eCommerce: Ranking

Top 5 Online Marketplaces in U.S. Fashion: Amazon, Walmart & Market Trends

Which are the top online marketplaces for U.S. fashion? Learn about GMV, forecasts, the top marketplace performances, and which competitors are lurking to take over the top positions.

Article by Nadine Koutsou-Wehling | May 24, 2024Download

Coming soon

Share

Top Online Marketplaces in U.S. Fashion: Key Insights

Defining online marketplaces: An online marketplace differs from an online store in that the marketplace is a place where different sellers and brands offer their products for consumers to choose from. The online store is a place where brands sell their private label products to consumers.

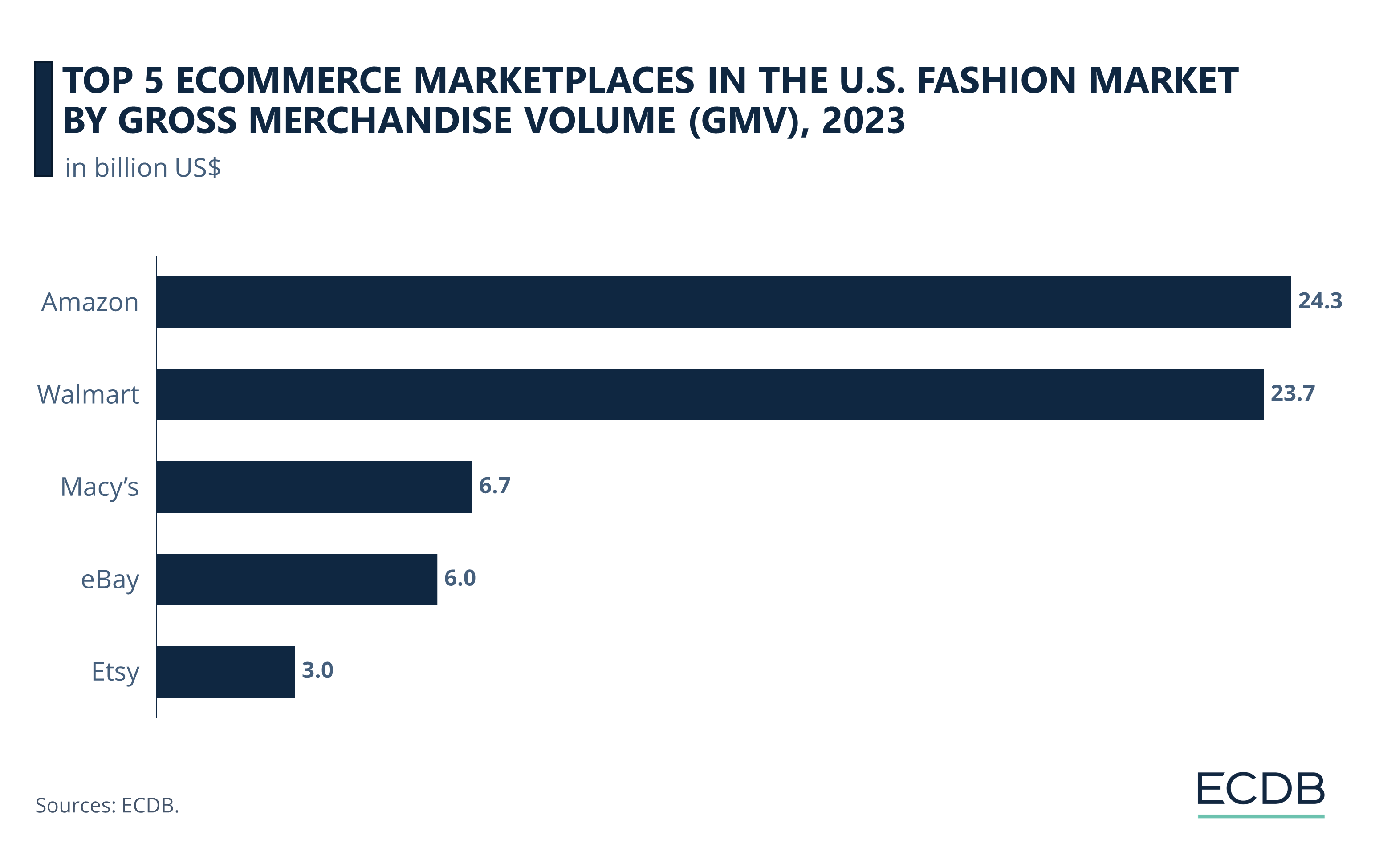

Top 5 marketplace rankings in U.S. fashion: Amazon and Walmart rank first and second in terms of gross merchandise value (GMV). In 2023, US$24.3 billion worth of fashion products were sold on Amazon, with Walmart following close behind at US$23.7 billion.

Lower rankings could soon be taken over by Temu: Lurking in 6th place, Temu isn't really that far behind 5th place Etsy. The difference in GMV between the two was around US$500 million in 2023. Secondhand marketplaces are also prevalent in the top 10.

The United States is the world’s second largest eCommerce market. Its homegrown companies are known for capturing a global audience with innovative business models and advanced technology.

ECDB recently reported on the most successful U.S. fashion online stores. Does the ranking correspond to the top marketplaces in U.S. fashion?

What Is a Marketplace? How Does It Apply to Fashion eCommerce?

An online marketplace is an eCommerce platform where various sellers can offer their products or services to consumers. The marketplace operator facilitates this by providing a platform for sellers to list their items and for buyers to browse and purchase them.

The operator typically earns money by charging a commission on each transaction and/or a fee for using the platform. Platforms such as Amazon and Walmart are a hybrid between a marketplace and an online store, meaning they sell both third-party and first-party products, acting both as marketplace providers and retailers.

In the fashion sector, participants include established brands taking advantage of extra sales channels, wholesale retailers selling third-party products from manufacturers, and private individuals reselling used items or goods they bought at a lower price to redistribute.

Top U.S. Fashion Marketplaces: Amazon and Walmart on Top

According to our ECDB Marketplace Ranking for fashion in the United States, these are the top marketplaces fashion in the U.S.:

Note the close proximity of first-place Amazon and second-place Walmart, with a US$600 million GMV difference. Here is more information about these top marketplaces:

1. Amazon

Amazon’s U.S. marketplace saw US$24.3 billion in sales of fashion products in 2023. While Amazon also acts as a seller through its online store, where it ranked second in the U.S. fashion market in 2023, its marketplace is particularly popular with third-party sellers looking to offer their assortments to a wider audience.

