eCommerce: Quick Commerce

Flipkart Enters India's Quick Commerce Market

India's largest eCommerce player is entering the quick commerce race. That's big news, but what does it mean for the overall market in the country?

Article by Cihan Uzunoglu | August 06, 2024Download

Coming soon

Share

Quick Commerce Market in India: Key Insights

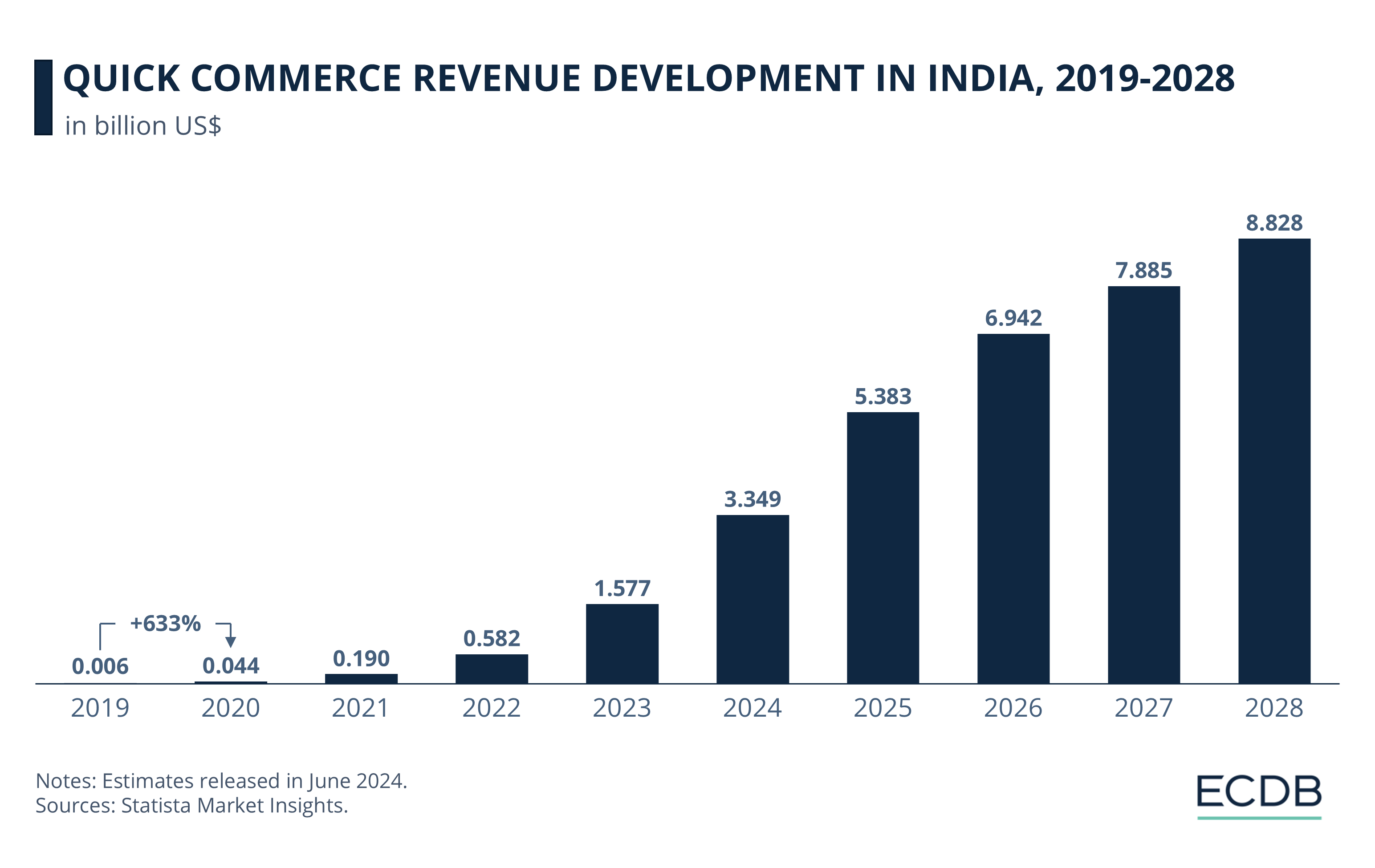

Market Expansion: India's quick commerce market is rapidly expanding, forecasted to grow from US$1.57 billion last year to over US$8 billion in a few years, driven by demand for ultra-fast deliveries and strategic moves by major players like Flipkart.

