eCommerce in France: Top Stores

Top 10 Online Stores in France: Shein.com and Amazon.fr Lead French eCommerce

As the ninth-largest market in the world, the French eCommerce sector has seen its share of ups and downs. Discover the country's latest developments in the industry.

June 18, 2024Download

Coming soon

Share

Top 10 Online Stores in France: Key Insights

The French eCommerce Market: The French eCommerce market is projected to reach US$75.7 billion by 2024, with a CAGR of 4.6% leading to US$90.8 billion by 2028.

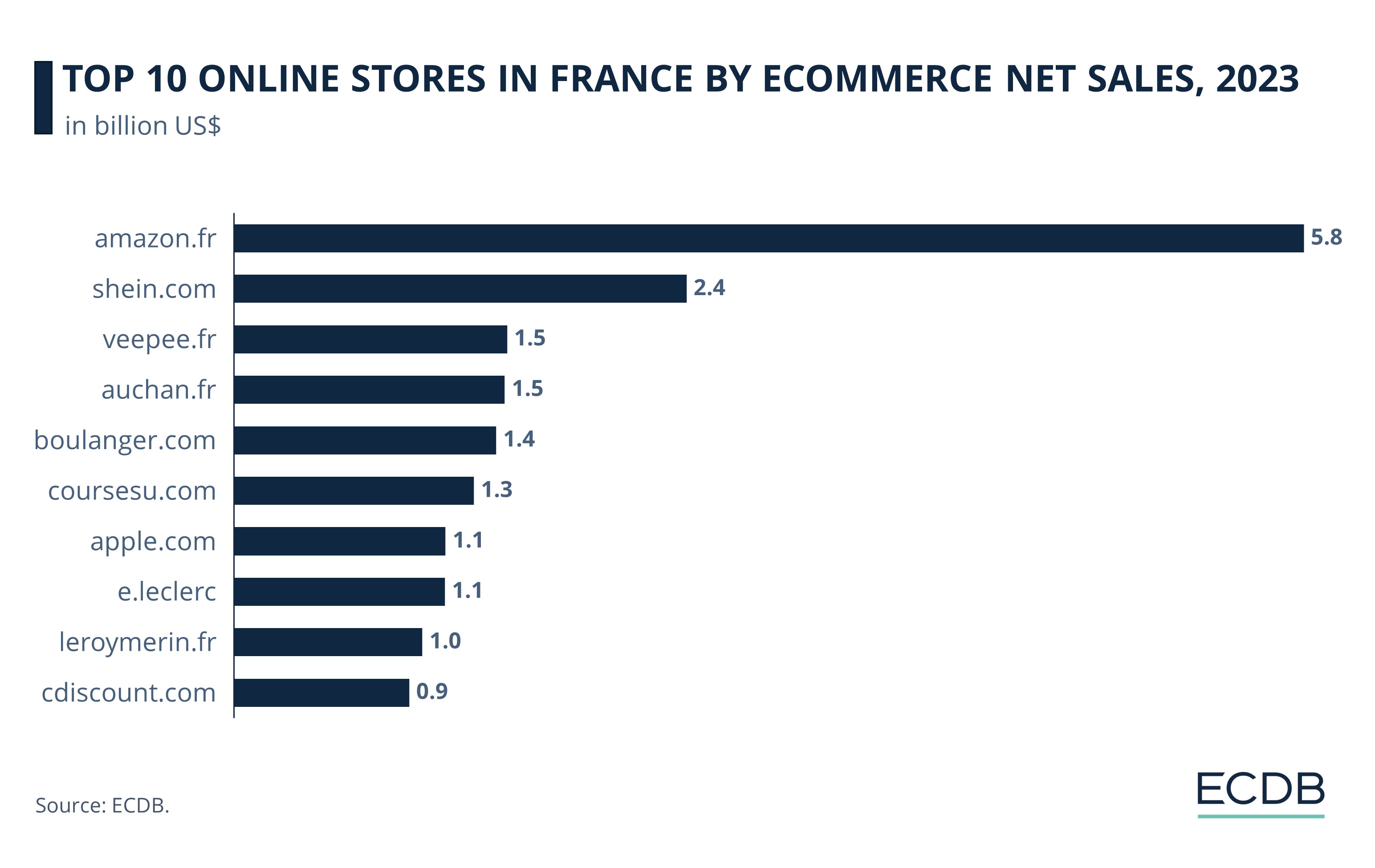

Leading Key Player: Amazon.fr and Shein.com are the leading forces in the French eCommerce market, jointly capturing over 10% of the total market share.

