending products and leveraging user-generated content, retailers can create buzz and drive traffic to their online stores.

Collaborating with influencers and running targeted ads further enhances visibility. Additionally, social proof techniques, such as highlighting popular items or running giveaways, can significantly boost consumer confidence and drive conversions.

2. Optimize Mobile Shopping Experience

With a majority of back-to-school shoppers using smartphones, a mobile-first approach is essential. Retailers should ensure their websites are fully optimized for mobile devices, offering fast load times and easy navigation.

Developing a user-friendly mobile app with exclusive deals and personalized recommendations can further enhance the shopping experience. Integrating mobile wallet options also simplifies the checkout process, reducing cart abandonment and increasing sales.

3. Personalize and Tailor Offers

Personalization is key to standing out during the back-to-school season. Retailers can use AI-powered tools to offer personalized product recommendations based on past purchases, grade levels, or specific interests.

Implementing dynamic pricing and offering customized discounts or bundles can cater to individual shopper needs, increasing customer satisfaction and loyalty. Interactive elements like quizzes can guide consumers to the perfect products, while loyalty programs encourage repeat purchases and long-term engagement.

Back-to-School Shopping: Closing Thoughts

Back-to-school shopping has seen a rapid shift toward digital and mobile-first shopping, driven largely by the pandemic. This change isn’t just a temporary spike; it’s changing how consumers approach this critical shopping season.

In the next years, we’re likely to see a deeper integration of AI and data analytics, enabling hyper-personalized shopping experiences. The growing focus on sustainability will also push retailers to offer eco-friendly products as a standard, not a niche.

As the market matures, we expect the back-to-school season to expand beyond traditional categories, increasingly overlapping with year-round eLearning and tech-focused purchases, solidifying its importance in the eCommerce market.

Sources: Mikmak, NRF, Deloitte, MikMak, Digital Turbine, Capital One Shopping, Taggstar, Martech Zone, Storyly, Salsify, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Factors That Impact U.S. Holiday Shopping in 2024: Election, Deals, Weather, Number of Days

Factors That Impact U.S. Holiday Shopping in 2024: Election, Deals, Weather, Number of Days

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Deep Dive

Peak Season of eCommerce & Air Cargo Capacity Crisis

Peak Season of eCommerce & Air Cargo Capacity Crisis

Deep Dive

Holiday Season Shoppers Turn to Discounts and Deals Early

Holiday Season Shoppers Turn to Discounts and Deals Early

Deep Dive

The Holiday Shopping Season Begins: How eCommerce is Preparing for Shopping Days

The Holiday Shopping Season Begins: How eCommerce is Preparing for Shopping Days

Back to main topics