ECOMMERCE: SUSTAINABLE DELIVERY

Sustainable Delivery: Online Consumer Behavior in China and the United States

China and the U.S. are the world’s largest eCommerce markets, which makes them critical from a sustainability perspective. We assess how sustainable delivery standards rank for Chinese and U.S. consumers, their attitudes towards delivery, and their willingness to pay a price premium for eco-friendly shipping.

Article by Nashra Fatima | September 16, 2024

Sustainable Delivery Preferences: Key Insights

Important delivery criteria: In both China and the U.S., the most important delivery criteria for consumers remain free and fast shipping. Sustainable options like environmentally friendly packaging and CO2 neutral delivery are low in importance, with requirement for them relatively higher in China.

Preferences in delivery: More consumers in China (41%) than in the U.S. (28%) prefer shopping at online stores that offer sustainable delivery. A larger share of U.S. (18%) than Chinese (14%) shoppers are not always sure what companies mean by sustainable delivery.

Eco-friendly delivery: Willingness to pay for eco-friendly delivery may depend on the surcharge. But compared to China (18%), a much larger share of consumers in the U.S. (37%) is unwilling to pay at all for eco-friendly delivery.

How do online shoppers like their shipping?

Fast and free. That is why retail giants like Amazon now offer same-day delivery.

But like all good things, this speed and affordability come at a cost - in this case, environmental harm. Thus, the calls for sustainability in eCommerce are ringing louder. Consumers are also becoming more eco-conscious – but how deep is the impact?

In this article, we analyze how sustainability ranks among the delivery criteria and preferences of online consumers in the two largest eCommerce markets in the world – China and the United States.

Important Criteria for Delivery: Free and Fast Shipping Beat Sustainability

Data confirms what we said earlier: free and fast shipping are the deciding factors in shipping for online consumers, in both China and the United States.

The Statista Consumer Survey of 2023 further shows how sustainable delivery criteria ranks in importance for Chinese and American shoppers.