Emerging Competitors: Coursesu.com and e.leclerc show significant growth, with Courses U reaching US$1.3 billion and e.leclerc making notable gains to secure a position in the top 10.

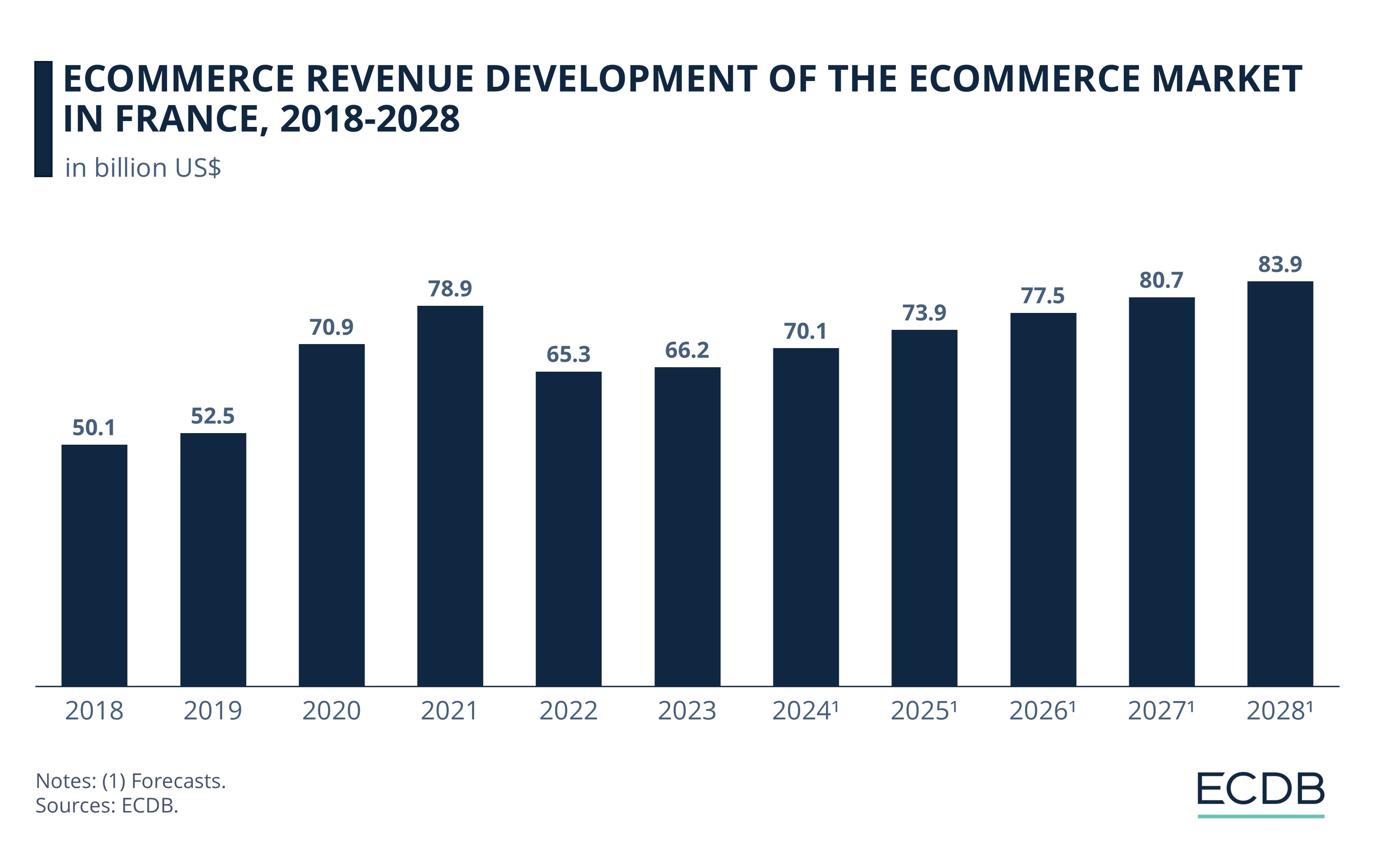

Market Development: The French eCommerce market experienced steady growth from 2017 to 2019. It peaked during the pandemic, adjusted in the years after, and is forecast to reach new heights by 2028.

The eCommerce industry in France is one of the largest in the world, and is expected to reach US$75.7 billion in revenues by 2024, or about one-fortieth of France's GDP at that time (US$3 trillion). Its revenue is expected to show a compound annual growth rate (CAGR 2024-2028) of 4.6%, resulting in a projected market volume of US$90.8 billion by 2028.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

Two major players have made their mark in this eCommerce space: amazon.fr and shein.com. Together, they account for more than 10% of the market.

1. Amazon.fr

Amazon.fr remains the unbeaten number one in the ranking of the biggest online stores in France in terms of total net sales. After a sharp decline in growth last year (-11.5% YoY growth rate), Amazon's French business grew again, albeit by only 0.7%. In 2023, amazon.fr reached US$5.8 billion in eCommerce net sales, twice as much as the second-largest online store in France – this corresponds to about 8% of eCommerce sales in France in 2023.

Although amazon.fr's performance remains strong compared to its rivals, the store was in the news earlier this year when the French data protection authority (CNIL) fined the Amazon's French unit US$34.9 million for an "excessively intrusive" surveillance system. A bad image that could affect this year's sales. In May, Amazon announced plans to invest US$1.3 billion in amazon.fr. In this way, Amazon creates 3,000 new jobs in France and invests in cloud infrastructure in the Paris region, with a focus on generative AI, as well as logistics infrastructure.

2. Shein.com

For the second year in a row, shein.com secures the second position in the top 10 online stores ranking with eCommerce net sales of US$2.4 billion in 2023. In total, 6.7% of its revenue is generated in France, making the French eCommerce market the second-most important market for the store globally. Although augmentation has slowed compared to YoY growth in 2022 (92.1%), shein.com’s development remains high at 39.6%.

Recently, Shein has announced to extend into reCommerce with a resale platform in Europe. The platform is already available in France as a first step and will continue to expand country by country. The company launched the platform in the United States in October 2022, in an effort to tap into the growing reCommerce market. A strategy to circumvent the measures taken by the National Assembly, the lower house of the French Parliament, against fast fashion, especially from Chinese mass producers. The measure contains among others a fee on fast fashion pieces.

3. Veepee.fr

Number three among the largest online stores in France is the fashion retailer veepee.fr. Between 2022 and 2023, the store lost net sales by 0.3% to a total of US$1.5 billion. Veepee is one of the online stores with a stable foothold in French eCommerce, as it has remained in third place for years. It has remained in third place for years on end now. Learn about the other rankings in the table below.

After peaking at over US$2 billion in 2020 thanks to the COVID-19 pandemic and the resulting eCommerce boom, net sales began to decline with a low point in 2023 of US$1.4 billion. Now veepee.fr seems to have regained its footing with a projected growth of 3% in 2024.

The fashion store was launched in France in 2001 under the name Vente-Privée, which means private sale. Depending on the country, the store had different names, such as eboutic.ch in Switzerland, which is why they completely changed to Veepee, as per Dépôt-De-Marque, a pronounceable and short new name.

4. Auchan.fr

Auchan.fr returned to 4th place, as shown in the table above, with net sales of US$1.5 billion in 2023, similar to veepee.fr. The online store with nationally focused sales is an all-rounder, covering products from eCommerce categories such as grocery (25%), fashion (17%), electronics (12%), and more.

