ECOMMERCE: ELECTRONICS

Global Smartphones eCommerce: Market Size, Online Share, Industry Trends

Many consumers are purchasing their smartphones online. In 2023, the online smartphones market generated revenues worth US$250 billion globally. How has the online market grown and what are the latest industry trends?

Article by Nashra Fatima | June 17, 2024

Global Smartphones eCommerce: Key Insights

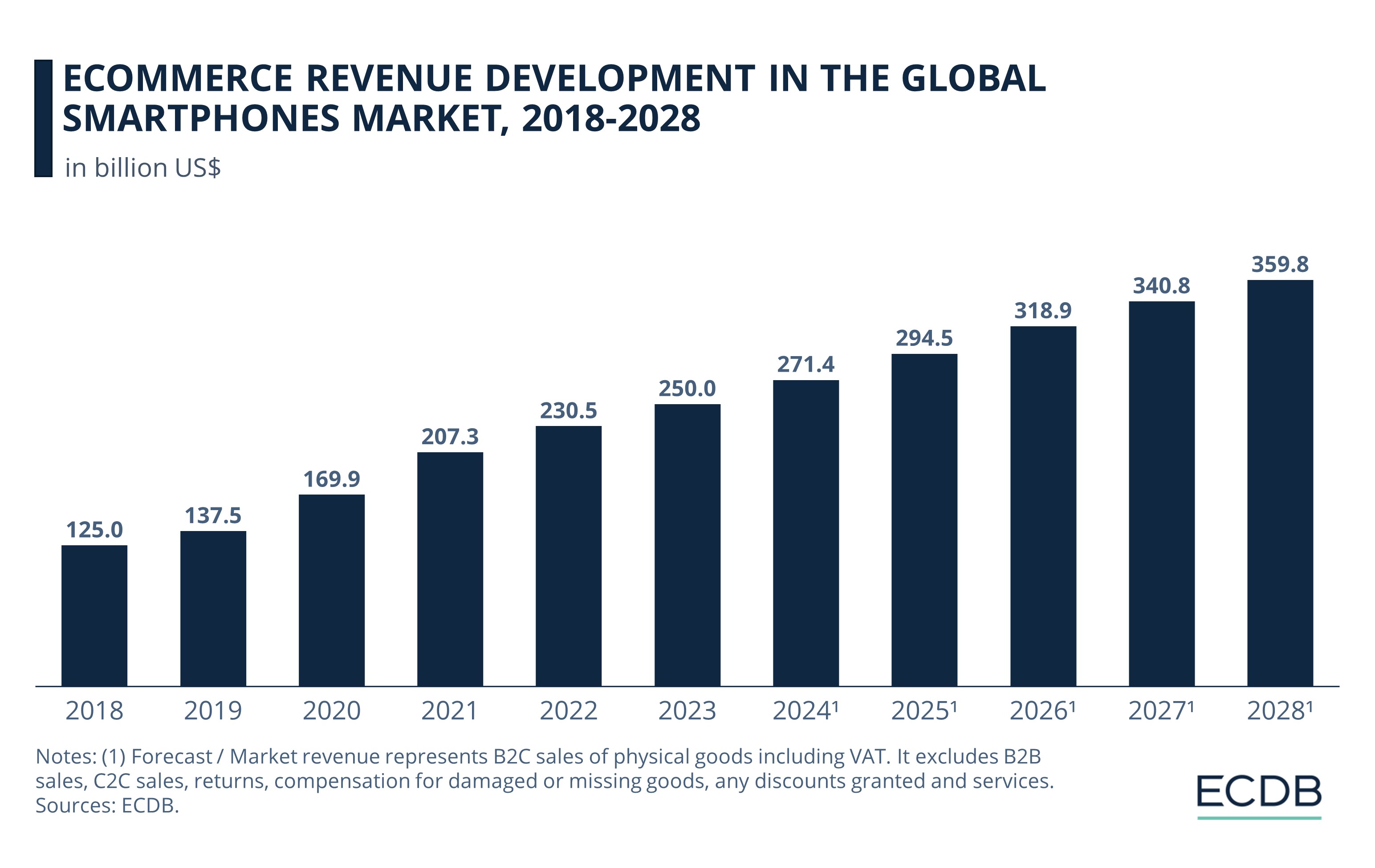

Revenue growth: The global smartphones eCommerce market has experienced consistent growth in the past years. In a five-year period (2018-2023), revenues increased from US$125 billion to US$250 billion.

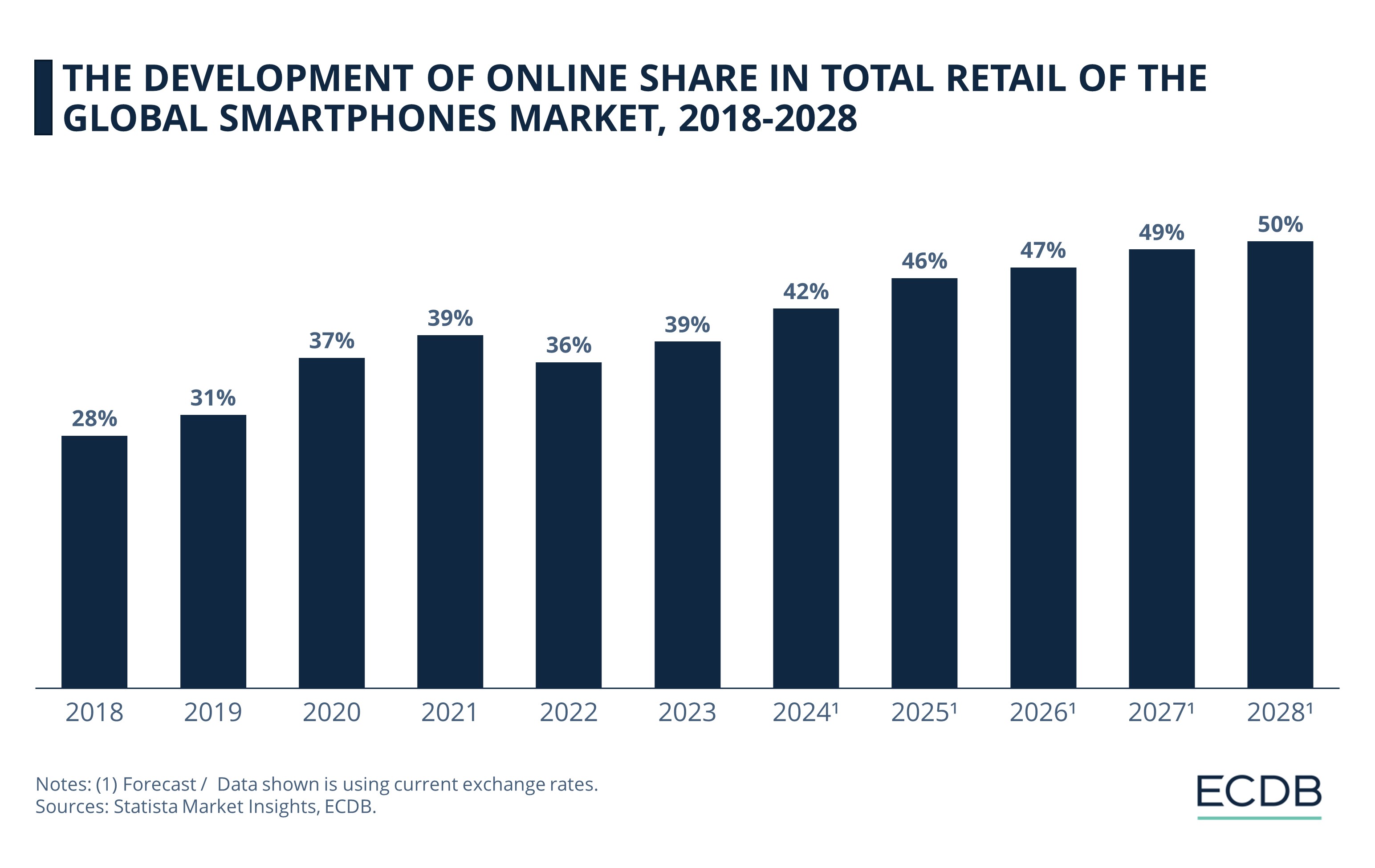

Online share: In 2023, 38.7% of all smartphone retail revenues were generated online. By 2028, the online share is expected to claim half of total smartphones retail volume globally.

Trends: Competition is fierce in the smartphones segment. A tug of war between Samsung and Apple for the top spot is observed in 2024. From a regional perspective, China remains the market to watch.

Are online shoppers using their phones to buy a new smartphone?

It is likely that they do. Not only are smartphones the preferred platform for online shopping today, but the smartphone eCommerce market is also expanding steadily. Across the world, a growing volume of smartphone retail is taking place online.

Learn about the development of the global smartphones market over the years, its online share in retail, and the latest trends in this competitive industry.

Global Smartphones eCommerce Market Size, 2018-2028

At ECDB, smartphones fall under Telecommunications – itself the largest sub-segment of Consumer Electronics. In 2023, smartphones made up for nearly 90% of Telecommunications revenue globally, which hints at its market strength.

From 2018 onwards, the smartphones eCommerce market has been growing consistently, with no decline in revenues recorded:

At US$125 billion in 2018, the smartphones eCommerce market was already sizeable before the pandemic, which nonetheless boosted its growth.