Blinkit's Valuation Surge: Blinkit, driven by urban demand for convenience, has surpassed Zomato's food delivery in value, with Goldman Sachs valuing it higher following Zomato's Q1FY25 profit and a market cap of US$30 billion.

Intense Competition: Flipkart Minutes will face stiff competition from Blinkit, Swiggy Instamart, and Zepto, who are rapidly expanding their dark store networks, intensifying the battle for dominance in India's quick commerce sector.

Walmart-owned Flipkart, India's largest eCommerce company, has launched its quick commerce service, Flipkart Minutes, in India.

This new service promises delivery of a wide range of items, from groceries to smartphones, within 10 to 15 minutes. To understand the significance of this development, we need to look at the market as a whole.

Quick Commerce Market in India

The quick commerce market in India is rapidly growing, attracting major players despite its challenges in other regions. Flipkart's entry into this sector, following the success of rivals like Blinkit, Zepto, and Swiggy Instamart, stands as a testament to the increasing demand for ultra-fast delivery services among urban consumers.

Estimated to be worth only US$6.24 million right before the pandemic, the quick commerce market in India hit US$44.8 million by 2020.

Continuing its growth, the market hit US$1.58 billion last year.

India’s quick commerce market is forecast to reach US$3.35 billion by the end of this year. In a few years, we might be looking at a market that’s above the US$8 billion mark.

Flipkart's strategic move involves leveraging hundreds of small warehouses, known as dark stores, to facilitate rapid deliveries. The company plans to establish around 100 dark stores by the festive season, a move that will enhance its quick commerce capabilities.

Flipkart bases its business model on competitive pricing, special shopping days like TBBD (The Big Billion Days), and payment options such as Flipkart Axis Bank Credit Card and Pay Later. Loyalty programs like "Flipkart Plus" and features like Video Commerce and AI-powered Flippi enhance customer engagement and drive significant growth.

This initiative is seen as a way to compete with Amazon, which has focused on same-day delivery for Prime members and has shown little interest in the quick commerce space.

Blinkit Surpasses Zomato's

Food Delivery in Value

Driven by urban consumers' preference for convenience, the quick commerce market in India has shown resilience and growth.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

Goldman Sachs estimates that Blinkit, the leading player in this space, is already valued higher than its parent company's food delivery operations. Blinkit's valuation boost came after Zomato reported a Q1FY25 profit of US$30 million, pushing its market cap to US$30 billion.

Flipkart's entry into quick commerce comes at a strategic time, as it aims to capture a larger share of the urban market dominated by Amazon. The Bengaluru-based firm raised US$350 million from Google in May, signaling a significant investment in its quick commerce ambitions.

Market Competition Intensifies

With Flipkart Minutes, the company will face intense competition from established players like Blinkit, Swiggy Instamart, and Zepto, all of which are expanding their dark store networks. Blinkit aims to reach 2,000 dark stores by 2026, while Zepto plans to double its presence to 700 by March 2025. Swiggy Instamart currently operates over 500 such warehouses.

As Flipkart rolls out its quick commerce service, the battle for market dominance in India's fast-growing quick commerce sector intensifies, promising faster deliveries and greater convenience for consumers.

Sources: TechCrunch, Economic Times, Entrepreneur India, Entrackr, CNBC-TV18, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Keeta in Saudi Arabia: Meituan to Expand Online Food Delivery Market

Keeta in Saudi Arabia: Meituan to Expand Online Food Delivery Market

Deep Dive

Flink: Grocery Delivery Startup Raised US$150 Million in Funding

Flink: Grocery Delivery Startup Raised US$150 Million in Funding

Deep Dive

Grocery Retailers Face Online Channel Profitability Challenge

Grocery Retailers Face Online Channel Profitability Challenge

Deep Dive

Quick Commerce in the U.S: Market Trends, Top Providers & Consumer Behavior

Quick Commerce in the U.S: Market Trends, Top Providers & Consumer Behavior

Deep Dive

Digital Grocery 2024: What’s New at Amazon, Getir, Walmart & Target

Digital Grocery 2024: What’s New at Amazon, Getir, Walmart & Target

Back to main topics