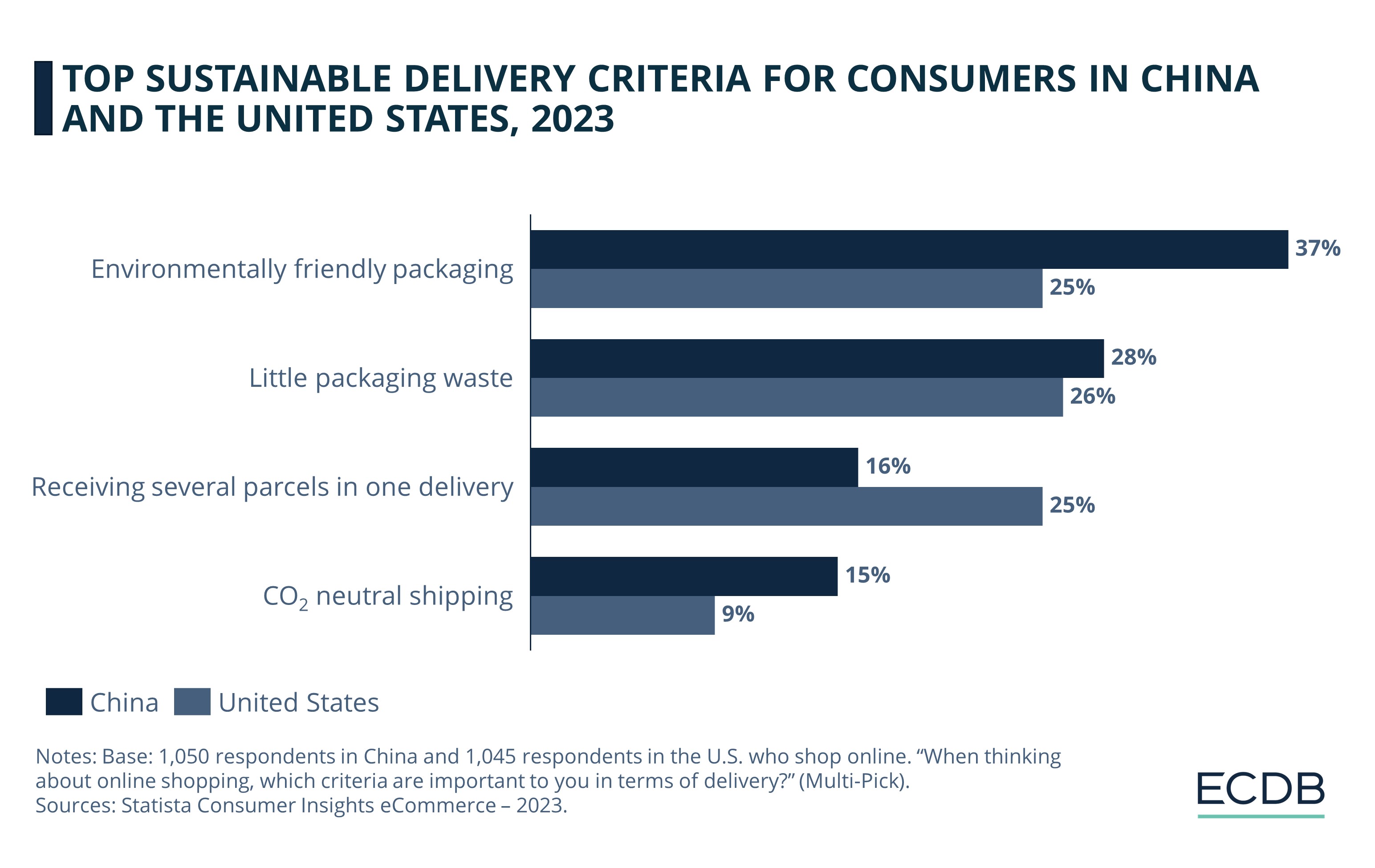

Consumers’ delivery requirements related to sustainability include:

Environmentally friendly packaging is important for 37% of Chinese respondents. At 25%, the share of U.S. shoppers who require recyclable packaging is lower.

Little packaging waste is more important for Chinese (28%) than U.S. (26%) shoppers.

Receiving several parcels in one go potentially reduces waste and is more convenient than split deliveries. It is an important to a quarter of American respondents – nine percentage points higher than their Chinese counterparts (16%).

CO2 neutral shipping is at the tail end of important delivery criteria in both countries. 15% of Chinese consumers require it, compared to 9% of U.S. shoppers.

In comparison, the shipping criteria that rank top in both countries are:

Free shipping – It is important to 70% of U.S. shoppers. The share of consumers is slightly lower in China, at 67%, but it is still thirty percentage points higher than the top-ranking sustainability criterion of environmentally friendly packaging.

Fast shipping, also a more important requirement for U.S. (60%) than Chinese (57%) consumers.

Free return shipping is indispensable to 64% of Chinese and 51% of American respondents.

The ranking underscores that, in delivery, sustainability is not yet at the forefront of consumers’ minds, in China or the United States. Convenience-oriented options like free and fast shipping far outrank sustainability in their shipping requirements.

So, what attitudes do consumers in the two countries have towards delivery of their online orders?

Attitudes Towards Sustainable Delivery in China and the U.S.

Consumers attitudes towards delivery and returns diverge in China and the United States, revealing differences in preferences and market dynamics.

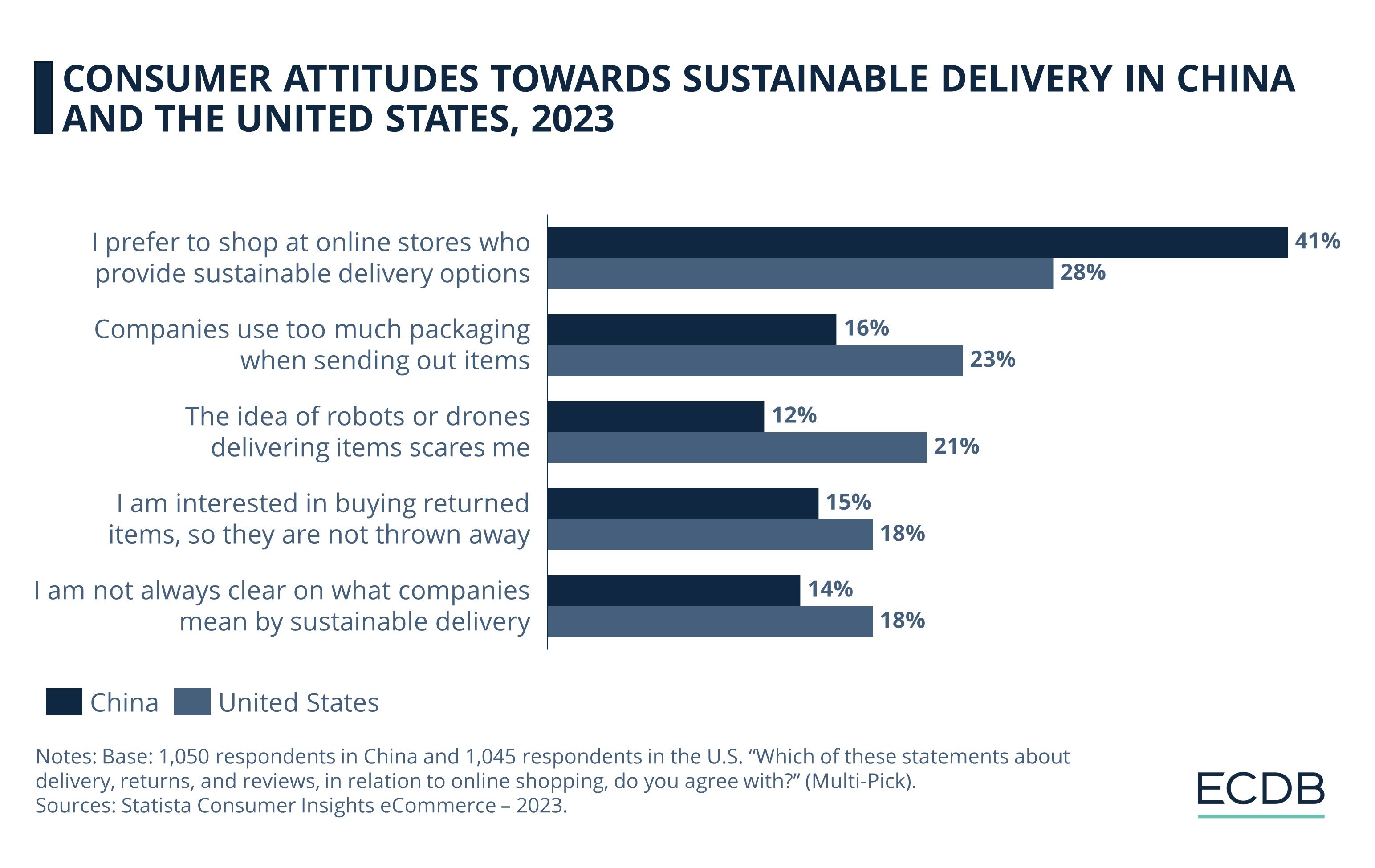

Stores that offer sustainable shipping are preferred by 41% of Chinese consumers. The share of U.S. shoppers who prefer the same lags by thirteen percentage points, at 28%.

Too much packaging is singled out as a concern by a larger share of U.S. (23%) than Chinese (16%) respondents.

Delivery powered by drones or robots is more popular among U.S. (21%) than Chinese (12%) shoppers. Such tech-driven delivery options may reduce emissions, but preference for them may be driven more by interest in experimental eCommerce solutions.

Buying returned items interests a slightly larger share of U.S. (18%) than Chinese (15%) consumers. This practice may also help reduce waste by preventing returned items from ending up in a landfill.

Lack of clarity about what companies mean by sustainable delivery is more prevalent among U.S. (18%) than Chinese (14%) consumers.

Consumer lack of clarity about sustainability is an attention-worthy matter. A 2023 McKinsey survey discovered that most U.S. consumers did not have a strong understanding of which packaging is sustainable: as much as 29% found packaging made of plastic, paper, and aluminum foil to be extremely or very sustainable, when that is not true. The findings reveal a significant gap in consumer understanding that must be addressed.

It is likely that consumers are inclined to make eco-conscious choices, but the lack of clarity thwarts their intentions. This also undercuts goals of recycling, reducing waste, and achieving climate neutrality. Data further shows that more Chinese consumers than Americans wish to shop at stores that offer sustainable delivery—a positive hint for Chinese eCommerce companies.

But are consumers in either country willing to back up their preference with their wallets?

Business Intelligence: Our rankings, updated regularly with fresh data, offer valuable insights to boost your performance. Which stores and companies are the leaders in eCommerce? What categories are generating the most sales? Explore our detailed rankings for companies, stores, and marketplaces.

Willingness to Pay for Eco-Friendly Shipping Higher in China than the U.S.

Shifting from traditional delivery methods to eco-friendly options could demand huge upfront investments from companies – costs they may adjust by charging consumers if they are inclined to pay.

The Statista Consumer Survey of 2023 asked Chinese and U.S. shoppers whether they are willing to pay surcharges for eco-friendly delivery or not. The answers they gave are:

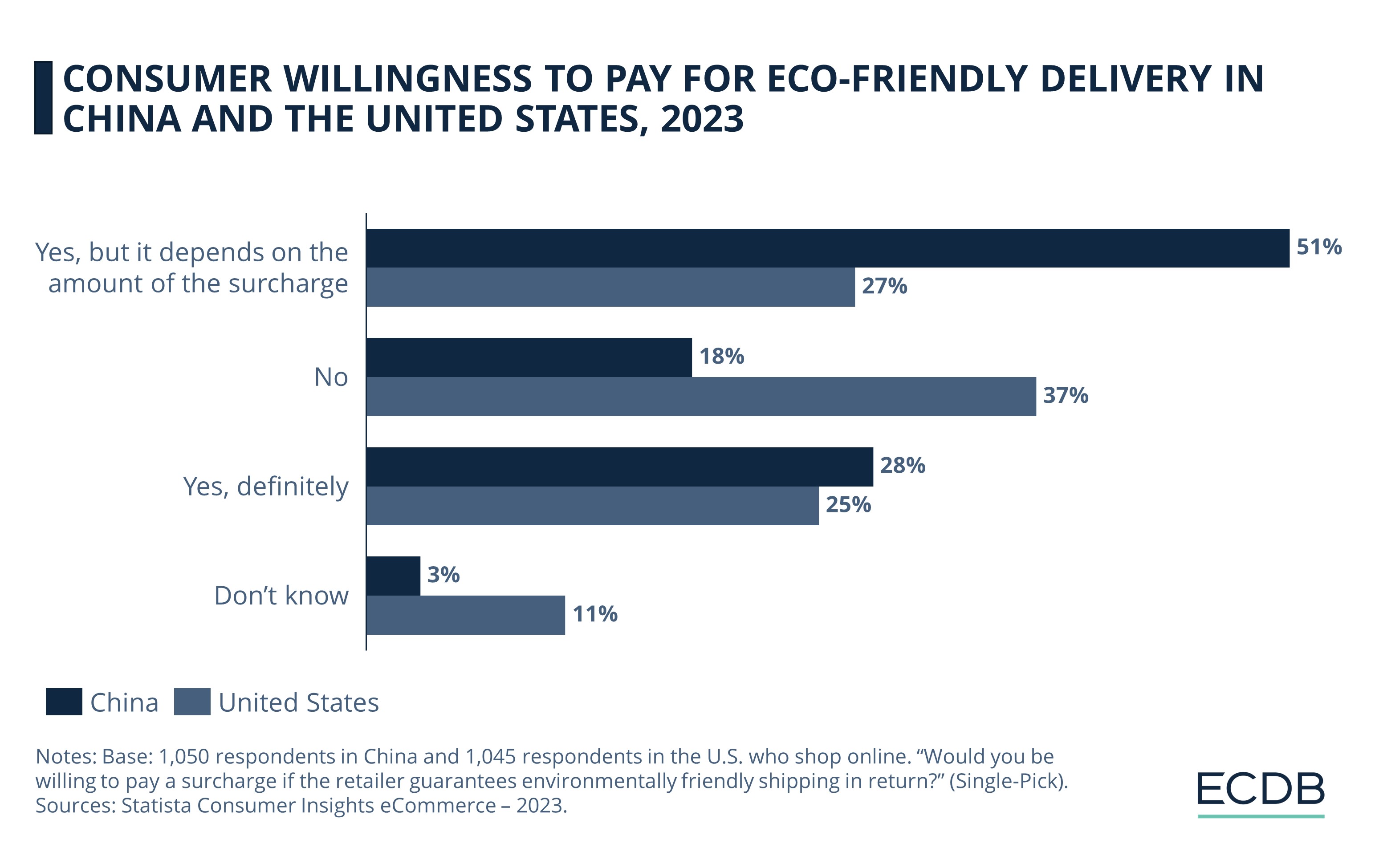

“Yes, but it depends on the amount of surcharge” – over half of Chinese respondents (51%) are open to this possibility. The share is nearly double than U.S. shoppers (27%) who said the same.

“No” is where U.S. shoppers lead with 37%. The share of Chinese consumers who said an outright no is nearly twenty percentage points lower, at 18%.

“Yes” - a slightly larger share of Chinese (28%) said “yes” compared to U.S. (25%) shoppers.

“Don’t know” – which may indicate unawareness or reservation – is an opinion held by a larger share of U.S. (11%) than Chinese (3%) shoppers.

Customers in China show a higher willingness to pay for eco-friendly shipping, but only if the amount is right. This is notable, considering the inclination towards all things free in shipping that tends to prevail in eCommerce. It may also be a positive indication for companies looking to invest in ecofriendly options in the country.

American consumers are more closed off to paying a premium for environmentally friendly delivery as of now. U.S.-based companies, if they switch to sustainable models, may have to shoulder the bulk of its financial burden.

Sustainable Delivery in China and the U.S.: Closing Remarks

The sustainability turn is gaining momentum in eCommerce. In both China and the United States, corporates are working towards eco-friendly models. For instance, JD has implemented green packaging and green logistics measures. In the U.S., Amazon recently announced replacing 95% of its plastic packaging with paper.

However, the current data on delivery criteria and buyer attitudes also shows that there is enormous room for improvement. An ECDB insight explains that consumers from the older demographic are unconvinced by green labels, while the younger cohorts are wary of greenwashing. To bring a lasting consumer shift towards sustainable choices, governments as well as eCommerce companies must play a bigger role.

Stricter sustainability regulations and economic incentives for retailers are paths forward at a policy level. Companies, on their part, could offer eco-friendly options, but also educate customers and engage them as important stakeholders in their sustainability drive.

Sources: McKinsey; JD; Amazon; ECDB.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Deep Dive

Guess Joins an Affiliation with SuperCircle for Clothing Recycling Program

Guess Joins an Affiliation with SuperCircle for Clothing Recycling Program

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

Almost Two-Thirds of German Consumers Favor Drone Delivery of Packages

Almost Two-Thirds of German Consumers Favor Drone Delivery of Packages

Deep Dive

Global Consumer Attitudes Towards Sustainable eCommerce: Delivery, Packaging, Country Preferences

Global Consumer Attitudes Towards Sustainable eCommerce: Delivery, Packaging, Country Preferences

Back to main topics