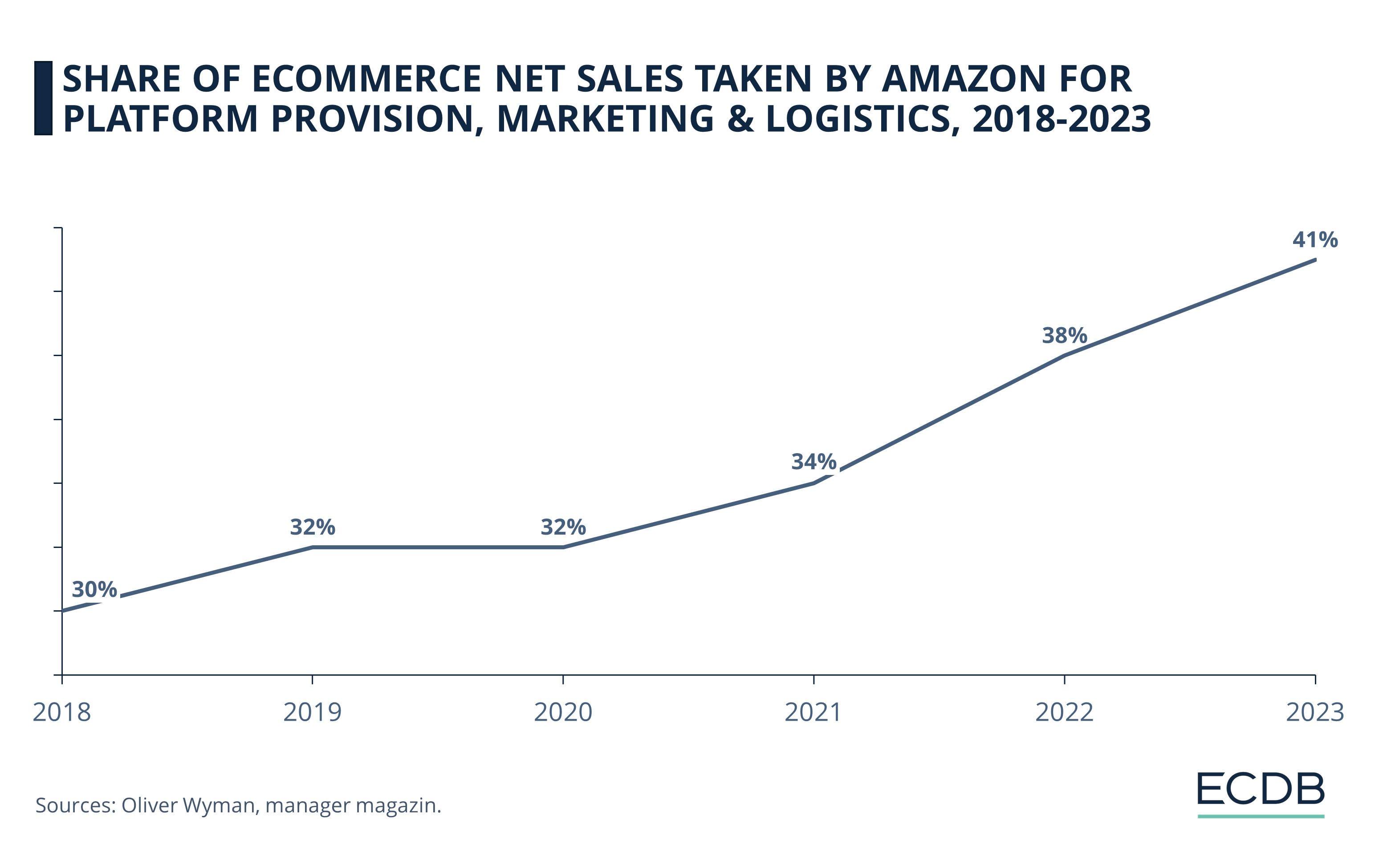

However, Amazon is increasingly coming under fire for raising the seller fees for platform provision, marketing and logistics services. See how steep the curve illustrating Amazon’s seller fees has been in recent years:

Note that these are maximum values: Amazon always charges a fee for providing the marketplace, but marketing and logistics services are optional. At least they are in theory: Recent reports suggest that sellers are incentivized to spend a large portion of their revenue on Amazon’s marketing services. Without this contribution, their listings usually do not rank at a high enough position for consumers to notice them.

2. Walmart

Close behind Amazon in the ranking of the top U.S. online marketplaces for fashion products is Walmart, which generated a GMV of US$23.7 billion in 2023. Together, the two generalist retailers overshadow the other marketplaces in the top 5 ranking.

Walmart’s business model is similar to Amazon’s in the sense that it operates both as a marketplace for third-party sellers and as a retailer of its own-branded products. With its online store, Walmart ranks first in the U.S. eCommerce fashion market. But unlike Amazon, Walmart started out as a brick-and-mortar chain and still manages a vast network of physical locations in North America, to which its online platforms are more of a complement. The opposite is true for Amazon.

3. Macy’s

Macy’s marketplace ranks third in U.S. fashion eCommerce with a GMV of US$6.7 billion. Like Walmart, Macy’s is one of the top 5 online stores for fashion in the U.S., acting as both a seller and a marketplace provider.

In recent years, Macy's marketplace has seen a slight decline in GMV, but this is expected to reverse in the coming years. Nevertheless, the competition is not asleep.

4. eBay

In fourth place is eBay with a 2023 GMV of US$6 billion in U.S. fashion. eBay holds the same position in the German marketplace ranking for fashion products. This reflects the continued relevance of eBay, the consumer-to-consumer (C2C) marketplace.

However, eBay has struggled to maintain its GMV level in recent years and even has seen a decline in growth.

5. Etsy

Another marketplace with a C2C focus is Etsy, the platform that started out as a haven for vintage and handmade products but has since evolved into something much more.

