eCommerce: Sports Retail

Online Bicycles Market: Signa Sports United’s Insolvency & Market Outlook

Signa Sports United, with 80+ platforms and a 6M+ global base, hits financial turbulence in the sports retail scene.

Article by Cihan Uzunoglu | October 30, 2023Download

Coming soon

Share

The online sports retail sector is facing a major upheaval with Signa Sports United (SSU) confirming its dire financial state.

Based in Berlin, SSU runs a range of businesses focused on cycling, tennis, and outdoor activities. The company manages over 80 online platforms and collaborates with 500 retail locations to serve a global customer base exceeding 6 million.

SSU in Distress, Facing Potential Insolvencies

SSU is responsible for a suite of eCommerce platforms such as WiggleCRC, Fahrrad.de, Bikester, Probikeshop, Campz, Addnature, and TennisPro, is navigating through the loss of a critical €150 million funding previously pledged by its parent company, Signa Holding GmbH.

Signa Holding retracted this lifeline on October 16, leaving SSU and its subsidiaries, including the renowned bicycle brands Vitus and Nukeproof, in a precarious position. In early October, SSU disclosed severe liquidity issues, which compelled it to propose the delisting of its shares from the New York Stock Exchange.

Insolvency is when an entity can't pay its debts due to insufficient assets or cash flow. It's a financial status that may lead to, but isn't synonymous with, bankruptcy. Bankruptcy is a legal procedure where an insolvent entity seeks debt relief, often through asset liquidation or restructuring, under court supervision. Essentially, insolvency is the issue, and bankruptcy is one legal remedy.

By October 20, the financial strain had intensified, with SSU acknowledging that the cessation of funds from Signa Holding necessitated the insolvency filing for Tennis-Point. The company also signaled that this financial shortfall would likely precipitate a broader insolvency across its operations, impacting its extensive network of eCommerce sites.

Bicycle Industry Risks Saturation

In this context, the bicycle industry finds itself at a crossroads. The insolvency of Internetstores GmbH, SSU's subsidiary managing Fahrrad.de and other outlets like Campz.de, Brügelmann, ChainReactionCycles, and Wiggle, has halted returns processing and cast a shadow over the future of its considerable inventory.

With the bicycle market already sluggish due to overstock from the pandemic's peak demand and subsequent supply chain disruptions, there's a looming risk of further market saturation. Should Fahrrad.de's inventory, potentially worth millions, be liquidated, it could trigger a domino effect of financial strain across the sector, potentially leading to additional insolvencies.

According to a report by Sinus-Institut, Pedelecs (electric bicycles that assist the rider's pedal power) were the top choice among German cyclists in 2021, accounting for 41% of purchases. Mountain bikes followed with 31%, while traditional bikes made up 25%. Sports bikes were chosen by 18% of buyers, trekking bikes by 16%, cargo bikes by 6%, and both custom-made and folding bikes by 3% each.

Dealers are grappling with the necessity to offer steep discounts to clear excess stock and sustain cash flow, which could introduce fresh challenges. This circumstance underscores the bicycle industry's susceptibility to the ebbs and flows of online retail health and emphasizes the importance of developing robust strategies to withstand market unpredictability.

With this in mind, let’s turn our focus on the online market and have a look at the top 10 online stores for bicycles in Germany.

Top 10 Specialized Online Stores for Bicycles in Germany

In Germany's eCommerce landscape, specialized in bicycles, Canyon.com is the leading online store with 2022 net sales of US$213.2 million, based on ECDB data. Close on their wheels, Bike24.de secures the second spot with sales of US$149.7 million, while Rosebikes.de pedals into third place, not far behind with US$146.8 million.

Positions four to six on our ranking feature a competitive race. Bike-discount.de cruises into fourth with US$107.2 million in net sales. The fifth spot is held by Fahrrad.de, which garnered US$89.8 million, a figure that reflects their strong market presence before their insolvency was declared. Fahrrad-xxl.de trails closely, occupying the sixth position with sales of US$87.1 million, illustrating a tight contest within this segment of the market.

The last four contenders on the list, while smaller in revenue, remain in relatively close competition. Bike-components.de rides into the seventh spot with sales reaching US$55.2 million, closely followed by Lucky-bike.de with a slightly lower US$54.7 million. Ktm-bikes.at and Boc24.de round out the list, marking their territory with US$37.9 million and US$27.2 million, respectively.

All of these online stores primarily earn their income in Germany, though the percentages differ. Most of the shops on the list see 92-100% of their revenue originating from Germany. However, canyon.com, bike-discount.de, bike-components.de, and ktm-bikes.at are exceptions, with 40%, 49.9%, 54.9%, and 60.5% of their revenue respectively coming from the country.