From an increase of 10% between 2018-2019, the market grew by 24% in 2020. In this two-year period, revenues climbed to nearly US$170 billion. Similar growth took place in 2021, with revenues crossing the US$200 billion mark.

Notably, the surge in the smartphones online segment was behind comparable markets. For example, in 2020, the global desktop PCs market grew by 38%, while notebooks & laptops grew by over 49%. This is likely because Covid enforced work and study from home, necessitating online purchase of desktops and laptops over smartphones.

The smartphones market has sustained its upward momentum. In 2023, revenues hit US$250 billion and are expected to reach US$271 billion this year.

At a compound annual growth rate (CAGR 2024-2028) of 7.3%, the market volume for smartphones eCommerce is projected at US$360 billion by 2028.

Online Share in Global Smartphones Retail

Our ECDB data further shows that the dynamics of the smartphones retail market are shifting from predominantly in-store sales to online sales.

A granular look at the development of online share in a ten-year period, from 2018 to 2028, reveals this change:

The online smartphones market across the world was on its way up in 2018, with the online share in total retail standing at 28.2%.

The online turn intensified for three years straight, helped by the pandemic. The increase was highest between 2019 and 2020. By 2021, the online share had jumped over ten percentage points to take 39.4% of the total smartphones retail.

In 2022, an inevitable downturn in online retail occurred, with the share (36.4%) dropping below the 2020 level (36.9%). Physical experience of a product and personalized customer service were motivating factors for shoppers who returned to in-store shopping for smartphones.

In 2023, the online share recovered to 38.7%. While this is smaller than the peak pandemic period, it is a promising improvement, with projections of growth. In 2024, the online share is expected to be 42.4% – the highest yet.

The in-store vs online share of shopping varies across different regions, depending on consumer preferences and other factors like internet penetration. For example, the online share for smartphones retail stood at 10% in India in 2023, compared to 50% in the UK.

Nonetheless, factors such as competitive pricing, wider variety, and promotions increasingly make online shopping for smartphones attractive for buyers. From a global perspective, online retail is anticipated to constitute half of all smartphones retail volume by 2028.

Apple and Samsung Fight for the Top Spot

Brands are fighting it out for supremacy in the Smartphones market.

2024 begun with news of Apple seizing the top spot, in terms of worldwide shipment. According to IDC, it displaced Samsung from the rank it had held since 2011.

Samsung’s decline was said to be a result of seasonality and a lull in demand, while Apple’s success was attributed to its unexpected growth, brand resilience, and interest-free financing plans for buyers.

The victory was short lived, however. By April, after the first quarter results were out, it emerged that Samsung had reclaimed its position as the leading smartphone provider.

This rivalry underscores that the global smartphones segment is concentrated, although it becomes progressively diverse with new brands entering the market.

Regional Domination: China Takes the Lion’s Share

According to Statista, China is the world’s largest market for smartphones.

China’s 2024 revenues are estimated at US$105.5 billion. In comparison, the United States, which is the second-largest market, has revenues of US$61 billion.

China has a very competitive industry, with players like, Huawei, Oppo, Honor and Vivo being some of the leading brands. They engage in constant innovation and aggressive pricing to capture the consumer market, from the lower to the higher end.

Still, smartphone sales in China were under pressure since the past two years. More recently, a market rebound has been reported. The positive effect is likely to reverberate in the worldwide revenue development of smartphones.

Global Smartphones eCommerce: Closing Remarks

The smartphones eCommerce market is a growing industry, as our ECDB data on revenues and online share in retail confirms. Moreover, the market is also dynamic as many players compete to gain consumer interest.

Recently, consumers show an inclination to splurge on smartphones, leading to an increase in the sales of premium brands. This defies the pattern noted just a few years ago, when people were more likely to choose budget phones.

This turn towards the premium is not as much for prestige as it is for longevity, as many buyers now look to use their phones for several years before upgrading. The sustainability turn also remains an interesting trend to observe, with the secondhand or refurbished smartphones market showing indications of a slowdown.

As many smartphone vendors now look to invest in emerging regions of Latin America and Southeast Asia, the industry as well as dominant consumer behaviors are poised to shift, going forward.

Sources: IDC: 1, 2; Statista; Canalys; Counterpoint

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Walmart Passes Apple as Amazon’s Lead in U.S. Online Store Ranking Diminishes

Walmart Passes Apple as Amazon’s Lead in U.S. Online Store Ranking Diminishes

Deep Dive

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Top Online Payment Methods in the United Kingdom: Cards & eWallets

Top Online Payment Methods in the United Kingdom: Cards & eWallets

Deep Dive

Inside Apple Revenue: Latest Sales Figures and Key Insights

Inside Apple Revenue: Latest Sales Figures and Key Insights

Back to main topics