eCommerce: Global Luxury Market

Top Luxury Brands: Global Market Concentration, Trends & Online Net Sales

More than half of total luxury net sales and online luxury net sales are produced by the world's top 25 brands – who are the top 25 and which company leads this ranking? Gain deeper insight into the market concentration of the global luxury market and its evolution beyond 2020.

Article by Nashra Fatima | May 02, 2024Download

Coming soon

Share

Top Luxury Brands in eCommerce: Key Insights

Growing Luxury Market: The global luxury market has seen a steady expansion in recent years with a CAGR of 18.4% from US$243 billion in 2020 to US$341 in 2022.

Top Brands Lead Online Luxury Sales: Online luxury sales are dominated by a few top brands, such as Louis Vuitton or Coach. The top 25 brands claim over half of the market share.

Challenges for Newcomers: Established luxury brands continue to dominate the market, making it difficult for smaller brands to gain a foothold.

According to ECDB's trend report on the global luxury market, it grew at a rate of 18.4% in recent years. In 2020, the global luxury market volume was at US$243 billion and continued to grow during the pandemic until it reached US$341 billion in 2022 – the equivalent of Uzbekistan's GDP in the same year.

But not every brand can compete. Our data from the report reveals all the details behind the luxury goods market, including market concentration, the top 25 brands, and their eCommerce sales.

Top 3 Brands in the Luxury Goods Market

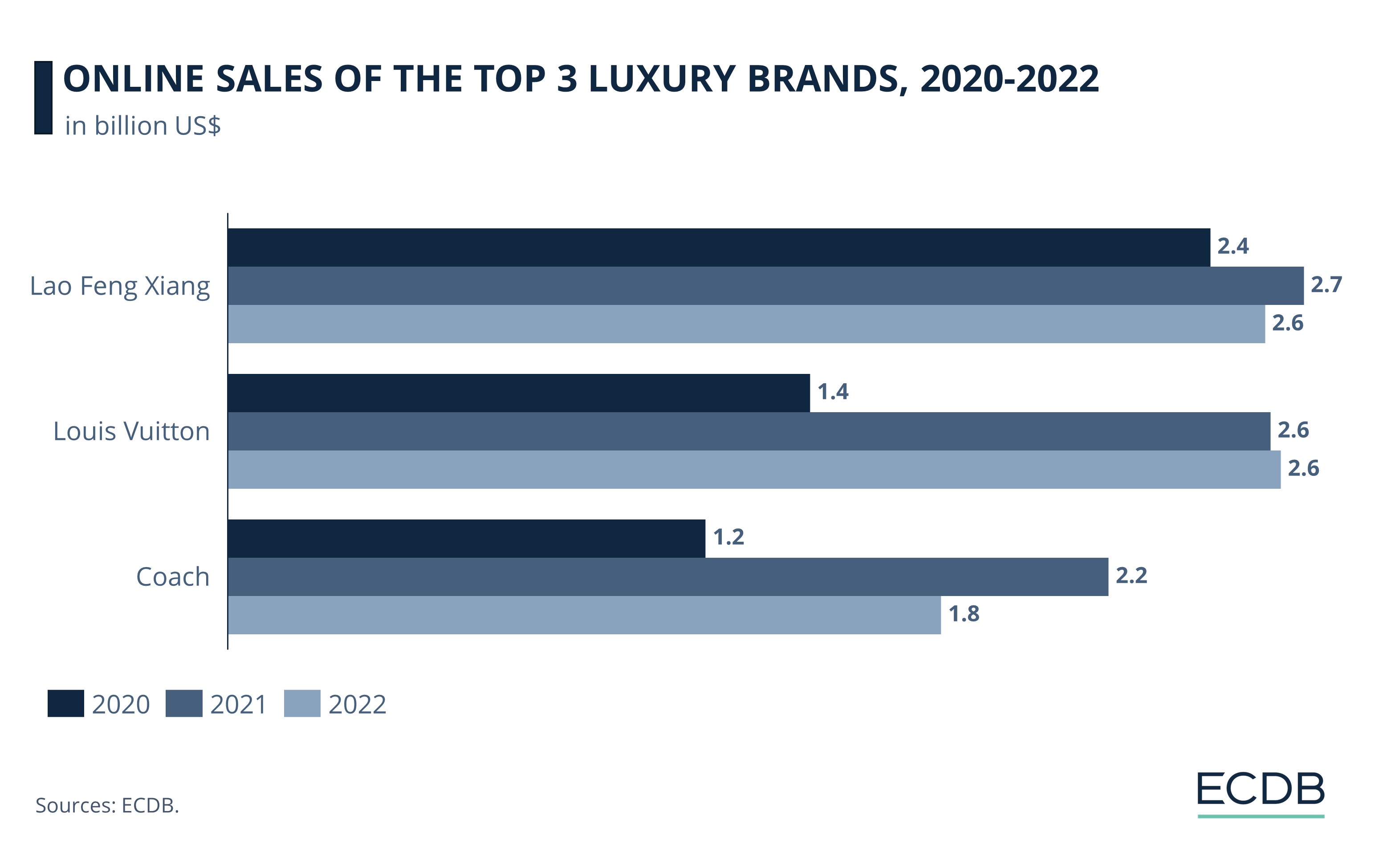

Louis Vuitton, Chanel, and Dior are the top three luxury brands by net sales but the latter two only make a minor share of their sales online. Considering eCommerce sales only, Lao Feng Xiang and Coach follow Louis Vuitton's first place.

Looking at the online sales of the most recent years, all companies could significantly improve their 2021 sales compared to the previous year – especially Coach and Louis Vuitton. The latter took the top spot in the luxury market in that year, with online sales of US$2.6 billion.

All brands followed the temporary recession that characterized most eCommerce markets in 2022. The extent to which losses occurred though varied between actors, with Louis Vuitton still managing slight growth as the only one of the top three brands.

The Top 25 Luxury Brands Claim Half of Total Online Sales

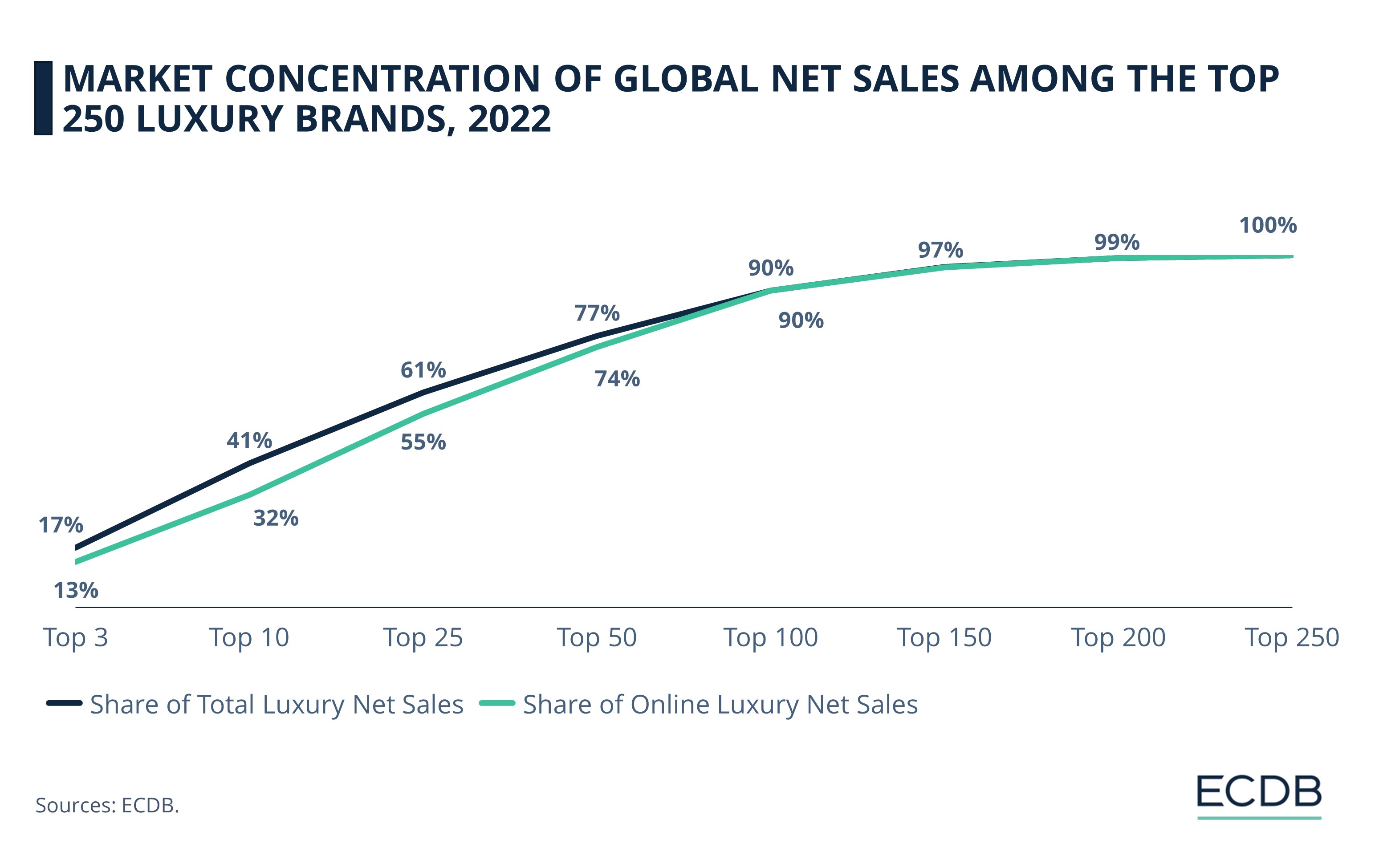

The top three brands mentioned above account for 13% of luxury eCommerce sales, while the top ten brands generate 32%. More than half of luxury eCommerce sales, 55%, came from the top 25 brands in 2022. The top 100 brands account for 90% of online sales. Ranks 101 to 250 generate the remaining 10%.

The top three brands, Louis Vuitton, Chanel, and Dior, account for 17% of total sales in the luxury market, which is almost a fifth of the entire market. The top ten brands claim 41% of total sales, while the top 25 brands take 61% of luxury retail revenues.

The numbers show that the top ten luxury brands control over 40% of the market, generating four out of every ten dollars. This demonstrates a highly consolidated market environment.

Market Concentration of Top Brands Increases

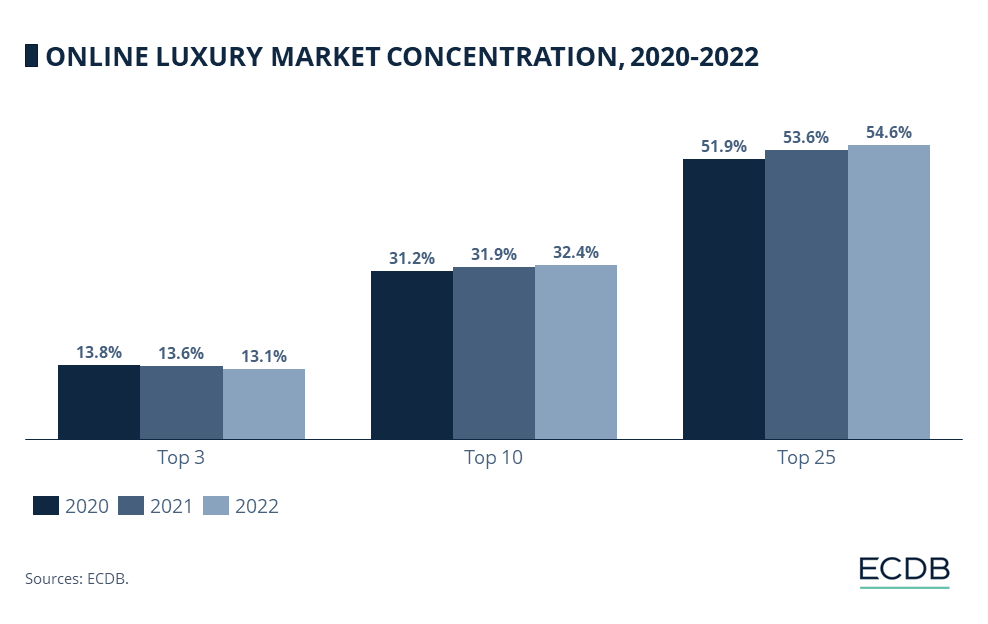

During the pandemic, from 2020 to 2022, the top 25 brands have increased their market concentration ratio by 2.7 percentage points. However, the top 3 brands have lost market share.

In 2021, the top 3 luxury eCommerce brands contributed a smaller share to the top 250’s luxury online revenues, which decreased from 13.8% to 13.6%, followed by an even further decrease to 13.1% the following year. The top ten brands followed an opposite trend. Their online market share showed an improvement in 2021, rising from 31.2% to 31.9%. In 2022 it further increased to 32.4%.

The 25 highest ranked luxury brands by eCommerce net sales experienced the most notable growth between 2020 and 2022. In 2020, they held a 51.9% market share, which increased to 54.6% in 2022.

The Luxury Goods Market: Players & Category Insights 2023 - Available Now

Are you searching for an in-depth analysis of the online market for luxury goods? Order ECDB’s exclusive report on The Luxury eCommerce Market: Players and Category Insights 2023 here.

The study provides a comprehensive overview of the personal luxury market with a focus on eCommerce. Next to an in-depth market analysis, readers will learn about the impact of Covid on the global luxury market, regional dynamics, sales channels (Business-to-Business and Direct-to-Consumer), as well as insights into different product categories.

The study further features an exclusive list of 250 leading luxury brands, including detailed performance metrics and brand properties, such as exclusivity and brand positioning. All sales numbers are provided for 2020 to 2022.