eCommerce: India

Amazon and Flipkart Violated India's Antitrust Laws

A recent investigation revealed that Amazon and Flipkart aren't being fair to all sellers on their platforms. What are the potential implications of this?

Article by Cihan Uzunoglu | September 17, 2024Download

Coming soon

Share

eCommerce Competition in India: Key Insights

Antitrust Challenges: The CCI determined that Amazon and Flipkart gave unfair advantages to select sellers, potentially disrupting their expansion strategies in India.

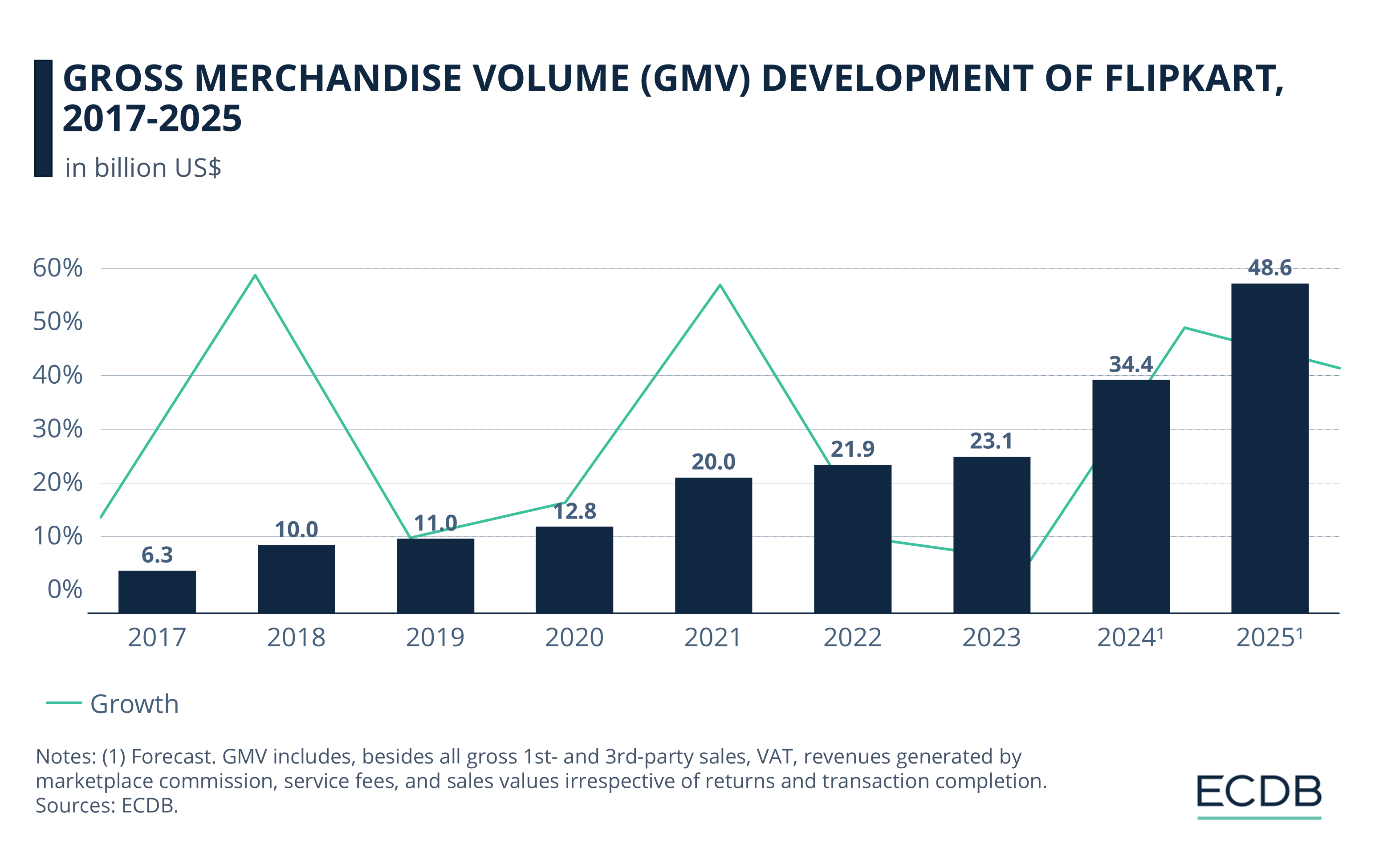

Flipkart’s Growth: Following modest growth after the pandemic, Flipkart is set to recover with expected GMV increases of 49% this year and 41% next year.

Competing for India’s Market: As both Amazon and Flipkart focus on India for growth, the recent antitrust ruling introduces legal obstacles that could complicate their efforts to lead the market.

Amazon and Flipkart, owned by Walmart, have been accused of violating India’s antitrust laws, according to findings by the Competition Commission of India (CCI).

An investigation launched in 2020 revealed that the two eCommerce giants prioritized select sellers on their platforms, giving them favorable rankings in search results, which disadvantaged smaller competitors.

Unfair Seller Promotion on

Amazon and Flipkart

The CCI concluded that both companies created systems that unfairly promoted preferred merchants with whom they had business ties, while ordinary sellers were left as "mere database entries."

These findings could have serious implications for Amazon and Flipkart as both companies seek to expand in India, the world’s most populous country.

After a GMV growth of 59% in 2018, Flipkart didn't experience the same boost that some retail giants did due to the pandemic.

However, the online marketplace closed 2021 with an impressive GMV growth of 57%, reaching US$20 billion.

Returning to single-digit annual growth rates thereafter, we expect Flipkart to make a comeback and grow 49% this year, and 41% next year.

India Expansion Plans

India remains a key growth market for both Amazon and Walmart, but this antitrust ruling could complicate their expansion strategies. Based on ECDB data, Walmart’s Flipkart generates 100% of its GMV in India.

Amazon has already announced plans to invest US$26 billion in India by 2030, including a significant focus on its eCommerce and cloud services sectors. Similarly, Walmart has been banking on Flipkart and Indian payments provider PhonePe to drive its goal of doubling its international gross merchandise volume to US$200 billion by 2028.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

In the broader context of their rivalry, Amazon continues to challenge Walmart’s dominance in the grocery sector. Amazon recently expanded partnerships with grocery chains like Metropolitan Market and Weis Markets, aiming to reduce Walmart’s considerable lead in this category.

As both companies continue to compete aggressively in India and other markets, compliance with local competition laws will be critical to their long-term success.

Sources: PYMNTS, Reuters, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

European Retailers Return to Physical Stores to Compete with Online Giants

European Retailers Return to Physical Stores to Compete with Online Giants

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Inflation's Impact on eCommerce

Inflation's Impact on eCommerce

Deep Dive

Older Consumers Drive Growth in the Chinese eCommerce Market

Older Consumers Drive Growth in the Chinese eCommerce Market

Deep Dive

Online Shopping in China: Where Chinese Consumers Shop Online

Online Shopping in China: Where Chinese Consumers Shop Online

Back to main topics