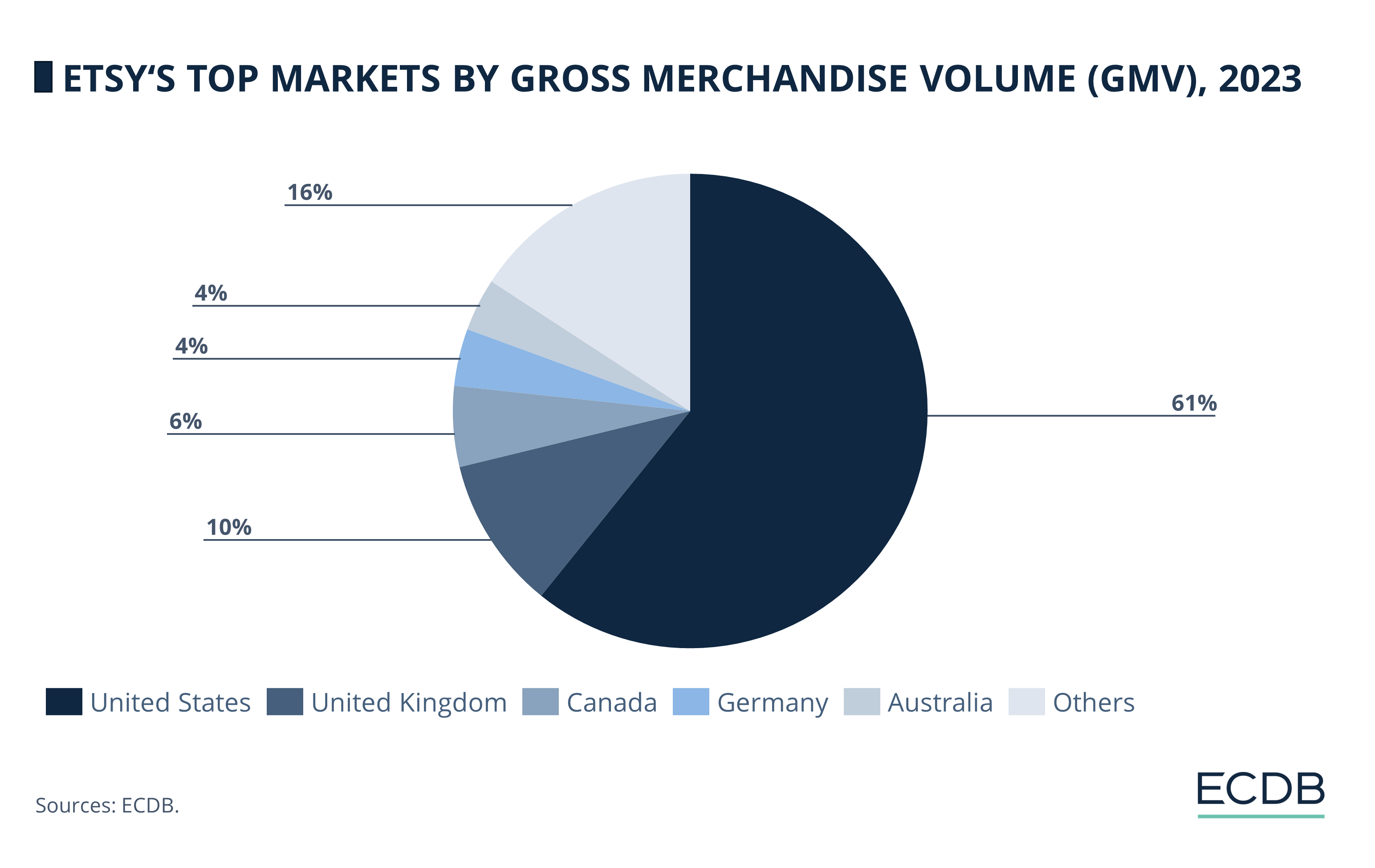

Like eBay, Etsy is highly relevant around the world. Of all the markets in which Etsy is available, the United States accounts for by far the most marketplace activity:

61% of Etsy’s 2023 GMV was generated in the United States, making it the marketplace’s primary market.

Further behind on second place is the United Kingdom, with a GMV share of 10%.

Ranks 3 through 5 are held by Canada (6%), Germany (4%), and Australia (4%).

Etsy's market fragmentation is reflected in a large number of very small market shares, which together account for 16% of its 2023 GMV.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