Due to several factors, including inflation in France and the Ukrainian-Russian war, sales declined in 2022. In response to these difficulties, according to EcommerceMag.fr, Auchan plans to invest around €400 million by 2028 (equivalent to US$433.6 million in June 2024) to bring its stores back into shape.

5. Boulanger.com

Not far behind is boulanger.com, which generated net sales of US$1.4 billion last year, dropping one place from fourth to fifth in 2022. The nationally focused online retailer offers products primarily in the electronics (90%) and DIY (10%) eCommerce categories.

In addition to shopping online at boulanger.com or in one of its 217 physical locations, the store offers repair and buy-back services for older equipment. Services that can be particularly useful in times of inflation, while contributing to a circular economy.

Top 10 Online Stores in France: Bottom Ranks

Further down the list follow coursesu.com, apple.com, e.leclerc, leroymerlin.fr and last but not least cdiscount.com. With net sales ranging from US$1.3 billion to US$900 million, they don't seem that far off from most of the top 5 – with the exception of the two leading online stores.

Coursesu.com is an online grocery store operated by Coopérative U Enseigne. In 2023, Courses U, also known as U Drive, reached a new high with net sales of US$1.3 billion. Its net sales increased by 17.4% from the previous year, moving the store from 8th to 6th place.

Apple.com performed poorly both globally and in France, with net sales of US$1.1 billion in 2023, a decline in growth of 16.6% year-on-year, pushing Apple down to 7th place in the top 10 ranking. The reasons for this development are the lack of new product models and the new devices with only minor upgrades.

E.leclerc shows remarkable growth in recent years, jumping from 3,247th place in 2020 to 11th place in 2021 with US$889 million, and finally reaching 8th place in 2023 with US$1.1 billion. The all-rounder covers several eCommerce categories, while its main category lies in fashion, with 32%.

Leroymerin.fr benefited greatly from the COVID-19 pandemic, quadrupling its net sales from US$294.8 million to US$1.2 billion between 2019 and 2021. However, the first post-Corona years have brought new challenges for the online store. Nevertheless, its rapid growth underscores its impact on the French market, particularly in the DIY category (56%) and more specifically in the tools and building supplies' category (41%).

Cdiscount.com occupied the second position for a long time, but the online store struggled in the last two years. While its net sales in 2021 amounted to US$2.1 billion, less than half of that is left in 2023 with US$1 billion – and this downward trend is expected to continue.

French eCommerce Market Could Peak

at US$90.8 Billion by 2028

The French eCommerce market has seen different challenges, be it pandemic or inflation. In general, the evolution of eCommerce revenues in France can be divided into four sections:

2018 to 2019: The French market grew at a steady rate from US$50.1 billion in 2018 to US$52.5 billion.

2020 to 2021: The pandemic that hit France at the end of 2019 had to result in a strong sudden increase between these years, reaching its peak in 2021 with revenues of US$78.9 billion.

2022 to 2023: The post-Corona era begins with the end of restrictions due to COVID-19, meaning that online retailers who have benefited from closed offline sellers now face sudden competition. After a larger decline in 2022 (US$69.3 billion), the market continues on a growth path, reaching US$71.5 billion in 2023.

2024 to 2028: According to our data, French eCommerce continues to climb. By 2025, the market is predicted to hit US$79.9 billion, exceeding its 2021 record and potentially peaking at US$90.8 billion by 2028.

Top 10 Online Stores in France:

Closing Thoughts

While the top two online stores are far ahead, leaving hardly any room for their competitors, the order below them changes regularly. For example, in the next year, auchan.fr could bump veepee.fr from third place, while cdiscount.com may disappear out of the top 10 in 2024.

Online stores like Shein, as well as marketplaces like Temu or AliExpress, have been criticized time and again for their cheap, low-quality products, driving domestic online retailers into bankruptcy. The National Assembly's recent measures are designed to protect domestic stores and the environment – but it is questionable whether this will be enough.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Back to main topics