Bicycle Sales in Germany: One Quarter Online, Three Quarters Offline

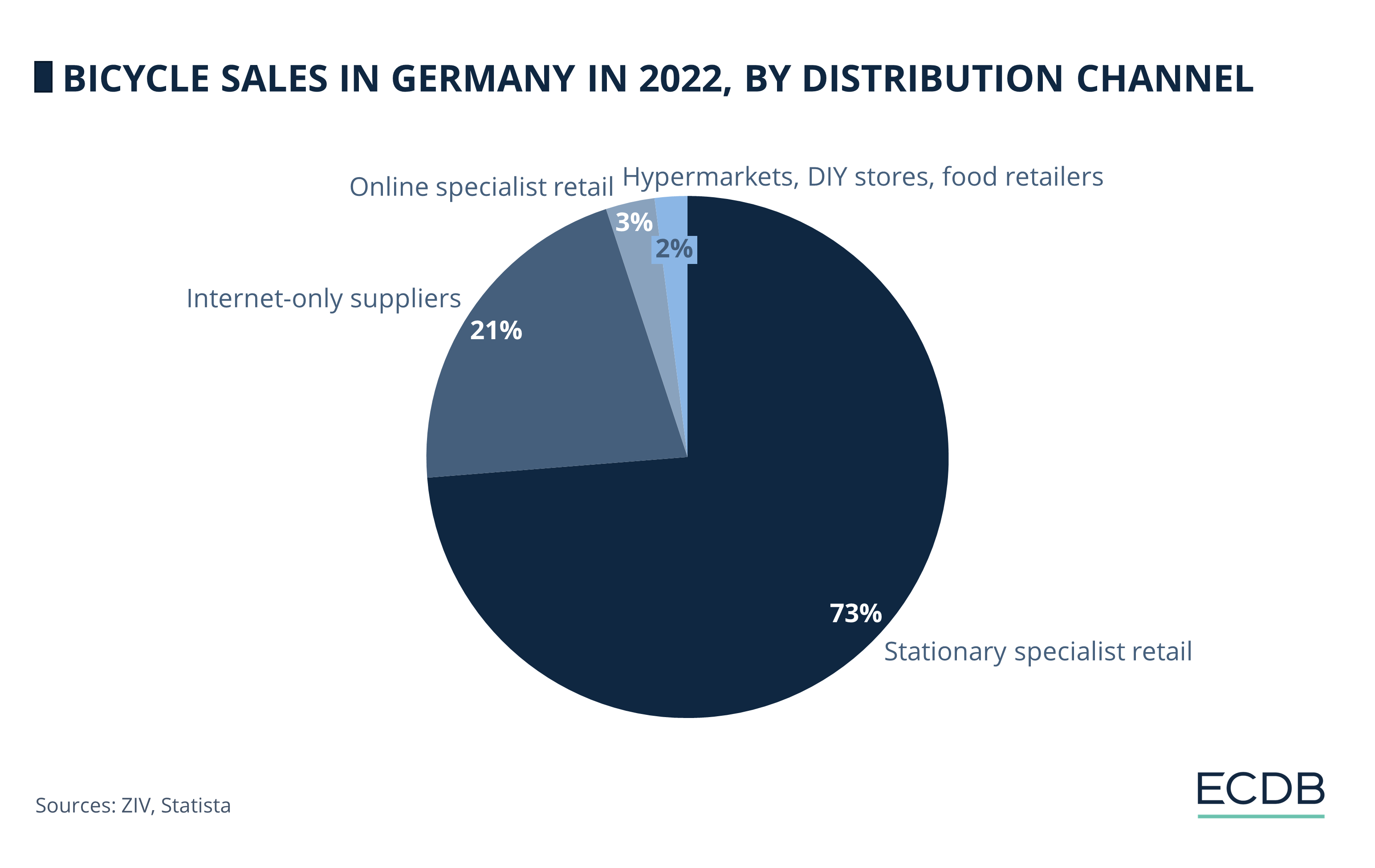

In 2022, bicycle sales in Germany were primarily dominated by stationary specialist retailers, which accounted for almost three quarters (73%) of the market share, indicating a strong consumer preference for purchasing from dedicated brick-and-mortar bicycle shops. Internet-only suppliers also held a significant portion of the market, with 21%, reflecting the robustness of eCommerce platforms in the bicycle industry.

Online specialist retail, which combines expertise with the convenience of online shopping, contributed to 3% of sales. Lastly, hypermarkets, DIY stores, and food retailers had the smallest slice of the pie, with 2%.

Online Bicycles Market: Key Takeaways

The German bicycle industry will be facing a period of recalibration. This shift comes at a time when traditional retail models are tested by the dynamics of online commerce and market forces exert a significant influence on the strategies of both established and emerging players.

Here are some key takeaways you can leave with:

Signa Sports United is confronting significant financial turmoil after the withdrawal of €150 million in funding by its parent company, leading to the insolvency of multiple subsidiaries and raising concerns of wider insolvency across its eCommerce platforms.

The bicycle market is at a critical juncture with the insolvency of SSU's Internetstores GmbH, threatening market saturation and financial stress across the industry amid existing overstock and discount pressures.

In Germany's specialized bicycle eCommerce, Canyon.com leads with US$213.2 million in 2022 sales, followed by Bike24.de and Rosebikes.de, with the market showing tight competition among the top six players and varied dependency on the German market for revenue.

In 2022, Germany's bicycle sales were heavily skewed towards stationary specialist retailers with 73% market share, while internet-only suppliers captured 21%, highlighting a strong consumer inclination towards physical stores alongside a notable online presence.

Sources: MTB News, Endurance.biz, SGB Media, Sinus-Institut, ZIV, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

Walmart Expands Pet Care Services

Walmart Expands Pet Care Services

Deep Dive

eCommerce in the United States: Best Product Categories

eCommerce in the United States: Best Product Categories

Back to main topics