eCommerce: Automotive Marketplaces

CarGurus Discloses Losses in 2024 Financial Report Due to Struggles in B2B Segment

CarGurus is an eCommerce marketplace that connects car sellers to those who are interested in buying a vehicle. Its most recent financial reports reveals that the B2B and product segments are struggling. Here is why.

Article by Nadine Koutsou-Wehling | September 19, 2024Download

Coming soon

Share

CarGurus Q2 2024 Financial Results: Key Insights

Losses in the B2B Segment: CarGurus is an online marketplace for trading cars. Financial results for the second quarter of 2024 show losses in the recently acquired B2B segment.

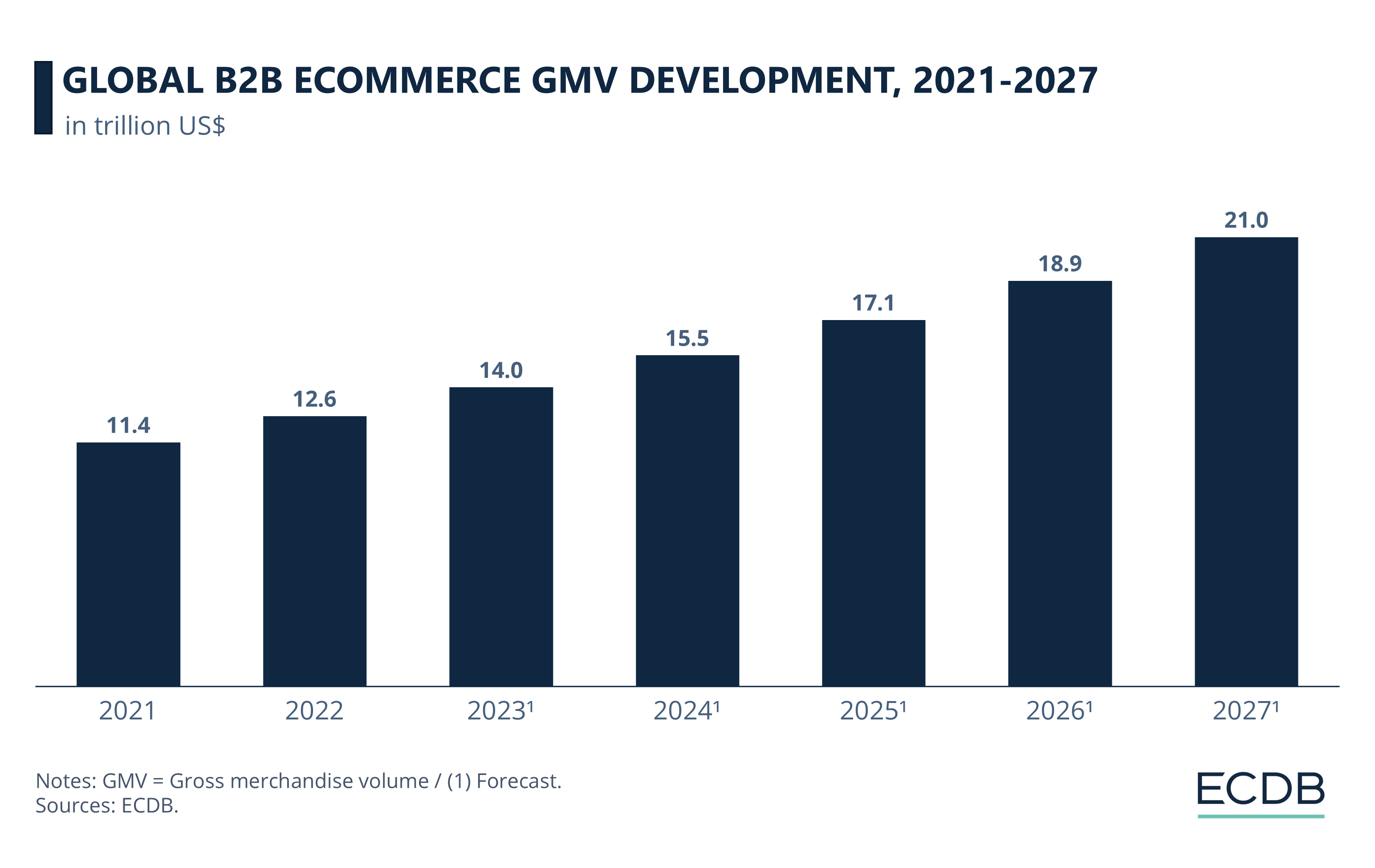

Market Dynamics: Although the B2B eCommerce market has a positive outlook with steady growth in the coming years, selling used cars online has become more difficult after the pandemic.

CarGurus, the online marketplace for new and used cars, is hitting roadblocks in its B2B segment this year. According to its second quarter financial results, CarGurus' revenue declined by 9% from the second quarter of 2023. This is mainly due to losses in CarGurus' wholesale and product segments, which came to a screeching halt this year. On the other hand, CarGurus' eCommerce Marketplace division increased its revenue year-over-year.

Revenue Decreases Due to Losses in B2B and Products Segments

Particularly responsible for this year's recession at CarGurus is the decline in revenue generated by its B2B wholesale marketplace, which provides a platform for businesses to buy and sell cars to other businesses. The wholesale segment saw a 58.9% decline in the second quarter of 2023, dropping from nearly US$32 million in the second quarter of 2023 to US$13 million in the second quarter of 2024. For the full first half of 2024, the decline is slightly lower, but still substantial, at 42%.

CarGurus' product segment experienced similarly large declines. Product revenue fell from US$35.7 million in Q2 2023 to US$10.5 million in Q2 2024. This represents a year-over-year decline of 70.7%. For the half year, the revenue decline is similar to 2023, at a rounded 70%.

Reasons for the Decline

The B2B eCommerce segment is growing, reaching into the trillions of dollars. By 2024, ECDB estimations expect a GMV of US$15.5 trillion on global B2B marketplaces.

So what is the problem with CarGurus' B2B segment?

CarGurus acquired a 51% stake in Car Offer in 2021. This resulted in a full acquisition in 2023, meaning that CarGurus has now added B2B sales to its business portfolio. While this investment was a prudent move during the pandemic, when most sectors of the economy moved online, consumers' propensity to buy used cars over the Internet has slowed.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

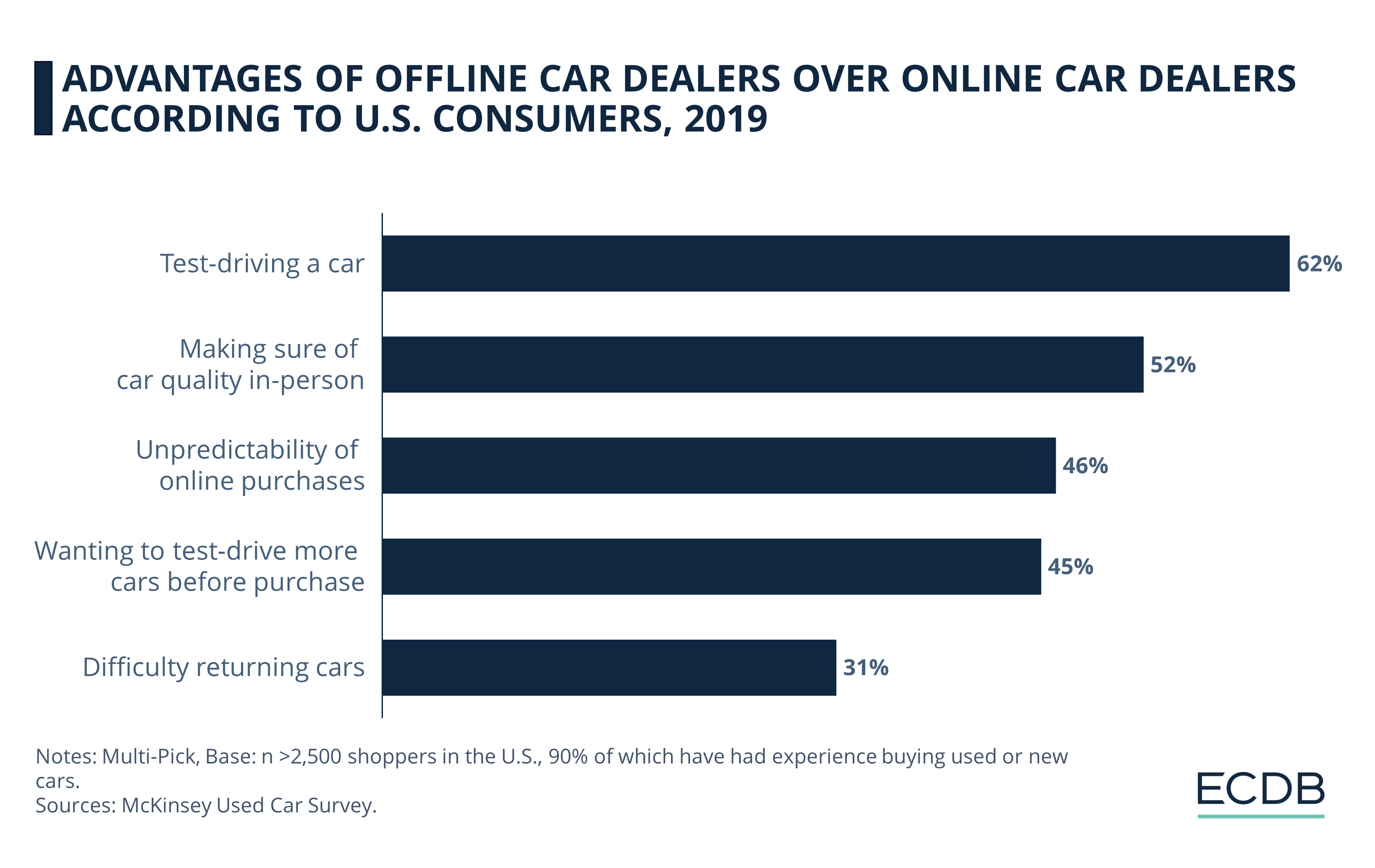

This is due in part to the continuing advantages of buying cars, especially used cars, in person: Test drives, quality control, and predictability of the buying process.

Another factor that comes with buying cars or used cars over the Internet is the risk of fraud. While CarGurus appears to have a good reputation among consumers in online forums, the risk of online fraud is higher than encountering the same problem in the physical world.

Sources: CarGurus – DigitalCommerce360

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Deep Dive

Secondhand Fashion Online Market in the UK: Categories, Preferences by Generation, Top Stores

Secondhand Fashion Online Market in the UK: Categories, Preferences by Generation, Top Stores

Deep Dive

FTC’s New Ban in Effect & How to Spot Fake Reviews in Online Shopping

FTC’s New Ban in Effect & How to Spot Fake Reviews in Online Shopping

Deep Dive

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Back to main topics