Temu Ranks 6th in the U.S. Fashion Marketplace Ranking in 2023

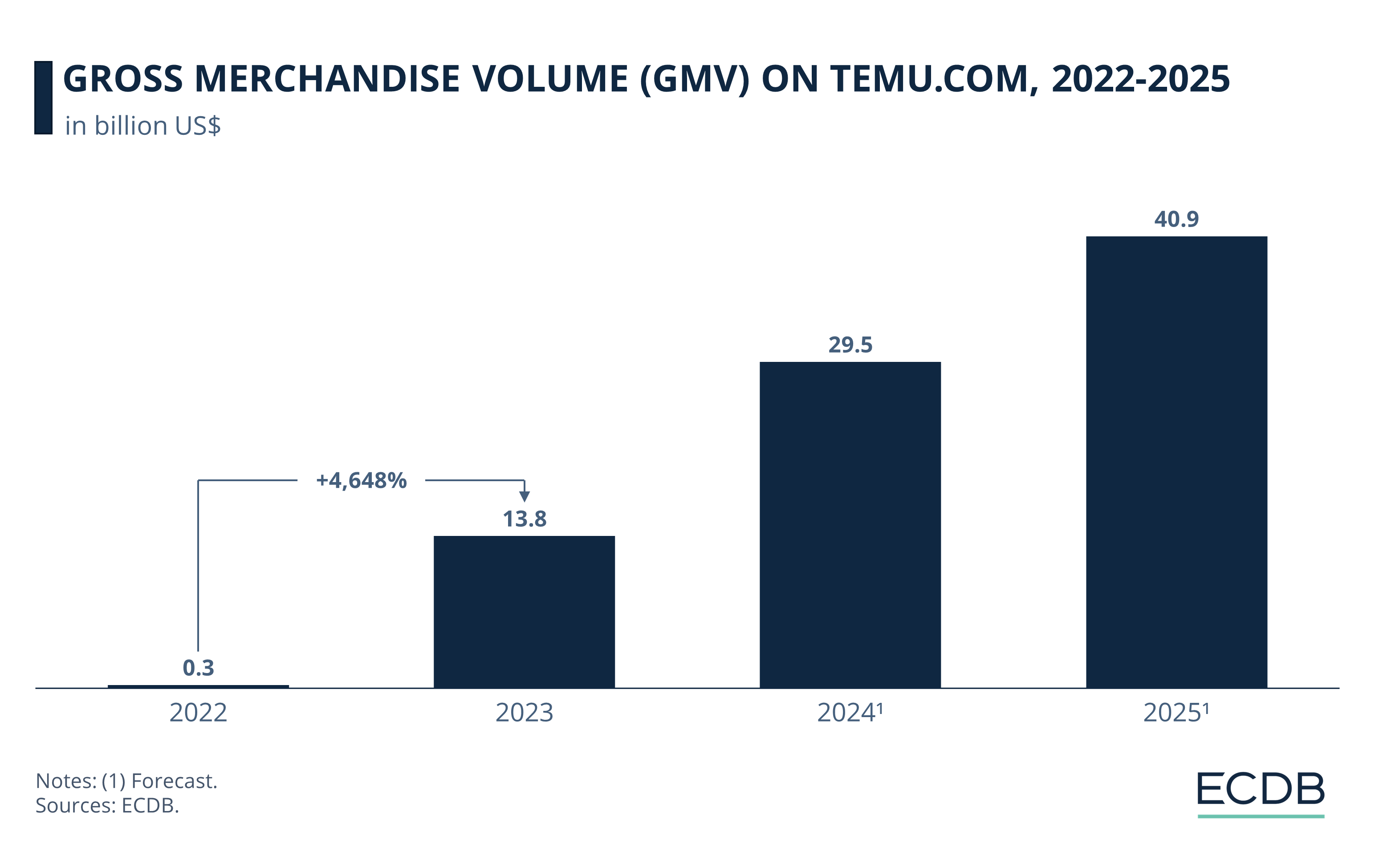

Close behind Etsy in the ranking of the top online marketplaces for fashion products in the United States is Temu, the emerging eCommerce platform from PDD Holdings. With a dizzying annual growth rate of 4,647.5% and a GMV of US$2.4 billion for fashion products in the United States, it is within US$500 million of the fifth place, Etsy.

At the current rate, Temu is sure to overtake the latter rankings on our list. Maybe even Amazon?

Temu’s explosive growth is at least expected to continue for at least the next few years.

Upcoming Trends: Secondhand Fashion Marketplaces

Another remarkable development is the proliferation of secondhand eCommerce marketplaces, including Poshmark and The RealReal in the top 10. Their success is in line with widespread calls to extend the lifecycle of products that are still good to use, and in turn accelerates the development of reCommerce.

Top U.S. eCommerce Marketplaces for Fashion: Wrap-Up

The eCommerce marketplace ranking for fashion in the United States highlights the importance of economies of scale, as larger players with an additional online store and years or decades of experience take the lead.

Also of interest is the global nature of the trends that are prevalent across the eCommerce marketplace rankings. Among the most notable are emerging low-cost marketplaces of Asian origin and secondhand initiatives.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics