eCommerce: Market Trends in India

Myntra Pilots 4-Hour Delivery Service, Joining the Quick Commerce Boom in India

Myntra is piloting a quick commerce service in India that cuts delivery times from a few days to four hours. The pilot is initially being tested in four Indian cities. Read more about the strategy here.

Article by Nadine Koutsou-Wehling | September 18, 2024Download

Coming soon

Share

Myntra's Quick Commerce Pilot: Key Insights

Cutting Delivery Time in Select Cities: According to TechCrunch sources, India's leading fashion eCommerce platform Myntra is piloting a 4-hour delivery service in four Indian cities. Myntra, a subsidiary of Flipkart and granddaughter company of Walmart, is therefore joining the quick commerce fray.

Quick Commerce Is a Growth Market in India: Startups with a quick commerce offering are backed by big capital, attracting the attention of domestic and international players alike. Adapting to regional preferences could be the decisive competitive advantage between Walmart and Amazon.

Myntra is piloting a quick commerce delivery service for its products in four major Indian cities, including Bengaluru and New Delhi. This is according to TechCrunch, which received information from insider sources. Myntra is an Indian eCommerce marketplace for fashion products, arguably the largest online platform for fashion sales in the market. Owned by Flipkart, Myntra therefore is Walmart’s granddaughter company.

Myntra’s foray into quick commerce comes at a time when the market for hours-long delivery is booming in India. By cutting its usual delivery window from a few days to as little as four hours, the strategy represents a logistical restructuring of the company to meet the demands of quick commerce.

The Context: Quick Commerce Trend Accelerates in India

Not only is quick commerce responding to existing consumer preferences in India, but the startups thriving in the market are also all backed by major domestic and international investors.

Blinkit, which is owned by Indian food giant Zomato, BigBasket’s BB Now, Zepto, backed by StepStone, and Instamart by Swiggy are all leading in the Indian quick commerce sector.

While Flipkart has joined the quick commerce race in August of this year, the launch of a quick commerce trial period by Flipkart’s subsidiary Myntra can be seen as a strategic move to lift up Myntra to approach the level of Flipkart in the market:

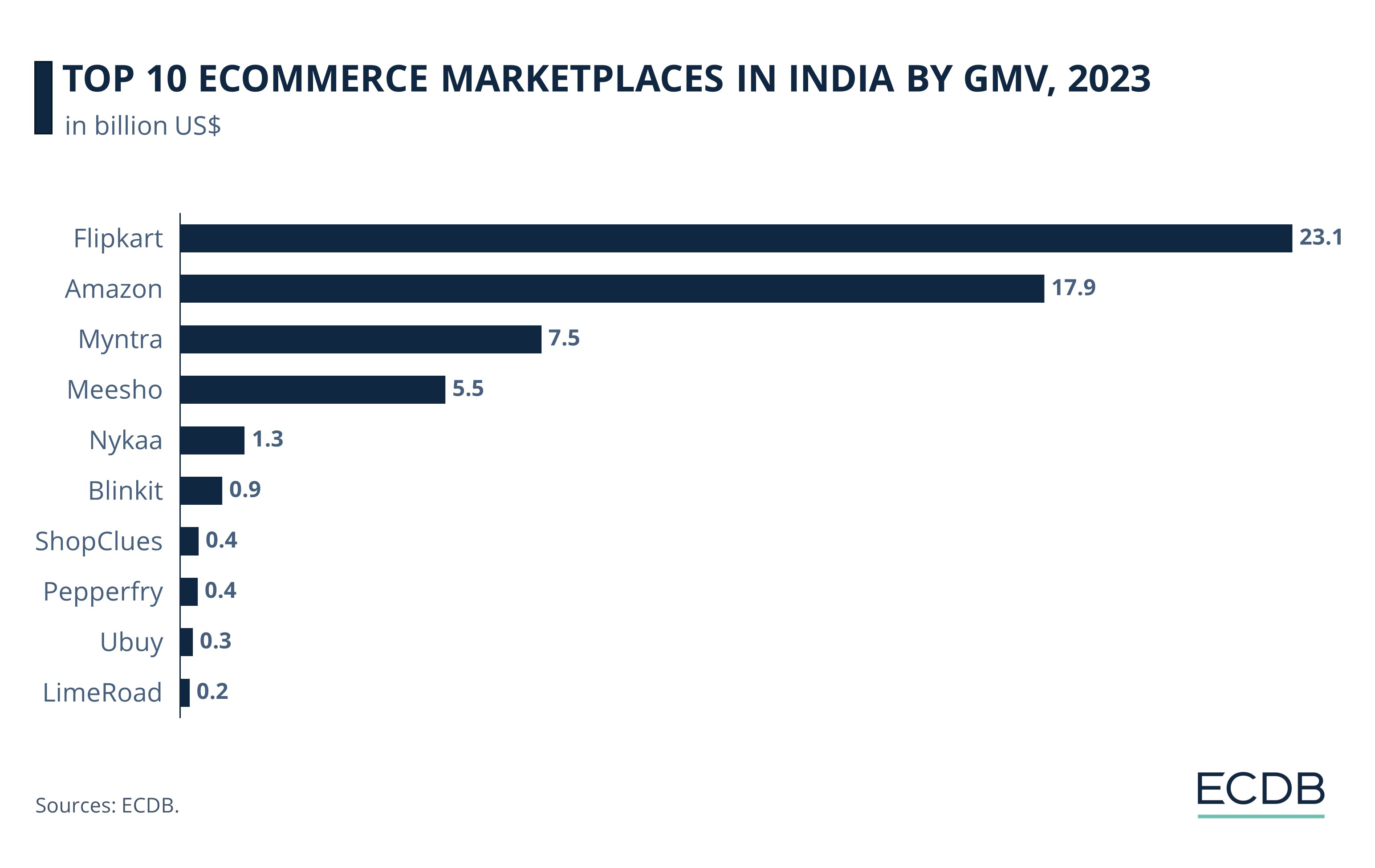

Currently, Flipkart is the leading eCommerce marketplace in India, with a GMV of US$23.1 billion in 2023. Myntra is in third place, with US$7.5 billion, still some way behind Amazon, which has a GMV of US$17.9 billion in India.

Amazon and Walmart in India: Who Takes the Lead?

Despite the buzz around quick commerce in the market, Amazon does not seem to be swayed to join the fray of major eCommerce retailers implementing a quick commerce strategy in the country. Rather, the U.S. retail giant is focusing on expanding its Prime features in the market. But both Walmart and Amazon are struggling with government regulations in India, accusing them of violating anti-trust laws. This, along with the peculiarities of Indian eCommerce, may prevent Amazon from taking over the market as it has done in many other countries.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

If Myntra’s new service proves successful, it would put Walmart at a significant advantage over its direct competitor, Amazon. Analysts expect the quick commerce market in India to be a deep gold mine, with Zepto announcing growth projections of 150% over the next year. But as always, these estimates should be taken with a grain of salt.

Sources: Economic Times India – Tech Crunch: 1 2

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics